The purchase transaction did not go through? What about the advance? All-knowing statistics say that almost every fifth real estate transaction involves an advance payment, which is transferred by the potential buyer to the seller of an apartment or private house. At the same time, many subsequently complain that if the sale and purchase fails, serious problems arise with the return of the transferred money. The main motive of the seller is the buyer’s fault that the transaction did not take place. So is there any way to solve this problem and get your funds back? We will look for the answer to this question in this article.

The main reason for problems with advance repayment

The presence of an advance payment, which constitutes some part of the cost of the purchased housing, is stipulated in the preliminary agreement or a special receipt confirming receipt of money by the seller. The vast majority of such documents contain a clause on non-refund of funds if the buyer refuses the transaction, as well as his other actions that led to its failure. It would seem that everything is extremely clear. But if you dig deeper, it turns out that all this is contrary to current legislation.

Making an advance, in accordance with the norms established by law, is just a kind of protocol of intent, and not an obligation to buy an apartment at any cost.

The money transferred to the seller is simply an addendum to the contract, which should be returned, regardless of the reasons why the transaction did not take place.

Advance amount for the apartment

The seller will always demand more. In cases where the selling party believes that the advance amount is too small, the Buyer must confidently justify its decision. The law does not establish the exact amount of the advance payment. But in practice it does not exceed 1-2% of the cost of the apartment.

It is important to remember that the Buyer’s intentions are confirmed not by the amount of the advance payment, but by the very fact of making an advance payment.

Advance or deposit: finding out the difference between the concepts

What are advance and deposit?

What is the difference? One of the serious problems due to which sellers of apartments or private houses insist on non-return of the money transferred to them is confusion in the concepts of “advance” and “deposit”. We have identified the functions of the first one - it only demonstrates the buyer’s intention to purchase real estate, but, unlike a deposit, it is not financial security for the transaction. That is why the transfer of the advance may not even be recorded in a specially drawn up preliminary agreement. All you need is a receipt from the buyer confirming the transfer of a particular amount to the seller. This document will definitely be considered by the court and in the vast majority of cases will become a killer argument that ensures a win.

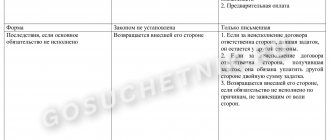

If we return to the legal requirements, we can find the following standards:

- The deposit is returned only if the fault for the failure of the transaction lies with the seller. If the buyer refuses to purchase the property, the funds remain with the other party (Article 381 of the Civil Code);

- the advance payment is returned in any case, regardless of whose fault the transaction did not take place. At the same time, it is generally illegal to include in the preliminary purchase and sale agreement any requirements and norms regarding the liability of one of the parties (Articles 421, 422 and 1102 of the Civil Code.

The presence of a receipt or agreement is sufficient proof that the money transferred to the seller is an advance. Therefore, in any case, the court must make a decision in favor of the failed buyer.

As practice shows, domestic courts do just that. Moreover, they don't even consider any of the sellers' arguments. Therefore, when filing a claim, you can safely count on success even if you do not have a receipt or any other documents on hand.

Better to play it safe

Claims for the return of advances are not something out of the ordinary in judicial practice. Their widespread distribution indicates the low level of legal culture of the population.

Unlike an advance payment, an earnest money deposit imposes certain obligations on the buyer. If he refuses the deal, this money will be lost to him. Therefore, market experts do not recommend that buyers enter into a deposit agreement due to its obvious unprofitability.

No matter how serious the intentions of the parties, life is life, and sometimes it brings unpleasant surprises. Perhaps the potential buyer really seriously intends to purchase the apartment he likes, but he may have circumstances that require cash expenses, or the bank will not approve the apartment. There are also more dramatic reasons for deal failure. Then the purchase will have to be postponed, or even canceled altogether. In the end, he may have another, more preferable option, so why drive himself into a tight framework of unpleasant obligations and add hassle to this already difficult period of life, which requires a certain amount of effort from a person and is associated with severe stress?

Share27 Class Tweet Share

In what situations is the advance not returned to the buyer?

When is the advance not returned?

Despite all of the above, sometimes situations still arise when the advance payment remains with the seller even after a court decision. And the reason for this is that real estate buyers are not very attentive to the process of drawing up, filling out and signing documents.

Most often, the advance payment is not returned for the simple reason that the addendum to the preliminary agreement states that if the buyer refuses to complete the transaction, the funds received from him remain with the seller as a fine for moral and other damage. In this situation, the court will quite rightly take the side of the latter and rule in his favor.

Will there be any compensation?

But in reality, the seller usually loses the advance if the deal is canceled, and he may also be required to pay interest for using someone else's money. However, first things first.

The advance payment agreement is concluded by the parties to the transaction - the buyer and the seller. The latter in this situation expects that if the fish falls off the hook, he will be able to keep money for himself in the form of compensation for lost time and the missed opportunity to find other applicants for the apartment. He is also convinced of this by the content of the contract, which states that if the deal fails due to the fault of the buyer, the seller receives an amount equal to double the advance amount. But in reality this guarantee does not work. Moreover, the seller may lose part of his own money, which may be demanded from him for using someone else’s funds for some time. The interest rate depends on the current Central Bank discount rate and averages about 9% per annum.

Be careful when signing documents on transfer of advance payment!

When signing the agreement to transfer the advance to the seller, make sure that this document contains the following information:

- the value of the property you intend to buy. This clause will not have any effect on the return of the advance payment, but will insure you against a sudden price increase at the initiative of the seller;

- the amount you transfer as an advance;

- detailed description of the property;

- the time frame within which the transaction must be completed.

In order to minimize all possible risks associated with the preliminary agreement, it must be signed by both parties.

In addition, it is better to entrust the drafting of the document to an experienced lawyer, who must be present at the procedure for signing the agreement. This is the only way you can count on the case for the return of the advance payment being considered in court, as well as on its successful outcome for you. Share Share Tweet Class

What to do if the seller does not return the money?

In cases where the parties cannot reach an agreement, the injured party may go to court. If the buyer can prove that the transaction did not take place solely through the fault of the seller, then he will be able to recover double the amount paid.

Pre-trial claim

Before filing a claim, a pre-trial claim must be filed and an attempt must be made to resolve the conflict amicably.

To do this, you must send an application to the seller, indicating the following:

- date and time of the failed transaction;

- buyer requirements;

- reasonable terms of return of funds.

The document is drawn up in two copies. It can be transferred personally to a legal entity if a transaction with a Developer was planned, or to the owner of housing on the secondary market.

It is preferable to send your claim by registered mail. An inventory of the documents sent must be included in the envelope. The court will need to provide a notice of service as evidence of an attempt to resolve the conflict pre-trial.

Going to court

If the seller refuses to return the money, the buyer can go to court.

To file a claim, you must do the following:

- Prepare documents proving the seller’s failure to fulfill obligations.

- Contact the court at the place of registration of the defendant.

- Wait for the documents to be accepted.

- Attend the meeting on the appointed date and time.

- Get a court decision.

- Submit the document to the FSSP for debt collection.

If the seller refuses to return the deposit, then he violates Ch. 25 Civil Code of the Russian Federation. When writing a claim, you should indicate the articles that were ignored by the other party.

The basis for filing a claim may be Law No. 2300-1 “On the Protection of Consumer Rights” if the apartment was purchased in a new building and the defendant is a legal entity. In such a situation, you will not need to pay state duty.

In this case, the reason for going to court may be improper information about the product and the buyer’s right to receive complete information about the object of the transaction. According to the legislative act, the consumer has the right to apply for moral compensation, as well as payment of legal costs.

If it was planned to buy an apartment on the secondary market, then the defendant will be an individual, the owner of the apartment. In this case, you will need to pay a state fee, the amount of which depends on the amount of the claim (Article 333.19 of the Tax Code of the Russian Federation).

Attention! The court will side with the buyer and decide to return the deposit in double amount only if there is an agreement or preliminary agreement. With a receipt, the seller confirms the receipt of funds.

Refund of deposit by receipt

A receipt for receipt of funds is one of the options for making an advance payment. The text must indicate that the money is transferred as a deposit for the execution of any agreement. The document must contain the following details:

- passport details of both parties;

- registration address;

- the item for which money is transferred (car, real estate, etc.);

- the exact cost of the item;

- the exact amount of transferred funds (in numerical and letter expressions);

- terms of conclusion and execution of intentions;

- signatures of counterparties.

Attention

If the legal form of drawing up and signing a receipt is observed, it is recognized as a full-fledged agreement and entails full legal liability of the parties in court. It is not necessary to indicate the penalties of the parties in the text, since the concept of “deposit” itself already provides for those for all participants.

Actions in case of refusal to return the deposit

If the opposite party refuses to return the deposit, the participant who contributed the funds has the right to demand their return exclusively in court. Contacting the police or other authorities will most likely not bring the desired result. Cases regarding financial disputes between private individuals are heard by courts of general jurisdiction. You can file a claim only after the expiration of the date specified in the agreement or receipt.

For your information

After filing a lawsuit, the court will review the case and make a ruling. If the judge determines that the failure of the agreement was due to the fault of the person who received the preliminary payment or due to force majeure obstacles, then most likely a decision will be made to return the money. If the court determines that the transaction was disrupted due to the fault of the participant who transferred the funds, then the deposit will remain with the opposite party.

What is a deposit?

The legal concept of this type of transfer of money is formulated in the Civil Code of the Russian Federation. Article 380 clarifies that a deposit is a sum of money transferred by one party to the other as an advance payment from the full amount of payment due under a written agreement.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

Attention

Earnest payment is a mutual method of obligation for the execution of a full-fledged agreement between the parties.

The transfer of money is always accompanied by the conclusion of a written agreement, which specifies the form (deposit), the parties, the subject and the amount of the transferred amount of money. Notarization of the document is not required, however, the concept of deposit must be indicated in its title and text, otherwise it will be considered that the parties have entered into an advance agreement, which entails other obligations.

For your information

Oral agreements or written documents that do not comply with legal standards are not recognized as a deposit, and the payment itself will most likely be recognized as an advance payment.

An alternative to a written agreement is a receipt of money, which is written from the person receiving the payment. The receipt also indicates the parties, the subject of the obligations and the amount of the contribution. The receipt must indicate that the financial contribution is a deposit.

Under contract

When the parties sign a deposit agreement, it has the form of a preliminary agreement, which guarantees the conclusion of the main agreement (alienation of real estate, purchase and sale of a vehicle, etc.). To fully protect themselves, the parties must correctly compose the text and indicate:

- name of the document (deposit agreement);

- accurate passport data of counterparties;

- subject of the contract;

- legal action with the subject (purchase and sale, rent, performance of services, etc.);

- liability of the parties;

- conditions for the return of the deposit;

- signatures with transcript.

Additional information

Since a written contract is a detailed form, the parties can specify special conditions for the return of the deposit or indicate that the money must be returned on the grounds provided by law. The conclusion of an agreement does not prevent the parties from specifying special conditions: fines for non-fulfillment or penalties.