How to get money back

There may be various reasons why you need to return the money, for example:

- excessive transfer of funds;

- erroneous transfer;

- termination or modification of the terms of the contract.

To return money if you have overpaid or get it back due to the return of a low-quality product, you must send a request to the supplier. This may be a letter for a refund due to the refusal of the goods or due to an error in the transfer of funds.

The complaint remained unanswered

If ten days have passed since the claim was submitted, and the seller has not responded to it in any way or has refused, then the first one can write a statement to the court. The requested amount includes:

- full amount of advance payment

- the amount of the penalty when deadlines are violated

- percentage of the use of other people's funds

- the amount of damage caused due to missed deadlines

- amount for moral damages

Also, if the buyer wins the case, the seller additionally pays half the fee of the entire payment amount.

Thus, in order to return a pre-paid payment, it is necessary to take into account some nuances and subtleties. Therefore, in order to carry out actions correctly, it is worth seeking advice from specialists.

Top

Write your question in the form below

How to make a requirement

There is no unified form for such a letter. An application for a refund is drawn up in free form, on company letterhead, which indicates:

- bank details where the excess transferred funds will be received;

- the reasons why the money was transferred incorrectly or an overpayment occurred;

- transaction details: agreement, payment order, amount;

- expected date of receipt of funds;

- signature and transcript of the full name of the responsible person - the head of the organization.

Application template

Application for overpayment

Application for return of advance payment

In order to resolve disagreements with the supplier, we recommend attaching a settlement reconciliation report to the letter.

Sample reconciliation report

When drawing up a request and a reconciliation report, be sure to make a reference to the contract.

Rules on how to return payment for goods

When a product is purchased with the conditions for making an advance payment, an agreement must be concluded in writing on paper. It contains the following information:

- full name of the product (service)

- Shipping deadlines are clearly established

- the amount of the preliminary fee is indicated

- the calculation procedure is described in detail

In the following situations, you can make a refund of the payment made:

- when a product or service result is of poor quality

- shipment deadlines have been violated, unless an additional agreement has been drawn up to reschedule. The consumer may also require a penalty, which is equal to 0.5% of the total amount. Penalties are charged for each day of delay

- Products delivered other than what was ordered

It is possible to return the prepayment made by the following methods:

- by terminating the contract

- filling out an application addressed to the director

In order for the result to be in favor of the buyer, it is necessary to competently write the statement of claim. It must be handed over to the seller against receipt. The text should include the following information:

- contract details

- reasons why you need to make a return

- links to legislative sources that allow you to return money

The manufacturer is obliged to transfer the amount for goods not shipped on time within 10 days. If the manufacturer refuses to pay the money, it is necessary to go to court.

Reflection of transactions in accounting

Let's consider the procedure for recording transactions in accounting accounts on the part of all participants in the transaction:

| № | Situation | Provider | Buyer |

| 1 | Excessive advance payment | Dt 51 Kt 62 - advance payment received; Dt 51 Kt 76/2 - excess amount received. | Dt 60 Kt 51 - prepayment transferred; Dt 76/2 Kt 51 - excessively transferred amount. |

| 2 | Incorrect enumeration | Dt 51 Kt 76/2 - erroneously received amount. | Dt 76/2 Kt 51 - erroneously transferred amount. |

| 3 | Termination or change of contract terms | Dt 51 Kt 62 - prepayment received. | Dt 60 Kt 51 - advance payment is transferred. |

When erroneous payments are returned, reverse accounting entries are made.

Nuances of accounting under the simplified tax system

Often, the supplier has disagreements with the tax authorities about the taxation of excess revenue. The fact is that the tax base is formed upon payment, i.e., at the time the money is received, income arises.

In case of erroneous or excessive transfer of payments, the amounts received are not taken into account when generating taxable income (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). Until the circumstances are clarified, these funds do not fall under the definition of income from sales or non-operating income (Articles 249, 250 of the Tax Code of the Russian Federation).

The above does not apply to advances returned due to termination or change in the terms of the contract. At the time of receipt of the prepayment, the taxpayer has an obligation to increase income. When collecting advances received from buyers for the refunded amount, the income of the period in which the funds were returned is reduced (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

Procedure

In most cases, the procedure for collecting an advance payment under a contract is carried out in 2 stages:

- First, the customer must make attempts to peacefully resolve the problem.

- If the contractor does not want to resolve the issue on his own, the customer has the right to initiate legal proceedings.

Claim (pre-trial) process

Attention. Before submitting a claim to a judicial authority, the customer must comply with the pre-trial procedure for resolving the dispute.

Read about disputes under construction contracts here.

It should be borne in mind that if this condition is not met, the claim may not be accepted for consideration.

So, the pre-trial procedure for resolving disagreements is as follows:

- First of all, you need to prepare a claim against the unscrupulous contractor. There is no single sample of such a document. It is usually developed independently. In this case, the following points should be included in its content:

- information about the addressee and applicant (a standard element of business letters);

information about the contract (date and number), including its subject;

- the amount of the transferred advance and details of the payment document;

- a message that the contractor failed to fulfill his responsibilities as a result of which the customer refuses the contract and wants to get his money (prepayment) back;

- the period by which the contractor must fulfill the specified requirement.

- The completed claim must be sent to the addressee.

This can be done in any way, from a personal visit to delivery by courier.Important. The main thing is that the applicant has in his hands documents confirming the fact that the pre-trial claim was actually sent to the other party.

- Next you need to wait for a response and a refund.

If this does not happen by the deadline specified in the letter, then the customer has every right to begin preparing a statement of claim in court.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 350-14-90

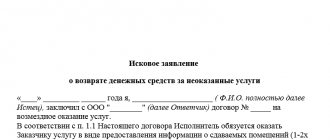

Trial

As noted above, if the executor does not want to cooperate, then the next step will be to collect the advance payment in court.

In this case, the action plan will be as follows:

- First you need to decide which court to file your claim in. Mainly, the answer to this question will depend on the legal status of the parties to the agreement. If we are talking about legal entities, then you need to contact the arbitration court. If the parties to the transaction (or at least one of them) are citizens, then in this case you need to submit an application to a court of general jurisdiction.

- Preparation of a statement of claim (this issue is discussed in more detail in the next subparagraph).

- Collection of documents - a complete list of papers that must be attached to the claim is indicated in Article 126 of the Arbitration Procedure Code of the Russian Federation and 132 of the Code of Civil Procedure of the Russian Federation. For clarity, you can indicate the documents that will be required to consider the case of collecting an advance payment in the courts of general jurisdiction. This includes:

- a document confirming the plaintiff’s exemption from paying state duty (according to clause 3 of Article 17 of the Federal Law of the Russian Federation “On ZPP”, consumers are exempt from this payment when filing a claim related to a violation of their rights);

- power of attorney to represent interests in court (must be held by the person acting on behalf of the customer);

- a copy of the claim previously sent to the defendant;

- papers confirming the legality of the demands made (contract, payment document for which the advance payment was sent, etc.);

- written calculation of the price to be collected;

- documents confirming the sending of a copy of the claim to all participants in the proceedings (for example, a notice of delivery).

- After receiving the statement of claim, you will need to wait for it to be considered by the court. If everything is in order, it will be accepted for production.

- Receiving a subpoena and actively participating in the proceedings.

- The court makes a final decision.

Reference. Civil cases are considered and resolved within 2 months from the date of filing the claim (clause 1 of Article 154 of the Code of Civil Procedure of the Russian Federation). If the proceedings are carried out in an arbitration court, then this period of time will increase to 6 months (clause 1 of Article 152 of the Arbitration Procedure Code of the Russian Federation).

Collection of money under a contract is possible in different cases. Our articles contain information about collecting not only prepayments, but also penalties.

Payment return period

Erroneously or excessively transferred payments are returned within seven days from the date the creditor submits a demand for its fulfillment (clause 2 of Article 314 of the Civil Code of the Russian Federation).

In cases of unlawful withholding of funds and evasion of their collection, interest is charged on the amount of the debt in accordance with the rules set out in clause 1 of Art. 395 of the Civil Code of the Russian Federation and clause 5 of the Review of the practice of considering disputes related to the application of rules on unjust enrichment (Information letter of the Supreme Arbitration Court of the Russian Federation No. 49 dated 01/11/2000).

Similar appeals for calculating interest are applied upon termination of a contract for the supply of goods (clauses 3–4 of Article 487 of the Civil Code of the Russian Federation).

To avoid paying interest for using someone else’s money, pay attention to the date of the document and fulfill your obligations no later than seven days.

A different legal situation arises in the event of the return of the advance upon termination or modification of the work contract. The organization that received the advance payment began to carry out the work. In this case, the contractor must prove that at the time of receipt of the notice of termination of the contract, part of it has already been completed. If this condition is met, the contractor retains part of the established price in proportion to the part of the work performed before receiving notice of the customer’s refusal to fulfill the contract, and compensates for losses caused by termination of the contract (Article 717 of the Civil Code of the Russian Federation).

When should the supplier return the advance?

Explanations - in the Ruling of the Supreme Court of the Russian Federation dated July 6, 2021 No. 308-ES20-8893 in case No. A32-9774/2019.

The parties to the contract may agree that the supplier will return the advance payment. If he returned even part of the money, then this fact indicates the actual termination of the contract. In this case, the buyer becomes free from paying the entire amount under the contract, and the supplier is free from the obligation to transfer the goods. The reasons why the supplier agreed to return the advance payment have no legal significance. He has no right to change his mind or cancel his consent. But in this situation, the supplier must return the advance in full.

There is no point in trying to keep at least part of the advance for yourself, even in the form of penalties.

He agreed to return the money. The obligation to transfer the goods ceased, but instead there was an obligation to return the advance payment. Contractual obligations in such circumstances cease automatically. The rules of the Civil Code on the supply agreement have ceased to apply. The supplier no longer has the right to withhold the advance.

Read in the berator “Practical Encyclopedia of an Accountant”

How to register received goods

What is a deposit and what functions does it perform?

The concept of this type of prepayment is explained in Art. 380 Civil Code of the Russian Federation.

The deposit performs two functions:

| Prepayment function | The cost of the ordered car is reduced by the amount of the previously paid deposit. |

| Warranty function | Depositing funds guarantees the completion of the transaction and also minimizes the risks of the parties. If the buyer, after making a deposit, refuses to purchase, the amount of money remains with the seller. In the event that a car dealership violates its obligations, the deposit is returned to the buyer in double amount (Article 381 of the Civil Code of the Russian Federation). |

Important: The agreement to make a deposit must be drawn up in writing and must indicate the amount of the advance payment. Otherwise, this amount is considered paid as an advance!

Advance concept

An advance is necessary to record the buyer's intentions. The salon, by prior agreement, accepts from the client an amount of money equal to several percent of the purchase price. That is, the money paid as an advance covers the seller’s upcoming expenses.

The agreement between the parties to the transaction must be in writing. Unlike other types of partial prepayment, an advance payment performs only a payment function and is practically not protected by legislative norms.

Important: If the buyer, after completing the agreement, refuses the transaction, it will not be possible to return the advance payment in full. The refund will be made minus the seller's costs (for example, collecting and preparing documents for the car).

Cases are different

Sometimes situations arise when you need to cancel a completed transaction and return the advance payment. There may be many reasons contributing to this development of events. For example, after making a deposit to purchase a car, the buyer urgently needed money. Or an advance payment was made for repairs, but it turned out that they were of poor quality.

How can I return my prepayment? When is this not possible? To find out the answers to these questions, you need to familiarize yourself with the relevant norms that are prescribed in the Civil Code and the Law “On the Protection of Consumer Rights”. So, is the advance payment refundable or not?

Termination of an agreement

In case of termination of the contract, the buyer must write a corresponding statement and bring it directly to the supplier. If the organization with which the transaction was concluded is serious and respects its principles, then, most likely, it will not spoil the opinion of itself and will meet the buyer halfway. The money will be fully refunded even when the supplier did not suffer losses from the client’s refusal.

If any expenses were incurred, the amount will be returned excluding expenses. Most often, such subtleties are established in the contract. In the case where the supplier does not want to give the money voluntarily, the buyer needs to file a claim according to the standard scheme. If it was sent to the address, then the money for the service not provided must be returned within ten days.

If this requirement is ignored, the buyer can expect to pay a penalty. It must be remembered that the claim is submitted in two copies, one of which remains with the buyer (with the seal and signature of the organization supplying it src=»https://businessman.ru/static/img/a/46695/338732/52862. jpg" class="aligncenter" width="640″ height="360″[/img]

Types of prepayment and its specifics

The Civil Code of the Russian Federation regulates the legal norms of relationships related to the conditions of prepayment. Here the main rules are established to ensure the correct order of this procedure.

Since sales contracts include various forms of payment with various conditions of legal relations, prepayment can be divided into the following types:

- full: the client pays the entire cost of the contract;

- partial (advance): incomplete payment for goods by the established amount or percentage of the amount;

- revolving – constant conclusion of a transaction with advance payment over a long period of time.

Is prepayment for services refundable? More on this later.