If the product does not comply with the terms of the contract or is of poor quality, the buyer has the right to return it to the supplier. Registration of returning goods to a supplier in 1C has a number of features that we will consider in this publication.

You will learn:

- how to make a return to the supplier in 1C 8.3;

- what documents need to be used;

- what transactions for returning to the supplier are generated in 1C 8.3.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

What you need to pay attention to when returning to the supplier in 1C 8.3

Registration of a return transaction to a supplier in 1C 8.3 Accounting depends on some nuances:

- whether the Organization (buyer) is a VAT payer;

- whether the goods are registered before they are returned.

In this case, a quality or low-quality product is returned, does not affect the design.

Returning materials to a supplier in 1C 8.3 is no different from returning goods, so the step-by-step instructions for returning goods to a supplier are also suitable for returning other materials. Postings in 1C 8.3 for returning materials to the supplier are similar.

The return of goods to the supplier in 1C 8.3 is reflected according to Dt 76.02 “Settlements for claims” (1C chart of accounts). If the returned goods have not previously been paid for, then when returning to the supplier in 1C 8.3, an additional entry Dt 60.01 Kt 76.02 is created, which automatically reduces the debt to the supplier by the cost of the returned goods.

Returning goods to the supplier of postings in 1C 8.3.

Next, in step-by-step instructions, we will look at how to return goods to a supplier in 1C in various circumstances and what transactions are generated by 1C Accounting 8.3 in each case.

Federal Law “On Accounting” Art. 9 p. 2

The required details of the primary accounting document are:

- Title of the document;

- date of document preparation;

- name of the economic entity that compiled the document;

- content of the fact of economic life;

- the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

- the name of the position of the person (persons) who completed the transaction, operation and the person(s) responsible for its execution, or the name of the position of the person(s) responsible for the execution of the event;

- signatures of persons provided for in Art. 2 clause 6 of the Federal Law “On Accounting”, indicating their last names and initials, or other details necessary to identify these persons.

Additional details of the primary accounting document The consignment note, in addition to the mandatory details, may contain any additional information; this is not a violation.

Return to the supplier of goods not accepted for registration in 1C 8.3

On September 10, the organization’s warehouse received the goods “Chairman Parm” Sofa (10 pcs.) from the supplier MebelLand LLC in the amount of 210,000 rubles. (including VAT 18%). Upon acceptance of the goods, a defect was discovered (5 pieces).

On September 12, the defective product was returned to the supplier.

If a defective product is taken into custody or only part of it is returned, then the low-quality product is first registered and then returned to the supplier.

Receipt of goods

How to issue a return to a supplier in 1C 8.3? Document the receipt of goods at the warehouse with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipt (acts, invoices).

If you are returning only part of the goods, then issue 2 documents Receipt (act, invoice) : one - for the receipt of goods accepted for registration, the second - for the receipt of goods not accepted for registration.

Fill in the data of primary documents in 1C (invoice and invoice) in the same way for both documents, according to the primary documents.

Receipt of registered goods in 1C.

Receipt of goods not accepted for registration in 1C.

In the form we indicate:

- Invoice No. from - number and date of the primary document;

- Amount - the total amount including VAT for the defective product;

- % VAT - Without VAT ;

- Accounting account - 002 “Inventory assets accepted for safekeeping.”

Postings upon receipt of goods not accepted for registration.

Wiring is generated:

- Dt 002 - reflection of goods not accepted for registration.

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice) and click the Register .

Invoice document will be automatically filled in.

The List of supporting documents must contain both documents: receipt of goods accepted and goods not accepted for registration.

Returning goods to the supplier

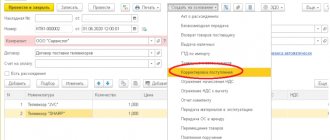

How to return goods to the supplier in 1C? For the return to the supplier of goods that have not been accepted for registration, fill out the document Return of goods to the supplier transaction type Purchase, commission based on the document Receipt (act, invoice) transaction type Goods (invoice) or in the section Purchases - Purchases - Returns to suppliers.

Return invoice in 1C 8.3 Accounting.

In the form we indicate:

- Receipt document - the document from which the batch is returned. May not be indicated if it is not known from which batch the item is being returned.

On the Products , fill in:

- Nomenclature - inventories that are returned to the supplier;

- Price, Amount - according to primary documents;

- Quantity - the number of returned goods;

- % VAT - VAT rate according to primary documents;

- Accounting account - 002 “Inventory assets accepted for safekeeping”, because the goods were not accepted for accounting.

Calculations tab unchanged.

Return of goods to the supplier in 1C 8.3 postings.

Returning wiring to the supplier in 1C 8.3:

- Kt 002 - goods returned to the supplier, not accepted for registration;

- Dt 60.01 Kt 76.02 - the debt to the supplier for returned goods has been reduced.

An invoice for the return of goods not accepted for accounting is not issued. An adjustment invoice from the supplier issued for a partial return of goods is not registered in the purchase book (Letter of the Ministry of Finance of the Russian Federation dated February 10, 2012 N 03-07-09/05).

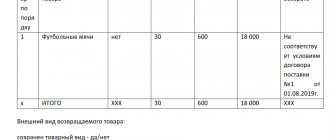

Grounds for returning inventory items

It is not always possible to return goods legally. For example, if the delivery requirements are fully met and the supplier refuses to enter into an additional agreement. But there are specific situations when the return of goods and materials is legal and necessary. Let us indicate the situations when you will have to prepare a return invoice for goods and materials:

| Situation | Comments | Link to legal acts |

| Inconsistency with quality | The buyer has a choice:

| Clause 2 Art. 475 Civil Code of the Russian Federation |

| Discrepancy in scope of supply | If an undelivered part of the inventory is identified, the purchaser returns the entire shipment. If the counterparty has shipped a larger volume of goods and materials, then the excess must be returned. | Art. 466 Civil Code of the Russian Federation |

| Incomplete supplied | You require the counterparty to supply the missing parts, parts and components, or you return the entire shipment. | Art. 480 Civil Code of the Russian Federation |

| Assortment mismatch | The recipient refuses the entire shipment. However, you can only return non-conforming items and request a replacement. | Art. 468 Civil Code of the Russian Federation |

| Failure to meet delivery deadlines | The supplier violates the terms of delivery of the goods, refuse the shipment altogether. But there are exceptions for goods with a limited shelf life. | Art. 511 Civil Code of the Russian Federation |

It is not necessary to go to extreme measures and terminate the supply contract. First, require the supplier to eliminate the identified deficiencies and discrepancies. If complaints do not yield results, proceed with countermeasures.

The buyer also refuses quality goods delivered on time and in full. But for this you will have to negotiate with the supplier. In this situation, you will have to conclude an additional agreement, which will reflect the new terms of cooperation or severance of business relations.

Return to the supplier of goods accepted for registration in 1C 8.3

On January 10, the Organization purchased the “Imperial” Table (100 pcs.) from the supplier “CLERMONT” LLC for the amount of RUB 1,416,000. (including VAT 18%). On the same day, the goods arrived at the warehouse and were accepted for accounting.

On February 6, part of the goods (38 pieces) was returned due to a defect.

Receipt of goods

The purchase of goods is documented with the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases - Purchases - Receipt (acts, invoices).

Study in more detail 1C: Typical scheme for purchasing goods in wholesale trade

Postings

Postings are generated:

- Dt 41.01 Kt 60.01 - goods accepted for accounting.

- Dt 19.03 Kt 60.01 - VAT accepted for accounting.

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice) and click the Register .

Invoice document will be automatically filled in.

Postings

Wiring is generated:

- Dt 68.02 Kt 19.03 - VAT accepted for deduction.

Returning goods to the supplier

How to reflect the return of goods to the supplier in 1C? Fill out the return of goods accepted for registration with the document Return of goods to supplier transaction type Purchase, commission based on the document Receipt (act, invoice) transaction type Goods (invoice) or in the section Purchases - Purchases - Returns to suppliers.

It does not matter whether part of the goods or the entire batch is returned.

Return invoice in 1C 8.3 Accounting.

In the form we indicate:

- Receipt document - the document from which the batch is returned. It may not be indicated if it is not known from which batch the goods are being returned.

On the Products , fill in:

- Nomenclature - inventories that are returned to the supplier;

- Quantity - the number of returned goods;

- Price —the purchase price of the MPZ; if the Receipt Document is specified, then the price is filled in automatically from the document; if not specified, then the last purchase price is indicated;

- % VAT - 18%, since the return of goods accepted for registration is a reverse sale.

Calculations tab unchanged.

Returning goods to the supplier of postings in 1C 8.3.

Postings are generated:

- Dt 76.02 Kt 41.01 - goods returned to the supplier;

- Dt 76.02 Kt 68.02 - VAT is charged on the returned goods.

Issuance of invoices for return to the supplier

If goods already accepted for registration are returned to the supplier, then issue an invoice for their return at the bottom of the document form Return of goods to supplier .

Invoice issued for sales will be automatically created .

- Operation type code — .

How to fill

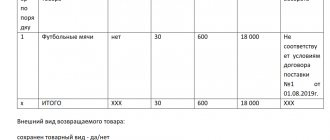

Typically, the TORG-12 consignment note is drawn up by the seller. The form contains information about the seller, buyer, name of the product, its quantity and cost, information about the financially responsible persons who shipped and received the goods.

We have collected the basic rules for filling out TORG-12 in the table:

| Count | Filling procedure |

| Shipper organization, address, telephone, fax, bank details | The name fits both full and short. |

| Structural subdivision | Maximum complete information (name, contact details). |

| Provider | Full and short name, address and bank information. |

| Consignee | Same as for the supplier. |

| Payer | The purchasing organization is indicated (if it independently purchases and pays for the cargo). |

| Base | The data of the contract or work order on the basis of which the transaction took place is indicated. |

| OKUD and OKPO codes, type of activity according to OKDP | The codes assigned to the organization by the statistics body upon registration are indicated. |

| Tabular section TOP-12 | The supplier lists the goods sold, their units of measurement and quantity, gross and net weight, price and VAT rate. The amount of goods with and without VAT is also indicated here. |

| The consignee received the cargo | Signature of the manager or employee who has the right to sign (order, power of attorney). |

| Accepted the cargo | Signature of the financially responsible person receiving the goods (storekeeper, driver, manager, etc.). |

| By power of attorney No. | Power of attorney details of the employee who received the cargo. Not to be filled in if the manager signed the line “The cargo was received by the consignee”. |

| The consignee received the cargo | To be completed when the cargo is received by the head of the organization. |

| Supplier side printing location | The supplier's seal is affixed, if available. |

| Place of seal on the part of the consignee | The consignee's stamp is affixed. If the cargo is received by proxy, then stamping is not required. |

| Date indicator | The actual date of shipment must match the date on the invoice. |

The standards for filling out TORG-12 explain how to correctly sign the invoice when receiving goods - the document is signed by both parties: representatives of the seller and the consignee (buyer). On the buyer’s side, the signature is left not only by the manager, but also by the employee who accepted the delivery. And on the supplier’s side, the document is signed by the employee responsible for the delivery, the chief accountant (if available) and the employee who released the cargo.

Return of goods by VAT non-payer

On March 29, the organization’s warehouse received the goods Computer desk “Boomerang-3N(M)” (20 pcs.) from the supplier KMH LLC in the amount of 139,240 rubles. (including VAT 18%).

On April 10, part of the goods (2 pieces) was returned due to a defect.

Receipt of goods

Reflect the purchase of goods in the document Receipt (act, invoice) type of transaction Goods in the section Purchases - Purchases - Receipts (acts, invoices) - Receipt button.

Study in more detail 1C: Typical scheme for purchasing goods in wholesale trade

Postings

Postings are generated:

- Dt 41.01 Kt 60.01 - goods accepted for accounting.

Registration of SF supplier

Enter the date and number of the incoming invoice at the bottom of the Receipt document form (act, invoice) and click the Register .

Invoice document will be automatically filled in.

Returning goods to the supplier

Fill out the return of goods with the document Return of goods to supplier transaction type Purchase, commission based on the document Receipt (act, invoice) transaction type Goods (invoice) or in the section Purchases - Purchases - Returns to suppliers.

Return invoice in 1C 8.3 Accounting.

In the form we indicate:

- Receipt document - the document from which the batch is returned. It may not be indicated if it is not known from which batch the goods are being returned.

On the Products , fill in:

- Nomenclature - inventories that are returned to the supplier;

- Quantity - the number of returned goods;

- Price —the purchase price of MPZ including VAT;

- % VAT - Without VAT , because a company using the simplified tax system is not a VAT payer and does not issue an invoice (clause 5 of article 168 of the Tax Code of the Russian Federation).

Calculations tab unchanged.

Return of goods to the supplier in 1C 8.3 postings.

Postings are generated:

- Dt 76.02 Kt 41.01 - goods returned to the supplier;

- Dt 60.01 Kt 76.02 - the debt to the supplier was reduced by the amount of the returned goods.

What are the grounds for registration of TORG-12

Since the consignment note is an accounting document by which products are transferred and received, the basis for registration is the contract.

As a rule, the price and quantity of transferred products are indicated in the contract or in annexes (specifications). An option is possible when, under the terms of the contract, the price of the goods is determined by the current price list of the company, and the quantity is determined in the application from the buyer.

IMPORTANT!

An alternative form is a universal transfer document (letter of the Federal Tax Service of Russia No. ММВ-20-3 / [email protected] dated 10/21/2013).

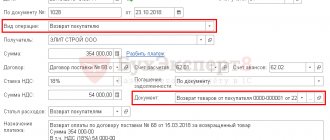

Refunds from the supplier: postings in 1C 8.3

On February 6, part of the goods (38 pieces) was returned due to a defect.

On February 8, payment was received to the bank account for the returned goods in the amount of RUB 538,080.

The return of funds from the supplier is documented using the document Receipt to the current account, transaction type Return from supplier in the Bank and cash desk - Bank - Bank statements section or based on the document Return of goods to supplier the Create based button .

In the form we indicate:

- Advances account - 76.02 “Calculations for claims.”

Postings

Wiring is generated:

- Dt Kt 76.02 - refund from the supplier for returned goods.

We looked at how to process the return of goods to the supplier in 1C.