When you need to send a return of goods from a buyer to a supplier, it is often difficult to figure out what documents to fill out so as not to make mistakes. You should know in which cases this is easy to do and in which it is not documented. And the main thing is to remember the rules and nuances of the process and reimbursement of expenses. The Civil Code stipulates that the buying party may not accept and send back the cargo in several cases. This is possible if there is no corresponding clause in the contract. Let's look at what this looks like and what to do.

How to return when the product is of poor quality

There are two articles in the Civil Code that give the opportunity to the person or organization who bought it to send the purchase back to the owner - 518 and 475. Products that do not comply with the contract must have serious deficiencies in:

- types of models, colors;

- configurations;

- quality;

- external signs.

If the violations are small and easily corrected, then sending the order to the seller is allowed only to correct the problems. If part of the kit breaks, then this particular part will be replaced.

But if there are large and noticeable defects, as well as those that cannot be eliminated, the buyer returns the product. He can then choose one of two options:

- get money back;

- exchange for the same new and intact cargo.

This operation is available as long as the product is in good condition and is covered by the manufacturer's warranty. This is also possible within 2 years from the date of purchase if:

- the owner of the product will be able to provide evidence that the defect was identified before the end of the warranty period;

- There was no warranty period specified for the product.

It is important to remember that the articles do not apply to those items that were purchased for further resale. Therefore, if a delivery agreement has been concluded, then you should not count on sending the improper purchase back.

Filling out KM-3 when using an online cash register

From July 2017-2019, all sellers, with rare exceptions, are required to use online cash registers.

Read about the use of online cash registers by UTII payers in the article “Use of online cash registers for UTII (nuances).”

When using an online cash register, it is not necessary to use KM-3 when returning money to the buyer. Fiscal data that comes to the tax office from online cash desks completely replaces information from forms KM-1, KM-2, KM-3, KM-4, KM-5, KM-6, KM-7, KM-8, KM-9 (see letter of the Ministry of Finance dated September 16, 2016 No. 03-01-15/54413 (notified to the tax inspectorates by letter of the Federal Tax Service dated September 26, 2016 No. ED-4-20/18059).

When the buyer returns the goods, the seller using the online cash register, based on the buyer’s application, must issue a check with the “return of receipt” sign (see letter of the Ministry of Finance of the Russian Federation dated July 4, 2017 No. 03-01-15/42312, 03-01-15/42315 ). In addition to the check with the sign “return of receipt”, it is also necessary to issue a cash receipt order for the amount of the refund (Article 1.1, Clause 1, Article 1.2, Clause 1, Article 4.7 of the Law of May 22, 2003 No. 54-FZ, Clause 6.2 of the Bank’s instructions Russia dated March 11, 2014 No. 3210-U).

If you trade retail and use OSNO, when returning goods from a buyer, it is important to correctly reflect the transaction for calculating VAT.

The Ministry of Finance explained in detail how to do this. To do everything right, get trial access to the ConsultantPlus system and find out the opinion of officials. It's free.

For more information on issuing refund checks, read the following materials:

- “How to make a refund check in KKM online?”;

- “How to make a refund for a purchase at an online checkout?”;

What to do if there is not enough money in the online cash register is discussed in the material “[LIFE HACK] If there is not enough money in the cash register for a refund, make a “cash deposit””.

And you can learn about processing a refund for non-cash payments from the material “[LIFEHACK] We issue a refund if the buyer pays by bank transfer.”

Laws

It is possible to return products to the supplier without conflict situations if the documentation is completed correctly. And also if you remember about the legislation that governs the return rules.

Art. 475 of the Civil Code of the Russian Federation. If defects are detected, the buyer-entrepreneur may demand:

- reduce the amount paid or demand that all violations be eliminated within a reasonable time;

- claim a refund for the money spent on fixing the problems yourself;

- if significant or irreparable deficiencies are identified, the buyer can completely withdraw from the contract and receive the finances back;

- is able to claim the right to replace a low-quality product with something that fully complies with what is specified in the contract.

Art. 476 of the Civil Code of the Russian Federation. The supplier is obliged to bear responsibility for defects that appear before the start of sales. There are 4 reasons why he will have to bear responsibility if he cannot prove the occurrence of violations after the transfer of the cargo to the customer.

Among them:

- violation of storage conditions;

- damage by third parties;

- misuse;

- irresistible force.

Quality is checked by a special supply agreement concluded by the parties. If it is not there, then everything is studied according to Art. 474 Civil Code of the Russian Federation.

Art. 477 Civil Code of the Russian Federation. During use of the purchased item, flaws or noticeable defects appeared. This also allows you to send it back at the designated time:

- until the warranty or the period for which the product is designed has expired;

- if this is not established, then within 2 years from the date of purchase.

Reasons for preparing a return note

The recipient has the right to return the goods to the supplier in the following cases provided for by the Civil Code of the Russian Federation:

- The supplier did not hand over accessories and documents related to the goods on time (Article 464 of the Civil Code of the Russian Federation);

- The supply contains less goods than stated in the contract (clause 1 of Article 466 of the Civil Code of the Russian Federation);

- The assortment does not comply with the contract in whole or in part (clause 1 and clause 2 of Article 468 of the Civil Code of the Russian Federation);

- The requirements for the quality of the goods or part of the goods included in the set have been violated (clause 2 and clause 4 of Article 475, clause 2 of Article 520 of the Civil Code of the Russian Federation);

- The supplier did not comply with the buyer’s requirements to complete the goods (Clause 2 of Article 480 of the Civil Code of the Russian Federation);

- There are no containers or packaging or they are of inadequate quality (Article 482 of the Civil Code of the Russian Federation).

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Reasons

Return of defects to the supplier is permitted if the defects are not indicated in advance in writing. This applies to both the entire product and individual parts. In reality, you can return it in different situations:

- products that do not meet quality standards, with visible flaws inside, on the container or box;

- differences in the amount of pieces, type, other features;

- the characteristics included in the contract do not work or are missing.

To determine discrepancies based on barcodes, volume and other parameters at the time of acceptance, it is worth installing special equipment. The use of a data collection terminal ensures that possible differences can be quickly identified - just scan the packaging to count it. After confirmation, the data will go into the database and be registered.

The presence of extra boxes, a lack of required packs, a different volume, color or similar appearance will be immediately determined by the technology. To install and configure the correct software and purchase suitable devices, you should contact Cleverence. The company will recommend quality equipment to help minimize costs and expenses due to unscrupulous contractors.

How to properly prepare documents for returning any goods to the supplier

We recommend that you complete the documentation correctly. To understand what papers to prepare and send to the contractor, you should find out whether ownership of the object has been transferred to the acquiring party. If you haven’t already, everything will be as simple as possible.

There are only 3 possible scenarios:

- identified simultaneously with acceptance - there is no need to accept such products;

- the discrepancy was not identified immediately;

- by agreement, the contractor regularly picks up questionable cargo and those that were not sold within the sales deadline.

Comments on the document “Report of defective goods”

Reply 0

| 4 Vladimir | 03/31/2017 at 13:42:29 Not bad! Almost what I was looking for |

Reply 0

| Olga | 06/08/2017 at 14:39:23 I hope this document will help us return a partially defective fence from the Zaborgrad company |

Reply 0

| Tatiana | 10/20/2017 at 07:02:21 Thank you . The information and document were very helpful in my work |

Reply 0

| 5 Lyudmila | 08/26/2020 at 10:57:14 Thanks for the info. |

Registration of correct return of any low-quality goods to the supplier, important documents

The purchaser must notify the contractor immediately of any defective parts found in the lot. If you do not follow this rule established by Art. 483. Civil Code, the seller has the right not to accept the returned property.

For example, if an organization accepted a delivery without checking and did not report any defects, then even the court will not satisfy the requirements.

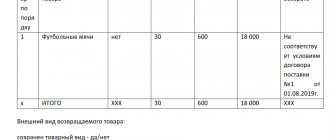

According to Art. 514, if everything is later sent back, the recipient is obliged to place the entire thing for safekeeping. His job will be to ensure the safety of the boxes until the shipper picks them up. If the manufacturer agrees with the existing defects and exports the batch, then the parties conclude:

- act of identifying inconsistencies (can be drawn up in the TORG-2 form);

- return invoice (TORG-12 is suitable as a basis).

If the purpose of sending products to the seller is to replace non-critical components or eliminate other minor defects, then everything must be done in writing. The days or weeks in which the shipper undertakes to replace defective parts, replenish or exchange parts should be agreed upon and specified in the documentation.

When the seller denies the possibility of violations, does not export and does not agree to change the defect, evidence is drawn up:

- claim;

- protocol according to which samples were taken for examination;

- a written or registered letter offer to participate in the inspection;

- expert opinion.

We must not forget that the statement of defects, written only by the recipient’s enterprise, only in a limited number of cases serves as an evidence base. This works if, when concluding the contract, both parties signed an agreement to apply such instructions. If it was not compiled, then it will not be evidence.

Returning goods: let's get to the bottom of it

The supply of products or goods is carried out on the basis of an agreement or contract. These documents reflect the key delivery terms and requirements. If the supplier violates the agreement, then, according to the provisions of the Civil Code of the Russian Federation, the buyer has the right to refuse the purchase.

The acquirer requires under Art. 475 Civil Code:

- price reduction;

- replacement of low-quality products;

- free elimination of defects;

- additional packaging and shipment;

- or other things.

In most cases, you will have to return products that have already been shipped. To do this, draw up a return invoice to the supplier, a letter of claim and a statement of discrepancy.

IMPORTANT!

If the buyer refuses a product that does not comply with the terms of the supply agreement, he is still obliged to ensure the safety of the supplied goods and materials until return. The requirement is enshrined in Part 1 of Art. 511 of the Civil Code of the Russian Federation.

Grounds for returning quality goods to the supplier

Broken or incomplete shipments are not always returned. Sometimes you have to send fully working equipment or furniture because:

- other people claim these products (according to Article 460);

- the volume does not match - it is more or less than necessary (Article 466);

- incorrect assortment matrix - unordered color, taste, functionality (Article 468);

- incomplete set or refusal to complete the set (Article 480).

The list cannot be called complete. You can agree to change the conditions or supplement them. The contract includes the possibility of re-loading items not sold on time. For this, an additional formal basis is usually prescribed:

- there is no demand for the model;

- the product is expired;

- the season in which the part is sold has ended;

- other agreed justifications.

These are just some of the reasons why you can return a quality product to the supplier: the return procedure here does not differ from the main sequence. But there are also situations when there are no complaints at all, but the delivery is sent back.

To timely check the quantity and range of supplied cargo, you can go in two ways. An employee can look at each box, compare contents and check barcodes manually. But there is a faster way - simply install special software.

To do this, just contact Cleverens. The company will select the right equipment for the business, which will simplify not only acceptance, but also automate many other processes. This will minimize costs and problems with mis-grading and quantity discrepancies, and will make accounting faster.

How to document return of unrealized

It is important to remember that returning quality products is allowed only if this is agreed in advance in the contract. Otherwise, you won’t be able to send the sofa back just because it’s not for sale.

There is another way. If such a procedure is not documented, but the companies have agreed on the possibility of such outcomes, then it is permissible to simply formalize a reverse sale. For example, if not all bicycles are sold before the end of summer and the manufacturer agrees to take them back.

In fact, this will be the sale of his own packages to the former owner. Created:

- TORG-12;

- invoice.

The name of his own company is entered in the “seller” line, and the buyer is a contractor who removes his former cargo in the cell. There is no need to fill out TORG-2 according to the sample. Documentedly, such castling does not differ from a regular sale.

How it is issued in different cases

What to do if you brought expired milk or a cake for sale - send it back. But the papers must be drawn up correctly. The supplier will not need to document the return of goods if it is a trusted partner who guarantees to replace everything as soon as possible.

If the shipper does not mind picking up the defect that was sent by an inattentive employee, then you don’t even have to write additional documents. It is enough to cross out items from the invoice that will not be accepted onto the company’s balance sheet. The driver will load them back into the car and take them to the warehouse from which they came.

They will not be reflected in accounting. But the representative of the second party must also sign, so he will confirm that the procedure took place with his participation. Within 5 working days, the shipper sends a new document with corrected figures.

If the relationship with the contractor is trusting and cooperation has been going on for many years, a simpler option is also possible. The receiving party signs the invoice without changes, calls the sender and tells about the poor quality of the delivery. He promises to deliver quality products in a short time.

The latter method is good because there is no red tape, no possible inconsistencies, and quick operations through the base. But it is recommended to use it only when working with a trusted counterparty.

When can I return an item?

The relationship between buyer and seller does not always develop without problems. For example, a situation may arise when you need to return products, for which you will need a sample certificate of return of goods to the supplier. This can happen in the following situations:

- Poor quality purchase. The buyer has the right to legally return goods that do not meet the quality requirements established by the terms of the contract (agreement), in accordance with clause 2 of Art. 475 of the Civil Code of the Russian Federation, Law No. 2300-1 “On the Protection of Consumer Rights”.

- The delivery does not comply with the terms of the contract. If the seller mistakenly delivered more units of goods, the buyer returns the excess cargo (Article 466 of the Civil Code of the Russian Federation). Conversely, if the purchasing organization identifies a defect, it has the right to return the entire batch.

- Shipment of incomplete products. Based on Art. 480 of the Civil Code of the Russian Federation, the buyer has the right to demand a reduction in price or delivery of missing parts of the goods, otherwise - return the entire batch of incomplete products.

- Inconsistency of the product range with the terms of the sales contract. If the seller delivered products that differ from the specifications, then the receiving company can return the products or the entire batch (Article 468 of the Civil Code of the Russian Federation).

- Product delivery time is overdue. This may also be a reason to refuse the cargo. An exception is if the receiving party did not promptly notify the supplier of the refusal to accept products with an overdue delivery date. In this case, it will not be possible to return the products (Article 511 of the Civil Code of the Russian Federation).

Registration procedure

There are two types of documents that must be properly prepared in order to make a return:

- claim;

- Act.

The first paper is drawn up on the organization’s letterhead. The signature of an accountant or other person authorized to sign the documentation is required.

Always indicated:

- legal and actual address;

- full title;

- information about the buyer - details, name, other information;

- information about the supply agreement that caused the claim, date, number;

- the reasons for creating the paper are described in full and in detail - discrepancies in quantity, quality, set;

- it is recommended to refer to the law;

- justification for the requirement - return, exchange, complete;

- time limits are established within which the supplying party must review and provide a written response;

- a census of everything invested.

Additionally, a return certificate is drawn up. This is a document that is drawn up by several authorized persons of the receiving company. It is confirmed by the results of the examination and is considered an official document sent from the buyer to the seller.

Here you need to provide information:

- date and place;

- details of both organizations;

- the name of the service or thing that is the basis;

- expert opinion;

- signs how purchased products will be returned to the warehouse;

- indicate invoice details for reverse transfer for low-quality goods;

- if there is compensation - terms and amounts;

- signatures;

- print.

Both parties will sign, but only the manager or other authorized person on each side. His right must be confirmed by a special power of attorney, otherwise the document has no legal force.

Results

The buyer has the right to return goods by law (when a low-quality or incomplete product is returned) or under the terms of the contract (for example, when returning goods that were not sold before the expiration date). If deficiencies are identified during the acceptance process, then in order to return it is enough to issue a report on discrepancies in quantity and quality.

When returning goods that have been capitalized, a delivery note is issued. Particular importance is attached to documents justifying the return. They will be referenced in the return invoice, and they will also serve as an attachment to this invoice. The information about the product in these documents is identical to that received upon delivery.

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

What you should know about - tax issues

There are several nuances, knowledge of which will simplify the procedure:

- If the products were not accepted, then a separate operation is not created. In this case, VAT is not paid and the buyer does not issue an invoice. The shipper will send him the corrected papers.

- If everything was accepted at first, but then violations were discovered, separate documentation is drawn up. It's paper and procedure. First, the consignee sends an invoice to the supplier, who will accept VAT for deduction. If necessary, the owner of the outlet restores the tax amount, this is done in the same period with the actual refund.

Sometimes the parties agree that defective items must be disposed of. In this case, the shipper attributes the costs to expenses from defects.

ACT No.____dated “_____”____20___ about the return of defective goods

1. Name of the organization ________________________________________________________________________________

2. Full name of the authorized person _____________________________________________________________________

3. Supplier’s delivery note and invoice number _____________________________________________________

4. Transport company __________________________________________________________ according to transport invoices No. _______________________________________________________________

5. Condition of containers and packaging of products ____________________________________________________________

6. Number of places received _____________________________________________________________________

7. Detailed description of the defective product:

| № | Name of product | Description (detailed description of the product, description of the defect, etc.) | Invoice No. | Price | Qty | Sum |

| 1 | ||||||

| 2 | ||||||

| 3 | ||||||

| 4 | ||||||

| 5 | ||||||

| 6 |

Total amount, rub. (in words) _____________________________________________________________________ including VAT, rub. (in words) ___________________________________________________________________

Conclusion of the commission on the nature of the identified defects in the product (goods) and the reason for their occurrence_________________________________________________________________________________________

The defective product is sent along with a defect report and an invoice for the amount of the defect to the supplier for review. The act is drawn up by a commission consisting of representatives of the supplier and buyer. Members of the commission are responsible for signing an act containing data that does not correspond to reality.

Position_______________________signature_________________________Full name__________________________

Position_______________________signature_________________________Full name__________________________

M.P.

Download the document “Report of defective goods”

Accounting in accounting and balances

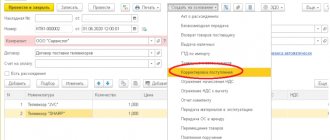

There are only three paths you can take to reflect changes in the program:

- The simplest one, for those who have been collaborating for a long time. Don't make any notes, accept everything on the list, then call the supplier and report any discrepancies. He brings a quality replacement.

- More difficult if the goods have not yet been accepted. Note the differences on the invoice and cross out what is not accepted. Sign, get the driver's signature. Wait for new documents from him in which the information has been corrected.

- If the product was accepted, but then a discrepancy was discovered. A consignment note TORG-12 and an act TORG-2 are drawn up. The seller must agree with the violations.

- If he does not agree, then a claim is drawn up, a protocol on sampling is drawn up, and the shipper is invited for an examination.

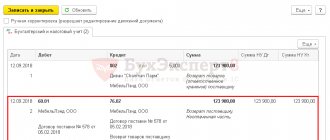

Nuances of filling out a return delivery note

You can download a sample return invoice on our website.

When returning goods, the supplier and shipper are the buyer under the contract. Its name, address and bank details are indicated in the appropriate columns. At the same time, filling in the data on the shipper is not mandatory (letter of the Federal Tax Service of Russia dated November 25, 2014 No. ED-4-15 / [email protected] ).

In the column “Consignee” the name and details of the supplier under the contract are indicated. He is also the payer if the buyer returns paid products and intends to get the money back. When cash payments are not expected, the “Payer” column may not be filled in.

The “Base” column is the most important in the return invoice. Here you need to indicate the content of the operation - “Return of goods”, and also list in detail:

- numbers and dates of invoices for which returned goods and materials were received;

- number and date of the contract;

- names and details of acts, defective statements, letters and other documents provided for by law or contract.

The return invoice is assigned a number in accordance with the numbering system adopted by the organization. If the goods are sent by road, the number and date of the waybill are indicated.

The product section is filled out in full accordance with the data of the invoices, according to which the goods were accepted for accounting. The invoice must make it possible to unambiguously establish the correspondence between the previously delivered and the returned property. Therefore, the name, units of measurement and packaging, and cost must match those indicated in the original invoice. In other words, the product is returned under the same conditions under which it was purchased.

Important! Recommendation from ConsultantPlus The procedure for the buyer to account for the return of goods depends on what kind of goods he is returning - high-quality or defective. The return of quality goods to the supplier is recognized when calculating income tax... (for more details, see K+).

Read about how VAT is calculated on returns and invoices are issued here.

The manager (deputy) and the chief accountant authorize the shipment according to the return invoice with their signatures. The fact of shipment is recorded with the signatures of the financially responsible person and the recipient - a representative of the counterparty or an employee of the transport organization.