Quite often, everyday life and unsettled life, as well as many other various reasons, bring citizens to the need to borrow money - sometimes they simply have no other choice. The borrowed amount may be relatively small, but sometimes, for example, if you purchase real estate, any residential premises, a car, or create your own company, a fairly large amount of money is needed.

Usually a promissory note must be written on it. As a rule, such a document is drawn up in simple writing in the client’s hand (this is the simplest and most popular way to draw up this document). A specific sample is not used in this case - it is simply not mandatory and not needed. In certain situations, a so-called loan agreement is concluded (but this happens much less frequently).

Collection of a debt by receipt from an individual through the court

Judicial procedure for collecting debts from individuals. persons on receipts is a common practice. During the proceedings, two parties are involved, as well as eyewitnesses to the transaction.

To apply to a judicial authority, you must file a claim. After his reception, the secretary will notify the parties about the time and date of the meeting. After considering the case, the court makes a decision. If the decision is satisfactory, the creditor receives a decree securing the claim. Repayment of a loan by an individual can be full or partial, in the form of installments. The latter option implies the consent of the plaintiff and the presence of valid reasons for the debtor (illness, loss of work, deterioration of financial situation).

The court decision must enter into force. After this, the creditor is issued a writ of execution (IL), which allows him to legally collect the debt from an individual by contacting the FSSP.

Can the costs of a lawyer and legal services of a firm in the Republic of Belarus and Minsk be borne by the debtor?

Certainly. This is a common practice when the court, along with the collected amounts, also imposes on the debtor the plaintiff’s expenses for providing legal assistance. The main condition for the court to assign expenses for legal services is the formalization of the relationship between you and the lawyer (i.e., the presence of a written agreement) and the expenses actually incurred for legal assistance at the time of the court hearing. If your transaction with a lawyer involves a percentage of the collected amount upon collection of the money, then such costs will not fall on the debtor.

Rules for filing a claim for debt collection

When filing a claim to collect a debt from an individual against a receipt, you must indicate:

- Name and address of the court.

- Full information about the defendant, applicant.

- Information about when and under what circumstances, witnesses (if any) funds were transferred to an individual.

- Information that the deadlines for fulfilling the obligation were violated by the borrower. If there were payments by receipt, indicate their date and amount.

- The amount to be recovered.

- Links to the Civil Code of the Russian Federation.

- Norms for calculating the amount of debt (interest, penalties).

The statement of claim ends with an appeal to the court with a request to collect the debt from the opponent.

The plaintiff has the right to include in the document requirements for loan repayment, taking into account interest. In this case, the refinancing rate of the Central Bank is taken into account. To calculate the final payment amount, you need to use the formula:

- Divide the debt amount by 360 days.

- Multiply by the number of days of actual delay and the Central Bank rate.

For example, the debt is 15,000 rubles. 30 days overdue.

The amount to be paid will be: 15,000/360*30*8.25% (approximate refinancing rate) = 103 rubles. in a day.

To file a claim to collect a debt from an individual, you need to pay a state fee. Its size depends on the amount to be returned:

- For a claim up to 20 thousand rubles. payment is 4% of the claim price, but not less than 400 rubles.

- For an amount exceeding 20 thousand, but not more than 100 thousand rubles. The state duty will be 3%+800 rubles.

- Debt is more than 100 thousand, but less than 200 thousand rubles. — 2% + 3,200 rub.

- In case of a claim for an amount of more than 200 thousand, but less than 1 million rubles, 1% + 5,200 rubles are subject to payment.

- Debt more than 1 million rubles. – 0.5% + 13,200 rub.

In all cases, interest is taken on an amount that exceeds the minimum allowable. For example, when collecting from an individual an amount of 80,000 rubles. The state duty will be calculated as follows:

- 80 000 – 20 000 = 60 000.

- 60 000 * 3% = 1 800.

- 800 + 1,800 = 2,600 rub.

Attention! If the claim is satisfied, the costs of paying the state duty are borne by the defendant.

The document to be submitted to the court must be drafted correctly. If the rules are violated, there is no detailed information about the parties to the case, or there are errors, the claim will not be considered.

Would you please give me a receipt?

The receipt turned out to be the only evidence that the person lent money to another person, but he never intended to return the funds. As a result, the local courts rejected the offended lender. The Supreme Court explained how to act legally in such situations.

It is difficult to find a person who has never lent money in his life. It is no secret that many of those who went forward and lent money to a relative, neighbor or acquaintance then hopelessly wait for months or years for the debtor to remember about them. That is why the situation that the Supreme Court examined may be of interest to many.

It all started when a certain citizen filed a lawsuit against a friend. The plaintiff asked to recover from the woman the money under the loan agreement and interest for the use of other people's funds. The citizen was rejected by the courts of first instance and appeal. In the district court, the woman said that she had receipts in her hands to confirm the loan agreements and their terms.

The transfer of money to the borrower can be confirmed by various evidence, except for the words of witnesses

From the contents of the receipts it follows that on March 20, 2008, her friend took 200,000 rubles from her at 4 percent per month for an indefinite period. At the same time, she undertook to pay interest on the amount every month on the 20th in cash, and agreed to return the rest of the amount upon request. Six months later, in the fall, the lady took the money from her again - now 100,000 rubles at the same 4 percent, and undertook to pay interest on the amount on the 20th of each month.

But the good intentions of the parties never became reality. The situation with the debt, unfortunately, turned out to be standard - the creditor asked to return her money, and the debtor promised to do so. So all the agreed and unspecified deadlines passed.

But the borrowed money never returned to the woman who once lent it to her friend. In the end, the woman had to go to court. The plaintiff had no doubt about her victory at the court hearing - after all, she had a receipt from the debtor in her hands. And she didn’t refuse either.

Imagine the plaintiff’s surprise when the local courts did not agree with the woman’s arguments and made the exact opposite decision.

In refusing to satisfy the citizen's claim, the courts proceeded from the fact that no loan agreement had been concluded between the ladies. And the receipt available in the case does not confirm the fact of receiving funds from the plaintiff, since it does not contain “information about the lender and the citizen’s obligation to return the amounts indicated in the receipt.”

The Judicial Collegium for Civil Cases of the Supreme Court examined the refusals of local courts and found the conclusions of the courts of first and appellate instances erroneous.

In explaining its arguments, the Judicial Collegium of the Supreme Court stated this:

Article 807 of the Civil Code of the Russian Federation says the following: under a loan agreement, one party (the lender) transfers into the ownership of the other party (the borrower) money or other things determined by generic characteristics. And the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal amount of other things received by him of the same kind and quality. In this case, the loan agreement is considered concluded from the moment of transfer of money or other things.

According to Articles 161, 808 of the same Civil Code, a loan agreement between citizens must be concluded in writing if its amount exceeds at least ten times the minimum wage established by law. Well, in the case when the lender is a legal entity - regardless of the amount.

In confirmation of the loan agreement and its terms, a receipt from the borrower or another document certifying the transfer of a certain amount of money by the lender to him may be presented.

Thus, the Judicial Collegium for Civil Cases of the Supreme Court emphasizes that in order to qualify the relations of the parties as borrowed, it is necessary to establish the nature of the obligation, including reaching an agreement between them on the obligation of the borrower to return the money received to the lender.

As stated in paragraph 1 of Article 160 of the Civil Code, a transaction in writing must be concluded “by drawing up a document expressing its contents and signed by the person or persons making the transaction, or persons duly authorized by them.”

According to paragraph of Article 162 of the Civil Code of the Russian Federation, violation of the form of transaction prescribed by law deprives the parties of the right, in the event of a dispute, to refer to the testimony of witnesses in support of the transaction. But it does not deprive them of the right to provide written and other evidence. Based on the above, the Supreme Court emphasizes that the transfer of a sum of money by a specific lender to a borrower can be confirmed by various evidence, in addition to testimony.

The Judicial Collegium for Civil Cases of the Supreme Court noted that from the case materials it follows that when considering the case, the defendant had the intention of concluding a settlement agreement with the plaintiff.

The court once again drew attention to the fact that the debtor generally agreed with her debt. But in fact, she only expressed disagreement in court only with the accrued interest. But the circumstances, which are very important for qualifying the legal relationship of the parties, in violation of the requirements of the law (part 4 of article 67, part 4 of article 198 of the Civil Procedure Code of the Russian Federation) did not receive any assessment from both courts.

In addition, the Supreme Court emphasized, the local courts did not take into account that, within the meaning of Article 408 of the Civil Code, the presence of a debt receipt with the lender confirms the failure to fulfill a monetary obligation on the part of the borrower, unless otherwise proven.

The local court's reference to the fact that the plaintiff did not present any other evidence (except for a receipt) in support of his claim at the court hearing is, in the opinion of the Supreme Court, unfounded.

The Judicial Collegium for Civil Cases of the Supreme Court once again emphasized that the responsibility of presenting evidence disproving the fact of concluding a loan agreement with a specific lender lay with the defendant. And this important point was also not drawn to the attention of local courts.

Therefore, the Supreme Court, in its decision, overturned the earlier verdicts of local courts and ordered the case of the promissory note to be reconsidered, but taking into account its clarifications.

When not to go to court

There are cases in which going to court to recover a debt from an individual against a receipt is not practical. Among them:

- Declaring the defendant bankrupt. In this case, the debt cannot be collected from an individual, since the citizen is officially declared insolvent.

- Absence of the borrower's signature on the receipt.

- Incorrectly drawn up loan agreement.

- The receipt was printed on a computer and only bears the signature of the borrower and the plaintiff. The defendant may file a counterclaim claiming that the autograph was placed on a blank sheet of paper. Moreover, if there were no witnesses present during the process of signing and transferring money.

- Loan less than RUB 5,000.

In these situations, it makes sense to draw up a voluntary agreement. The parties can find a compromise solution by making some concessions.

Features of a receipt to guarantee debt repayment

A correctly executed loan agreement will help protect the interests of the borrower. Article 808 of the Civil Code of the Russian Federation establishes that if an amount of up to 10 thousand rubles is borrowed, the agreement can be oral. If citizens lend each other a large amount or a legal entity acts as a borrower or lender, the agreement is drawn up exclusively in writing.

An oral agreement on a loan can be confirmed by a receipt from the borrower, which reflects the fact of the transfer of money and valuables. The receipt may contain the terms of the transaction itself, the procedure and deadline for return. It is optimal to issue a receipt from a notary or in the presence of two or more witnesses.

The document is written following the example of a civil contract. It should indicate:

- personal data of both parties: full name, passport details, registration and residence addresses;

- date and place of compilation;

- loan terms: amount in numbers and words, loan currency, fact of transfer of funds by the lender to the borrower;

- repayment procedure: repayment date or frequency of payments, volume and currency of payments;

- cost of use, if agreed upon by the parties;

- witness data;

- signatures of the parties.

Note!

The interested party in receiving the receipt is the creditor, but the debtor has the right to receive his own copy of the document in case the creditor tries to make changes to the document after signing.

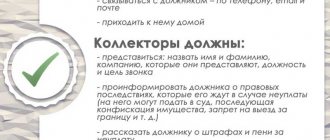

Tips and rules for debtor behavior

Often, the borrower, realizing that he cannot cope with the timely fulfillment of the obligation, begins to hide. Then the creditor naturally begins active and sometimes radical collection actions. In such cases, it is better to take constructive steps:

- Discuss the current situation with the creditor. Offer your options for repaying the debt.

- If it was not possible to reach a settlement agreement, appear in court to hear the case. Explain and justify your position by providing evidence that your financial situation does not allow you to pay on time. In practice, judges look favorably on defendants who make contact.

There is no point in hiding or changing your place of residence or phone numbers. The creditor has the right not only to go to court, but also to repay the debt to collectors. At the same time, an attempt to evade responsibility for assumed obligations may be regarded as fraud.

There are several ways to collect a debt from an individual under a receipt. However, it is not always worth taking the case to court. If the amount of debt is small, it is better to agree on an installment plan or restructuring.

How to invalidate a receipt?

In order for a promissory note to be declared invalid by the court, it must not meet the requirements of the loan agreement because, in fact, that is what it is. If the receipt does not indicate in full or does not indicate at all such information about the borrower as last name, first name, patronymic, passport details, residential address, then the agreement may be declared invalid by the court (according to Article 808 of the Civil Code of the Russian Federation). After all, there are a lot of people with the same first and last names in the country, the plaintiff needs to prove the claims against a specific person.

The lack of signatures of the parties and witnesses, notarization, and the date of drawing up the document in the receipt can also make the plaintiff’s demands illegal. The defendant has the right to declare forgery.

If all the necessary details are available to claim the debt, the defendant may insist on forging his signature on the receipt. But you need to be prepared for a handwriting examination to be carried out. If the expert establishes the authenticity of the signature, the costs of the examination will have to be borne by the defendant.

If the borrower has not received the loan specified by the receipt or has not received it in full, then the defendant has the right to prove in court his lack of money. Moreover, in the first case, the loan agreement will be considered invalid, and in the second, the amount of the agreement will be a certain amount transferred to the borrower.

How the trial itself goes and the decision is made

The legal process for debt collection takes place in accordance with the requirements of the Civil Procedure Code of the Russian Federation. The plaintiff and defendant have the right to defend their rights and present their evidence to the court.

The plaintiff may file a petition for interim measures against the debtor. If the debtor's property was indicated correctly, then the court has no grounds for returning the petition and the property is seized.

During the trial, defendants have the right to petition to have the loan agreement declared invalid. The court is obliged to take into account the defendant’s objections if they are legally justified and the loan agreement may be declared invalid.

For example, if a transaction is recognized as enslaving for the borrower:

- if it was committed during a difficult period of life;

- the transaction was concluded on obviously unfavorable terms for the borrower;

- the rights of the borrower are violated;

- the circumstances under which the transaction was completed differ for the borrower for the worse from the circumstances of similar transactions.

Another reason for declaring a receipt invalid may be a violation of the requirements of the Civil Code of the Russian Federation for processing a debt loan. For example, if the receipt contains incomplete details of the defendant (residence address, passport details).

If the lawsuit ends in favor of the plaintiff, then he has the right, on the basis of a court decision, to demand full payment of the loan amount with accrued interest. The writ of execution must be handed over to the bailiffs for the execution of the court decision at the defendant’s place of residence.

If the court rules in favor of the plaintiff, and the defendant does not comply with the court decision, then the plaintiff has the right to contact law enforcement agencies to initiate criminal proceedings against the borrower under Article 177 of the Criminal Code of the Russian Federation.

Other non-payment options

If the borrower assumes that he may not be able to meet the deadline for repaying the debt or simply does not want to repay the money, then as an option he sometimes takes a number of other actions that are designed to help him not part with the loan.

To prevent bailiffs from seizing and selling the property, the debtor transfers it to one of his close relatives. By law, only what is legally recognized as the property of the defendant can be confiscated.

Some of the defaulters do not even resort to such measures, but simply hide their property with someone close to them. With real estate, however, this option is not feasible. Then he simply gets a job where the official salary is low. And from this income the bailiffs will withhold the debt, which extends significantly over time.

However, with this option, it should be borne in mind that bailiffs often closely monitor the life of the debtor. This means that he will not be able to afford any serious purchases or vacation trips.

The best option if it is impossible to pay the full amount on time is an agreement with the creditor. In this case, you can resolve the issue with a time frame or the ability to pay the debt in installments.

Responsibility for non-return

Often, creditors are faced with a fact when the debtor has a receipt, but he does not repay the debt. When such a situation arises, bailiffs can help. But initially you will have to file a claim in court, and then go to the SSP with a writ of execution. Service employees can hold the defaulter financially responsible, that is, force him to return the money.

Until the situation with debt repayment is finally resolved, various restrictions will be imposed on the borrower. For example, he may not be allowed to go abroad.

If either party has evidence of the borrower’s deliberate fraudulent actions, he or she will face criminal liability.

Legal advice

Maxim Igorevich, Tula

You should not give a loan to a person if there are doubts about its return, and the person does not have any personal property. In case of non-repayment of funds, if the case goes to court, the debtor will have nothing to secure the claims.

Oleg Alekseevich, Moscow

Even in the case of renting residential premises, it may be necessary to draw up receipts when transferring the amount for renting housing or part of the money as a deposit. This will help the tenant protect himself from unfair actions of the owner of the premises.

Video on the topic: