What are the features of recovering debts from individuals without receipts and witnesses? Is it possible to repay a debt without going to court? Where can I order debt collection services without a receipt?

A good friend comes to you and tearfully asks you to lend him some money to urgently repay a loan, for medicine for a second cousin, or for a trip to a sanatorium for his beloved wife, who needs to immediately improve her health.

You feel sympathy for your friend and lend him money without even taking a receipt. Why formalities - after all, this is your friend! Moreover, he asks for money literally for 1-2 months. You wait patiently, but 2, 3, 4 months, six months pass, and you still don’t see your money.

Surely a similar story has happened, if not to you, then to someone you know. In such a situation, many give up. Friendship is friendship, but you want to get your money back, because you don’t have too much of it.

Is it possible to repay a debt if there is no documentary evidence of the transaction - a receipt? And if so, how to do it? I, Anna Medvedeva, an expert at the online magazine HeaterBeaver, will answer these questions in this article.

At the end of the article you will find an overview of situations where, unfortunately, it is impossible to get your money back. Read carefully and do not make such mistakes.

Features of debt repayment without a receipt

Let’s say right away that this process is difficult and does not at all guarantee a successful outcome for you. After all, we are talking about actions within the law, and the law needs evidence. Things that are obvious to you are not obvious to the court - it requires factual confirmation.

How to repay a debt without a receipt? The algorithm of actions is basically similar to the scheme when you have evidence in your hands.

But at the same time, two factors increase significantly:

- attendant difficulties and troubles;

- the likelihood of an unsuccessful outcome for the creditor.

We will pay special attention to the situation when funds were not transferred in cash, but were transferred to a bank card or bank account .

In this case, you need to send a claim to the borrower demanding the return of funds that were transferred erroneously. This is called unjust enrichment.

Important!

The claim must be written within 10 days.

If the debtor does not return the money, you go to court with this claim, but you are writing a statement of claim not to collect the debt, but to return the amount of unjust enrichment. In this case, it will be unrealistic to prove the fact of the loan, but it will be possible to prove an erroneous transfer.

At the request of the court, the borrower will have to provide the basis for receiving the funds and, naturally, will not be able to do this. Then the court will rule in your favor.

How to proceed when borrowing cash will be discussed in the next section.

For related topics, read the article “Debt Collection”.

Methods for collecting debt from an individual

There are several legal ways to get your money back:

- pre-trial;

- judicial;

- extrajudicial.

At the pre-trial stage of collection, an automated contact center will increase the efficiency and speed of collection.

The organization of a contact center in a specialized CRM system for collection “BIT.Debt Management” occurs as follows:

- Automatic distribution of calls to an assigned manager

- Automatic dialing to non-contact debtors

- Call directly from the debtor’s card, where all information on the agreement and on past events is visible

- The operator's work is concentrated in one active window

- Minimizing the time to process one contract

- Minimizing the costs of training/retraining a new employee

- Building a call map for effective negotiations with the debtor

At the judicial stage of collection, a large amount of time is spent on creating standard documents, in which only information about the debtor and the contract actually changes. This problem could be solved using a mechanism for mass creation of electronic documents based on a template.

A tool for generating electronic documents using custom templates will help you generate the necessary documents for the selected pool of cases in one click.

Using the integration with the FSSP portal built into the BIT.Debt Management program, you can obtain open data on enforcement proceedings of individuals provided by the resource of the Federal Bailiff Service (hereinafter referred to as FSSP) fssprus.ru.

- Obtaining complete information on all past and current debts of a person;

- The ability to assess whether the debtor has movable and immovable property that can be recovered;

- Ability to assess the debtor’s solvency;

- The ability to add any information you need to the downloaded data from the FSSP into the program;

- The ability to receive information about bailiffs: full name, phone number for effective tracking of enforcement proceedings;

- Ability to upload information on debtors to BIT.UZ according to a given schedule.

BIT.Debt management is a specialized CRM system for debt collection at all stages.

- Increases the percentage of successful collections by 30%;

- Increases employee productivity by 2 times;

- Allows you to scale quickly;

- Speeds up pre-trial collection;

- Reduces refusals in court by 2 times;

- Reduces collection costs.

More details Request a demo

Methods of repaying a debt without a receipt - 4 main methods

Even in such a seemingly hopeless situation, there are also some loopholes.

Let's see what ways you can try to recover debts from individuals without a receipt.

Method 1. Solving the problem peacefully

Most often, a person is not given a receipt not because of an oversight, but because of trust. Usually money is given on parole to close friends or relatives. Therefore, during negotiations, the working button will be conscience.

What can you agree on with the debtor if he does not repay the debt due to financial difficulties:

- postpone the payment deadline;

- offer payment in installments;

- agree to the so-called barter, when in exchange for a debt the borrower gives you some property or provides any services.

Example

Vasily is an individual entrepreneur who runs a building materials store and a team for repairing and finishing apartments. He borrowed money from his close friend Sergei to develop his business.

But the next wave of crisis in the country sharply reduced the store’s turnover and, accordingly, Vasily’s income. Now he cannot not only repay the debt on time, but even name the date of the expected payment.

The business barely pays off, the friendship comes to an end. However, being civilized people and old friends, Vasily and Sergei found a compromise.

They agreed that for the amount that Vasily borrowed from Sergei, he would do part of the repairs in a friend’s apartment, providing materials from his store and finishing craftsmen.

We suggest reading a separate publication on our website about the benefits of pre-trial debt collection.

Method 2. Reporting fraud to the police

If peace negotiations are unsuccessful, try to repay the debt with the help of the police. How?

The Criminal Code contains an article on theft of money through deception and abuse of trust. That is, about fraud. This article can quite realistically be applied to a situation where the debtor took advantage of the lack of evidence to avoid repaying the debt.

You will learn how events will develop further in the next section.

Method 3. Trial

Debt collection through court is the longest, but also the most effective method. They resort to it if all other options have been exhausted.

In this situation, a claim is filed for the return of funds, other documents are collected, witnesses are brought in, etc. The court's decision depends on the circumstances of the case and, mainly, on the available evidence.

Practical advice on how to repay a debt on a receipt awaits you in the article “Collecting debts on a receipt.”

Method 4. Attracting collectors

To delegate debt collection to a third party (collection agency), one indispensable condition is necessary - the fact of the debt must be confirmed by the court. Therefore, this method is possible only after the completion of the trial.

In addition, collection agencies charge considerable interest rates for their services - up to 50. Not everyone will agree to this.

Let's summarize the data in a table:

| № | A way to repay a debt without a receipt | Probability of success |

| 1 | Resolving the issue peacefully, pre-trial | Low, often very low |

| 2 | Initiation of a criminal case for fraud | Low, has 2 possible outcomes, most often ends in refusal |

| 3 | Court | Quite high if there is at least some evidence |

| 4 | Collectors services | Ambiguous, because even if the case is successfully completed, you will not receive the entire amount of the debt, most often only half |

Steep “showdowns” and prohibited measures

In desperate cases, people turn to debt collectors. And they are different, there are many people who are ready not to limit themselves in the means of collecting debts.

Before you decide to contact them, you should think about it and, of course, warn the debtor.

Collectors can buy debt at half price, but they only buy officially issued (with documents) clean debts.

What is unacceptable

Under no circumstances and amounts of debts can you:

- threaten the debtor and family with violence, damage property;

- turn to magicians and sorcerers (unless, of course, you want to lose even more money).

All this will turn against you and take away valuable time.

How to repay a debt without a receipt - step-by-step instructions

Now let’s consider in practice how to repay a debt without a receipt or witnesses.

It is noteworthy that the development of the process depends on what position the debtor takes.

Step 1. Contact the borrower

Even if you have communicated with the debtor several times before, do so again to clarify his intentions. If you can’t resolve the matter peacefully, take active steps.

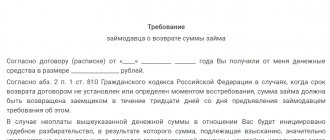

The first of these will be a formal claim against the borrower. Send E1 by registered mail so that you have receipt of receipt. This notice will be very useful in court.

Step 2. We collect the necessary evidence of the fact of transfer of money

Try to get a receipt from the debtor even when the agreed period for repayment of the debt has passed. If this fails, collect other evidence.

These may be:

- audio and video recordings of conversations with the debtor, where we are talking about the return of borrowed money;

- files with conversations via email, social networks, SMS or other communication systems.

It would be great if there were witnesses to the transaction. Agree with them about their participation in the case and trial.

We suggest watching an entertaining video about how people use their imagination to obtain evidence of a debt.

Step 3. Contact the police and file a report of fraud

If the debtor categorically refuses to contact you, go to the police department to file a fraud report.

The application includes:

- debtor data;

- time and place of transfer of money to the debtor;

- the period that has passed since the date of the promised repayment of the debt;

- description of all circumstances.

At the end of the application, state a request for verification for the crime.

These measures are sometimes enough for the debtor to change his position. He will be called in for questioning to identify signs of a crime. This procedure is unpleasant, and also threatens the initiation of a criminal case.

If the debtor has nerves of steel and similar measures do not affect him, the criminal trial will be denied. But the debtor may indirectly admit his guilt.

Example

Ivan Smirnov wrote a similar statement against his neighbor Anatoly Kuznetsov, who some time ago borrowed money from him without a receipt, and subsequently refused to return it.

Kuznetsov was summoned for questioning, where he made a mistake. He began to claim that he did not steal the money, but only borrowed it and did not refuse to return it.

This indirect confession, like all other testimony, was entered into the interrogation record. Now a copy of the protocol will be one of the main pieces of evidence in court.

Step 4. We receive a certificate of refusal to open criminal proceedings

So, the criminal case for fraud did not take place. This means that a lawsuit needs to be started. Along with the certificate of refusal to initiate a criminal case, take a copy of the protocol to the police department.

After this, you can file a claim for debt repayment through the court.

Step 5. Draw up an application to the court

Draw up the debt collection application correctly so that you don’t have to rewrite it in the future.

A well-written document contains:

- data of the borrower and lender;

- amount of debt with interest;

- circumstances of the case;

- a description of the measures you took to repay the debt;

- list of attached evidence;

- date of writing the application and signature.

In parallel with filing a claim for debt collection, we advise you to draw up a petition to seize the borrower’s property.

Step 6. Provide materials on the case

All evidence that you managed to obtain is attached to the statement of claim. We have already listed them. Do not forget to attach to the package a certificate of refusal to initiate criminal proceedings and a copy of the protocol.

It’s good if you have additional indirect arguments.

For example:

- information from witnesses to the transaction;

- information that on the day you indicate as the date of the loan, the debtor acquired any property.

In addition, you will need to pay the state fee, and the payment receipt will also be attached to the claim.

Step 7. We wait for the decision of the trial and get our money

Be prepared for the fact that the return of the borrowed money through the court will take a long time. It is possible that more than one court hearing will be scheduled.

If the court makes a decision to forcibly collect the debt, then a new stage will begin - enforcement proceedings. The work of the bailiffs is already here.

What to do if the court finds that the evidence provided is insufficient? In this case, there is another option - appealing the court decision to a higher authority.

In the publication “Recovery of debts from individuals”, read more details of this process.

Example

Ivanov S. asked to borrow money from his colleague Petrov V. When transferring the money, Petrov did not take a receipt, and it so happened that he gave the money without witnesses.

But the transaction turned out to be filmed on an office video camera, since the matter took place within the walls of the institution where Ivanov and Petrov work in the same department. To prove the fact of the transfer of funds, this video recording is of great value.

Differences between debt repayment with and without a receipt:

| № | If there is a receipt | Without receipt |

| 1 | High probability of success | Chances of success are significantly reduced |

| 2 | Only a receipt is sufficient as proof | You will have to look for other evidence: witnesses to the transaction, confession of the debtor recorded on paper, audio or video recordings |

| 3 | We can hope for an accelerated process | Debt repayment period increases |