What are the features of recovering debts from individuals without receipts and witnesses? Is it possible to repay a debt without going to court? Where can I order debt collection services without a receipt?

A good friend comes to you and tearfully asks you to lend him some money to urgently repay a loan, for medicine for a second cousin, or for a trip to a sanatorium for his beloved wife, who needs to immediately improve her health.

You feel sympathy for your friend and lend him money without even taking a receipt. Why formalities - after all, this is your friend! Moreover, he asks for money literally for 1-2 months. You wait patiently, but 2, 3, 4 months, six months pass, and you still don’t see your money.

Surely a similar story has happened, if not to you, then to someone you know. In such a situation, many give up. Friendship is friendship, but you want to get your money back, because you don’t have too much of it.

Is it possible to repay a debt if there is no documentary evidence of the transaction - a receipt? And if so, how to do it? I, Anna Medvedeva, an expert at the online magazine HeaterBeaver, will answer these questions in this article.

At the end of the article you will find an overview of situations where, unfortunately, it is impossible to get your money back. Read carefully and do not make such mistakes.

Features of debt repayment without a receipt

Let’s say right away that this process is difficult and does not at all guarantee a successful outcome for you. After all, we are talking about actions within the law, and the law needs evidence. Things that are obvious to you are not obvious to the court - it requires factual confirmation.

How to repay a debt without a receipt? The algorithm of actions is basically similar to the scheme when you have evidence in your hands.

But at the same time, two factors increase significantly:

- attendant difficulties and troubles;

- the likelihood of an unsuccessful outcome for the creditor.

We will pay special attention to the situation when funds were not transferred in cash, but were transferred to a bank card or bank account .

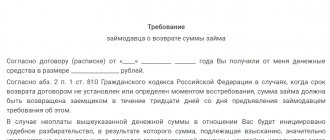

In this case, you need to send a claim to the borrower demanding the return of funds that were transferred erroneously. This is called unjust enrichment.

Important!

The claim must be written within 10 days.

If the debtor does not return the money, you go to court with this claim, but you are writing a statement of claim not to collect the debt, but to return the amount of unjust enrichment. In this case, it will be unrealistic to prove the fact of the loan, but it will be possible to prove an erroneous transfer.

At the request of the court, the borrower will have to provide the basis for receiving the funds and, naturally, will not be able to do this. Then the court will rule in your favor.

How to proceed when borrowing cash will be discussed in the next section.

For related topics, read the article “Debt Collection”.

Statement of claim to court

To begin legal proceedings, you need to prepare a statement of claim for the debt to be collected under the loan agreement.

Important! The document is standard, but it will contain different personal data, as well as a description of the situation with money and evidence. Having a standard template will make it easier to prepare documents for the trial.

The claim is filed in the district court at the place of residence of the debtor, and evidence is attached to it. If there are other documents confirming the existence of a debt, copies of them should also be attached to the application. There should also be a copy of the claim that was sent to the debtor, a receipt for payment of the state duty.

Methods of repaying a debt without a receipt - 4 main methods

Even in such a seemingly hopeless situation, there are also some loopholes.

Let's see what ways you can try to recover debts from individuals without a receipt.

Method 1. Solving the problem peacefully

Most often, a person is not given a receipt not because of an oversight, but because of trust. Usually money is given on parole to close friends or relatives. Therefore, during negotiations, the working button will be conscience.

What can you agree on with the debtor if he does not repay the debt due to financial difficulties:

- postpone the payment deadline;

- offer payment in installments;

- agree to the so-called barter, when in exchange for a debt the borrower gives you some property or provides any services.

Example

Vasily is an individual entrepreneur who runs a building materials store and a team for repairing and finishing apartments. He borrowed money from his close friend Sergei to develop his business.

But the next wave of crisis in the country sharply reduced the store’s turnover and, accordingly, Vasily’s income. Now he cannot not only repay the debt on time, but even name the date of the expected payment.

The business barely pays off, the friendship comes to an end. However, being civilized people and old friends, Vasily and Sergei found a compromise.

They agreed that for the amount that Vasily borrowed from Sergei, he would do part of the repairs in a friend’s apartment, providing materials from his store and finishing craftsmen.

We suggest reading a separate publication on our website about the benefits of pre-trial debt collection.

Method 2. Reporting fraud to the police

If peace negotiations are unsuccessful, try to repay the debt with the help of the police. How?

The Criminal Code contains an article on theft of money through deception and abuse of trust. That is, about fraud. This article can quite realistically be applied to a situation where the debtor took advantage of the lack of evidence to avoid repaying the debt.

You will learn how events will develop further in the next section.

Method 3. Trial

Debt collection through court is the longest, but also the most effective method. They resort to it if all other options have been exhausted.

In this situation, a claim is filed for the return of funds, other documents are collected, witnesses are brought in, etc. The court's decision depends on the circumstances of the case and, mainly, on the available evidence.

Practical advice on how to repay a debt on a receipt awaits you in the article “Collecting debts on a receipt.”

Method 4. Attracting collectors

To delegate debt collection to a third party (collection agency), one indispensable condition is necessary - the fact of the debt must be confirmed by the court. Therefore, this method is possible only after the completion of the trial.

In addition, collection agencies charge considerable interest rates for their services - up to 50. Not everyone will agree to this.

Let's summarize the data in a table:

| № | A way to repay a debt without a receipt | Probability of success |

| 1 | Resolving the issue peacefully, pre-trial | Low, often very low |

| 2 | Initiation of a criminal case for fraud | Low, has 2 possible outcomes, most often ends in refusal |

| 3 | Court | Quite high if there is at least some evidence |

| 4 | Collectors services | Ambiguous, because even if the case is successfully completed, you will not receive the entire amount of the debt, most often only half |

How to repay a debt without a receipt - step-by-step instructions

Now let’s consider in practice how to repay a debt without a receipt or witnesses.

It is noteworthy that the development of the process depends on what position the debtor takes.

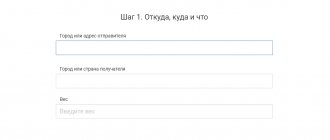

Step 1. Contact the borrower

Even if you have communicated with the debtor several times before, do so again to clarify his intentions. If you can’t resolve the matter peacefully, take active steps.

The first of these will be a formal claim against the borrower. Send E1 by registered mail so that you have receipt of receipt. This notice will be very useful in court.

Step 2. We collect the necessary evidence of the fact of transfer of money

Try to get a receipt from the debtor even when the agreed period for repayment of the debt has passed. If this fails, collect other evidence.

These may be:

- audio and video recordings of conversations with the debtor, where we are talking about the return of borrowed money;

- files with conversations via email, social networks, SMS or other communication systems.

It would be great if there were witnesses to the transaction. Agree with them about their participation in the case and trial.

We suggest watching an entertaining video about how people use their imagination to obtain evidence of a debt.

Step 3. Contact the police and file a report of fraud

If the debtor categorically refuses to contact you, go to the police department to file a fraud report.

The application includes:

- debtor data;

- time and place of transfer of money to the debtor;

- the period that has passed since the date of the promised repayment of the debt;

- description of all circumstances.

At the end of the application, state a request for verification for the crime.

These measures are sometimes enough for the debtor to change his position. He will be called in for questioning to identify signs of a crime. This procedure is unpleasant, and also threatens the initiation of a criminal case.

If the debtor has nerves of steel and similar measures do not affect him, the criminal trial will be denied. But the debtor may indirectly admit his guilt.

Example

Ivan Smirnov wrote a similar statement against his neighbor Anatoly Kuznetsov, who some time ago borrowed money from him without a receipt, and subsequently refused to return it.

Kuznetsov was summoned for questioning, where he made a mistake. He began to claim that he did not steal the money, but only borrowed it and did not refuse to return it.

This indirect confession, like all other testimony, was entered into the interrogation record. Now a copy of the protocol will be one of the main pieces of evidence in court.

Step 4. We receive a certificate of refusal to open criminal proceedings

So, the criminal case for fraud did not take place. This means that a lawsuit needs to be started. Along with the certificate of refusal to initiate a criminal case, take a copy of the protocol to the police department.

After this, you can file a claim for debt repayment through the court.

Step 5. Draw up an application to the court

Draw up the debt collection application correctly so that you don’t have to rewrite it in the future.

A well-written document contains:

- data of the borrower and lender;

- amount of debt with interest;

- circumstances of the case;

- a description of the measures you took to repay the debt;

- list of attached evidence;

- date of writing the application and signature.

In parallel with filing a claim for debt collection, we advise you to draw up a petition to seize the borrower’s property.

Step 6. Provide materials on the case

All evidence that you managed to obtain is attached to the statement of claim. We have already listed them. Do not forget to attach to the package a certificate of refusal to initiate criminal proceedings and a copy of the protocol.

It’s good if you have additional indirect arguments.

For example:

- information from witnesses to the transaction;

- information that on the day you indicate as the date of the loan, the debtor acquired any property.

In addition, you will need to pay the state fee, and the payment receipt will also be attached to the claim.

Step 7. We wait for the decision of the trial and get our money

Be prepared for the fact that the return of the borrowed money through the court will take a long time. It is possible that more than one court hearing will be scheduled.

If the court makes a decision to forcibly collect the debt, then a new stage will begin - enforcement proceedings. The work of the bailiffs is already here.

What to do if the court finds that the evidence provided is insufficient? In this case, there is another option - appealing the court decision to a higher authority.

In the publication “Recovery of debts from individuals”, read more details of this process.

Legal issue

The courts are considering many cases of debt repayment in the presence of a promissory note. But there are even more of those who do not have any paper - neither handwritten, nor, especially, notarized. Very often it is psychologically difficult for a person to ask for a receipt for receiving money from his relative, friend or colleague.

Writing a written obligation or simply a receipt is regulated by Article 808 of the Civil Code of the Russian Federation. According to the same article, such a document must indicate information about the borrower and lender, the repayment period and the amount of the debt.

Notarization is not necessary at all; personal signatures of the two parties to the transaction are quite sufficient. Even such a document has legal force and can become a significant advantage when considering a case in court. Courts usually take the creditor's side in such disputes, especially if there is confirmation in the form of a receipt.