Before making any expensive purchase, a rational person weighs the pros and cons of the action. The most important expensive acquisitions in every person’s life include the purchase of real estate (apartment, house, cottage). In addition to detailed analysis and processing of large amounts of information, there remains an interest in protecting one’s rights at the legislative level. This allows you to avoid asking questions in the future: how not to fall into the hands of scammers when buying an apartment?, how to protect your rights in the event of controversial situations?, how to understand that the apartment you are buying is “clean”?, how to properly draw up documents for the purchased property? To answer these and many other questions, read the rules and features of real estate title insurance.

What is title insurance

Title usually refers to ownership of movable or immovable property, documented and legally proven by the owner. This term gave the name to the type of insurance service under consideration, which is quite logical, given the nature of insurance.

The presence of title insurance guarantees the buyer compensation for damages incurred in the event that the rights to the real estate acquired during a mortgage lending transaction are declared invalid. In this case, the objects of insurance are ownership rights to any type of real estate - both residential (apartment, private house, room, shares in all listed objects), and commercial, economic or industrial (offices, warehouses, garages, bathhouses, etc.) .d.)

Features of title insurance

The main characteristic feature of title insurance is the narrow specialization of this type of insurance. It provides protection for the borrower and lender from one specific risk associated with the loss of ownership rights to the purchased property. Therefore, the contract with the insurance company does not include such insured events as physical destruction of the object, reconstruction or change in its design features and other similar risks. However, in practice, quite often a comprehensive policy is issued that provides title insurance as one of many insurance risks.

Other significant features of title insurance include:

- voluntary nature.

Despite the fact that some banks insist on obtaining title insurance, this requirement is not mandatory in accordance with the provisions of No. 102-FZ and the Civil Code; - Frequently used when purchasing commercial real estate with a mortgage. For such transactions, especially when a legal entity acts as the buyer and borrower, title insurance is almost always taken out;

- long duration of the insurance contract.

Until recently, the standard policy period was no more than 3 years. However, changes in legislation have led to the possibility of entering into agreements with the borrower for up to 10 years. Title insurance is an accompanying measure in relation to a mortgage, often concluded for 20-30 years, so many clients prefer to take out a policy with a maximum term; - benefits for both parties to the mortgage contract.

Two other types of mortgage insurance - property and health of the borrower - are more beneficial to the banking organization than to its client. In contrast, title insurance effectively protects both the lender and the buyer of the property, which is often the deciding factor in taking out the policy.

An essential feature of title insurance is the presence of five main reasons that serve as the basis for invalidating a transaction to purchase real estate with a mortgage. These include:

- forgery and falsification of documents and signatures of parties involved in the purchase and sale of real estate;

- violation of the legal rights of owners who are minors or incompetent;

- concluding a transaction with an individual or legal entity who is not the legal owner of the object;

- violations during the privatization of real estate purchased with a mortgage;

- legal violations during the execution and implementation of the transaction.

"Rosgosstrakh" - Is it worth buying a policy for an apartment and a house?

The most important reason to buy a policy is to save money and nerves. By insuring your property, you can avoid financial expenses in the following situations:

- if the housing and the property that is located in it suffers from fire, theft, flooding and other reasons specified in the contract;

- if the policyholder himself causes damage to the property of other people.

All material costs associated with repairing property, restoring documents, and resolving disputes will be borne by the insurance company.

Risks of title loss

An insured event covered by title insurance occurs as a result of the actions of a third party whose interests were infringed during the purchase and sale of real estate. As a rule, in such a situation we are talking about a lawsuit of one of two types - vindication or declaring the transaction invalid.

Vindication claim

A vindication claim is understood as the recovery of real estate from illegal use. The possibility of such an appeal to the judicial authorities is provided only to legal owners who are able to prove their own rights to real estate. In fact, consideration of evidence of this becomes the subject of legal proceedings.

In such a situation, practically nothing depends on the borrower. The main thing to obtain insurance is to confirm the status of a bona fide buyer who did not know that the other party to the transaction was not the legal owner. It is also extremely important to prove the paid nature of the purchase and sale, for the implementation of which both borrowed funds from the bank under a mortgage loan and one’s own money were used.

The statutory limitation period for vindication claims is 3 years. Considering this fact, it becomes clear why, when carrying out transactions with property owned for longer than the specified period, title insurance is used much less frequently.

Claim for recognition of a completed real estate transaction as void

The most common reason for filing such a claim is a violation of the legal rights of property owners who are incapacitated or minors. For such transactions, the legislation provides for a special procedure for implementation, which requires mandatory obtaining permission from the guardianship authorities.

Real judicial practice is formed in such a way that the likelihood of a judge’s verdict declaring the transaction void is extremely high. Therefore, taking out title insurance when purchasing a property, the owners of which include the above categories of owners, is a competent and balanced decision. It will ensure the protection of the interests of the mortgage borrower in the event of unfavorable developments. It is important to note that the statute of limitations for this type of claim is also set at 3 years.

About company

Rosgosstrakh is a large insurance company that has been in business for almost 100 years (since 1921). As of 2021, the insurer has more than 1,500 offices throughout the Russian Federation.

You can receive the product either in the office or through an agent. Especially for this, the company has a staff of field agents of 35,000 people who will deliver any policy to the client’s home.

Based on the results of 2021, Rosgosstrakh confirmed its high rating, after verification by Expert RA. The company was assigned a ruA rating. This is a positive assessment of the integrity and solvency of the organization.

As of January 2021, Rosgosstrakh actively cooperates and is accredited with the following banks:

- Sberbank;

- Bank of Moscow;

- Opening;

- VTB 24;

- Zenith;

- Khanty-Mansiysk Bank;

- Intesa;

- Baltinvestbank;

- Promsvyazbank;

- MTS;

- BPA;

- Absolute;

- Nordea;

- AK Bars;

- Uralsib;

- Revival;

- UniCredit;

- Connection;

- Housing Finance Bank;

- Gazprombank;

- Raiffeisen;

- RosEvroBank;

- PrimSotsBank;

- Alfa Bank;

- RosselkhozBank;

- Union.

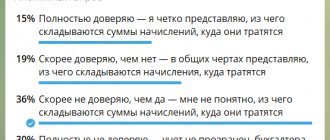

Rosgosstrakh offers only profitable products on attractive terms. Special attention should be paid to mortgage insurance.

How much does title cost in mortgage insurance?

When deciding whether to take out title insurance, one of the important arguments for or against is the cost of the policy. The insurance price is determined taking into account several key parameters, including:

- duration of the insurance policy;

- the approximate cost of the property purchased using a mortgage loan;

- functional purpose of real estate (residential, industrial, commercial or economic);

- the status of the borrower, which can be both organizations and individuals;

- parameters of the mortgage loan agreement concluded with the bank;

- predicted level of risk;

- the duration of the property's ownership by the seller, etc.

Currently, the standard level of rates for title insurance is in the range of 0.3-1.5%. It is important to note that when calculating the cost of issuing a policy, the specified rate is not multiplied by the market value of the property, but by the size of the mortgage loan.

"Insurance Rosgosstrakh" – Policy Activation for Apartments and Houses

If insurance was purchased from Rosgosstrakh partners, it can be easily activated on the company’s website. To do this you need to know:

- envelope number;

- activation code;

- date of purchase;

- cost of the policy;

- check number.

You also need to enter the name of the policyholder, his contact number, address and date of birth.

What to look for when taking out insurance

Title insurance is deservedly considered a legally complex transaction. Therefore, when preparing and signing documents, you should be extremely careful about their content. The optimal solution to eliminate possible problems in the future is to involve qualified lawyers specializing in this type of insurance.

In any case, when applying for a policy, you need to pay close attention to several fundamental points, including:

- duration of the contract.

Ranges from 1 to 10 years. In most cases, it is more profitable to make a longer transaction, especially considering the fact that the mortgage is also almost always concluded for a serious period; - distribution of payments by year.

As a rule, larger payments under the insurance contract are provided for in the first years of the policy. This approach is beneficial to insurance companies, therefore it is in the interests of the borrower to distribute payments more evenly across calendar periods; - formula for calculating the insurance amount.

The main requirement is to link the amount of possible compensation in the event of an insured event to the real value of the property; - clear formulation of the insured risk.

One of the most common grounds for refusing to pay compensation is failure to recognize the occurrence of an insured event. Avoiding such a situation is quite simple - you need to clearly define all possible insured events.

Taking into account each of the listed parameters in the process of preparing and signing an agreement on title insurance of a real estate property will make the policy an effective means of protecting the interests of the mortgage borrower when receiving a loan. It is important to note that the relatively low cost of title insurance makes this service extremely attractive for all parties to the transaction - both the borrower and the banking institution. Serious interest in obtaining a title insurance policy leads to the fact that it is almost always possible to select conditions for the transaction that are suitable and beneficial for both parties.

How to insure a transaction when buying a home?

Step 1. Find the apartment you want to purchase. You can find suitable housing yourself or contact realtors.

Let us immediately make a reservation that not all real estate objects are covered by title insurance. You can insure the transaction if you purchase:

- apartment on the secondary market ; this type of insurance does not apply to new buildings;

- any residential premises: rooms, apartments, country houses;

- plots of land, regardless of the presence of buildings on it;

- non-residential areas, entire factories or individual workshops can be insured.

Necessary documents for registration

When applying for title insurance, the mortgage borrower prepares and provides the following set of documents to the insurance company:

- from the buyer - a passport (for individuals) or a set of statutory and registration documentation (for organizations);

- from the seller - similar documents, as well as documents confirming his legal capacity;

- title documents, which are: an extract from the Unified State Register of Real Estate, a will or other documentation on the inheritance of real estate, a certificate of state registration of property rights, an agreement of gift, exchange or sale, etc.;

- registration certificate or other documents on the characteristics of real estate;

- expert opinion on the market value of the property, obtained during the process of drawing up a mortgage agreement with the bank;

- an agreement on the provision of a mortgage loan, as part of the preparation of which title insurance of real estate takes place.

Questions and Answers on Property and Real Estate at Rosgosstrakh

The company's website has sections that contain answers to the most frequently asked questions about apartment and house .

A popular question about insuring a building in a garden partnership is whether it can be insured only on the basis of a garden book. The company’s specialists answer that it is possible if this document is properly executed: it contains complete information about the owner and is certified with the seal and signature of ST.

Clients also often ask whether it is necessary to enter into an agreement with a full set of risks. The insurer responds that the client can choose any combination of risks.

You can get advice on questions of interest by calling 0530 or 8 (800) 200-99-77 .

FAQ

What cases are included in title insurance?

Title insurance provides protection against invalidation of a real estate purchase transaction with a mortgage. Such a decision is made by the judicial authorities and may be caused by the following reasons:

- falsification of documents drawn up during the transaction and the signatures of the parties involved in it;

- violation of the rights of owners, who are persons who are minors or incompetent;

- making transactions with a person who is not the legal owner;

- violations committed during the privatization of the object;

- violations in the process of registration and completion of a purchase and sale transaction.

Can I give up title on a mortgage?

From the point of view of domestic legislation, title insurance is voluntary. At the same time, banking organizations have the right to independently determine the conditions for providing mortgage lending services.

As a result, the client has every right to refuse the title. Typically, in such a situation, the bank either refuses to issue a mortgage or significantly increases the interest rate. Therefore, in most cases it is advisable to agree to the terms of the financial organization. Moreover, title insurance is extremely beneficial for the borrower himself, protecting him from very unpleasant financially and at the same time very real consequences.

When might a policy fail?

Insurance companies often refuse to pay compensation when an insured event occurs. The basis for such a decision in most cases is:

- failure by the mortgage borrower to fulfill the obligations stipulated by the agreement concluded with the insurance company. Most often, we are talking about late payment or complete non-payment of insurance premiums;

- force majeure circumstances specified in the contract, for example, loss of title during hostilities or as a result of confiscation of real estate by the state;

- use of the insured property for other purposes or in violation of operating conditions;

- sale, exchange or donation of pledged property to third parties and other similar actions of the policyholder.

"Rosgosstrakh" - Non-Insured Events for Apartments and Houses

The company will not compensate for damage in the following situations:

- precipitation got onto the insured items and into the insured apartment through the roof or other openings, as well as through open doors, windows, through a balcony, loggia, terrace;

- property has deteriorated due to natural processes, such as rotting, corrosion and other processes;

- the property has defects;

- the service life has expired;

- the damage was caused as a result of a military operation, terrorist attack, civil war and other similar incidents;

- damage may be compensated by the manufacturer's warranty.

Damage to property, its seizure, or confiscation by order of government agencies are also not considered insured events.