Banks or private lenders are commercial entities whose purpose is to make a profit by issuing loans at interest. Also, do not forget that fines, commissions and penalties are also of commercial interest and can generate profit. And the entire debt business as a whole is very profitable.

Therefore, the borrower’s acquisition of his own debt is a good deal for both parties, but under clear margin conditions. For example, a bank analyzed a problematic contract and came to the conclusion that it would make a profit upon sale.

In general, the concept of profitability for credit institutions in this matter is vague. This is due to the Central Bank’s resolution on restrictions on the issuance of new funds until old debts are written off from the balance sheet.

How it works:

- The Central Bank takes money at 2-3% from the government or other states and distributes it among bankers.

- Each bank is allocated a certain amount (quota). That is, the amount of money issued is strictly limited.

- Next, the bank issues loans to people or companies at its own interest and distributes the amount received from the Central Bank among the borrowers.

- If the borrower stops paying and his debt hangs on the lender’s balance sheet, then the next time the tranche is distributed, the bank will not receive funds in the amount specified in the agreement.

An interesting situation is emerging - it is beneficial for the bank to quickly get rid of the problematic agreement. In principle, he does not lose anything, but only earns. So feel free to negotiate the purchase of personal debt.

Who has the right to redeem the debt:

- an individual representing the interests of the borrower;

- commercial organization (collectors);

- lawyers;

- non-profit structures.

According to Article 382 of the Civil Code, the creditor assigns the rights of claim to third parties for a certain percentage of the total debt.

Consequently, anyone can acquire a debt, except the debtor himself. The only question is the price. But this process is different for different financial structures, since not all creditors can receive money from the budget.

Grounds for ransom

The purchase is formalized by an assignment agreement - an agreement under which the rights of the creditor are transferred to another person (Article 382 of the Civil Code).

The buyer, when concluding an agreement, must be sure that the seller (creditor) has the right to demand payment of the debt.

Supporting documents:

- receipt;

- loan agreement;

- executive document;

- resolution to initiate enforcement proceedings;

- papers indicating that the debtor is undergoing bankruptcy proceedings.

Receipt

Debts on receipt are redeemed reluctantly. Typically, the amount of money borrowed is small. Often the paper is drawn up in violation of the requirements of Art. 808 Civil Code:

- is printed on a computer, but must be written by the debtor exclusively by hand;

- there is no information about the borrower, which makes identification difficult (full name, passport details, registration);

- the loan amount is written in numbers, it is more correct to decipher it in words;

- there is no date of receipt, repayment period, type of loan (interest-bearing or non-interest-bearing);

- there is no phrase “the money was received by me personally.”

Considering that money on a receipt is given to relatives or acquaintances, the lender rarely notarizes it.

As a result, it is difficult to legally demand a refund based on an incorrectly drawn up document. Collectors will not risk their finances if the chance of receiving income is minimal.

Loan agreement

Most often, an assignment agreement is concluded on the basis of a loan agreement. It is beneficial for the bank to get rid of the debt if repayment will entail large legal costs.

When the cost of repayment exceeds the required amount, the debt is more profitable and easier to assign.

Financial institutions sell such agreements in bulk at a low price. Therefore, collectors are more willing to enter into an agreement for the assignment of the right of claim on the basis of a loan agreement.

Executive document

The writ of execution is issued after the court decision enters into legal force (10 days after its issuance). On its basis, the creditor has the right to independently collect funds or entrust this to the bailiffs by initiating enforcement proceedings.

A debt claim based on a writ of execution has a greater chance of being satisfied. The buyer will not have to spend money on legal proceedings. As a result, the price of such an offer turns out to be higher than the wholesale price.

The benefit to the acquirer is obvious. The seller will be able to return 10-50% of the required amount and return the finances as soon as possible.

Resolution on initiation of enforcement proceedings

The resolution indicates that compulsory measures are already being taken against the debtor. The person who has redeemed the debt can only provide the assignment agreement at the place where enforcement actions are carried out, monitor the progress of the case, provide all possible assistance and wait for the result.

Documents on the financial insolvency procedure

The financial affairs of a debtor undergoing bankruptcy proceedings are handled by a bankruptcy trustee. He carries out an inventory, inventory and valuation of property. Tries to even out the situation with the client's debt. The person who entered into the assignment agreement contacts the manager and jointly solves the problem of repaying the debt.

Is it legal to sell debts?

Before discussing the legality of a particular action on the part of an organization controlled by many services, in this case a bank, it is important to take into account that most Russian laws have such a line as “unless otherwise provided by the terms of the contract.” This means that almost any action of the bank in relation to a specific client is legal if it is specified in the loan agreement and the borrower has signed it.

Issues of consumer lending are regulated by the law on the protection of consumer rights. It does not explicitly prohibit the assignment of claims under a loan. There is only an obligation for banks to enter into such transactions only with organizations that have a license to conduct banking activities.

Therefore, you need to re-read your loan agreement again and find out if there is a clause that talks about the possible transfer of debt and information about the client and information on the loan. If the client was warned at the stage of signing the contract, there can be no claims against the bank. During the first months of delay, the debtor is repeatedly reminded about it and the possible consequences. Not earlier than after 3-6 months of complete absence of payments, the bank transfers the right of claim to collectors.

At the bank

Redemption of debts from a bank is a complex process, since there are many applicants for the acquisition, and the procedure is complicated due to bureaucratic delays.

If delays occur, the financial institution will analyze the prospect of getting rid of the contract. And if the credit commission thinks that the debt can be repaid, then all methods will be tried and only then a final decision will be made.

If the bank goes to court and wins the case, the Central Bank will write off this agreement from its balance sheet and provide new funds. The same applies to bankruptcy or initiation of criminal proceedings against the borrower.

Why is it profitable for a bank to sell a borrower’s debt?

The credit institution also benefits from the sale:

- Receives real money that can be immediately spent on development.

- Improves statistics that affect the flow of new funds from the Central Bank fund.

- Saves on costs associated with debt collection. No debt - no costs for lawyers, state fees, or additional work for employees.

- Maintains a positive reputation.

What debts can be redeemed?

- Unpromising - the client lacks property and official income. Even if you win the trial, the bailiffs will complete the enforcement proceedings on the basis of Art. 46 part 4 of Federal Law No. 229.

- Paid – Most of the loan has been paid off. That is, the bank wants to receive only the expected profit in the form of interest or fines.

- Controversial - the borrower has found violations in the contract and is trying to terminate it in accordance with Art. 451 Civil Code.

- With the statute of limitations expired, the bank has no choice but to sell the debt to collectors or a representative of the borrower.

The principle that guides the creditor when selling debt is profit. If the debt is bad, collection will require significant costs, the bank will try to get rid of the “bad” loan as soon as possible. But if there is a chance to return the money, the financial institution will not make the deal.

For example, if the loan was issued against collateral, the purchase of a mortgage, or a car loan, it is more profitable for the bank to seize the collateral and sell it.

If the debtor has a solvent guarantor, the creditor will not back down and will recover the money from the latter through the court.

Most often, the bank assigns loans for consumer loans when it becomes obvious that repayment is impossible or unprofitable.

Required documents

Since the borrower does not have the right to redeem his own debt, representatives must do this, but documents are collected by all parties to the transaction, including the lender.

Borrower (debtor):

- loan agreement;

- account statement;

- the bank's claim indicating the final requirement (hereinafter referred to as the CT);

- property documents;

- income certificates.

Debtor's representative:

- application for debt redemption;

- evidence of the borrower's insolvency;

- documents confirming the benefit of the bank, for example, providing other debt obligations of the client, proving that selling the problem loan would be the best option.

Bank:

- contract analysis;

- monetary demand;

- providing a report that shows how the debt was formed.

For each specific transaction, a separate package of documents is generated.

Assignment agreement

Based on the assignment agreement, the rights of claim are assigned. This provision is regulated by the Civil Code, Art. 388-390.

The debtor is obliged to agree to the sale, but if the agreement is a banking one, then this point was indicated. Therefore, the presence of the borrower at the conclusion of the transaction is not necessary.

If there was no agreement initially, then the debtor is obliged to agree to the sale of the debt.

Options for interaction between a bank and a collection agency

When issuing loans, banks expect to repay the borrowed amount and pay interest during the use of the borrowed funds. But not all borrowers fulfill their loan obligations on time and in full. Banks try to recover lost funds in several stages. When it is not possible to appeal to the conscience of defaulters with the help of its own employees, the bank turns to collection agencies. There are two scenarios in which the interaction between the bank and collectors occurs.

- The loan is not transferred anywhere, the debt remains on the bank’s balance sheet, and collectors only provide assistance in the process of returning borrowed funds.

- Assignment of rights of claim. This means that the bank sold the debt to a collection agency, and now it will search for an unscrupulous client and collect the debt on the loan.

Having received information about an old debt taken out from a bank from collectors, you must carefully read the letter and determine whether there is an assignment of claims, or whether the collector represents the interests of the same bank.

From a moneylender or microfinance organization

Often people borrow money through private advertisements from moneylenders or microfinance organizations. These structures do not receive money from the Central Bank, but may be registered in the register.

Therefore, they do not need to urgently get rid of debts. For example, MFOs circulate investor funds, whose goal is to return them in any way and put them back into circulation. Even if it is a loss.

Moneylenders insure themselves with collateral, so they can add fines and interest for a long time, then sell the property and issue a security deposit, receiving the rest of the debt in court.

Based on this information, it is concluded that it is easier to acquire MFO debts than from a private lender. The problem is the interest rates, which are unreasonably high in microcredit. An MFO may request more than when going to court. Although the purchase process itself will be as simple as possible.

It is more difficult to negotiate with a private lender. Ordinary mathematics will play an important role. If it can be proven numerically that selling the contract is more profitable than litigation, then the debt will be sold.

In the latter case, we advise you not to involve friends or relatives, but to contact financial consultants (lawyers) specializing in this industry.

Who to pay and how much

In cases where collection agencies act on the basis of a partnership agreement for the provision of services, that is, they perform collection work instead of the bank, but the debt remains with the original credit institution, all payments to repay the debt must be sent only to the bank to the previous account. For a long delay, the amount of the monthly payment increases due to accrued penalties and fines, which must be paid first.

When the right of claim is assigned, the borrower ceases to be indebted to the bank, and now the loan is repaid in the interests of the collectors. But this does not mean a multiple increase in the size of the debt. The law protects the rights of citizens. Regardless of who the loan debt is transferred to, no one can change the terms of the initial agreement with the bank without the consent of the borrower. This means the interest rate, the procedure for calculating fines, etc. should not be subject to adjustment by collectors.

Through a third party

The concept of “third party” is not reflected in the legislation, but is used everywhere in the legal field. Therefore, these persons can be anyone:

- Friends;

- relatives;

- legal entities;

- Colleagues.

Therefore, anyone can contact the bank and offer to buy out the debt. The wife has the legal right to purchase her husband's loan under an assignment agreement.

Since the borrower cannot negotiate with the lender, he is obliged to turn to a third party.

If the borrower has offered the bank to buy out his agreement, the participation of a representative is a prerequisite. The main thing in such relationships is trust. Otherwise, the debt will remain in the hands of the assignee.

Which banks take debtors to court?

Banks such as VTB, Raiffeisenbank, Alfa Bank, Sberbank value their reputation and do not use the services of collection companies. The bank has the right to sue the debtor, even if the loan is overdue for only one day. But managers first try to find out why the debtor stopped paying. Immediately after the first day of delay, expect a call from the bank. They may call you for two months, after which the case will be sent to court.

Offer from the creditor to the debtor

Often, moneylenders try to negotiate with debtors to buy out the debt. Banks may also offer this, but with rare exceptions. Typically, the borrower independently seeks approaches to financial organizations by sending a proposal to the organization’s head office or sending a representative to an appointment. Let's assume the bankers are satisfied with the terms and agree to the deal, let's see how this happens.

Redemption procedure

There are two options for the development of events:

- A court decision has been made regarding the debt.

- The creditor did not go to court.

On the second point, everything is simple - they paid a fee and entered into an assignment agreement.

If there was a trial, the process becomes more complicated. The buyer must submit an application for succession, and after the court makes a ruling, submit it to the bailiffs. Next, you need to pick up the writ of execution, thereby ending the proceedings.

The bank will never take away the writ of execution. This carries a significant risk for him.

Application to the bank for debt redemption

The document represents the usual standard form.

Sample

To____name of bank___

I, ___F. AND ABOUT._______________

Address______________________

Tel._______________________

Debt buyout offer

I, (F. I. O.), propose to (name of the bank) conclude an agreement for the assignment of claims for debt collection from (F. I. O. debtor) in the total amount (amount).

The amount of debt was confirmed (case number) by a court decision. With the value of the assigned right in the amount (indicate the amount for which you are willing to redeem the debt) and the payment period within 7 calendar days from the date of conclusion of the assignment agreement.

Date of______________

Signature___________

Classic: debtor bank

The classic sales scheme is to assign the contract directly to the borrower’s representative (relative).

Typically, lenders ask for at least 50% of the PL. But this market does not adhere to clear prices, so in practice it is possible to reduce the cost to 40-30%.

It is worth noting that the agreement is sold to a collection agency for only 10% of the total cost.

Multi-step: bank-collectors-debtor

The bank does not always agree to the debtor's proposal. In some cases, the debt will be sold in a general portfolio to debt collectors.

Here you need to negotiate with representatives of the agency and understand the price for which they bought the debt.

The agency's conditions for repurchase are much more loyal than those of the bank. The explanation is simple: there are a lot of debts, but they pay little. The percentage of closed contracts is only 5% (according to NAPCA) of the total. Therefore, it is much easier to agree.

Debtor's first actions

If the information letter refers to the transfer of a debt, the citizen has the right to verify whether there was actually a transaction between the bank and the collection agency. Therefore, first you need to send a request to the organization specified in the letter to provide supporting official documents (a certified copy of the agreement and an extract directly from the loan). It is better to use mail as a means of communication, send a registered letter with notification of receipt.

If the bank really entered into an agreement on the assignment of claims under this loan, the agency will not have difficulty proving this. Until a written response, the debtor may not send funds to the collection account, and the accrued fines for the waiting period can be challenged, and the court will be on the side of the borrower.

It would also be a good idea to contact the bank where the loan was issued. There is always a possibility that the mailing is just another intimidation to activate debtors. Then it’s better not to tempt fate and start repaying the overdue loan immediately.

How can an organization buy back debt?

A legal entity can also fall into a debt trap, but with a larger number of creditors than a physicist. For example, business partners who provided a delay in receiving goods. This debt is called debit.

Debit Accounts (DA)

We have already told you how to use debit debt to get rid of debts to an individual, now let’s look at whether a company can buy back such a debt.

The procedure will be similar to the acquisition of any debt. Everything is done through representatives. The only difference is that a court decision must be made on this debt.

Loans

Loans for organizations are much larger in amount than for individuals. There are also more ways to collect. For example, blocking and seizure of accounts without which legal entities. the person ceases to operate.

But securing loans is much more serious. Banks lend funds only to trusted organizations that, in their opinion, are able to repay everything on time.

Directors of enterprises are subject to criminal liability for non-repayment of loans. Therefore, companies take such problems seriously and try to resolve the issue as quickly as possible.

An ordinary person can pay or turn off the phone and disappear. This won’t work with organizations. Before issuing money, they are checked by security officers and pulled out all the ins and outs. In fact, companies provide information about all income, even those they try to hide. After all, it is in their interests. It's simple: the higher the income, the larger the loan.

The debt is repurchased either at the negotiation stage - with the help of a reduction in the debt, or after the trial, the debt is repurchased for 30-50% of the nominal value. Provided that there is no bankruptcy procedure.

Credit line

This financial product is provided in portioned tranches. That is, the bank controls a large amount, dividing it into separate payments. When debt arises, not the entire loan is lost, but only a part.

It is possible to buy back this debt, but only if there is a serious delay. Typically, creditors make concessions and are willing to wait quite a long time for funds to arrive. A striking example is the agricultural industry, in which the receipt of payments is delayed for seven to eight months, from the time of sowing the crop until the moment of sale.

Leasing

Typically, enterprises buy special equipment, industrial equipment or commercial real estate on lease. Since this product is highly liquid, the bank takes it first.

It is not practical to buy out such debts, but the company does this to preserve its reputation. Typically, the sale of the collateral covers all expenses and the amount owed is not significant.

Mortgaged property

The company can buy the collateral from the bank on a first-come, first-served basis. But it is necessary to understand that such a turn is undesirable for the organization. As a rule, a company that owes money begins bankruptcy proceedings.

The debt, like the property, is sold by the bankruptcy trustee, but as a result of bankruptcy, such debt is not collectible, and its purchase by any of the parties does not make sense.

Where are debts bought and sold?

- Auctions are specialized online platforms where lenders announce the starting price of an overdue loan. The person who offers the highest price will be able to purchase it. Usually, bad debts (which have been abandoned by collectors) end up at auctions. Their cost is 2-3 times less than the amount of the debt itself.

- Register of banks. Today, every bank publishes information about overdue debts that it is ready to assign. A special Internet page of a financial organization contains information about the amount, date of arrears, the region of the Russian Federation where it exists, and the price for which the debt is repaid. Contacts are indicated.

- Ads. Most collection agencies make their intentions known on the company's website or on social media.

It is difficult to say how much it will cost to purchase on each site. Much depends on the period of delay, how much the loan was secured, and whether the debtor has liquid assets. The price range varies from 5% to 75%. Sometimes the bank sells a portfolio of consumer debts for even 3% of the total amount.

The difficulty is that the buyer does not have the opportunity to obtain complete and objective information about the debtor, and therefore to correctly calculate the risks.

Do's and don'ts for debt collectors

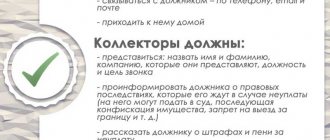

Collection agencies are organizations that have the appropriate license, are officially registered and carry out their main activity, namely debt collection, in accordance with current legislation. By definition, debt collectors are not bandits or criminals. But, unfortunately, in practice, in order to force unscrupulous payers to repay debts, collectors often use methods that go beyond their powers. Actions that violate the rights of citizens are illegal:

- Blackmail, threats and intimidation of the borrower and his relatives.

- Night calls (from 22.00 to 8.00).

- Calls to work and personal numbers more than 6 times a day.

- Public posting of information about the debt (social networks, inscriptions on the walls of the entrance, etc.)

- Penetration into the debtor's home.

- Attempts at any confiscation or simply inventory of property.

- Use of profanity, insults, humiliation and elevated tone of speech in dialogue.

- Demanding minute-by-minute payment directly to the collector.

- Inflating the amount of debt by adding additional penalties, fines and commissions not provided for in the original loan agreement.

All that collectors have the right to do is to remind by means of telephone calls and sending letters, notices of the existence of a debt and the need to repay it, to visit the debtor’s place of residence to personally communicate the requirements, without trying to break in by force and observing the rules of business communication.

To collect debt by selling property, collectors must collect the necessary documents and go to court. Only on the basis of a court decision is it possible to use funds in a citizen’s accounts or proceeds received from the sale of his property to pay off a debt. But this process is the work of a bailiff, not a collector.