Most often, situations are considered when banks offer loans and you have to study the offers and subtleties. But cases when an ordinary person borrows money also arise quite often. And here it’s even more difficult than with banking organizations. Banks employ lawyers who are familiar with all legal norms, but in everyday life people are rarely aware of legal nuances. In this regard, it often turns out that a person cannot get the debt repaid and loses money.

To avoid getting into trouble, you first need to figure out how to properly apply for a loan. There are several types of legal registration of debt.

Receipt

This option is suitable if you are lending a small amount to friends or relatives. It is the simplest and only requires that the debtor himself write the text of the receipt.

It indicates the full name of the borrower and the lender, as well as the amount of the loan and the period during which it will be repaid. If the debt will be repaid in parts, then it is possible to describe a payment schedule. You should not forget to write the place and date of birth of the debtor. This will be useful if the money is not returned and you need to go to court and then receive a writ of execution. The latter must indicate the defendant’s place of birth. Without this information, it will not be possible to obtain a writ of execution. It is also necessary to indicate the passport details and address of the person who gives or borrows money.

The loan amount is recorded in numbers and words. At the end of the text of the receipt the date of signing, signature and its decoding in the form of full name or initials and surname are indicated.

The need for passport data and addresses for temporary or permanent registration lies in the fact that there are cases when the receipt is issued in printed form, and the signature is such that it is not possible to establish that it belongs to a specific person. Sometimes even graphological examination is powerless. In such a situation, the document cannot be accepted by the court as an evidentiary fact.

But many people perceive the receipt simply as a piece of paper that means nothing. Actually this is not true. A receipt is an important document. To give it greater legal significance, it makes sense to have it certified by a notary. This procedure is inexpensive and will protect the interests of the lender from an unscrupulous debtor. But it is worth noting that, according to judicial practice, it is quite difficult to return money on the basis of one receipt. Often I consider it only as a document that confirms the transfer of money. Therefore, its text must be approached extremely responsibly and all the above points must be spelled out.

Notaries recommend using a receipt only when the amount of debt is relatively small.

You cannot indicate the amount of penalties or repayment terms on the receipt. These clauses are specified in the collateral agreement.

Experts advise transferring money not in cash, but by bank transfer. A certificate of the transaction can serve as evidence in court.

Tips for applying for a loan secured by a share

If you want to apply for a regular loan, show the loan officer your interest in preserving the collateral asset.

Say that you are taking money, for example, to renovate a room or purchase furniture for it. Don't forget to allocate your share first.

If you are taking out a mortgage loan, involve the remaining owners of the apartment as co-borrowers or make sure that after buying out the shares you own the home completely. After repaying the loan, you will be able to register the entire apartment with one owner in Rosreestr.

Loan agreement

The second document that ensures the return of money on a debt is a loan agreement. It, too, as in the receipt, indicates the full name, passport details and registration addresses at the place of residence of the parties. The amount and term of the contract must be written down in numbers and deciphered in words. The conditions for full and partial early repayment are prescribed, as well as the interest rate on the loan. In the interest clause, it is recommended to indicate the conditions for a possible rate reduction if the money is returned before the due date.

Specialists in loan agreements recommend indicating the judicial authority to which the lender will contact if necessary.

One of the necessary items is the method of repaying the loan. Repayments can be made either in cash or by transfer to a card or current account. If the payment is non-cash, then the details for performing transactions are indicated.

The document must also record the fact of transfer of funds when this occurs in cash.

The loan agreement must have a section on penalties. It is necessary to indicate what penalties the debtor will be required to pay if the deadlines are violated.

For an agreement to have legal force, it must be signed in the appropriate form. If the loan amount exceeds 10 thousand rubles, then only written form is allowed.

Attention! When the interest rate is specified in the agreement, the lender will have to pay 13% income tax.

When signing a document, two witnesses may be present to confirm the transaction.

Notarization is also recommended. The presence of a notary at the transaction guarantees that the parties to the agreement performed their actions voluntarily and in a capable state. Accordingly, in the future the borrower will no longer be able to refer to the fact that he was forced to receive a debt or that he did not understand what he was doing.

In addition, the notarial form of concluding relations allows you to collect funds without involving the judiciary. If the lender does not receive the money within the specified period, he can contact the notary for a writ of execution. After putting down the appropriate mark, you can immediately contact the bailiffs.

How to get a loan secured by a share in an apartment - 5 main steps

There are a fair number of owners of shared property in the Russian Federation, but only some banks work with such collateral. Other financial companies are more willing to make contact, but interaction with such organizations is always a risky and unpredictable undertaking.

To avoid mistakes and apply for a loan legally , use the expert step-by-step guide.

Stage 1. Selecting a company and submitting an application

Finding a good deal in banks is not an easy task, but it is quite feasible, especially for people living in big cities. Out of dozens of banks, there will probably be 2-3 institutions that will consider your option and make a positive decision on issuing a loan.

Use the search and comparison services for banking offers - Banki.ru and Sravni.ru. These resources save time and at the same time contain reviews from real users about the quality of service and current promotions in banks.

When choosing a bank, consider first the company whose services you already use. Banks provide individual conditions and lower interest rates .

If you live in a small town and you couldn’t find a bank with the required program, look for potential partners among microfinance organizations, pawnshops and other financial companies with an impeccable reputation. Don’t be overly trusting, don’t take anyone’s word for it, check the organization on the website of the Tax Service and the Bank of Russia.

Stage 2. Real estate valuation

You have the right to evaluate the property yourself. To do this, find a competent appraiser and order the service at your own expense. You will have to shell out extra money, but you will get an objective idea of the price and a document confirming this.

If the appraisal is carried out by a lender, it is in his interests to underestimate the value in order to reduce his risks.

Example

You know that your room costs approximately 1 million rubles . A representative of the credit institution carried out an assessment and set a slightly different price - 700,000 rubles . But from this amount you will receive only 400 thousand according to the terms of the agreement (50-60%).

If for some reason you cannot pay the debt, the room will be seized and the debt will be paid off with the proceeds from the sale. It turns out that you lost your room for 40% of the real market price.

Stage 3. Collection of documents

I have already given a list of the borrower’s documents above.

You will definitely need real estate papers:

- a fresh extract from the Unified State Register of Real Estate – from 2021 it replaces the certificate of ownership;

- documents confirming that the property was acquired legally - purchased, inherited, privatized, donated;

- technical passport of the object - if you don’t have one, it will be made at the BTI;

- cadastral passport;

- certificate of absence of debts for utility services - debts should be closed in advance;

- extract from the house register;

- information about other owners and residents registered in the apartment - as well as the consent of other owners to manipulate the property.

If there is an assessment document, we attach it too. Banks will almost certainly require insurance for the property, but you have the right to choose the insurance company yourself.

Stage 4. Signing the contract

Each loan agreement secured by real estate is drawn up individually. There are no formal agreements . The document must be read before signing, preferably more than once.

The most important points of the agreement:

- final rate;

- the rights of the creditor and your rights;

- conditions for early closure of the loan;

- the presence of commissions for financial and banking transactions;

- conditions for calculating fines.

If any points seem dubious to you, you have the right to insist on their exclusion from the contract or changing the wording.

Large banks will not commit outright deception, but small credit companies with a dubious sign can easily concoct an agreement under which you not only will not receive money, but will also be left without a room.

And one more point: the loan agreement and the collateral agreement are different documents. And their purpose is also different. Check both agreements, preferably with the assistance of a professional lawyer. Lawyer, an online legal services service, can help you with this.

Stage 5. Receiving money and repaying the loan

Until you receive a transfer to your card or cash in your hands, do not relax.

In some microfinance organizations and pawnshops, they first issue an advance, then the rest of the amount. Make sure you get everything down to the ruble.

All you have to do is spend the money for its intended purpose and start paying it back according to the payment schedule. Be sure to keep payment documents that indicate when, for what and how much was paid. Avoid delays, use the safest and cheapest methods of transferring money.

Pledge agreement

The loan agreement can be supported by the presence of collateral, which will guarantee the lender the receipt of the disbursed funds in any case. The collateral depends on the loan amount. It can be a garage, a car, a country house or an apartment. But it is worth noting that the value of the collateral does not have to correspond to the amount of the loan issued. But it cannot be less than the debt. That is, it must cover the amount of money borrowed.

The need for collateral is due to the fact that many people take out varying amounts of loans and then do not pay them back. And in order to get his money back, the lender will have to spend a lot of time in court. If the debtor does not have a stable income, then repayment of the debt may take a long period of time.

Important! The presence of collateral significantly protects the lender from non-repayment of money.

Both movable property and real estate can be used as loan collateral. Experts recommend using real estate, because an unscrupulous borrower can hide movable property.

According to the law, a pledge agreement does not require notarization. But if the object of the pledge is real estate, its registration with the Rosreestr authorities is mandatory. The fact of transfer of money is documented in the form of a receipt. If the return is made in cash, it is also necessary to prepare it.

Conditions for purchasing a share

“Rosbank Dom” has developed two loan programs at once, under which you can purchase just part of the real estate:

- to purchase a share. This is relevant if, after processing the loan, the entire apartment becomes the property of the borrower, that is, this is the last share;

- to purchase a room. We are talking about a allocated part in the form of a room in a communal apartment. It is important that the property meets the bank's criteria.

To apply for a mortgage loan for a share of an apartment, the borrower must provide a package of documents, which includes a certificate of income. Rosbank House considers citizens of any country aged 21-65 years as clients. Down payment - from 15% for the last share, from 25% for a room.

Interest on debt

Most often, borrowing money between friends or close relatives does not include interest payments. But this loan option is also possible and this issue is regulated by the norms of the Civil Code of the Russian Federation. The interest rate, according to the law, is established by decision of the parties and is specified in the security document.

If the amount of interest is not specified, then the creditor has the right to receive an amount that is calculated at the refinancing rate at the time of full repayment of the debt or part of it. The calculation is carried out taking into account the lender’s place of residence or address if the lender is a legal entity.

It is also recommended at the time of registration of documents to discuss the issue of reducing interest in case of early repayment of money.

It’s also not worth setting an unreasonably high interest rate, because in this case the contract can easily be declared invalid due to onerous conditions.

Borrow money secured by real estate

Securing a loan with real estate collateral occurs when the loan amount exceeds one million rubles. In this situation, the parties sign the agreement in 3 copies. Next, you need to sign a pledge agreement. After registration with Rosreestr, an encumbrance is placed on the property, and the borrower will not be able to dispose of it without the consent of the lender.

Reference! If the debt is not paid, the property is put up for auction, and the money from the sale is returned to the creditor to pay off the debt.

Before entering into a transaction, it is necessary to check the estimated value of the real estate, its liquidity and the presence of third parties living in it. For example, if children under 18 live in an apartment or house, this property cannot be used as collateral.

Applying for a mortgage to purchase a share in an apartment

First, the borrower needs to collect documents to consider the application: passport, work certificates, information about marital status, etc. The bank will analyze the information received and decide whether it is possible to provide a loan.

If the decision is positive, the client can begin collecting documents for the purchased object. If the collateral is legally clear and meets the requirements of the banking organization, the transaction is concluded.

If you plan to purchase the last share and then become the owner of the entire property, there will be no problems. But when it comes to a room in a communal apartment, it is necessary to obtain consent to the transaction from other co-owners, since they have the primary right to purchase.

A mortgage loan for the purchase of a share in an apartment may be more expensive than a loan for the purchase of an entire property. The bank bears increased risks, and therefore increases rates. For example, Rosbank Dom increases the rate by 0.5% if the client takes out a mortgage for a room.

What to do if the debt is not repaid?

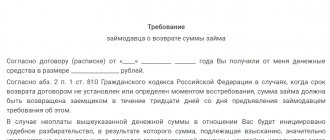

If the term of the receipt or loan agreement has expired and the creditor has not received the funds back in full, he has the right to go to court. This can be done the next day after the expiration date. In this case, there is no need to notify the borrower of your actions.

According to the Civil Code of the Russian Federation, funds received on demand (without specifying the repayment period in the agreement) must be transferred to the lender within thirty days from the date of the first demand. Such a requirement is issued in the form of a registered letter and will serve as evidence in future legal proceedings.

If the borrower fails to meet payment deadlines, the lender may also file a lawsuit. Before applying, it is possible to file a claim with the debtor, but this point is not mandatory from the point of view of law.

In a situation where a collateral agreement has been signed, and the borrower is in default more than three times a year, the lender can also file a claim in court to collect the debt at the expense of the collateral.

If the estimated value of the collateral exceeds the amount of the debt, the lender is obliged to return the remaining amount to the borrower. If the collateral is not sold, the lender can keep it and return 25% of the cost to the other party.

Before applying to a notary for a writ of execution, the lender must notify the borrower of its intention. This is done by sending a registered letter. Next, you should wait fourteen days and, if during this period the lender has not received his money, he has the right to contact any notary.

When applying, the notary will not only carry out the writ of execution, but will also check the documents, confirming their legality. This notary service is paid. The fee is 1⁄2 percent of the amount owed.

Attention! The presence of a writ of execution exempts the debtor from paying fines for violating the deadlines under the contract.

Where to get a loan secured by a share in an apartment - review of the TOP 5 banks

Mortgaging a room is not the fastest and far from the only way to borrow money from a bank.

If you need a relatively small loan in the amount of 200-750 thousand rubles , then it is more profitable to order a credit card. Such products have a grace period of 50 days or more, during which interest on purchases and withdrawals is not charged.

Our expert review of the five best banks in the Russian Federation will help you choose a company.

1) Sovcombank

Sovcombank offers loans secured by an apartment and any other real estate. The list of objects includes rooms, houses, cottages with and without plots, non-residential and commercial premises. Regular clients and pensioners receive preferential lending conditions.

Conditions:

- amount from 300,000 to 3 million rubles ;

- terms from 5 to 10 years;

- the collateral must be within the product's coverage area;

- the client must have permanent registration;

- The client must have a landline home or work telephone.

Base rate – from 18.9% per annum.

2) VTB Bank of Moscow

VTB Bank of Moscow – consumer loans for all occasions at a rate of 13.9% per annum. The maximum amount is 3 million rubles . Fill out the application on the website, wait 15 minutes for a response, if the decision is positive, take the documents and go to the nearest branch to sign the contract.

The list of beneficiaries includes doctors, teachers, tax and law enforcement officials, and working pensioners.

3) Tinkoff Bank

Tinkoff Bank offers to take out a loan quickly and without leaving your home. Order a credit card with a limit of 300,000 rubles and receive it by courier on the day you apply.

Grace period – 55 days. For every purchase - cashback up to 30% in points. Issue and delivery are free. Annual maintenance – 590 rubles . The base rate is 19.9% per year.

4) Alfa-Bank

Alfa-Bank – special lending conditions for salary clients and persons who already have a current account. Consumer loans up to 3 million and above, as well as mortgage loans secured by existing housing. Mortgage rate – from 9.2%.

Several types of credit cards are available with a limit from 300,000 rubles to 1 million . To receive one, fill out an application on the Alpha website, wait for a response and receive the card at the nearest branch. This bank has record terms for preferential lending - from 60 to 100 days.

5) Renaissance Credit

Renaissance Credit – cash loans up to 750,000 rubles under 4 lending programs. There is a universal rule - the more documents, the more favorable the conditions.

If you need money quickly, get a credit card with a limit of 200,000 . and a grace period of 50 days. Get it same day at the branch closest to your home. The base rate is 24.9% per annum.

Comparison table of bank offers:

| № | Bank | Rate, % per annum | Maximum loan amount |

| 1 | 18.9 for a loan secured by real estate | Up to 30 million, but not more than 60% of the value of the collateral | |

| 2 | From 13.9 | Up to 3 million | |

| 3 | 19.9 by card, 14.9 by cash loan | Up to 300,000 on a card, up to 1 million on a cash loan | |

| 4 | 23.99 for a credit card, from 9.2 for mortgage loans | Up to 1 million on card and up to 5 million in cash | |

| 5 | 24.9 on a card, from 14.9 on a regular loan | Up to 200 thousand on a card, up to 750 on a cash loan |

conclusions

Before lending money, you need to select a suitable document to protect your rights as a lender. If the amount is small, then you can limit yourself to a receipt. In all other cases, an agreement should be drawn up. This could be a loan agreement. It must indicate the details of each party. This is your full name, registration address, passport details and place of birth. It is also necessary to agree on the amount of debt and the timing of its repayment. If there is an interest rate, then it is indicated in the contract. You can also prescribe the conditions for reducing it in case of early repayment of the debt.

The agreement must be drawn up in writing, and in case of significant amounts, it must be certified by a notary. Concluding a transaction with a notary protects both parties from groundless claims in the future.

Important! The fact of transfer of money is recorded using a receipt.

After affixing your signature, you should write a full transcript of your full name on each document.

If the collateral amount exceeds one million, then a loan agreement must be drawn up. After signing, the documents are submitted to Rosreestr for registration and an encumbrance is placed on the pledged property. Accordingly, until the date of full repayment, the borrower cannot sell or give away property without the consent of the lender.

If the debtor fulfills the terms of the transaction in bad faith and allows delays, the lender has the right to apply to a notary for a writ of execution. After putting down the appropriate mark, you can contact the bailiffs, bypassing the court.

As for the pledge agreement, if the terms are violated, the creditor can file a claim in court. By decision of the court, the property will be put up for auction, and the funds received will be transferred to the lender to pay off the debt.

According to the recommendation of many notaries, any debt should be formalized in the form of an agreement and preferably notarized. The receipt also has legal force, but it will be quite difficult to get your money back, having only this in hand.

How to urgently apply for a loan secured by a share in an apartment - 4 useful tips

The presence of collateral in itself speeds up the receipt of a response from the bank.

And expert advice will help you get a loan on more favorable terms.

Tip 1. Use the services of brokers

A professional credit broker knows EVERYTHING about profitable loans in your region. He is aware of the conditions in a particular institution and has established contacts with bank employees.

Such a specialist will find the most profitable option for you out of all possible, and, if necessary, will help you get a loan with bad “credit karma”.

The question is how to find an honest and truly helpful broker? A qualified specialist is looked for like a good doctor - based on recommendations. If this method is not available to you, focus on ratings, company status, and reviews on independent resources.

Tip 2. Take a private loan

Advice for those who have already been rejected by banks and other financial companies. A private lender does not care about your credit history; he will not require a bunch of documents to confirm your solvency. At the same time, the private owner issues money almost instantly.

Cons: risk of contacting a scammer, high interest rates.

Tip 3. Calculate loan terms using a loan calculator

If you want to save time, use loan calculators that are available on the website of any self-respecting bank and microfinance organization. This way you will immediately understand what awaits you and quickly select the most profitable option.

Tip 4: Consult with investors

Professional investors invest their funds only in profitable projects. But if necessary, they will help you choose an individual lending program that will speed up the loan process.

Investment companies, like private traders, are not interested in your credit history. Their guarantee is the property itself, which you do not want to lose.

A short video to help: