The transfer of cash from one person to another must be accompanied by the preparation of a special receipt. Most often, this document is used in relations between individuals, but sometimes it can also be used between ordinary citizens and organizations (for example, when it comes to banks or microfinance companies).

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Why do you need a receipt?

A receipt is a document that confirms that money was transferred from one individual or legal entity to another person as a loan or for other reasons.

The receipt contains information about how much money was given, under what conditions, and in what period it should be returned to the lender.

In cases where disagreements arise between the creditor and the debtor and one of them decides to go to court, it is the receipt that becomes the official document that proves the fact of the transfer of money, and also shows the conditions for their use and the time frame within which they should have been received given back.

A receipt is not one of the mandatory documents that must accompany the transfer of cash (by the way, in relations between citizens there are no such documents at all), but it is recommended.

What to do if the borrower is bankrupt

If the borrower is declared bankrupt, the loan is collected in accordance with bankruptcy law.

After the introduction of debt restructuring, the deadline for the fulfillment of all obligations is considered to have arrived, and the accrual of penalties stops.

To be able to collect the debt, the borrower must submit an application to the arbitration court to include his claims in the register of creditors' claims within two months from the date of publication of the application declaring the debtor bankrupt (in the Kommersant newspaper). You can also track the information on the Fedresurs website.

To correctly draw up an application and prove the existence of a debt, contact a lawyer.

We have prepared a detailed article on how to recover money by initiating bankruptcy proceedings for the debtor. Useful material for lenders - we recommend you read it!

Are you a creditor and do you need protection of your interests in court? Sign up for a consultation!

Sign up

When is the document most often used?

There are many reasons for creating a receipt for receiving funds:

- purchase and sale of goods;

- payment for services or rent;

- simple debt, etc.

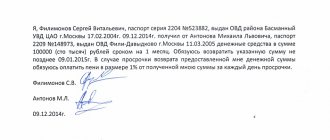

It should be noted that in a situation where we are talking about a debt obligation, the parties sometimes enter into a loan agreement between themselves - it is more serious from the point of view of the law, because contains more complete and detailed information, but must be drawn up according to a certain scheme and structure, while a receipt is simpler in terms of design and at the same time has almost equal legal force (provided, of course, that it contains some mandatory information).

Pre-trial procedure for debt collection by receipt

The lender may try to recover funds from the borrower out of court. To do this, draw up and send a claim to the debtor.

In your complaint please indicate:

- information about the parties to the loan agreement,

- the fact that the borrower has received funds,

- the loan repayment deadline has arrived,

- demand for its return.

Send the claim by mail with notification or hand it to the debtor in person.

If the loan repayment period is not specified, then before going to court you must send the borrower a written request to repay the loan, wait 30 days, and only after that go to court.

Do I need to get it certified by a notary?

The obligation to certify a receipt by a notary is not stipulated in the legislation of the Russian Federation, i.e. Each lender has the right to decide for himself whether he is interested in having the receipt certified by the signature of an employee of a notary office or not.

However, the very fact of having a notary’s autograph gives the receipt greater significance, so you should not neglect it.

The only minus here, or rather, even two – time costs and additional financial expenses.

How to challenge a receipt for lack of money

The presence of a receipt from the lender is confirmation of the borrower’s failure to fulfill the obligations of the borrower to repay the loan, unless otherwise proven (Decision of the Supreme Court of the Russian Federation dated February 13, 2018 No. 41-KG17-39; Appeal determination of the Moscow City Court dated November 28, 2019 No. 33-51586/2019) .

The loan agreement is considered concluded from the moment the money is transferred. The debtor can challenge the loan by proving that in reality the funds were not provided to him.

Evidence may include:

- information about the financial situation of the creditor, which does not allow him to provide the loan amount indicated in the receipt,

- witness's testimonies,

- information about the lack of funds from the debtor after the issuance of the receipt.

Attention! In itself, the argument that the lender does not have a sufficient amount of money is not a basis for recognizing the loan agreement as non-monetary (Appeal ruling of the Moscow Court dated July 22, 2019 in case No. 33-12511/2019).

But in case of bankruptcy of the debtor, the reality of issuing funds to close relatives and other affiliated persons, on the basis of a receipt, can be challenged by the financial manager or bankruptcy creditor as an imaginary transaction precisely on the basis of the above signs.

The courts also take into account such signs as the issuance of further loans in the conditions of non-repayment of previously issued amounts, the failure of the creditor to take measures to claim the loan amount. If the court determines that the note is fictitious, it will refuse to include the creditor’s claims in the register (resolution of the Moscow District Court of April 30, 2019 in case No. A40-243525/17).

People often turn to their friends, relatives, and colleagues for cash in order to avoid taking out a bank loan. As a rule, borrowers in such situations try to repay their debt on time and in full in order to maintain normal human relationships and not burden themselves with unnecessary legal and personal problems. However, not everyone succeeds and not always.

Then lenders have to one way or another return their money on a claim, through the court, the bailiff service, or even using the services of collection agencies.

In fact, there are a large number of options for civil transactions, the failure of which may result in receivables. But in practice, disputes about the collection of the loan amount against a receipt are especially common, since this is the most popular type of civil dispute about the collection of funds between individuals. People often borrow money from their loved ones and, unfortunately, are not always able to repay it on time or in full.

Why are witnesses needed?

Some lenders prudently enlist the support of witnesses when transferring money. They may be uninterested persons, information about whom is also required to be included in the receipt (their full name, passport details and address of residence).

With their signatures, they confirm the fact that the money was transferred exactly in the amount stated in the receipt and on the conditions indicated in it.

In fact, in some way the witnesses perform the function of a notary.

How to collect a debt on a receipt in court

The statement of claim is filed with the district court at the defendant’s place of residence.

If the loan amount together with interest does not exceed 50,000 rubles, then contact the magistrate.

After the court decision comes into force (one month after the decision is made, unless an appeal is filed), you can receive a writ of execution to present it to the bailiff service.

Magistrates also have jurisdiction over cases of issuing a court order. A court order is issued for monetary claims of no more than 500,000 rubles, based on a written transaction. A court order is an executive document. But not all courts recognize the receipt as an indisputable requirement.

If the amount of the claim is no more than 100,000 rubles, then the case can be considered through simplified proceedings without calling the parties.

To correctly determine the jurisdiction of the dispute and draw up a statement, contact a lawyer.

How to properly file a claim for debt collection using a receipt

When filing both a claim and an application for a court order, you must pay a state fee. Its size depends on the amount of the claim.

In the statement of claim, please indicate:

- name of the court,

- information about the plaintiff and defendant,

- circumstances of the loan,

- demand for loan repayment.

Attention! If the loan amount is indicated in the receipt in a foreign currency (currency of the debt), then you have the right to collect it only in Russian rubles (currency of payment) in an amount equivalent to the currency of the debt at the exchange rate of the Central Bank of the Russian Federation on the date of execution of the court decision. (Resolution of the Plenum of the Armed Forces of the Russian Federation No. 54 of November 22, 2016).

- requirement to pay interest for using a loan (if the loan is interest-bearing), interest on the basis of Art. 395 of the Civil Code of the Russian Federation for late loan repayment,

Attention! The obligation to pay interest on the loan amount (penalty) in the amount provided for in clause 1 of Art. 395 of the Civil Code from the day when it should have been returned until the day it is returned to the lender, arises in case of delay in obligations, regardless of the payment of interest provided for in paragraph 1 of Art. 809 of the Civil Code, for the use of a loan (Definition of the Armed Forces of the Russian Federation dated September 5, 2016 No. 4-KG15-75).

- signature.

What documents should be attached to the claim?

Attach to the application a copy of the receipt, a receipt for payment of the state fee (request for deferment), as well as evidence of sending the claim to the defendant.

In addition, evidence of the issuance of the loan and its terms may include:

- audio or video recording,

- recording of a telephone conversation.

Submit your application to the court by mail or via the Internet by filling out a special form on the website.

claim for debt collection

2021 sample

View document

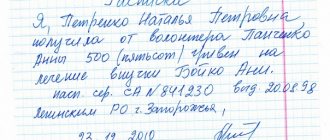

Rules for drawing up receipts

This document is formed in simple written form in any form on a regular sheet of paper. It is also possible to print the receipt on a computer, but this option is not considered the best, since if there is a need for a graphological or handwriting examination, such a receipt will not be the most convenient object of study.

The text must indicate:

- date and place of document formation;

- last name, first name and patronymic of the person who takes the money, his passport details, address of residence (official and actual). Similarly, the receipt contains information about who gives the money;

- amount - it must be indicated in numbers and words;

- if cash is transferred in foreign currency, we advise you to indicate its current exchange rate and the amount in which the debt will need to be repaid;

- deadline for refund;

- return method: cash or by bank transfer - to a card or bank account) and return method - lump sum or in installments. If the second option is chosen, you need to draw up a detailed payment schedule;

- in the case where money was given, what is called “at interest,” this must also be indicated in the document (and the amount of the interest rate must be specified).

Finally, the receipt must be certified by the signature of the person who accepts the money (it is desirable that the signature matches the one in his passport) and the autographs of witnesses, if any, during the money transfer procedure. If desired, the lender can also sign the document.

The receipt is drawn up in a single copy and handed over to the lender.

Deadline for collection of funds according to receipt

A general limitation period of three years applies to loan repayments. How to calculate it?

If the receipt indicates the loan repayment period, the statute of limitations begins to run the next day after the expiration of the repayment period. If the period is not specified, then the statute of limitations is counted after 30 days from the date of sending the lender’s request to repay the loan.

But the court will apply the statute of limitations only if the defendant declares so. Therefore, if you are the defendant, claim the statute of limitations before the court makes a decision.

FAQ

Is it worth making a receipt when granting a loan?

Yes, the presence of a document secures the creditor’s rights to close the debt.

In what form is the document drawn up - handwritten or printed?

Both options are considered legal. The main thing is to include all the necessary data and details in the document.

How to avoid mistakes when drawing up a receipt?

The easiest way is to carefully read the information posted on our website. Here are also links to the form and a sample of a completed receipt, studying which will also help you draw up the document correctly.

Our services and prices

Free consultation

0 ₽

- You talk about your problem, ask questions;

- The lawyer clarifies the necessary information, analyzes the situation, tells options for the development of events;

- Together you choose a profitable option - bankruptcy, refinancing, just a complaint against debt collectors or a bank;

- The lawyer tells you how to prepare, where to get documents, and what to do in your case.

Read more

Out-of-court bankruptcy in MFC on a turnkey basis

25 000 ₽

- Verification and recording of debts and proceedings in the FSSP, assessment of property and contestability of transactions for 3 years

- Drawing up an application and list of creditors

- Filing a bankruptcy application to the MFC by proxy

- Working with banks and collectors - notification of refusal to cooperate, complaints to the prosecutor's office and the FSSP in case of violations

- Representation of interests by a lawyer in case of objections from creditors

- Six months later, you receive a decision from the MFC to declare you bankrupt and write off your debts.

Read more

Turnkey bankruptcy of an individual

from 8,000 ₽/month.

- Filing a bankruptcy petition

- Collection of necessary documents

- State duty and remuneration of the arbitration manager

- Representation of interests by a lawyer at a court hearing on the introduction of bankruptcy proceedings

- Full support of bankruptcy proceedings by financial managers

More details

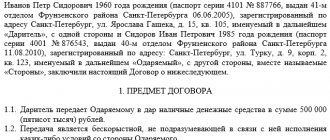

Sample receipt for division of jointly acquired property

There is no approved form for the receipt; it can be written in any form. The main requirement is that the information must be as complete as possible and meet the basic requirements for legal documents.

Example:

Receipt for division of property

Moscow

03/15/2018

Citizens Ezhikov I.I. and Ezhikova S.S., marriage registered on June 1, 2011 in the registry office of the Central District, decided to divide the common property in accordance with Art. 38 SK under the following conditions:

- Common property is:

- 3-room apartment at st. Lenina, 12 Certificate of Rosreestr No. 00000000 dated 06/06/2014

- A dacha plot of 0.8 hectares in the Zvezda residential complex. Cadastral number 123456789. Rosreestr Certificate No. 000000 dated 08/18/2012.

- The car is a Lada 2013 model. Technical passport 000000.

- Deposit in Tinkoff Bank account No. 000000 in the name of S.S. Ivanova. in the amount of 1,300,050 rubles.

- Jewelry: gold necklace weighing 10 g with a 5 carat diamond.

- The parties agreed to the division of property as follows:

- The apartment is transferred to I.I. Ezhikov.

- Transport, jewelry, summer cottage, deposits remain the property of S.S. Ezhikova.

- The property is transferred to the parties in accordance with the established procedure.

- Registration of rights to movable and immovable property must occur within 90 days after the conclusion of the contract.

- The parties guarantee that the property is not pledged to the bank, is not under arrest, is not donated or sold to third parties.

Ezhikov I.I. _________(signature)

Ezhikova S.S. _________(signature)

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

Features of property division

After the spouses have divorced, all property acquired by them while living together must be divided accordingly. It is worth noting that the procedure does not require judicial intervention if the parties can independently and without disputes divide all acquired movable real estate.

When dividing the property of spouses, emphasis is placed on the property of the first, second and third order. These include the following types of property:

- Securities, shares, cash deposits in different currencies.

- Real estate - houses, apartments, commercial buildings, garage, land.

- Transport – land, water, air.

- Luxury art items.

When drawing up a marriage contract, the value of all the types of property listed above is indicated in kind. This is necessary if one party during a divorce wants to buy the entire property. In this case, the spouse must pay part of the share of the property specified in the agreement.

It is worth noting that the completed marriage contract must be registered with a notary. In the case of a receipt or agreement, if all points of the document are observed, notarization is not required. Recognition of rights to property under an agreement is carried out after its signing. If it is necessary to re-register the right to 1 person, the agreement will confirm the transfer of this property to one of the divorced spouses.

After the divorce, the agreement takes on its legal force. The motivating condition of the agreement is precisely the fact of divorce. Until this moment, while the spouses are not divorced, they can challenge the transfer of ownership under the receipt. A document in accordance with the established procedure of a settlement agreement allows, without the involvement of judicial authorities, to carry out the redistribution of property that was received during the marriage.

In what cases is a no-claims declaration used in a divorce?

Refusal of property does not always indicate the honesty of the other party.

In many cases, a person does not want to simply share common debts and obligations. During a divorce, both spouses can give up their jointly acquired property in a passive or active form. Passive refusal leads to an uncertain status of the property, which does not allow it to be sold/changed/donated.

The renouncing party has the right to challenge its rights after the other party has completed administrative actions, regardless of the time that has passed since the divorce. To eliminate the uncertainty of status, the second party must sue and legalize the first party's abandonment of the property.

Active refusal implies legal actions - drawing up an agreement with the will on the disposal of property. This is most beneficial, as there is legal certainty of real estate and the opportunity to protect legal property rights.

An agreement between spouses can be drawn up in the form of:

- contracts;

- consent to the transaction;

- receipts;

- a positive response to a written proposal sent by any means of communication.

Only a written form of agreement can take legal force. It can be registered by a notary.

The law provides for equal distribution between husband and wife. However, when a mutual decision is reached, such a condition may be violated. An example: the wife was left with a personal plot, the husband – a garage. Property valuation is based on average market prices or written expert assessments.

An oral refusal of jointly acquired property has no legal force. When it is sold or donated, one party must compensate the other half as required by law.

Receipts may be written when transferring monetary compensation to another party. For example, a spouse gives up part of a house on the condition that the spouse pays for its value. After receiving the funds, the ex-wife is considered to have relinquished her share of the property.

Typical mistakes and consequences

The most common mistake when drawing up a receipt is the lack of detailed information about the parties to the transaction. Particularly high demands in this matter are placed on information about the borrower. Its volume must ensure clear and unambiguous identification of the debtor.

Another typical mistake is the absence of mandatory details of the agreement in the document. These include: the date of transfer and return of money, the loan amount, and when collecting interest - the rates for using borrowed funds. In both cases, the lack of information makes a positive court decision and, as a result, successful enforcement of the debt problematic.

How much does certification cost?

The form of a debt agreement is arbitrary. Its notarization is not required.

If, through the operation, a person wants to receive a 100% guarantee of productive cooperation with the borrower, then the price of giving legal force to the paper will depend on these factors:

- the subject contacts a public or private lawyer;

- what region the person lives in (prices may differ in different areas and regions);

- what object of the contract are we talking about;

- how quickly the client's request needs to be fulfilled.

To find out the approximate prices of the service, there is a free consultation with a lawyer, which will help you obtain complete, reliable information about the points of interest to a person.

Basic terms and definitions

A receipt for borrowed money is a personal document that is needed to protect the rights of both parties.

Debt documents are allowed to be used in situations where the parties to the transaction are:

- Only individuals.

- One individual and one legal entity between whom the transfer takes place.

Each case has its own characteristics associated with filling out promissory notes. But the legislation has not yet established a single, unified form of the document. Therefore, it is permissible to simply fill it out in free form.

Typically receipts are small pieces of paper. They contain the main positions relating to debt at a particular point in time. The more nuances are described, the greater the likelihood of a problem-free transaction.

How to write correctly?

Lending money is a very risky step. Trust is the main thing. Only if you draw up an agreement correctly will you be able to count on a peaceful resolution of issues.

Each following paragraph must be written:

- Complete information regarding the person who is the debtor. This applies to full name and other similar data from the identification document. If available, a list of contact telephone numbers and addresses should be provided.

- Applicant's passport details. They are formatted without abbreviations.

- Why do they deal with a document confirming a transaction? Debt amounts are indicated both in words and as a combination of numbers.

- Indication of the date when the money was actually received by the borrower, with or without the participation of a notary.

- It is also necessary to formalize the date when the money should be returned, depending on the agreement with the other party.

- The debtor needs to write for what purposes the amounts in the amount of this or that assistance are taken.

- If the debtor's signature is missing, the document will not be considered valid. The signature in the passport and here are the same. Mandatory requirements for drafting are decoding of the signature.

- A prerequisite is the presence of witnesses. Their passport details along with telephone numbers are also indicated. The document ends with the signatures of witnesses.