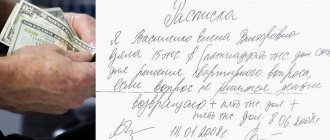

Features of a receipt to guarantee debt repayment

A correctly executed loan agreement will help protect the interests of the borrower. Article 808 of the Civil Code of the Russian Federation establishes that if an amount of up to 10 thousand rubles is borrowed, the agreement can be oral. If citizens lend each other a large amount or a legal entity acts as a borrower or lender, the agreement is drawn up exclusively in writing.

An oral agreement on a loan can be confirmed by a receipt from the borrower, which reflects the fact of the transfer of money and valuables. The receipt may contain the terms of the transaction itself, the procedure and deadline for return. It is optimal to issue a receipt from a notary or in the presence of two or more witnesses.

The document is written following the example of a civil contract. It should indicate:

- personal data of both parties: full name, passport details, registration and residence addresses;

- date and place of compilation;

- loan terms: amount in numbers and words, loan currency, fact of transfer of funds by the lender to the borrower;

- repayment procedure: repayment date or frequency of payments, volume and currency of payments;

- cost of use, if agreed upon by the parties;

- witness data;

- signatures of the parties.

Note!

The interested party in receiving the receipt is the creditor, but the debtor has the right to receive his own copy of the document in case the creditor tries to make changes to the document after signing.

Rules for drawing up a receipt

It is worth noting that this document is considered an analogue of a loan agreement and the terms of the agreement can be specified in it. Namely:

- the amount borrowed;

- time when you need to repay the debt;

- the amount of interest (optional) and the procedure for their payment;

- method of refund (bank transfer, cash);

- other conditions.

What should the receipt look like?

The repayment of a loan on a receipt depends on how well it is drawn up. The document must be in writing. It is signed by the borrower, this confirms that he has received a certain amount. In some cases, the paper is signed by both parties to the agreement. If the procedure takes place in front of witnesses, they must put their signatures and also indicate their passport information in the document.

When do you need a notary?

The participation of a notary in drawing up the receipt is optional. However, this will give an advantage to the one who lends the funds. In particular, when drawing up a document, a notary:

- will confirm the legal capacity of both parties;

- will check the authenticity of passport data;

- make sure that no fraud is committed and no one is threatened;

- will mark the transfer of money.

The disadvantage of notarization is the fact that you have to pay a fee. A percentage of the transaction amount is charged.

5 important points when lending money

Borrowing money is always associated with risks, even when the funds go to relatives or close friends. To minimize risks, it is worth considering the recommendations of lawyers specializing in debt collection by receipt:

- Before drawing up the paper, you need to check the original passport of the person to whom the money is being transferred. This can be done through the online services of the Ministry of Internal Affairs. Also, you should not accept copies or documents of third parties instead of originals.

- It is better to ask for a handwritten receipt. If the document is disputed, it will be possible to resort to a handwriting examination. If the person has already typed the text, you can ask to decipher the full name by hand next to the signature.

- You must provide your passport details accurately. The loan amount must be indicated in both numbers and words.

- The lender must have the original. You can also make two copies.

- It is prohibited to take the debtor's passport as collateral. They may be held accountable for this.

How to transfer money correctly

Typically, if a receipt is issued, the transfer of money occurs in cash. Each party independently recalculates the funds. Then indicate the amount on the paper.

If money is lent by transfer to a bank card, it is advisable to indicate the purpose of the transfer in the purpose of the payment. It is almost impossible to challenge a payment document. This will serve as evidence in court.

Are witnesses needed?

To receive a debt under a receipt, the presence of third parties is not necessary. But if a person wants to attract witnesses, it is important that they see the entire process and confirm the actions with signatures.

How to collect a debt from a debtor on a receipt without going to court

One of the chances to avoid court is to send a pre-trial claim to the debtor. This is an official letter indicating the seriousness of the intentions of the injured party. In it the creditor:

- Reminds you of the loan agreement, the terms of its conclusion and the agreed repayment terms.

- Indicates the accumulated debt and calculates the penalties for delay established by Article 395 of the Civil Code of the Russian Federation. Interest for the use of funds is accrued at the rate of the Bank of Russia.

- Makes a demand for return within a certain period.

- Warns that after the expiration of the specified period he will go to court.

Note!

The claim is sent by letter with notification. A Postal Service delivery receipt is included with the motion to certify that the defendant was given the opportunity to resolve the dispute voluntarily.

Simplified and alternative methods of collecting debt by receipt

If the creditor does not intend to communicate with the debtor and file a claim in court, it is possible to enter into an agreement and assign the right to claim the debt under a promissory note. There are many companies on the market that are ready to buy out the debts of individuals in order to collect debts in the future, having the official right.

If the creditor prefers to proceed through the court, an application must be submitted for the court to issue an order, as well as to obtain a writ of execution.

In order for the court to issue an order in the case, it is necessary to provide an application from the creditor, drawn up accordingly, and documents confirming the existence of the debt - a promissory note.

In case of assignment of the right, there will be no trial in the case; the debtor will not be summoned to court. The state fee in this case is 2 times less than a similar payment when filing a regular claim.

It is worth considering that the debtor has the right to express his objections to the judicial authority within 10 days from the moment the order was issued. If there are such objections, the court order will be canceled.

In this case, the creditor is recommended to apply to the court against the debtor. Often in such a situation it is possible to resolve the conflict if the debtor realizes that a trial is inevitable and the debt under the receipt will increase several times. As a result, work with the debt is stopped, and a settlement agreement is concluded between the creditor and the debtor to pay off the debt and the claim is refused to be brought to court.

The Vympel-M company does not purchase debts!

Get a free situation analysis

How to recover through court

You can apply for collection to the magistrates or district court at the defendant’s place of residence. When choosing the first option, you should remember that the jurisdiction of the magistrate is limited to collections up to 50 thousand rubles. The applicant should also choose in which order to submit the application:

- writ proceedings. The processing time is 5 days. But the judge is obliged to cancel the order if the defendant receives an objection without taking into account their validity and circumstances. You can claim up to half a million rubles in this way.

- claim. The court considers the positions and arguments of the parties.

Note!

If the claim has not been sent before, it should be prepared and sent to the debtor before the trial. According to the requirements of Article 4 of the Arbitration Procedural Code of the Russian Federation, pre-trial settlement is mandatory for all claims for material claims.

The application contains:

- name of the court;

- Full name and addresses of the plaintiff and defendant;

- description of the concluded agreement and the facts of its violation by the defendant;

- references to Article 810 of the Civil Code of the Russian Federation “On mandatory repayment of loans”;

- the amount of the claim, which includes the body of the debt and interest accrued by prior agreement or under Article 809;

- appealing to the court with a request to recognize the claims as legal and force the defendant to pay the debt;

- list of applications;

- date and signature.

Note!

The application is accompanied by a copy of the claim with a postal notification and a receipt. You must pay a state fee from 400 to 60,000 rubles, depending on the amount of the claim.

The result of the trial will be a court order or resolution with a writ of execution. On their basis, you can entrust the process of debt repayment to the Federal Bailiff Service, which is authorized to seize the debtor’s funds and foreclose on his property.

Instead of court, you can turn to a collection company, but its services may cost more than half of the actual debt.

Collection of a debt by receipt from an individual through the court

Many people believe that collecting a debt from an individual against a receipt is possible only in court, which can drag on for a long time.

uses various options for influencing the debtor to quickly repay the debt on a receipt from 100,000 rubles in Moscow and Moscow Region, from 1,500,000 rubles in other regions, depending on the specifics of the specific situation. At the same time, pre-trial repayment of the debt is possible on a receipt of 100,000 rubles. Nowadays, the practice of registering a loan with a receipt is very common. The debtors' arguments about the impossibility of timely payment are not an argument for violation of contractual obligations. Vympel specialists repay debts against receipts using various technologies.

The services of lawyers lie exclusively within the legal framework and are under the constant control of the Prosecutor's Office of the Russian Federation and the Investigative Committee of the Russian Federation, which guarantees our clients the legitimacy of all actions and the absence of any questions from the competent law enforcement agencies of the Russian Federation. Liability of activities to third parties is insured for 50,000,000 rubles.

The civil procedural and executive legislation of the Russian Federation has its own specifics, which must be taken into account.

You can repay a debt on a receipt from an individual yourself, but you will need to study the law, reserve time to visit the court and participate in the proceedings of the case, or you can entrust the solution to professional lawyers.

Contacting third parties

It is recommended to resort to transferring an individual’s debt to a collection company only in extreme cases, because when selling the debt, it will not be possible to fully recover the money lent. Often, collectors return 70-90% of the debt amount if there is already a writ of execution for it. If you only have a receipt, the discount can reach 50%.

The advantages of this collection method include:

- High probability of getting money back in a short time.

- No need to maintain contact with the borrower. To find out the current state of affairs, you just need to dial the call center number of the company to which the debt was sold and ask the dispatcher for all the answers to your questions.

An example of an agreement on the sale of debt to collectors can be found here.

Debt sale agreement p.1

p.2

p.3

Would you please give me a receipt?

The receipt turned out to be the only evidence that a person lent money to another person, but he did not return it. As a result, the local courts rejected the lender. The Supreme Court clarified how to act legally in such situations.

It is difficult to find a person who has never lent money in his life. And many of those who lent money to a relative, neighbor or acquaintance then hopelessly wait for years for the debtor to remember about them. That is why the situation that the Supreme Court examined may be of interest to many.

It all started when a certain citizen filed a lawsuit against a friend. She asked to recover from the woman the money under the loan agreement and interest for the use of other people's funds. The courts of first instance and appeal rejected her. In the district court, the woman said that she had receipts in her hands to confirm the loan agreements and their terms. It follows from them that on March 20, 2008, her friend took 200,000 rubles from her at 4% per month for an indefinite period. At the same time, she undertook to pay interest on the amount every month on the 20th in cash, and return the rest of the amount upon request. Six months later, the lady took the money from her again - now 100,000 rubles at the same 4% - and undertook to pay interest on the amount on the 20th of each month.

But the good intentions of the parties never became reality. The situation with the debt, unfortunately, turned out to be standard - the creditor asked to return her money, and the debtor promised to do so. So all the agreed and unspecified deadlines passed.

But the borrowed money never returned to the one who lent it. In the end, the woman had to go to court. The plaintiff had no doubt about her victory at the court hearing - after all, she had a receipt from the debtor in her hands. And she didn’t refuse either.

Imagine the plaintiff’s surprise when the local courts did not agree with the woman’s arguments and made the exact opposite decision.

In refusing to satisfy the citizen's claim, the courts proceeded from the fact that no loan agreement had been concluded between the ladies. And the receipt available in the case does not confirm the fact of receiving money from the plaintiff, since it does not contain “information about the lender and the citizen’s obligation to return the amounts indicated in the receipt.”

The Judicial Collegium for Civil Cases of the Supreme Court examined the refusals of local courts and found the conclusions of the courts of first and appellate instances erroneous. In explaining her arguments, she explained: “Article 807 of the Civil Code says: under a loan agreement, one party (the lender) transfers into the ownership of the other party (the borrower) money or other things determined by generic characteristics. And the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal amount of other things received by him of the same kind and quality. In this case, the loan agreement is considered concluded from the moment of transfer of money or other things.

According to Articles 161, 808 of the same Civil Code, a loan agreement between citizens must be concluded in writing if its amount exceeds at least ten times the minimum wage established by law. Well, in the case when the lender is a legal entity, regardless of the amount.

In support of the loan agreement and its terms, a receipt from the borrower or another document certifying that the lender has transferred a certain amount of money to him or her may be presented.”

Thus, the Judicial Panel emphasizes, in order to qualify the relationship of the parties as borrowed, it is necessary to establish the nature of the obligation, including reaching an agreement between them on the obligation of the borrower to return the money received to the lender.

As stated in paragraph 1 of Article 160 of the Civil Code, a transaction in writing must be concluded “by drawing up a document expressing its contents and signed by the person or persons making the transaction, or persons duly authorized by them.”

According to paragraph of Article 162 of the Civil Code, violation of the form of transaction prescribed by law deprives the parties of the right, in the event of a dispute, to refer to the testimony of witnesses in support of the transaction. But it does not deprive them of the right to provide written and other evidence. Based on this, the Supreme Court emphasizes that the transfer of money by a specific lender to a borrower can be confirmed by various evidence, in addition to testimony.

The panel of judges noted that from the case materials it follows: when considering the case, the defendant had the intention of concluding a settlement agreement with the plaintiff.

The court once again drew attention to the fact that the debtor actually agreed with her debt. But in fact, she only expressed disagreement in court only with the accrued interest. But the circumstances, which are very important for qualifying the legal relationship of the parties, in violation of the requirements of the law (part 4 of article 67, part 4 of article 198 of the Civil Procedure Code), did not receive any assessment from both courts.

In addition, the Supreme Court emphasized, the local courts did not take into account that, within the meaning of Article 408 of the Civil Code, the presence of a debt receipt with the lender confirms the failure to fulfill a monetary obligation on the part of the borrower, unless otherwise proven. The local court's reference to the fact that the plaintiff did not present any other evidence (except for a receipt) in support of his claim at the court hearing is, in the opinion of the Supreme Court, unfounded.

The panel of judges once again emphasized: the fact is that the responsibility for presenting evidence disproving the fact of concluding a loan agreement with a specific lender lay with the defendant. And this important point was also not drawn to the attention of local courts.

Therefore, the Supreme Court overturned the earlier verdicts of local courts and ordered the case of the debt receipt to be reconsidered, but taking into account its own explanations.

Pre-trial ways to get money

Whether it is necessary to send a written claim to the borrower demanding repayment of the debt or not depends on the previously drawn up loan agreement. It often happens that when people write a receipt, they do not attach importance to some important aspects, for example, they do not indicate the date and time of transfer of funds. In their absence, by law it is considered that in this way the lender has agreed with its borrower to return the money on demand. If the receipt is printed and not handwritten, the borrower often denies the very fact of its authenticity. In this case, it is very difficult to verify this.

Example of a written request:

If the receipt indicates the deadline for repayment of the loan amount, then there is no need to send a letter demanding repayment of the debt. Therefore, if there is such an agreement, you can go to court without warning the debtor about it.

In special situations, you can try to bring a person who has not paid the debt on time under Article 159 of the Criminal Code of the Russian Federation (fraud). But in 90% of cases, after filing an application from a creditor, they refuse to initiate a criminal case, since it is quite difficult to prove fraud in non-payment of debts. But still, if the victim decides to contact the police department, it is important that he writes a statement that includes the following information:

- Full initials of the debtor, his passport details, residential address and place of birth.

- The amount the debtor borrowed.

- Date and approximate time of transfer of funds.

- Additional information (borrower’s place of work, mobile phone).

An example of filling out a police report can be downloaded from this link.

Statement

Pre-trial collection

Collection of funds against receipts can be carried out not only through civil court. Lenders can contact their debtors directly in order to receive back the money previously issued for use.

Legal practice in such cases notes that in most cases people try to resolve the issue on their own without resorting to court proceedings.

This may be due to the fact that each person will incur even greater expenses, and collection in the future will be carried out with the help of interim measures and bailiffs. Therefore, in communication with the debtor and if there is a receipt, the creditor can point out the fact that the borrower may have serious problems in the future in the event of litigation.

If a decision is made in favor of the plaintiff, the defendant's movable and immovable property may be seized, and he will not be able to travel abroad until the entire amount under the writ of execution is repaid.

What legal force does a promissory note have?

Many Russian citizens want to know a comprehensive answer to this question: does a standard promissory note, written by hand, without any sample and not certified by anyone, have legal force?

If it has legal force, then how will it be possible to collect a debt using a receipt (if it is written on an ordinary piece of paper, not according to any established templates and samples)? And is this really possible? In fact, collection of credit debt against a receipt is carried out in accordance with part two of Article 808 of the Civil Code of the Russian Federation. This article basically says that you can use the borrower’s receipt to collect credit debt. Such a receipt certifies the fact that the lender has transferred a certain amount of money. This receipt is a confirmation of the loan agreement. However, it does not have to be notarized or drawn up in front of witnesses. In this case, all this is not necessary. How such a document is roughly drawn up can be seen at the stand of almost any notary office (there are very detailed examples of such documents there).

A receipt is a very serious document, and if the borrower does not repay the debt within the time period indicated in it, then, guided by this document, the lender has the right to file a claim with the courts in order to collect the debt.

What are the ways to repay a debt from a citizen in the Republic of Belarus?

1. Applying to the court to collect a debt against a receipt

This is the first and mandatory stage. It will not be possible to move forward without a trial. To go to court, you need to collect evidence of the debt. In most cases, this is a written receipt or loan agreement. Without them, there is no chance of repaying the debt. Then everything is simple. You pay a state fee of 5% of the amount of the claim (which the courts assign entirely to the debtor), write a claim and send it to the court at the place of registration of the debtor. As a result, the court makes a decision, and after 15 days issues a writ of execution, with which you can move on.

2. Repayment of money from an individual under a loan through enforcement proceedings and bailiffs (bailiffs)

Here the further vector of development of events is determined. Perhaps you will be lucky and the debtor will have money in his accounts or liquid property. In this case, the contractor will sell it and transfer the money received to you. The most sad thing that can happen at this stage is that the debtor transfers a meager amount towards the debt once a month. Such payments often act like a sedative on the performer and completely block their activity, because “The debtor pays, why bother him.”

3. Deprivation of the debtor's driver's license and ban on traveling abroad for non-repayment of money

If the money is not returned at the stage of enforcement proceedings, you can initiate legal proceedings for deprivation of the right to drive a car (motor boat more than 5 horsepower), deprivation of the right to hunt, a ban on traveling abroad, on receiving parcels, on visiting gambling establishments, on using mobile communications , to receive parcels and letters. Moreover, it is possible to prohibit the debtor from receiving utilities such as electricity, gas, heat and water (unfortunately, we do not yet have such a practice in our country).

4. Challenging transactions for the re-registration of real estate, cars, shares in the authorized capital to relatives in order to remove this property from arrest

Few people know, but transactions whose main purpose is to remove assets from seizure (legally speaking, imaginary transactions) are illegal and can be challenged. Simply put, through the court, the procedure for transferring assets to loved ones can be declared illegal and returned to the debtor. And then all you have to do is wait until the bailiff sells everything and returns your legal money, taking into account the penalties accrued during the delay.

5. Bringing the debtor to criminal and administrative liability for non-repayment of debt

Unbelievable but true. The Criminal Code of Belarus provides for liability for non-repayment of debts under a loan agreement or receipt with the possibility of imprisonment of the debtor for up to 10 years. The threat of imprisonment will certainly tell the debtor where to get money to pay off the debt.

What to do in practice, you ask. First of all, I advise you to find people to whom the debtor, like you, does not return the money. The massive number of appeals will serve as a signal for internal affairs bodies to more thoroughly check the debtor and increase the chances of initiating a criminal case. I advise you to write not one collective appeal, but several individual ones. Even if a criminal case is not initiated, a police officer is obliged to respond to each appeal and call the debtor for an interview, which will create pressure on him from the authorities. To everyone’s joy, there are already such precedents in Belarus. This means that there are chances.