The question “where can I get money right now?” occurs to many of us. Situations when you need finance are different: you need to urgently visit the dentist, repair your car or buy a new one, open your own business, go on vacation or buy a bag from a new collection. There is a difference in the desired amount, possible return period, and available collateral. Therefore, for each case there is a solution.

Our review contains many ways to find money - a lot or just a little, for urgent needs or to buy a home, from friends and through crowdfunding systems.

Where to go when you urgently need to get money before payday?

Microloans

Such loan products are micro-sized and must be repaid within a micro-term. Usually the borrower is offered only a few tens of thousands of rubles for a period of 1 to 4 weeks, sometimes for a couple of months. According to these parameters, microloans are ideal for borrowing before payday.

Another advantage of such loans is their availability. Upon receipt from the client, a minimum of formalities is required. Usually a passport is enough. And recently, you can apply for a microloan completely remotely, without even presenting an identity card. When filling out the online application, you only need to provide the following set of information about yourself:

- passport details;

- Contact Information;

- bank card or electronic wallet details.

You will be able to receive borrowed funds from microfinance organizations directly to a card or wallet of electronic payment systems (Yandex.money, Qiwi, WebMoney). The entire procedure takes just a few minutes – online applications are processed automatically and often around the clock.

To apply for a microloan, you must be an adult Russian citizen. Other characteristics are unimportant, although permanent registration in a specific region of the country is sometimes required. This allows students, pensioners and the unemployed to use the service. Even a bad credit history will not prevent you from borrowing – anyone can get some money.

It is convenient not only to borrow from an MFO, but also to return the money - in most cases, you can pay for the overdue loan, then your credit history will not be damaged. But there are also disadvantages to microloans - the interest rate is high and on average reaches 1-2% per day.

Credit cards

Another way to quickly borrow a small amount is to use a card with a credit limit. A credit card becomes a “bank in your pocket” and you can borrow money at any time by paying for purchases or withdrawing cash. But you need to arrange it in advance - before an urgent need for money arises.

To do this, you will need, at a minimum, a passport, and at a maximum, a certificate of income. All banks want to see the owner of a credit card as an adult citizen of the Russian Federation who has official employment and permanent registration in the country. The credit limit depends on the requirements for the client and the availability of funds: without certificates it will not be possible to borrow much. A positive credit history is also desirable; without it, the bank may refuse to issue a card.

Some cards are issued only during a personal visit to a bank branch, while others can be received by mail when applying remotely. For some credit cards you will have to pay annually - a service fee will be debited from your account, while others are available for free.

It is most convenient to use a credit card not for withdrawing cash, but for non-cash payments, then you can save on fees.

How to borrow without interest

Although not always, lenders provide the opportunity to borrow money for free - without paying interest. There are, of course, a number of restrictions, but there is still a chance to save on interest:

- The grace period for credit cards does not apply to all transactions (usually only for purchases), lasts for a certain period of time (20-55 days from the date of the transaction), you will have to incur additional costs (card maintenance, commission for withdrawal or transfer of funds). If the deadline or type of preferential transaction is violated, interest will have to be paid at the base rate, without concessions.

- Microloans at 0% - such special offers are made by microfinance companies for new clients - those who repay their first loan received here without violations or delays. It’s just that for clients “on the street” the approved amount is tiny, and there is also a short refund period. If payments are delayed by at least a day, you will need to pay interest in full.

There are no other ways to borrow from a bank or microfinance organization without interest. Unless, to save money, you can use loans from friends, or find special solutions for purchasing necessary goods in installments.

What to do if the debt is issued against receipt

Lawyers recommend borrowing money only if a number of conditions are met. You are 100% sure that the borrower is an honest person, you have known him for a long time and well, you have eaten what is called “a lot of salt.” This citizen will be able to repay the debt without constant reminders, and then you will not need to waste your nerves bringing the matter to trial. However, smart people say that even in this case, an IOU is far from an unnecessary attribute.

In its simplest form, a receipt is a handwritten document that indicates the name of the debtor, his passport and contact information, the amount of obligations and the period by which they must be fulfilled. In the future, the receipt will be used as evidence of the defendant’s guilt in court proceedings.

To repay a debt if you have a receipt, you can use the following methods:

- Peaceful settlement of the issue - many debtors are afraid of publicity; they can be influenced through mutual relatives or acquaintances. If during the negotiations it turned out that a person found himself in a difficult life situation - he became ill, became disabled, was left without work, you can offer him to postpone the debt repayment period, installment plan or return the loan in kind.

- Contacting the court or the police - if you have a written receipt, contacting the court or law enforcement agencies can be the most effective way to quickly return the borrowed funds. After receiving a court decision, the plaintiff submits it to the Bailiff Service to forcibly collect the debt.

- Assign the rights to claim the debt to third parties. This method of debt repayment seems simple only at first. In fact, collectors charge up to 50% of the debt amount for their services, but they do not provide any guarantee of a successful resolution of the issue. Or they may offer you to buy out the debt for a ridiculous 5–7% of its real amount.

An attempt to collect debts documented with documents confirming them is the easiest process, often making the participation of a lawyer unnecessary. Notarization of the receipt will be a significant advantage in favor of the lender. Let’s say right away that getting a receipt certified by a notary is an optional step. But the presence of notary marks on the document will allow the court not to doubt its authenticity and legality.

There are often situations when the debtor refuses to acknowledge the fact of issuing a receipt and his signature on it. In this case, a handwriting examination will be required. Therefore, if a document is printed on a computer, in order to obtain reliable results during the examination, in addition to the signature, the debtor must write a couple more words. For example, the place where the receipt was drawn up, enter your full name, put down the date and amount of the debt in numbers and words.

What should the receipt look like?

The receipt is drawn up in any form in written or printed form. To ensure that the court does not have questions or claims regarding the document itself and its contents, when drawing it up it is worth considering certain points:

- Ideally, the receipt should be written by the borrower in his own hand. This will greatly facilitate the handwriting examination. If a person was under pressure at the time of writing the document, he was upset, under the influence of emotions or in strong emotional excitement - this will affect the handwriting, which the expert will also indicate in his conclusion.

- All the numbers indicated in the document - and this is the amount of debt, the repayment period, interest - must be written down again in words.

- To avoid misunderstandings, no errors, corrections or cross-outs are allowed in the text of the receipt. It is better to ask to rewrite the receipt than to later explain to the court why the corrections occurred.

- A mandatory point is to indicate that the funds were transferred for temporary use, otherwise the opposing party’s lawyers may refer in court that the money was provided free of charge and does not imply the emergence of rights of claim. Like, it was such a gift.

- If we are talking about a large amount, then the receipt should be certified by a notary, or a meeting between the borrower and the lender should be held in the presence of witnesses, who also sign the document.

- When drawing up a receipt, the creditor must ask the debtor to provide a passport in order to compare the signatures on the documents.

Our lawyers advise: if you are not sure that you will be able to receive your money on time and in full, then you should take a receipt from the debtor. Regardless of whether he is your brother, uncle or cousin, how well you know the person and who vouched for him.

But if you are not sure of repaying the debt, you should not borrow, even if it is a small amount. Then the problem of how to get your money back with or without a receipt will bypass you.

Where can I get a lot of money on credit?

Do you need money urgently and do you need a lot of money? In such a situation, a car pawnshop offers a solution, but you can also find a solution in a bank. The main condition is the availability of appropriate movable or immovable property to secure the requested obligations.

Loans from a car pawnshop

In this establishment you can quickly pawn your car and get money. The car owner is offered two transaction options:

- the documents for the car remain in the pawnshop - PTS, the borrower himself continues to use it, but is limited in transferring ownership;

- The car is left in the pawnshop parking lot, and the client does not have access to it until the loan is fully repaid.

At the same time, car pawnshops are increasingly requiring the issuance of a comprehensive insurance policy in order not to lose the pledged item as a result of theft or damage in an accident. Moreover, both vehicles that are pawned by the pawnshop and vehicles that the owners continue to use are also covered by insurance.

It is proposed to repay debts according to the scheme - interest monthly, and the full amount - at the end of the agreed period in a lump sum payment.

Loans secured by property

In situations where the most important thing is not the speed of receipt, but the period of repayment of funds, secured loans from a bank are suitable. It is proposed to return them within 5-10 or even 20 years if real estate serves as collateral. And loans secured by vehicles are issued for several years, and not for several months, as in a pawnshop.

A mortgage allows you to receive a large amount for a long period of time, but requires additional guarantees of return - insurance of the property. Also, a loan secured by a car requires that you take out a property insurance policy.

These insurance costs are important to reduce the lender's risk. Having an insured collateral makes it possible to borrow money at a low interest rate.

General signs

It is important to choose the right time for any monetary transactions. First of all, focus on the lunar cycle:

- you need to return previously taken money only when the Moon wanes;

- borrow - when it grows.

Some astrologers believe that it is necessary to borrow money only on the waxing Moon. At this time, monetary energy remains, which will increase your well-being. You will easily return the borrowed amount and will no longer be in serious need. This will only work if you took the money with pure intentions and a desire to return it as quickly as possible.

There are several days of the week when you cannot give money, so you should rely on folk wisdom in this matter:

- Monday is an unfavorable day for any calculations, bill payments, or other manipulations;

- Tuesday – you shouldn’t get involved with debt obligations, otherwise you’ll have to borrow money for the rest of your life;

- Sunday - you cannot borrow or lend, as this attracts lack of money and failure in trading.

The remaining days are considered favorable for conducting financial transactions. Exceptions are Maundy Thursday and Good Friday, since at this time it is worth renouncing everything worldly. But it’s worth remembering one rule: you should definitely repay debts and borrow in the morning or during the daytime. In the evening, it is better not to touch money at all unless necessary.

It is always better to transfer money to another person folded in half, with the fold pointing away from you. It is believed that this is how you pave the way for wealth to come to you. For this purpose, it is better not to borrow from other people at all, but to lend to them. This way you will program money so that it comes back to you.

Urgent lending from individuals

The option to “intercept” the required amount before your salary is still relevant when solving financial issues. Borrowing a little without formalities is very convenient. And if you borrow from friends without interest, it’s also profitable.

Borrow from friends

Friends, relatives, and colleagues lend money without asking for a credit history or asking for proof of income. They can issue the requested money immediately. But too many “buts” can affect the deal:

- loved ones will not have the required amount on hand at the right time;

- they themselves need money in the coming days and they will not be able to provide a loan for the desired period, they will rush you to repay;

- there are no clear borrowing conditions, which can cause misunderstandings and disagreements;

- in case of problems with return, the conflict will negatively affect personal relationships;

- It’s not always convenient to talk about your own needs and goals to your family or colleagues.

Most problems can be solved by drawing up a loan agreement or a receipt, which specifies all the conditions for issuing money and returning it.

P2p - Lending from a stranger

There is another opportunity to get a private loan - without attracting funds from friends or relatives. On mutual lending exchanges, forums and p2p services, strangers lend money.

At their core, such private loans can be anything - the parties to the transaction can independently agree on the issuance parameters and repayment conditions. But different resources have their own rules for providing borrowed funds:

- Personal communication between users may be limited and funding may be automated;

- sometimes the platform is just a place for lenders and borrowers to meet - they independently discuss all the details and communicate outside the service.

This option is convenient, but the risks are high, which is why high fees are charged for loans in the p2p lending service. But you can find the best option - in terms of amounts and terms - and borrow without unnecessary formalities.

Other changes in legislation

You can borrow money not only in the form of cash. It is allowed to lend securities and non-cash funds.

As a result of the innovation, the court received more rights. In particular, he may determine that the percentages you indicate are very high, so he will decide to reduce them. Most often this happens in cases where the interest rate is 2 or more times higher than what is usually set in the receipts.

The new rules on loans and credits are characterized by loyalty towards borrowers. However, it should be taken into account that if the contract or oral agreement was made before the first of June, then the issue will be resolved according to the previous rules.

We are looking for money even if all banks and microloans have refused

Even in the absence of a financial cushion and the ability to borrow, you can survive difficult times using available resources. The recipe “earn more and spend less” only helps in the long term. There are also quick effective solutions:

- looking for part-time work and freelancing to quickly replenish your budget;

- renting out your own home and moving to your family or to a simpler apartment;

- sale of unnecessary assets - things are sold on bulletin boards quite actively;

- the property can be pledged to a pawnshop and redeemed when the financial situation improves.

Lending with bad credit history

You can’t give up on loans either. After all, having a damaged credit history does not completely block access to funds. There are microfinance organizations and banks on the market that provide loans even to clients with a bad credit history.

There are special offers that allow you to quickly improve the debtor’s reputation. The product “Credit Doctor” from Sovcombank is designed for this. For a fee, the client receives an improvement in his credit history, and at the same time a card with interest on the balance of his own funds and a life or property insurance policy. You won’t be able to get money in your hands under such a program in the first stages.

However, other loyal institutions are completely ready to provide microloans to clients with a bad credit history. With each fulfilled obligation, the corresponding notes will be entered into the dossier. This will allow you to whiten your reputation in the face of potential creditors slowly but surely.

Among these generous and unscrupulous lenders are mainly microfinance organizations and microcredit companies. Any bank will require the applicant to have no debts or arrears.

How to repay a debt so that your luck doesn’t run out

First of all, you need to remember on what day you cannot repay the debt. You should not do this on Monday, Tuesday, Friday, Sunday, or church holidays. In order for money to be transferred, several conditions must be met:

- Carry out all manipulations only in the morning.

- Do not pass money through the threshold; in general, it is not worth passing anything through it. Go into the apartment, say hello and, best of all, put them on the chest of drawers or cabinet.

- Always repay a loan with pure thoughts and a good mood. Don't regret this amount to attract financial luck and prosperity.

- Do not try to give money in larger bills; it is best to exchange them in smaller ones.

- Fold the bills in half and pass them with your right hand. This will help convey them with positive energy. If you position the folded edge away from you, it will save you from running out of money.

But the most important thing is not to violate the days when you cannot give money. Signs say that this will lead you to financial ruin. You can fold the bills incorrectly or hand them over; this will not bring as many problems as carrying out manipulations on church holidays or on Monday.

Where to get money to buy real estate

Buying a home requires a large investment. For the average family, such an acquisition is unaffordable at their own expense.

Mortgage loans

The solution is a mortgage. The bank pays for the property and until the borrower returns the entire amount with interest, the purchased apartment or house is pledged. It will not be possible to sell such living space without the special permission of the lender.

To save money when applying for a mortgage, we recommend:

- take advantage of preferential programs for certain categories of mortgage holders (young families, workers in a certain field, salary clients of the bank);

- make the maximum possible amount as a down payment - discounts start when you pay from 30-50% of the cost of housing at your own expense;

- use maternity capital or other certificates from the state to improve housing conditions;

- receive a tax deduction when purchasing real estate and use it to pay off your mortgage early.

A mandatory condition for issuing a mortgage loan is property insurance of the subject of the mortgage. Other insurance policies, for example, life insurance of the borrower, are only additional guarantees of repayment.

A number of banks offer offers to get a mortgage without a down payment or use matkapital as this contribution. Home insurance and deed registration costs can be added to the total loan amount. So there is a chance to get an apartment on a mortgage without money. And then you will have to make monthly repayment payments, similar to the amount of rent for someone else’s housing, but the borrower will already live at home.

Which mortgage is more profitable: on a primary mortgage or on a secondary one?

Buying a new building with a mortgage is easier than buying a resale property. Banks and developers have already developed a suitable cooperation scheme; the client can only declare his desire to quickly celebrate the housewarming party. Housing on the secondary market may not be suitable for the lender as liquid collateral, and more issues will have to be settled with the seller when finalizing the transaction. The cheapest way to purchase square meters is at the excavation stage, but this means a high mortgage rate - after all, there will be no collateral for some time. And in the period before the object is handed over, the borrower needs to live somewhere and spend additional money on rent.

Mortgage for individual construction

There are similar proposals for financing the construction of a house. Banks will be willing to finance the transaction if the client chooses a reliable developer - from among the companies that have previously collaborated with financial institutions and have been accredited. There is less chance of approval for a loan that goes towards building a house yourself. In any case, the bank will transfer funds in tranches - after a report on the progress of construction and completion of its stages. The borrower needs money for a down payment; a land plot acts as collateral, then an unfinished construction project, and then a finished house. Accordingly, the collateral will have to be insured.

Loan secured by existing real estate

It is optimal to already own real estate when you come to the bank, which will become collateral for the loan. For example, this could be the parents’ home, or a country house, a garage or a plot of land. Moreover, the mortgagor may not be the borrower himself, but his relatives. All this will help reduce risks, which means the mortgage rate.

Other home buying options

There is also an alternative to a mortgage for the purchase of housing or its construction:

- Rent with subsequent purchase - when renting a living space, you can discuss with the owner the possibility of purchasing it in installments. The tenant simultaneously pays for accommodation and makes partial payments for the complete purchase of the apartment. This is risky for the buyer, since the property will be owned by the owner for several years, and this transaction is not regulated by anything other than the terms of the contract.

- Lifetime annuity - this is how apartments are usually purchased from representatives of the older generation who have no heirs. It is enough to negotiate the living conditions of the elderly homeowner and regularly pay him a living allowance in order to subsequently receive ownership of his apartment. Such a will must be notarized, but it will not be possible to approach this transaction formally - too many personal factors can influence it.

- Housing cooperative - the down payment can be made gradually, in small payments, over several years. It will not be possible to obtain the right to living space right away, so at the same time you will also need to spend money on renting an apartment. Membership fees may be lost if the management of the cooperative is fraudulent or the developer goes bankrupt. And over the course of a few years, real estate prices may rise, family circumstances and income levels may change.

Pledge agreement

The loan agreement can be supported by the presence of collateral, which will guarantee the lender the receipt of the disbursed funds in any case. The collateral depends on the loan amount. It can be a garage, a car, a country house or an apartment. But it is worth noting that the value of the collateral does not have to correspond to the amount of the loan issued. But it cannot be less than the debt. That is, it must cover the amount of money borrowed.

The need for collateral is due to the fact that many people take out varying amounts of loans and then do not pay them back. And in order to get his money back, the lender will have to spend a lot of time in court. If the debtor does not have a stable income, then repayment of the debt may take a long period of time.

Important! The presence of collateral significantly protects the lender from non-repayment of money.

Both movable property and real estate can be used as loan collateral. Experts recommend using real estate, because an unscrupulous borrower can hide movable property.

According to the law, a pledge agreement does not require notarization. But if the object of the pledge is real estate, its registration with the Rosreestr authorities is mandatory. The fact of transfer of money is documented in the form of a receipt. If the return is made in cash, it is also necessary to prepare it.

Car loan – an opportunity to borrow money to buy a car

If you decide to get a brand new car, but you don’t have the required amount of money, then you can consider two options:

- if a car is purchased for use by a legal entity, vehicle leasing is available to him,

- If a private person buys a car, the most common scheme is car financing.

Types of car loans

Car loans are issued on various conditions:

- purchasing a new car at a dealer’s showroom with filling out an application from representatives of different banks present at the showroom;

- purchasing a new car at a car dealership through special affiliate programs of auto banks, with the opportunity not to pay the down payment or interest;

- buying a used car at a car dealership that cooperates with several banks, when an application is submitted to all of them at once and the appropriate option is selected;

- a transaction with a private car owner to purchase a used vehicle second-hand using a bank loan;

- trade-in scheme - the client trades in his used car to a car dealership, it is used as a credit instead of a down payment, as a result he receives a new car, and the difference in cost is taken out on credit;

- car loan with deferred payment - differs in that during the lending period the client pays only 50-80% of the cost of the car, and at the last stage can choose: full redemption of the car with a one-time payment of the balance of the debt, payment in installments of the remaining obligations, return of the car with offset of previously paid funds in as a down payment on a new car.

CASCO insurance against damage and theft is desirable for car loans, but not required. True, the risks in the absence of a policy are much higher, so the rate may be 5-10 percentage points higher than the option with insurance.

Reinforce the fact of transferring money

The simplest document confirming the fact of transfer of money from one person to another is a receipt. However, it is not a loan agreement and does not replace it completely. In some cases, even if it is available, you may not receive money.

Experts and lawyers say that a receipt is the optimal document for supporting small loans, and when borrowing large amounts, it is better to spend time and effort on drawing up a loan agreement. In it you can define in more detail the interest, the procedure and schedule of payments, late fees, collateral, guarantee and other points.

Where can I get money for business development and startup?

It is most difficult for small businesses to communicate with banks. After all, large and established organizations do not turn to banks for loans. But a businessman who is looking for money to develop his business is not a desirable client. The probability of issuing a bank loan to a beginning businessman is much lower than when approving loans to individuals.

Business development loan: difficult, but possible.

The most important thing when trying to raise money for a project is a business plan. Moreover, with this document in hand, you first need to contact the bank and listen to the opinion of experts.

If a loan is denied for objective reasons - unreliable calculations, incomplete analysis of the market situation, an unrealistic picture of development, errors in assessing the project and its risks - then it is better to rethink the idea. Banking analysts may assess the project more adequately and comprehensively, taking into account their own experience. If the reasons for the refusal are subjective: “we do not give out more than X thousand rubles to one person,” “you have just registered a company and cannot yet submit reports,” “our portfolio is full of similar projects, we no longer give money to this industry,” then It’s worth taking your idea somewhere else. The bank didn’t give it, private investors or the state will give it.

Do banks give money for startups?

Getting money to start a business is even more difficult. After all, the potential borrower only has a plan, but no real results. This means that it is almost impossible to convince the bank of your solvency. The startup himself does not yet know whether his project will take off or not, and the lender needs serious guarantees of money back.

The following steps will help you increase your chances of getting a loan to start your own business:

- Opening your own business as a franchise - according to a ready-made plan and an already known business model (Sberbank has a special preferential loan program for financing franchising).

- Payment for part of the project from your own funds - from 30-50% of the total starting capital.

- Request for funds secured by liquid property - obtaining a loan for the purchase of fixed assets, and not for other expenses.

- Registration of guarantees and guarantees in specialized business support funds.

But in general, there is no need to try to find a common language with harsh bankers. Start-up capital can also be obtained from other sources.

Crowdfunding - all over the world

You can also find money for the implementation of your business project under other conditions: collect sponsorship fees from future potential clients and simply investors who support the idea. Crowdfunding is crowd funding, that is, people give money for a specific project.

If you decide to launch your startup fundraising campaign, then you need to prepare the following:

- project description;

- its promotion according to the rules of the selected platform for attracting financing;

- acceptance of contributions;

- investor remuneration;

- a report on the intended use of the collected amount.

There are several such crowdfunding services on the RuNet, the most famous of which are Planeta.ru and Boomstarter. Here you can find sponsors and investors for projects in the field of production, creativity or scientific development.

Attracting a private investor

Another option for finding start-up capital is to attract funds from one or more private investors to the project. There is no need for publicity; it is enough to draw up a business plan and find the right person - it can be someone you know or a third-party business angel. There are entire associations and communities of investors and business angels who select projects and finance them.

When investing, a businessman gets a partner and it is important to clearly stipulate the degree of his participation in the project and the conditions for returning the funds raised. How will he influence the project, what will he manage, how much and when will he start taking money to pay off the debt, what kind of reward does he plan to receive? All this is important when attracting a private investor. The parameters of the transaction must be written transparently and clearly in the contract in order to avoid disagreements.

Grants and subsidies

You can get support for your business initiatives from the budget. The country has several federal and regional financial assistance programs for both start-up and existing small and medium-sized businesses. According to them, money for opening or developing your business is provided free of charge. You won't have to return them.

The project is reviewed by a commission and assessed according to many criteria, the main ones being the social component and the tax burden. To receive funding for these support programs you must:

- propose a project in a socially significant area, in a niche that is not occupied;

- create maximum jobs;

- bring innovation to activities and use new technologies;

- pay maximum fees and taxes to the budget;

- promise to spend the funds strictly for the purposes indicated in the program (purchase of real estate, purchase of machinery and equipment, etc.).

If the intended expenditure is violated, the money received will need to be returned. For several years after the grant or subsidy is issued, government officials will regularly check the operation of the business, arrange on-site inspections, and request reports and financial documentation for the project. If the actual data differ greatly from the forecast, the entrepreneur will also be required to reimburse the amount of the grant/subsidy.

Provide for delay conditions

In the terms of the transaction, you can determine not only interest, but also fines that are imposed on the borrower in case of late payment. You can set a fixed or conditional fine:

• You lend 60,000 rubles at 9% interest with a fine of 5,000 rubles on top of interest in case of non-repayment within 3 months.

• You lend 70,000 rubles at 7% with the interest rate doubling if the borrower does not repay the funds within 6 months.

You can also define a fine that increases in accordance with the period of delay. For example, if the borrower has not repaid the debt by December 31, 2021, from January 1, 2021, using the loan will cost 1% per day.

If you are afraid of conflict or rejection of a deal, be rational about it. The borrower will have an extra incentive to repay on time. And if you fail to fulfill your obligations on time, you will receive compensation for the nerves and effort spent in court. A conscientious borrower should not be embarrassed by such conditions if he really plans to repay everything on time.

If the terms of the receipt do not specify a fine, and the debtor does not pay on time, it is possible, even without this condition, to increase the amount of the debt by interest for the delay. According to Article 395 of the Civil Code of the Russian Federation, the borrower is charged interest for non-repayment within the agreed period, equal to the key rate. They are calculated on the amount transferred for use.

Learn to say “NO!”

It can be very scary to simply say “NO!” without explaining the reasons, especially if this is a significant person for you. As a rule, we begin to look for reasons and explanations why we cannot respond to a request. We are afraid that our refusal may affect our relationship with this person. If you don't give him money, nothing bad will happen. Your relationship will remain the same. Moreover, there is a high probability that if you borrow a large amount, your relationship will deteriorate. As a rule, debts are not repaid on time and you will have to constantly remind and worry about your money.

If the case goes to court

The law establishes that you can write a statement to the court regarding delays the very next day after the return period has expired. This rule applies to transactions in the receipt and agreement for which a specific return period was indicated. If the parties have not determined it, Article 810 of the Civil Code of the Russian Federation says that the funds must be returned within 30 days after the first demand. Confirmation of sending the claim to the court is a registered letter addressed to the debtor. In case of non-repayment, the statement of claim must be drawn up in three copies: one for you, the second for the court, and the third for the borrower. Each copy of the application must be supplemented with a copy of the receipt. Keep the original with you - it will be useful for the trial. To ensure timely processing of the application and start of paperwork, do not forget to pay the state fee and attach a receipt.

Judicial collection of borrowed money under a receipt or loan agreement

The money can be returned by receipt through legal proceedings. Let's look at a few steps on how to do this correctly.

Step 1. Finding out the borrower’s position

We should try to resolve the matter peacefully. You can talk to the debtor and find out the reasons for non-repayment of the debt. It is quite possible that he has a difficult financial situation at this time and is not able to repay his debts. If this is indeed the case, then it would be correct to agree to change the refund period.

If the debtor tries to hide from you and does not get in touch, you need to be determined and go to court.

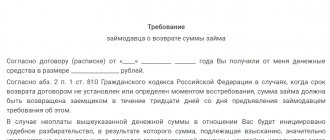

Step 2. Submitting a claim

Here we are talking about a letter of claim - a document that is considered in court. When you send this letter to the borrower, you will receive a delivery notification.

The first step in the collection process is sending the borrower a letter of claim. There are no exact and specific requirements for the correct preparation of such a document.

But it is important to know several points that should be contained in a letter of claim:

- amount of debt, including interest;

- information about the borrower;

- maturity date of debt obligations;

- date of receipt;

- date of writing the claim.

Step 3. Drawing up a statement of claim

How to properly file a claim for repayment of a debt against a receipt? First of all, fill in the following information in your claim:

- name of the judicial authority;

- Full name, address and telephone number of the lender;

- Full name, address and telephone number of the debtor;

- the amount to be recovered, taking into account the debt with interest, payment of state fees, legal services and other additional expenses;

- a list of documents confirming the requirements and attached to the claim.

Next, you need to describe in detail all the circumstances and situations when you did anything to return your funds. All actions and measures should be supported by documents or testimony of witnesses.

Step 4. Payment of the state fee for consideration of the case in court

In 2021, the amount of the state duty depends on the amount you plan to collect. According to the Tax Code of the Russian Federation, there are two ways to correctly calculate the state duty:

- you need to estimate the amount of the claim;

- no claim assessment is required.

You can use online calculators on the websites of various law firms.

Step 5. Submitting the required documents

The claim must be submitted to the court, as well as the following documents:

- receipt;

- receipt of payment of state duty;

- copy of the claim;

- calculation of the amount claimed;

- letters and other documents confirming that you took action to repay the debt.

In addition to everything, you must issue a power of attorney if you are acting through a proxy.

Step 6. Waiting for the court's decision

Do not be upset if the entire legal process drags on and there is no answer for a long time. It is not uncommon for a trial to last several months and consist of a number of hearings.

There is also writ proceedings - an accelerated mode of consideration of the case in five days.

Each specific case affects the course of the trial and its duration.

Step 7. Receive funds

Funds can be recovered after receiving a writ of execution. It is necessary to contact the bailiffs and then wait for the completion of events.

If you are faced with the fact that the bailiff is not fulfilling his duties, then you need to file a complaint with the prosecutor's office.

It is also possible to involve collection companies in cases where the amount is significant and the money needs to be received quickly. It would be correct to conclude an agreement on the assignment of the right to claim the debt. Then 70–90% of the total debt can be collected immediately, leaving the collection service to deal with the borrower. This method is suitable if you need money urgently, but you are not interested in the debtor’s property.