Last modified: March 2021

When the need arises to transfer ownership of land with a house located on it free of charge, the simplest, most easily feasible and optimal method is a deed of gift. Its difference from a purchase and sale agreement or lifelong maintenance of the donor with residence is that after the transaction is completed, the donor has no right to count on any compensation in return. The provisions of Article 572 of the Civil Code of the Russian Federation regulate how to draw up a deed of gift for a house.

Features of donating a residential building

According to the law, a residential building is an individual structure consisting of rooms, utility and other premises. It will not be possible to give a high-rise building as a gift - it is owned by several citizens, and alienation in favor of one person will require the will of all owners.

The owner of a residential individual house has the right to give it to any person, but it is important to observe several features. According to Art. 572 of the Civil Code of the Russian Federation, a gift agreement (hereinafter referred to as DD) implies a gratuitous transaction, because the donor has no right to demand money or services from the recipient.

There are other conditions:

- real estate cannot be donated by actual transfer - the right of ownership to it is given;

- the house is alienated only with the land plot on which it is located (donation separately is prohibited (Article 35 of the Land Code of the Russian Federation);

- household appliances, tools, furniture and various devices located in the house will not be transferred to the donee unless they are indicated in the deed of gift;

- the donee's right of ownership arises not from the moment of signing the DD, but from the date of registration of such right in Rosreestr;

- If the house is mortgaged, the written consent of the mortgagee will be required for alienation.

Important! If the house was purchased by the donor during marriage, the consent of the spouse must be obtained. Real estate transactions made without consent can be challenged by the spouse within 1 year from the moment it became known about the alienation of property (Article 35 of the RF IC).

Donation of a house on a rented plot

If a house is built by a donor on a rented plot of land, the building itself can be donated, but the transaction must be agreed upon with the owner of the land, because the rental agreement will need to be renegotiated.

If the plot with the house belongs to the donor and is rented out under a lease agreement, before drawing up the deed of gift, you need to negotiate the terms of the transaction with the tenants. You should also look at the rental agreement itself regarding early termination.

There are two options here:

- real estate is donated, the donee continues to rent it out to tenants;

- The lease agreement is terminated and a deed of gift is drawn up.

It is important to consider that if employers do not agree to early termination, they will be able to go to court to resolve the issue.

Donating a house for different forms of ownership

Property can be joint or shared. In the first case, the house belongs to several citizens on equal rights, in the second, shares determined by them are allocated by agreement.

If the house is jointly owned, the consent of the other owners will be required for the donation. You can also agree on the allocation of shares: in this case, you will not have to obtain permission, but the DD will be notarized.

Joint property of spouses

Property acquired by spouses during marriage is recognized as their common joint property. They own, use and dispose of it together by mutual consent.

Common property includes:

- income of each spouse from work;

- income from business and intellectual activities;

- benefits and pensions that do not have a designated purpose;

- movable and immovable objects;

- shares;

- securities;

- other property acquired during the marriage.

Find out in more detail how joint property of spouses is formed.

Form of gift agreement

Donation is made in two ways - orally or in writing. To transfer a house as a gift, only written form is used, because... a completed contract form will be needed to register the transfer of ownership in Rosreestr.

Another condition is the presence of signatures of the donor and the recipient. If they cannot sign in person, it is allowed to issue a deed of gift with qualified electronic signatures (Article 6 of the Federal Law dated 04/06/2011 No. 63-FZ). An alternative option is to draw up a notarized power of attorney for another person who will represent the interests.

Features and procedure for donating a land share for agricultural purposes

What is more profitable: an exchange agreement or a gift agreement?

Deadlines for registering a transaction in Rosreestr

Federal Law No. 218-FZ of July 13, 2015 regulates all issues related to state registration of real estate. Article 16 of the law specifies the time limits allotted to the body to perform its functions. Since the registration procedure consists of two actions (registration in the register and registration in the cadastre), there are several deadlines, calculated in working days:

- cadastral registration - 5 days;

- registration of property rights – 7 days;

- simultaneous registration in the cadastre and Rosreestr – 10 days.

If a deed of gift for a house and accompanying papers are submitted through a multifunctional center (MFC), then 2 days are added to each period, i.e., 7, 9 and 12 days respectively.

Since the law does not provide for liability measures for employees for violating established deadlines, they are often violated. In 2019, due to technical failures, the actual time frame for registering real estate reached 30 days.

Who can you give a house to?

The owner of a residential premises has the right to give it to any person:

- close relative: mother, father, children, sister, brother, spouse;

- to a third party (acquaintances, friends, etc.).

Note! After signing the deed of gift and registering with Rosreestr, the donor loses ownership rights, so the identity of the donee must be approached as responsibly as possible if you want to continue living in the house in the future.

Donating a house to children as a maternity capital obligation

According to Art. 10 Federal Law dated December 29, 2006 No. 256-FZ, parents who have used funds under the maternity capital program to build or buy a house sign a notarial obligation to allocate shares to all family members, incl. and children.

Shares can be allocated by drawing up an agreement of the same name, or through the execution of a deed of gift.

This must be done within six months after the Pension Fund transfers money to the seller, pays the last installment under the purchase and sale agreement, fully repays the mortgage or settles with the organization that built the housing.

Gift between spouses

According to the law, property purchased during marriage belongs to the spouses in equal shares and is jointly owned without actual separation (50/50). In order for a wife to give a house to her husband, the shares must be allocated by agreement, after which she will be able to draw up a deed of gift for it.

If the real estate belongs to the donor solely on the basis of a marriage contract, shares are not allocated, and the consent of the second spouse is not required.

Property received during marriage by the donor as a gift, inheritance or before marriage belongs only to him. He has the right to give housing to his wife without obtaining her consent.

Important! If the donor intends to give the house to a third party, in the absence of a marriage contract or agreement on the allocation of shares, the consent of the spouse must be obtained.

Donating a house to the state

Donations to state or municipal institutions are allowed, but with some restrictions:

- You cannot make gifts to employees of such organizations if the transaction is related to their official position and the value of the gift exceeds 3,000 rubles;

- if the donor is a legal entity, the transaction is carried out in agreement with other owners, if this is provided for by the terms of the charter.

Legal advice: if the house is planned to be used for socially beneficial purposes, and the role of the donee is a non-profit organization (hospital, school, social institution, etc.), instead of a standard deed of gift, it is better to draw up a donation agreement and indicate exactly how it should be used. If these conditions are not met, the donor will be able to cancel the transaction (Article 582 of the Civil Code of the Russian Federation).

Fate of donated property during divorce

Divorce is often painful for spouses, as it is accompanied not only by emotional discomfort, but also by resolving complex property issues.

Many citizens do not want to share their property with their ex-spouse. What worries them most is the question of who will receive the donated items during the division of property.

As mentioned above, it all depends on what ownership the item is in and who it was gifted to. Thus, newlyweds are often given an apartment as a gift for their wedding. In this case, the gift is usually intended for both spouses and receives the status of joint property. Such gifted property is subject to division upon divorce.

Let's consider another situation when the spouses are in an officially registered marriage, but the gift was given to only one of them. For example, parents gave real estate to their daughter, which they formalized in an appropriate agreement, indicating her as the donee.

Such housing will be considered her personal property, which removes the question of whether an apartment given to one of the spouses during marriage is divided during a divorce.

Issues related to the division of property are not always resolved in a standard manner, since there is no single template for making decisions in such cases.

In the event of a trial, the court takes into account the circumstances of the case, which may differ in each case, which affects the final result.

Judicial practice shows that the division of gifted property during a divorce is a very pressing issue, and the outcome of the case is difficult to predict.

In many situations, lawyers help resolve property disputes, in particular, how property is divided under a deed of gift.

Is notarization required?

Despite the mandatory written form, the signature and seal of a notary will only be required if a share in the property right is alienated.

Cost of notary services when donating a house

If the DD is subject to mandatory notarization, a state fee is paid in accordance with Art. 333.24 Tax Code of the Russian Federation. It is calculated from the cadastral value of the house and land and is 0.5% (not less than 300 and not more than 20,000 rubles).

Calculation example:

A house and a plot of land with a total value of 5 million rubles are donated. The notary fee will be:

5,000,000 x 0.5% = 25,000 rub.

Due to the restrictions established by the Tax Code of the Russian Federation, the maximum amount applied to payment is 20,000 rubles.

If notarization is not necessary, the parties can turn to a notary for their own protection: a deed of gift with his signature is more difficult to challenge.

In this case, the notary fee is paid in accordance with Art. 22.1 “Fundamentals of legislation on notaries” - it depends on the value of the object and the family ties of the donor and the donee:

- Alienation in favor of a relative: child, spouse, mother, father, brother, sister with a real estate value of up to 10 million rubles. 0.2% +3,000. If housing costs from 10 million - 0.1% of the amount over 10,000, plus 23,000.

- Donation to other persons with a value of up to 1 million – 3,000 + 0.4%; from 1 to 10 million – 0.2% + 7,000; from 10 million – 0.1% + 25,000.

The maximum tariff cannot exceed RUB 100,000. If the payment is calculated to be 200,000, the maximum allowable amount is actually transferred.

How to draw up a donation agreement for a house and land: step-by-step instructions

If the deed of gift is certified by a notary, you can submit documents for registration through him - in any case, he transmits information about the transaction to Rosreestr and the tax service.

The service is provided free of charge; the recipient will only have to receive a new extract from the Unified State Register of Real Estate.

When concluding a transaction yourself, you need to complete several steps:

- Notify the donee of the intention to donate property.

- Draw up and sign the DD.

- Submit documents for registration to Rosreestr or MFC.

- The recipient - receive an extract from the Unified State Register of Real Estate.

Let's look at the stages in detail.

Step 1: agreeing on the transaction with the donee

First, you need to agree on the donation with the recipient of the property - he has the right to refuse the transaction until the ownership is re-registered.

Step 2: signing the deed of gift

When the terms are agreed upon, a contract is drawn up and signed.

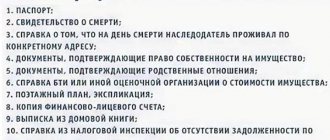

The following documents will be needed:

- passports;

- cadastral passport;

- certificate of ownership or extract from the Unified State Register of Real Estate;

- a document on the basis of which the donor’s ownership arose: certificate of inheritance, deed of gift, purchase and sale agreement, etc.

Important! If a representative acts on behalf of the donor or recipient, a power of attorney is required. Without it, a stranger has no right to sign on behalf of the owner, and besides, its details are included in the contract.

Contents of the gift agreement

To prevent the registrar from refusing to re-register ownership rights, the deed of gift must include detailed information about:

- donee and donor: full name, registration addresses, passport details;

- property: address, year of construction, area, number of rooms, details of title documents, etc.;

- the date of commencement of execution of the transaction: after signing, on a specific day or upon the occurrence of an event (if a contract of promise of gift is drawn up);

- responsibilities, rights and obligations of the parties;

- conditions for termination of the DD.

At the end, the donor and recipient sign. Each person receives one copy of the agreement, the third is drawn up for the registrar.

Sample agreement for the donation of a residential building and land: alt: Agreement for the donation of a residential building and land

Sample agreement for donation of a share of a house and land: alt: Agreement for donation of a share of a house and land

Step 3: registration with Rosreestr

The parties need to submit documents for re-registration of the house to the new owner to Rosreestr, or through the one-stop service - MFC. Both must be present.

If the property is given to a child under 14 years of age, he does not come - his interests are represented by his mother or father. You should contact the agency at the location of the property.

Documentation

For registration, documents used to formalize the deed of gift are provided.

Additionally, you will need the contract itself: on its basis, ownership is re-registered, then it is returned to the donee with the registrar’s notes upon receipt of the extract.

State duty

The donee pays the duty. For individuals the amount is 2,000 rubles, for organizations - 22,000 rubles.

Step 4: obtaining an extract from the Unified State Register of Real Estate

10 days after submitting the documents, the new home owner needs to come to Rosreestr or the MFC for an extract, where he will be indicated as the owner.

Note! Some MFCs provide home delivery of documents for a small fee - about 300-500 rubles. If you wish, you can use this service by paying separately from the state fee.

Re-registration

In order for the gift agreement to come into force after signature, it is necessary to register ownership rights.

This procedure consists of several stages:

- Payment of the state fee for registration, which is 2000 rubles.

- Contacting the body conducting registration (Rosreestr or its territorial body).

- Drawing up an application and providing a package of documents, including a receipt for payment of the state duty.

- Receipt of receipt of documents acceptance and instructions on the deadline for obtaining the certificate.

- Obtaining a certificate for the plot and house.

If registration of property rights is refused, errors must be corrected and the application for registration repeated.

With the participation of a notary, the registration issue is simplified. As a rule, the notary himself fills out the gift deed. After the agreement is signed by the parties to the transaction, the notary begins to deal with registration issues. The participants in the transaction can only come to the notary at the right time and receive a certificate of registration of property rights.

Challenging a residential building donation agreement

You can challenge the deed of gift on the grounds specified in Art. 578 and in other provisions of the Civil Code of the Russian Federation:

- death of the donor through the fault of the donee: the heirs have the right to challenge;

- conclusion of a DD within six months after the donor is declared bankrupt, if the housing was purchased with funds from business activities;

- registration of a deed of gift under the influence of delusion, threats, blackmail;

- drawing up a DD by an incapacitated person;

- transfer of property as a gift by a citizen unable to understand the legal consequences;

- causing harm to the health and life of the donor or his close relatives by the recipient.

Donors themselves, legal representatives or third parties authorized to file a claim can go to court to challenge it.

Rights and obligations of the parties

Issues of the rights and obligations of both parties are regulated by various articles of Chapter 32 of the Civil Code.

The recipient may refuse to receive a donated residential house or other property. This can be done before taking actual possession. The refusal is formalized legally if the agreement has already been registered and ownership rights have been transferred from one person to another.

A person who subsequently received damage from the donated property may demand compensation from the donor for the damage caused if he knew about the danger but did not warn about it.

The donor may refuse to fulfill the agreement on the subsequent transfer of property if this worsens his financial situation, or revoke the agreement if the donee has the idea of making an attempt on the life, property and health of the donor or members of his family. In these cases, he is exempt from paying damages for failure to fulfill the terms of the contract.

Arbitrage practice

It is difficult to invalidate a deed of gift, but it is quite possible if you present the court with maximum evidence and justify your claims.

This is confirmed by real decisions made by courts in different regions:

- Decision No. 2-4547/2018 2-4547/2018~M-3264/2018 M-3264/2018 dated October 10, 2021 in case No. 2-4547/2018;

- Decision No. 2-1337/2018 2-1337/2018 ~ M-1515/2018 M-1515/2018 dated June 8, 2021 in case No. 2-1337/2018;

- Decision No. 2-94/2017 2-94/2017~M-752/2016 M-752/2016 dated May 16, 2017 in case No. 2-94/2017.

Lawyer's answers to frequently asked questions

Is it possible to draw up a deed of gift for a house using a power of attorney?

It is possible, but the deed of gift must be certified by a notary.

What happens to the donated house after the donor dies?

If a real DD is drawn up and the donee is listed as the new owner, the house is not included in the inheritance estate. If a promise of gift agreement is drawn up and the donor dies, his obligations pass to his heirs (Article 581 of the Civil Code of the Russian Federation).

Is it possible to donate a house that is pledged to a bank?

If a house is purchased with a mortgage or pledged to a bank when applying for another loan, transactions with it are carried out only with the consent of the lender.

Is consent required for the donation of a house from the people registered in it?

No, consent is not required. The owner has the right to dispose of the property at his own discretion, but before signing the DD, everyone must be signed out.

Is it necessary to draw up a transfer and acceptance certificate when donating a residential building?

It is not necessary, but the parties can arrange it if they wish. It confirms the actual transfer of the gift, and it can reflect possible shortcomings.

When can a spouse claim donated property?

Despite the position of the law regarding the personal property of a citizen, there are still exceptions to the generally accepted rules that can play an important role in the division of property.

Much has already been said about whether a spouse has the right to gifted property. Since gifts are personal property, they are not subject to division unless they are given to a husband and wife together.

However, if, using common family funds or the personal money of the second spouse, a serious modernization of the premises was made, which significantly increased its market value, then even if the apartment was given as a gift to one of the spouses during marriage, the second can lay claim to it.

Such changes include:

- major repairs,

- reconstruction,

- redevelopment,

- refurbishment

Under such circumstances, the court may recognize personal property as joint, based on the investments made in real estate by each of them. Thus, it is possible that claimants may appear for gifted property after marriage, although the property would seem to be considered personal.

In this regard, it is worth taking into account all the nuances not only when registering real estate, but also using it during marriage.

As practice shows, the homeowner often has to, if not share the apartment, then compensate for funds for its repairs and other work.