Donating a share is perhaps the easiest way to transfer part of a residential property to a relative or any other person. The main advantage is that you usually don’t need to ask anyone for permission, and the recipient receives rights to square meters only for signing the contract. Read about these and other subtleties of giving in our material.

Law

The procedure for drawing up donation agreements and subsequent re-registration of ownership rights is established by the following regulations:

- Civil Code of the Russian Federation.

- Fundamentals of legislation on notaries.

- Federal Law “On State Registration of Rights...”.

- Federal Law “On Cadastral Activities”.

- Federal Law “On State Registration of Real Estate”.

The Notary Law applies to the notarization of contracts. When donating a share in an apartment, a mandatory notarization of the contract is required.

How much money will you have to spend on this procedure?

You will have to spend money on notary services and a state fee of 2,000 rubles. Payment for notary services is calculated from the cost of the share of the apartment being donated (or the entire apartment being donated).

Here the amount is determined according to the individual scheme offered by a particular notary office. Usually this is from 0.2% of the value of the donated property or more.

Is it taxable?

Since the donor does not have any monetary benefit and the transaction between relatives is gratuitous, then, by virtue of Article 217 of the Tax Code of the Russian Federation, people related by close kinship are exempt from the obligation to pay 13%. This is mother, father, grandmother, grandfather, brother, sister.

What is an apartment share

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

The owner of the premises may be one person or several. If there are several co-owners, each of them owns a certain part of the property (house, apartment).

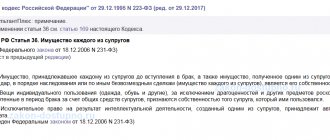

Moreover, property can be common or shared (Article 244 of the Civil Code of the Russian Federation). Common property means property without determining the shares of participants.

Their size depends on the number of co-owners. For example, in a privatized apartment for three people, each family member owns 1/3 of the housing.

With shared ownership, each owner owns a specific portion of the property. Moreover, the shares may be different.

Causing damage by a gift

It happens that a gift given can cause harm to its owner. Let’s say a car received with defects leads to an accident. Here you need to understand on whose shoulders the compensation will fall.

For this case there is Art. 580 Civil Code of the Russian Federation. She says that financial obligations rest with the donor. In turn, the owner of the gift is obliged to collect evidence.

He must convince the court that the defects were not obvious and existed before the deed of gift was issued. Additionally, it is confirmed that the donor deliberately kept silent about the problems.

How to properly gift a share in an apartment to a close relative, mother, daughter, son

The basic requirement when concluding transactions is the full legal capacity of the parties to the agreement. That is, citizens must reach the age of majority. The interests of minors are represented by their parents or other legal representatives (guardians, adoptive parents).

The share donation agreement is drawn up in writing. The rule applies regardless of the degree of relationship between the parties to the transaction. Oral alienation of real estate is prohibited. The agreement gains force after its signing.

A prerequisite is its notarization. The reason for contacting a notary is the need to conduct a transaction with shares in real estate.

The right of ownership to the alienated object arises after entering information into the Unified State Register.

Example. The head of the family decided to sign over his apartment to his son and daughter from his first marriage.

Each of them was entitled to ½ part of the housing. Both children have reached adulthood. Therefore, their mother's consent was not required. The parties discussed all the main terms of the deal. The deed of gift was drawn up by a notary. On the same day, the papers were submitted to Rosreestr. A week later, the recipients received an extract from the Unified State Register of Real Estate.

Donation of certain types of property rights in Russia in 2021

Alienation of any property right, no matter what transaction becomes the basis for this, can be classified as a separate category of civil transactions, which is confirmed in Chapter 24 of the Civil Code of the Russian Federation, that is, the need to take into account the rights of the creditor when transferring property rights to another person when concluding a donation ( 3, paragraph 576 of Article of the Civil Code).

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

According to the requirements and norms listed in Articles 388 and 382 of the Civil Code of the Russian Federation, the donation of property rights must be made by assignment. Along with this, not every right can act as the subject of a gift. Thus, according to the information established in Article 383 of the Civil Code of the Russian Federation, the legislator prohibits the alienation of rights that are inextricably linked with the personality of the creditor!

In addition to the generally accepted features relating to the assignment process, parties should be aware of a group of special rules that may arise and apply in specific transactions. I will talk about this later in the article.

Agreement conditions

The donation is free of charge. There should be no counter-conditions in the agreement. Otherwise it can be challenged.

The contract must contain a clear description of the alienated property. The transfer of the share is carried out during the lifetime of the owner of the object.

Violation of any clause makes the gift agreement void or voidable.

Is the consent of the co-owners required for the alienation of part of the premises? Typically, consent is required in case of sale of property (Article 250 of the Civil Code of the Russian Federation).

When concluding a gift agreement there are some nuances. Only the allocated share can be given as a gift without the consent of the co-owners. An object in joint ownership can be donated only with the consent of the co-owners.

The donor and his heirs

It happens that the donor dies before the gift passes to its owner. Then the following rules apply. The obligation to provide property passes to the heirs, with the exception of a special clause in the contract (Article 581 of the Civil Code of the Russian Federation).

In the event that the future owner of the gift has died, the heirs, as a general rule, cannot claim it. But again, the deed of gift may provide otherwise.

A similar scheme is provided when an enterprise is liquidated or undergoes a reorganization procedure. Then the powers can pass to his legal successors.

Article 572 of the Civil Code of the Russian Federation lists cases in which the execution of a deed of gift is unacceptable. Thus, an agreement cannot be signed on behalf of a minor or disabled person. Also, the restrictions do not affect items with a value of up to 3,000 rubles.

The educational institution, hospital, social protection organization where the donor is located has no right to accept gifts. The same applies to officials of different ranks. After all, by donating expensive goods, unscrupulous citizens want to receive a loyal attitude towards themselves and speed up the resolution of the necessary issue.

Enterprises cannot use the deed of gift. True, only those whose activities are focused on making a profit. Public associations and charitable organizations are not prohibited.

A special case is a donation agreement. According to it, property is transferred for the purpose of realizing socially useful purposes. If the initiative comes from a citizen, then the agreement provides for the intended use of the gift.

Methods

The donation of part of the housing occurs by concluding an agreement. However, sometimes citizens have to go to court. The reason is the death of the donor. If the recipient did not have time to register ownership, then the property of the testator is included in the inheritance. The legal successors of the property are the family members of the deceased subject.

Example. The plaintiff went to court. He asked to recognize the deed of gift as concluded, and the certificate issued by the notary as invalid. The plaintiff also asked to cancel the certificate of ownership. Justification of the requirements - a gift agreement was drawn up between the plaintiff (son from his first marriage) and the late citizen K. But the plaintiff did not have time to register ownership of the premises due to the death of the donor. The defendants were the heirs of the deceased subject. They knew about the conclusion of the gift agreement, however, they turned to a notary to register the inheritance. As a result, the plaintiff lost the property donated to him. The legal successors registered the ownership rights with the Federal Registration Service of the Omsk Region. Two defendants admitted the claims. Another claimed that he knew nothing about the existence of a gift agreement. Moreover, the agreement was not certified by a notary. Therefore, he asked to dismiss the claim. However, the court did not agree with the defendant's opinion. The deal was concluded before amendments were made to Federal Law No. 172-FZ. Therefore, notarization of the agreement was not required. The claims were satisfied.

Procedure

Transaction participants must perform the following actions:

- Collect the necessary documents.

- Prepare a draft agreement.

- Contact a notary.

- Prepare a deed of gift.

- Register ownership.

Procedure

Initially, the parties to the transaction need to contact a notary office. You can develop a draft agreement yourself or take it from a notary.

To conclude an agreement, you will need the appropriate papers. The notary establishes the identities of the participants and verifies their legal capacity.

At the same time, the parties to the agreement are explained their rights/responsibilities. The deed of gift is considered executed from the moment it is signed by the parties.

Data on the conclusion of the contract are entered into the state register. To avoid mistakes, you need to carefully check the text of the agreement.

Documentation

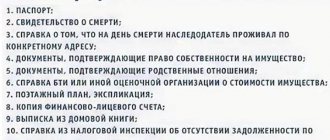

To prepare a deed of gift you will need:

- Passports of the donor and recipient.

- Documents for property (extract from the Unified State Register, cadastral passport).

- Extract from the house register.

- Consent of the spouse to the alienation of a share of the premises (if necessary).

- Confirmation of relationship.

If the latter document is available, the parties to the agreement are exempt from paying personal income tax (Article 217 of the Tax Code of the Russian Federation). The rule applies only to close relatives.

Expenses

At the conclusion of the deed, the parties to the deed incur certain costs. How much it costs to register a donation depends on the market price of the object.

For notarization of the transaction you will have to pay 0.5% of the value of the share. The minimum collection amount is 300 rubles. The maximum rate is 20 thousand rubles. The state duty is usually paid by the recipient.

Notary services are paid in addition to the basic tax. On average they amount to 5 thousand rubles. Details need to be clarified at the notary office.

Registration of rights is a separate cost item. When re-registering premises in an apartment building, the tax amount is 200 rubles. When registering an entire apartment, the copyright holder pays 2 thousand rubles.

Taxes

The only tax when concluding a deed of gift is personal income tax. Its size for residents of the Russian Federation is 13%. Non-residents pay 30%.

Who is exempt from paying income tax? Citizens who are close relatives do not pay personal income tax. This includes parents, children, spouses, brothers/sisters. The benefit also applies to grandparents.

Deadlines

You can conclude a deed of gift at any time. The parties to the contract determine the time to contact the notary independently.

How long does it take to register ownership? The beneficiary can submit papers at any time.

However, delaying the procedure is fraught with certain consequences. In the event of the death of the donor, the beneficiary will have to prove his rights to the property in court. Otherwise it will become part of the inheritance.

Registration of deed of gift

The procedure for drawing up an agreement is regulated by law. Initially, the parties need to agree on the key points of the agreement. One of them is the right to refuse the transfer of a gift. The reason may be the deterioration of the property status of the donor.

Next, the parties to the transaction should visit a notary. The link goes to the location of the apartment. You need to have documents with you. The notary will calculate the amount of the fee and provide details for payment. You can make a payment at any bank in the country. Notarization of the transaction occurs after payment of the fee.

The deed of gift is drawn up in triplicate. One is given to the donor, the second to the beneficiary, and the third remains with the notary.

Who can you donate real estate to?

A house, cottage, land plot or other object is given to anyone: spouse, parents, brother or sister, friend, child.

The right to choose the donee remains with the donor. But in each case the transaction has its own characteristics.

From husband to wife

Spouses can give real estate to each other. If the transaction is made in favor of the second spouse and a share in community property is given, it is not necessary to obtain his consent.

There are other points:

- having donated a share in joint property, the spouse will not be able to divide it in the event of a divorce;

- The child’s property is not given as a gift – the property of parents and children is separated.

To kid

If the donation is made in favor of a child from 14 to 18 years old, he puts his signature on the transaction, but parental consent will be required. Subsequently, the deed of gift is registered in his presence. When giving a gift to a minor child (under 14 years old), all actions are performed for him by his legal representatives.

When giving real estate to a child by one of the parents, the consent of the other will also be required if it was acquired during marriage. If the apartment was purchased before marriage, consent is also not required: the mother and father have the same rights to the children, and they equally represent their interests even in the event of a divorce.

From parents to adult children

Parents have the right to donate real estate to their adult children, but consent to the transaction from the recipient will be required. The mother and father no longer represent the interests of children over 18 years of age.

As in previous cases, to transfer a gift in the form of jointly acquired property, you must obtain the notarial consent of the spouse.

Lawyer's advice: the best option is to draw up a deed of gift for the child, especially if he is married. In the event of a divorce, his spouse will not be able to claim the gifted property.

From mother's daughter

Children have the right to give their parents any property that belongs to them by right of ownership. The DD is issued for both one and both parents, distributing the shares to them.

Also, sons and daughters can act as donors under one agreement, having issued it in the name of the parents or only in the name of the mother and father. There are no restrictions in this regard.

To a close relative

Close relatives mean children, parents, brothers, sisters, grandparents.

Donating to them is not prohibited, and if several rules are followed, the transaction can be carried out:

- consent of the donee is required;

- if housing purchased during marriage is donated, the notarized consent of the spouse is required;

- The agreement is drawn up in writing and registered with Rosreestr.

From an individual to a legal entity

An individual is a citizen who is not engaged in commercial activities. Despite the fact that individual entrepreneurs are also individuals, they cannot donate property to an LLC.

For citizens, there are no restrictions on donating real estate to enterprises; the main thing is that the transaction is voluntary. The only exception that must not be forgotten is the prohibition on a transaction addressed to a bank, state or municipal institution if it is related to the performance of official duties of specific persons.

If the donor wants to transfer a right or thing for general beneficial purposes, it is better to enter into a donation agreement instead of a standard deed of gift. It does not require the consent of the donee, and the document can indicate for what purposes the gift is being transferred (Article 582 of the Civil Code of the Russian Federation).

Legal advice: the recipient (organization) should take into account that the housing presented as a gift cannot be used for commercial purposes - for this, the property must be recognized as non-residential. You will have to deal with the re-registration procedure yourself. Non-residential properties also cannot be used for human habitation.

From a legal entity to an individual

The company has the right to give real estate to employees: for example, for exemplary work or special merits. This is most common among state and municipal institutions.

If the donation is carried out by a commercial organization and the charter provides for preliminary approval of the transaction by all owners, you will have to hold a meeting and draw up a protocol based on the results.

If the company has a single owner, a single decision is sufficient.

How to transfer a share to a relative

There are several ways of alienation - sale, barter, donation. Each of them has strengths and weaknesses. When concluding a purchase and sale agreement, the priority right of redemption belongs to the co-owners.

Alienation of property to third parties is permitted only upon refusal of the main applicants. When concluding a deed of gift, such restrictions may not exist.

For free

The best option for the alienation of property is a gift agreement. Relatives do not pay income tax.

However, such transactions are not completely free. A state fee is charged for notarization of the deed of gift.

Participants in the transaction are paid separately for notary services.

Without deed of gift

Is it possible to give away a share without registering a deed of gift? You can transfer part of the apartment to a relative by concluding a purchase and sale agreement or exchange.

Both options are appropriate within the framework of inheritance law. For example, if several people inherited shares in different property.

Co-owners can agree among themselves to buy out or exchange the missing part. The ultimate goal of such transactions is to obtain ownership of the entire object.

Citizens can also draw up an agreement on the division of inheritance. However, they must first obtain a certificate from a notary (Article 1165 of the Civil Code of the Russian Federation). The choice of method for transferring part of the property depends on the circumstances of the case.

Concept of donation

A donation is an agreement on the free disposal of property. By virtue of the deed of gift, one party gains benefit at the expense of the other. The essence of donation as a civil transaction is determined by the scope of mutual rights of the parties.

The donor voluntarily undertakes to transfer the subject of the transaction to the donee free of charge.

If there are grounds, the donor may:

- cancel the transaction and withdraw the gift (Article 578 of the Civil Code);

- refuse a previously made gift promise;

- to recover compensation for the costs of preparing and transporting property from the donee, who agreed in writing to accept it and later refused.

The donee has the right:

- accept a gift;

- demand it from the donor who promised in writing (Part 2 of Article 572 of the Civil Code);

- refuse the gift until the moment it is accepted in kind (Article 573 of the Civil Code).

Any negotiable object can act as a gift (Article 129 of the Civil Code):

- currency, cash and non-cash money;

- things, various types of property from the results of intellectual activity to entire property complexes of enterprises;

- release of the donee from debt to the donor;

- transfer of debt to the creditor from the donee to the donor (Article 391 of the Civil Code);

- transfer by the donor to the donee of rights of claim from a third party (Article 382 of the Civil Code).

Registration of ownership

Real estate transactions are subject to state registration. The recipient of the gift can contact one of the branches of Rosreestr. You can also submit papers through the MFC. Registration of property rights occurs at the request of the copyright holder.

You need to attach to it:

- gift agreement;

- property documents;

- identification;

- excerpt from the house register;

- written consent of the co-owners (not always);

- confirmation of payment of the duty.

Note. The consent of the co-owners is required when alienating part of an apartment that is jointly owned by citizens. If the property is in shared ownership, then the consent of the co-owners is not required.

Their legal representatives act on behalf of children. If the copyright holder is under 14 years of age, a birth certificate will be additionally required. Children aged 14 years apply independently. The only condition is the written consent of the parents.

The registration procedure takes from 5 to 12 days. The exact deadline depends on two factors - the method of submitting documents and the type of action being registered.

The transaction is considered completed after the issuance of an extract from the Unified State Register to the beneficiary.