In what cases is an extract required?

Information from the Unified State Register is necessary when it comes to real estate transactions. This is the main document that confirms the right to an apartment, plot or other real estate. There are a lot of situations when an extract is required. Let's look at the most common ones:

- purchase or sale of real estate;

- entry into inheritance;

- registration of deed of gift;

- privatization of housing;

- mortgage registration;

- obtaining a bank loan if the collateral is an apartment;

- placing on a waiting list for improved housing conditions;

- receiving a tax deduction for an apartment or house;

- property division;

- litigation regarding square meters.

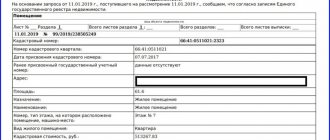

An example of an extract from the USRN about characteristics and rights

What information can you find out from the extract?

Extracts from the Unified State Register of Real Estate are divided into several types. The most popular ones are about characteristics and rights, about the transfer of ownership, a complete statement about the property. Which one to choose depends on the situation. Thanks to the extract you can find out:

- who is the real owner of the property;

- information about previous owners;

- cadastral number of the object;

- address, area, floor, type of premises;

- cadastral value of the property;

- when it was registered;

- presence of encumbrances – arrests, pledges.

Who and how can receive an extract

The information listed above is open. Anyone can receive them without any problems. You can view it on the EGRN.Reestr portal.

However, access to some information is still limited. It can only be recognized by the owner of the property, his authorized representative or notaries. For example, details of title documents, general information about the rights to real estate of a particular person, the fact that the owner of an apartment or plot is declared incompetent.

An extract from the Unified State Register can be ordered in several ways: at the offices of Rosreestr, at the MFC, by on-site service, through the government services website and third-party online services. The most convenient way is to go to the MFC or get information on the Internet. It will be a paper version or electronic, it doesn’t matter. Both have the same legal force.

What is needed to register a transaction with collateral

Registration of ownership of an apartment under a mortgage requires the provision of a list of documents established by law (). Their list will be provided by the bank manager or realtor with whom you cooperate. Although it may vary slightly depending on the characteristics of the transaction, the basic list is as follows:

- Passports of the participants in the credit transaction, that is, sellers and buyers.

- Application for registration of ownership. The forms will be printed by the specialist accepting the documents, all you have to do is check the data and sign.

- Receipt of payment of the state fee for registration of property rights. The state duty is divided equally among all future owners. If you are mortgaging your property, you must register the mortgage agreement. The state fee for it is divided equally between all mortgagors and the creditor.

- Agreement with the seller (for resale) or with the developer (for new housing).

- Documents confirming title to housing (extract from the general register of real estate).

- The document in connection with which the right of ownership appeared (privatization, donation, etc.).

- Collateral papers. In case of encumbrance, by force of law, an agreement with the creditor and a mortgage are used; by force of agreement, a special mortgage agreement is used. Some banks do not issue a mortgage, and this also happens within the framework of the law - the restriction of the right is registered only on the basis of the loan and purchase agreement.

- Technical documentation.

- Notarized power of attorney, if the seller is represented by his authorized representative.

- Permission from government agencies to sell living space if there are children among the sellers.

- Notarized permission of the borrower's husband or wife for the encumbrance.

In order to submit documents and not be refused, you should clarify in advance what is required to register ownership of an apartment with a mortgage.

Separately, it is worth mentioning such an important document as a mortgage (). Although many banks neglect its registration, large financial organizations practice registering collateral through a mortgage note. The document must contain:

- data of mortgagors, that is, mortgage borrowers on this loan;

- characteristics of the apartment (location, floor, number of square meters, estimated price, etc.);

- information about the mortgage (amount, details of the loan agreement, rate, etc.);

- features of repayment, date and amount of payment;

- signatures of all borrowers.

Recommended article: How to buy a summer house with a mortgage

A printed and signed mortgage must be submitted for registration. Otherwise, it is not recognized as legal. The original document is stored in the bank archive until the loan is closed. After payment, they will give you the mortgage note, because it will be needed to remove the deposit.

Please note that the mortgage can be transferred to another organization, and not only if payments are late. It all depends on the terms of the loan agreement you signed. By and large, nothing seriously changes for the payer except payment details. The rules for taking away housing are clearly regulated by Russian legislation, so there is no need to worry.

How to obtain an extract from the Unified State Register of Real Estate online

In order not to waste time on trips to the MFC or the Rosreestr branch, you can order an extract without leaving your home, online. It will arrive electronically. You can print it if necessary.

On the Rosreestr website you need to find the “Individuals” section, then click on the “Get information from the Unified State Register” link. This resource has some inconveniences - it requires too much information from the person wishing to receive an extract. You need to know the exact address of the object, enter your personal data, including your passport, and indicate other documents. You are asked to fill out more than 15 fields. All this takes at least half an hour. Then you receive an email with a link to pay the state fee. As soon as it is paid, they provide a link where you can download the statement.

The government services website issues statements using approximately the same principle. But the customer faces additional difficulties if he has never used this service. Before receiving the service, you will have to create an account and wait for account confirmation. The service is also paid.

It’s easier, more convenient and cheaper to get an extract from the Unified State Register using the Unified State Register .

Amount of state duty for individuals and payment procedure

The cost of the fee for registering a transaction between individuals will be 1,000 rubles, and between companies – 4,000 rubles.

If the agreement is concluded by the bank and the borrower - 1000 rubles, of which the receipt of an individual is 500 rubles, and the payment order of a legal entity is 500 rubles.

State fees are the same for both the MFC and Rosreestr. The duty is paid regardless of the number of real estate objects that are the subject of the mortgage agreement.

Who should pay the state fee? It can be paid jointly by the bank and the borrower, but most often these costs fall on the shoulders of the client. You can make the payment at any bank branch or terminal .

How to obtain an extract from the Unified State Register of Real Estate online through the website egrnreester.ru

To receive an extract, you need to take just a few steps:

- We go to the EGRN.Reestr website and indicate the cadastral number of the property or its address.

- We select the required type of statement depending on its content.

- Provide your phone number and email. We pay for the service and wait for the finished document.

The document production time is 30-60 minutes. The extract will be certified by an electronic digital signature of Rosreestr, which means that the document will have full legal force.

Features of property rights under a mortgage

When applying for a housing loan, the property is immediately registered in the name of the borrower and his family members (if jointly owned). Is an apartment with a mortgage considered the property of the bank client? Yes exactly (). Contrary to popular belief, the bank is not the owner of the property.

However, the apartment is subject to an encumbrance, a mortgage in force ():

- law, when the subject of collateral is the purchased living space;

- agreement when other real estate of the borrower or his relatives is pledged. At the same time, no restrictions are imposed on the purchased apartment.

With a mortgage, the apartment is not owned by the bank. A pledge implies a significant restriction on the disposal of real estate. In this case, the loan payer and his family can live in this apartment. What restrictions will there be on the rights of borrowers to own an apartment with a mortgage:

- Carrying out transactions involving a change of owner with collateral. That is, you will not be able to sell, give as a gift, enter into an exchange agreement, or redistribute shares. Even if the sale is necessary to pay off the remaining mortgage debt.

- Concluding a rental agreement. Of course, many borrowers do this, but illegally, without registering the rental agreement with the tax office. If you decide to prepare the documents in the required manner, you will first have to obtain permission from the bank. The financial institution is unlikely to give consent to the lease, because there is a high probability that the tenants will cause irreparable harm to the pledged property (for example, start a fire).

- Registration of new residents. By law, the bank cannot prevent the registration of family members of the borrower, but they will still have to obtain permission from him.

- Redevelopment. The decision on the possibility of changing important structural elements is made not only by BTI, but also by the bank. He has the right to refuse to issue consent if he considers that the reconstruction will worsen the condition of the housing.

- Transfer of ownership of an apartment under a mortgage. Some banks still meet halfway, offering clients who contact them to buy an apartment as collateral with a mortgage. This allows current borrowers to solve financial problems by giving up their mortgage on the property. The bank keeps the liquid apartment as collateral, transferring the debt to a more solvent client ().

Owners of a mortgaged apartment can live in it, make repairs and use it for their own needs. They also have the right to bequeath it in accordance with the law, that is, by drawing up an appropriate order with a notary. Documents for the ownership of an apartment with a mortgage are kept by the mortgagor (loan recipient). Only copies should be provided to the financial institution.

A mortgage on a owned apartment from a bank differs from an installment purchase from a building society. In the latter case, shareholders receive ownership rights only after full payment of the debt. At the same time, there is no certainty that the house will be completed and the property itself will be transferred to you by agreement.

In case of failure to fulfill mortgage obligations, the lender has the right to sell the collateral property through the court to pay off the debt (). The part needed to pay off the debt will be used to cover the loan, and only the remainder will go to the defaulting borrower.

It should be noted that this is an extremely unprofitable deal in which the bank receives interest for using credit funds, while the client is left without money and without an apartment. Therefore, you should avoid selling property as much as possible. Now mortgage borrowers can take advantage of credit holidays (), which will allow them to improve their financial situation or correct the situation in another way.

Ownership of an apartment with a mortgage can be registered:

- Individually for the borrower, even if he is married. Subsequently, the husband and wife will be able to allocate a portion to each or divide housing during a divorce. According to the law on ownership of an apartment with a mortgage, spouses can establish a half share or resolve the issue differently.

- For husband and wife as joint property. Parts of housing are not clearly stated. By default, they are divided equally between spouses (). The spouse will definitely become a co-borrower on the mortgage, unless there is a prenuptial agreement.

- Under a mortgage, common shared ownership of an apartment is registered in the name of the family of the mortgage client. For example, parts are allocated to children and co-borrowers (they are often the parents of the loan payer).

Whose property is it if the apartment has a mortgage? It is possible to allocate the right of ownership to the borrower, his spouse, and minor children. If co-borrowers are involved, for example, parents in order to increase the loan amount, they can also become co-owners of the home.

At the same time, the percentage of the share allocated to them does not play a big role. The main thing is that when taking a mortgage on an apartment in common ownership, at least some part is registered in the name of the main borrower. However, banks can set their own restrictions in this regard. You should consult your mortgage specialist for details of the transaction.

Depending on how you decide to obtain ownership of the apartment with a mortgage, it will be determined how to proceed and what documents to collect. In some transactions, a simple transfer for registration will be enough for you; in others, you will have to go to a notary’s office and pay a considerable amount there.

How to obtain an extract from the Unified State Register of Real Estate through the MFC: instructions

For some, it will be more convenient to come to the MFC in person. First, on the website of the Center in your region, familiarize yourself with the documents, the cost of the service, and the deadline for issuing an extract.

STEP 1. Collecting documents

In order to contact the MFC to obtain a certificate, you need to collect a package of documents:

- applicant's passport;

- power of attorney, notarized, if received by a representative of the applicant;

- representative's passport;

- receipt of payment of state duty (at the discretion of the applicant);

- completed application.

STEP 2. Come to the MFC

You can fill out a request for information locally. Be careful and careful: the application is filled out on 5 sheets in block letters without blots or errors.

STEP 3. Receive a receipt

After the MFC employee accepts all the documents from you, he must issue a receipt that he has received the necessary papers. He will also schedule a follow-up visit to issue an extract.

STEP 4. We pick up the finished document within the specified period.

How much does a USRN extract cost?

Obtaining an extract from the Unified State Register is a paid service. Regardless of where to order it: directly from Rosreestr, through the State Services website, MFC or online services.

When receiving a certificate from the MFC, branches of Rosreestr and government services, you need to pay a state fee. The amount depends on the information you need and your status - whether you are an individual or a legal entity. An electronic statement is cheaper than a paper version.

For example, a certificate of transfer of rights for a “physicist” will cost 460 rubles. on paper and 290 rubles. electronic. A legal entity will pay 1270 rubles. and 580 rub. respectively. An extract about the main characteristics and rights costs 460 and 1270 rubles. on paper, 290 and 820 rubles. in electronic version.

Prices on the website egrnreester.ru are lower. An extended real estate report costs 350 rubles. For this amount, the report provides comprehensive information about the object:

- who is the current owner;

- who are the former owners;

- when the rights expire;

- when the property was registered;

- how much does the property cost according to cadastral valuation?;

- is there a ban on re-registration, bail or arrest?

Features of registering an apartment under a military mortgage

Especially many questions arise regarding military mortgages. Indeed, such credit and property transactions differ significantly from others. Registration of ownership of an apartment under a military mortgage occurs in a standard manner. Except that the mortgagee is not only the bank, but also the Ministry of Defense of the Russian Federation, which actually pays the debt ().

Is an apartment with a mortgage a property for the military? The right of ownership is registered in the name of the client who applied, that is, the military personnel. Please note that targeted government payments are not considered joint property (). Is the apartment owned by a husband and wife if there is a mortgage? The right of ownership is not registered in the name of the spouse, and in the event of a divorce she will not have the right to divide this living space.

When does an apartment become a property under a military mortgage? At the time of registration of the agreement in Rosreestr, that is, almost immediately after signing the loan documentation. Additionally, the package of papers for registering the transaction includes a targeted loan agreement with Rosvoenipoteka. The same restrictions on real estate apply as with a regular mortgage.

If a serviceman decides to leave service early, he can continue paying the mortgage on his own or leave the apartment to the state. In the first case, the encumbrance in favor of the RF Ministry of Defense is lifted ahead of schedule. The client assumes responsibility for paying off the mortgage.

When the debt to the lender is repaid in full, ownership of the apartment takes place after the mortgage. The payer needs to order a certificate of fulfilled obligations and pick up the mortgage. Then, with these papers, you must come to the representative office of Rosreestr and submit an application for cancellation of the pledge.