If you are thinking of making a deed of gift for a loved one or someone you care about, or, conversely, such a generous gift is being prepared for you, and you are also unfamiliar with some legal subtleties, then this article is for you.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

To protect yourself and your loved ones from unforeseen life circumstances, you need to immediately issue a deed of gift for your apartment. In order not to lose your right to property, as is possible when registering an inheritance.

Article 572 of Russian legislation states that citizens have the right to donate their real estate to other persons.

The main thing here is to formalize everything correctly, so it is best to entrust this to a notary. If documents are lost, a notary can always confirm the existence of a deed of gift, and when contacting the established authorities, you can quickly obtain a copy.

What is a deed of gift for an apartment?

A deed of gift is the best way to transfer your real estate to another person, free of charge.

Here, one of the parties (the donor) transfers his real estate to the other party (the donee) into his ownership. Often, therefore, parents register an apartment for their children in order to provide them with housing at least in the future.

The main conditions of the deed of gift are gratuitousness and, of course, unconditionality:

- gratuitousness is when the donor gives real estate completely free of charge, without demanding any material compensation in return.

- unconditionality is when the donor, having transferred his property, will not be able to impose any material or other burdens on the donee in the future.

Arbitrage practice

To cancel a deed of gift, evidence is needed to confirm the existence of grounds. Audio and video recordings and documents are presented to the courts, and witnesses are called, but this does not guarantee the satisfaction of claims.

But there are examples of decisions where plaintiffs managed to obtain in court the cancellation of transactions made with brothers, sisters and other citizens:

- Decision No. 2-55/2019 2-55/2019(2-775/2018;)~M-675/2018 2-775/2018 M-675/2018 dated June 17, 2021 in case No. 2-55/2019 ;

- Decision No. 2-2788/2018 2-2788/2018~M-2443/2018 M-2443/2018 dated June 26, 2021 in case No. 2-2788/2018;

- Decision No. 2-1773/2017 2-1773/2017 ~ M-1803/2017 M-1803/2017 dated October 18, 2021 in case No. 2-1773/2017.

Legal advice: courts carefully study the circumstances of the case and evidence, so it is recommended to seek help in challenging a lawyer in order to increase the chance of satisfaction of the claims. Challenging a contract on your own is extremely problematic.

How to draw up a deed of gift for an apartment?

- First, a gift agreement is signed by both parties.

- Then it is registered with the Federal Registration Service.

- You can have the document certified by a notary; this, of course, is not necessary, but it is advisable. This is a useful service; if documents are lost, you can always count on a copy.

Provide the necessary documents:

- consent of all family members, and necessarily notarized, if, of course, this property is jointly acquired;

- a document proving your ownership of it;

- certificate about the number of registered people in the apartment;

- appraisal paper from the BTI;

- for a minor, as well as an incapacitated citizen, the written consent of a guardian will be required;

- if the apartment has several owners, their consent will also be required;

- passports of 2 parties;

- a gift agreement, which must be signed by both parties;

- cadastral passport received from the BTI;

- the authorized representative will need a completed agreement in accordance with all the rules;

The Federal Reserve System often requires additional documents; these will also need to be provided in full. You will also need to pay a fixed state fee. duty. The size and details will be communicated and issued immediately on the spot.

The registrar will take all the documents you have prepared, of course, except for passports. In return, you will be given a receipt in the prescribed form. They will definitely set a time when you need to come up with a completed contract.

Registration process

Includes 2 design options, optional:

- independent;

- through a notary.

In option 1, you will have to fill out the document yourself with the following information:

- information about the subject of the donation;

- data of 2 parties;

- name of the required object;

- document on legal ownership;

- signatures;

- exact parameters and data of the object.

Documents are prepared at the Registration Chamber. When the registrar receives them, you will need to draw up a statement signed on both sides.

Then the registrar will take all the documents and issue in return (within 10 calendar days):

- copies of the finished contract;

- certificate of your right to property.

If you want to save your time and use (prudently) the services of a notary, then just prepare the necessary documents for him and pay him, although the services are not cheap. He will quickly and sensibly draw up an agreement, and you just sign it. And after some time, the recipient will receive a completed certificate.

Required documents

According to our legislation, the registration procedure is required to be carried out by the Federal Registration Service.

To carry out this procedure we will need:

- a document with the true assessed value of the property;

- a certificate indicating the number of registered people in the apartment;

- 2 passports: donee, donor;

- cadastral passport (take from BTI);

- documents about your existing property rights;

- technical passport of housing;

- agreement on drawing up a deed of gift;

- gift agreement;

- extract from the house register, etc.

This is the main package of documents, but it may change and be added a little. Much depends on the design conditions. When the deed of gift is ready, you immediately need to re-register the apartment in your name. It is better to clarify the list of documents in the Registration Chamber (reference window) or the MFC.

Contents of the gift agreement

It looks like this:

- Subject of the agreement - the name is indicated (for example, a three-room apartment). The technical data of the object is also entered here.

- Parties to the agreement enter the details of both passports and place of registration. If the donee is a minor, instead of passport data, entries from the birth certificate are made.

- No encumbrances - your apartment must be free from unfounded and justified property claims of other persons; written evidence of this is needed.

- Registration - when there are registered people in the apartment, it is necessary to indicate the deadline for their eviction and check-out.

- Title document - you need to start with the words “This living space now belongs to (full name) based on the data...”

Below are the exact details of the documents:

- original certificate of inheritance;

- agreement for joint participation in shared construction;

- a document indicating the right to your property.

Responsibility and rights of both parties - write the phrase: “Rights and responsibilities are not at all provided for in this agreement, but are established in accordance with the current legislation of the Russian Federation.”

But often this paragraph also includes:

- termination of this agreement - note under what circumstances and how this transaction can be canceled;

- signatures of 2 parties - legal representatives, signed in person when submitting documents.

Registration of the agreement

The gift agreement is considered legal and valid only after state registration. When a transaction is formalized by a notary, this agreement is immediately drawn up and signed.

Then it must be certified and registered at will:

- MFC;

- Registration Chamber.

There are situations where notarization is not required, since the agreement is submitted for registration immediately, in the case of:

- the apartment has one owner;

- joint property of both spouses.

Gift tax

Only the closest relatives should be exempt from paying taxes: fathers, mothers, children, grandchildren, grandmothers, grandfathers, etc. When donating to all other relatives, other persons will have to pay 13% of the total cost.

Registration costs

Costs will depend on the option chosen:

- If the documents were certified by a notary, then you will need to pay: services from approximately 8 thousand rubles +% of the transaction and up to 10–13 thousand rubles. for carrying out technical work.

- Self-registration will cost 3 thousand rubles.

How long does it take to issue a deed of gift?

A competent lawyer can draw up an agreement in less than an hour, but this, of course, is provided that he has all the documents he needs. The transaction then goes through the required registration.

The timing will depend on the workload of employees, the choice of registration service, etc. But on average it will not exceed 10–15 days. If you do this yourself, then with the collection of all the necessary data it will take about a month.

Documents for registration

Registration of the transfer of ownership under a gift agreement in Rosreestr requires the submission of the following package of documents:

1. Donation agreement - 3 copies.

2. Application for state registration of transfer of ownership.

3. Notarized power of attorney for a representative, if you are acting through a representative.

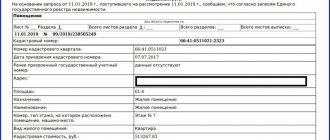

4. Certificate of state registration of ownership, if it was issued (this document was issued only until July 15, 2016), or an extract from the Unified State Register of Real Estate.

5. Passports of the parties to the agreement.

6. Other documents if necessary. For example, a spouse’s consent to donate an apartment that is in common ownership (notarial).

How to issue a deed of gift for a child or incapacitated person?

The law protects the rights of children - this is stated in Articles 26, 28 of the Civil Code of the Russian Federation. As well as incapacitated citizens - this is Article 29 of the Civil Code of the Russian Federation.

The following may accept property from them:

- one of their parents;

- guardian.

But giving someone else’s property, even on their behalf, is strictly prohibited at the legislative level. Minors can also enter into an agreement, but only after 14 years of age. But this only requires the unanimous consent of legal representatives.

The law protects the rights of children - Article 37 of the Civil Code of the Russian Federation. Incapacitated citizens can take part in a transaction, but only with the written consent of their guardians (Article 29 of the Civil Code of the Russian Federation).

Who cannot be the recipient?

Article 575 of the Civil Code of the Russian Federation imposes a number of prohibitions on such a transaction. The recipient cannot be:

- people working: hospitals, schools, nursing homes, etc.;

- when the donor is a pupil of a children's or medical institution;

- persons under 14 years of age and their representatives;

- incapacitated citizens and their legal representatives;

- some categories of employees holding high state and even municipal positions, Bank employees;

- commercial organizations.

Features of donating a share in an apartment

Starting from 2021, in June, the conditions for donating a share have completely changed. There are situations when registration is possible only with a notary.

But sometimes it is possible to act independently when:

- The apartment has several owners;

- The common share is the property of one spouse or both spouses - which means they acquired it during marriage.

- A certain share is given to only one of the spouses - this is when they jointly buy an apartment and register it as joint ownership. Then, instead of donating, it is best to draw up an agreement, or even a marriage contract. One of the spouses must give the other half his share with the right of complete disposal.

Donating a share, of course, can be done independently in the following cases:

- the apartment has one owner;

- property acquired during marriage.

Nuances when donating an apartment

If the donor, for reasons dependent or beyond his control, wants to terminate the contract, he can do this through the court within 365 days (from the date of conclusion of the transaction). We must not forget that it is quite difficult to cancel a deed of gift; the legal process will last a very long time.

You can cancel the contract in 3 cases:

- death of the new owner;

- threat of destruction or significant damage to property;

- an attempt on the life of the donor or causing injury to him.

If a person has a lot of relatives, but wants to leave his property to only one, then the most acceptable option is to donate it. Because a will can be easily contested, and a deed of gift is certainly possible, but it is not so easy to do.

A deed of gift, like any other transaction, has its pros and cons. Therefore, before making any decision, first think carefully and give yourself an honest answer, for what purpose are you doing this?

Only then will you be able to understand whether you need it now, or you can wait a while, the right type of contract has been chosen, or you are not sure whether you need to play it safe, or, in general, choose other methods of transferring property, etc.

There is no need to waste time drawing up a contract yourself or looking for the necessary templates on the Internet. They are usually presented there either too outdated or standard templates.

And each transaction is truly unique, so only a lawyer can draw up the correct contract, taking into account all the nuances known only to him, without typos and spelling errors. If they exist, the deal may even be suspended. And time and nerves are now expensive!

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Who should pay

The law does not specify who, when making a gift, must pay the notary for his services. Most notaries will have the donee appear on payment receipts, because They are beneficiaries, but notaries don’t care who gives the money. Therefore, donors and recipients can agree on payment themselves.

Other articles

After the donation, the new owner can register in the apartment.

If you have questions, you can consult for free. To do this, you can use the form below, the online consultant window and telephone numbers (24 hours a day, seven days a week): 8 Moscow and region; 8 St. Petersburg and region; all regions of the Russian Federation.