EFRSB ( Unified Federal Register of Bankruptcy Information

) is an information Internet portal accessible to everyone and containing data on all bankruptcy procedures taking place in Russia.

The EFRSB publishes information about auction organizers, SROs (self-regulatory organizations), stages of the bankruptcy process and operators of electronic platforms.

Since the end of 2015, information not only on individual entrepreneurs/legal entities has been entered into the register, but also information on the financial insolvency of ordinary citizens, since there is no separate resource for posting such messages, and the law on bankruptcy of individuals

has already entered into force.

What is bankruptcy you can learn from our article here

Find out what changes have affected bankruptcy legislation in 2021 from our article here

Website of the Unified Federal Register of Bankruptcy Information

contains only reliable information regarding the bankruptcy process, if one is being conducted in relation to a company or individual. Link to the official website of the EFRSB https://bankrot.fedresurs.ru/

How to use the EFRSB

The bankruptcy register is available at https://bankrot.fedresurs.ru/ at any time for every visitor.

On the start page of the EFRSB portal online, you can view the latest posted messages containing data such as:

- type of message and date of its publication;

- data (name of company/individual entrepreneur) and address of the debtor;

- information about the person who published the information

In addition, there are tabs above where you can find the following information:

- Messages—you can search for a company that is subject to bankruptcy proceedings by message (for example, by details of a court decision).

- Reports of arbitration managers.

- Regulatory body - information about regulations in the field of bankruptcy.

- Information about auctions (sale of property of a company in bankruptcy process).

- Types of registers containing data on companies undergoing bankruptcy.

- Latest news in the field of bankruptcy.

- Help - if such a need arises, you can contact the site’s technical support.

Also the website of the unified register of bankruptcy

, in addition to the register of debtors, contains a list that includes:

- auction organizers;

- SRO of arbitration managers;

- disqualified persons;

- trading platforms.

The tab called “Help” answers the most popular questions and also contains all the documentation, instructions (video file) and other useful information.

A special card is issued for each participant in the bankruptcy process, which contains all available contact information, full name and necessary details. In addition, all messages about the stages of the process, documentation from the Files of Arbitration Cases and the reports of the arbitration manager are entered here.

What information is presented on the website of the Unified Federal Register of Bankruptcy Information?

Loan secured by PTS CashDrive, Person. No. 18-034-75-009039

from 0.05%

rate per day

up to 1 million

90 – 2,555 days

Take out a loan

On the main page of the site you can find the latest messages and updated information on debtors. Each message includes:

- the date and time of its creation;

- a brief description of the essence (a message about a decision made in court, at a meeting, information about recognition/non-recognition of bankruptcy, etc.);

- full official name of the potential bankrupt;

- legal address of the organization;

- the name of the authorized employee who entered the information.

In addition, the unified register places a bidding plan indicating the date and venue, as well as their type (open/closed auction).

Documents required for registration

Federal Register of Bankruptcy

accepts only documentation certified by an electronic digital signature (electronic digital signature), with which you can easily identify the person who published the message and find out whether any amendments have been made to the document.

Various types of digital signatures are used for various operations:

– reinforced

– simple.

The second signature option is necessary only for maintaining documentation, but when using the first digital signature it has the same legal signature. force, like the original document itself, which was signed with one’s own hand.

To obtain an electronic digital signature, you will need to personally contact any of the certification centers, the addresses and contact details of which you can find in the “Help” tab. The password and login, without which you will not be able to log into your personal account, are sent by email. mail.

But in order to use the EFRSB, you need to send your request for the publication of information, which must contain information such as the user’s last name, first name and patronymic and all available contact information, in addition to this you need to attach a certified copy of the registration certificate .

Reasons for checking a citizen

The law provides citizens with the opportunity to obtain information about the bankruptcy of individuals in respect of whom the procedure has been or is currently underway.

The need to check the financial stability of a counterparty usually arises from the following entities:

- banking institutions;

- microcredit companies;

- citizens before lending a large amount;

- owners of rental property;

- organizations before possible signing of a contract with a new partner;

- people entering into a contract for a large sum.

- company owners before giving the applicant a management position, because according to the law, a bankrupt has no right to occupy management positions for three years after a court ruling.

How to search for bankrupts

On the EFRSB website you can find information:

- on holding meetings;

- about the stages of the bankruptcy process;

- and the necessary documentation, which is prepared by the arbitration manager.

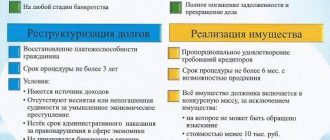

You can find out what stages of bankruptcy apply to different categories of persons from our article here

To find out about the financial situation of a particular citizen, you just need to enter the full name in the search field and indicate in the type “Individuals”. However, it is worth remembering that there is a high probability that different people with the same data may become bankrupt. To solve this problem, an advanced search is provided that allows you to specify your request. You will need to enter other information known to you (for example, date or place of birth, region, telephone number, INN, SNILS, place of residence, etc.), thanks to which the most suitable option will be selected.

The EFRSB also contains a list of bankrupt legal entities. To search for a company, you will need to enter data such as its name, legal/actual address, category (regular organization or, for example, city-forming, etc.), INN, OGRN, OKPO, OKOPF.

What is a unified bankruptcy register?

When starting a bankruptcy procedure, the arbitration manager (body, department or specialist) is obliged to provide information to the EFRSB for its publication.

Information provided to the EFRSB:

- information about the launch of the bankruptcy procedure, about all its stages, about the recognition of the financial insolvency of the enterprise and the closure of the procedure;

- detailed information about the arbitration manager performing external management;

- information about the entity who expressed a desire to repay the debts of the bankrupt company;

- data on the holding of auctions (sale of company property) and their results.

Loan for 1 hour secured by PTS/car Credeo, Person. No. -

from 0.06%

rate per day

up to 5 million

30 – 1,825 days

Take out a loan

Authorized employees of the EFRSB are responsible for entering information into the register, and they are also responsible for the accuracy and completeness of the specified data.

Why is the register of bankruptcy of legal entities maintained, and who may need the information presented in it?

Since a particular legal entity, as a rule, has quite a lot of current and potential counterparties, information about its bankruptcy procedure directly concerns many companies and individuals. First of all, the register is monitored by creditors who need to send a claim to the court as quickly as possible if one of its debtors is declared bankrupt.

The information may also be of interest to those wishing to purchase real estate or equipment at reduced prices. This is possible because the property of a bankrupt organization is sold at auctions, and the price is reduced to speed up the sale process.

And finally, the registry allows you to check a potential partner and make sure of his reliability.

What are the requirements for information?

First of all, the information must be reliable and relevant. Arbitration managers should enter new information into the federal resource as soon as possible so that operators can check and edit it.

The register must contain all information regarding:

- The bankrupt himself: name, TIN, address, etc.;

- His arbitration manager: full name, tax identification number, information on membership in the SRO, etc.;

- Information about the place and time of trading and its results. Depending on the property on display, you will need to indicate its characteristics, the initial cost, how much the price can be raised and what the deposit will be if you win;

- They also indicate the full name of the person who provided the information - this will help quickly find the culprit if an error occurs.

What can you learn from the bankruptcy register?

The register contains the following information:

- Information about the debtor himself: full name, address, telephone number, TIN, etc.;

- Information about the events being carried out: about the appointment of an arbitration manager, about claims received from creditors, about the meeting and the results of the meeting of creditors, about auctions, etc.;

- Information about the auction itself: the time of its holding, the lots offered and the cost, the rules for submitting an application for participation, etc.;

- Details of arbitration managers: what organization they work for, what year they have been operating, what creditors they have “managed”. The latter can be traced from the messages left by the arbitration managers.

What other information is included in the registry?

If someone decides to fully repay the bankrupt’s debts before settling the debts, he will need to contact an insolvency practitioner. If the latter agrees, information about the redemption of debts, indicating the details of the person or company, will be indicated in the register.

Who may need the EFRSB

First of all, this information will be useful to the creditors themselves, as they help track everything that happens to the debtor. Once the debtor is on the registry, creditors will have only 30 days to file claims against him.

If they fail to do this, their claims will be considered only after all principal payments have been made. It often happens that if there is a huge debt, even all the debtor’s property is not enough to pay it off, therefore, creditors who are not included in the priority list risk being left with nothing.

The registry is no less useful for some people participating in the auction. This is due to the fact that when assessing the debtor’s property, the value of things is greatly reduced, which allows bidders to make an acquisition at a favorable price. At the end of the auction, some resell items by raising the price.

It happens that the debtor, even after being entered into the register, continues to conduct business, trying to deceive someone. In this case, checking the organization by its name will help verify fraud or, on the contrary, confirm that.

For example, before contacting a tour operator, it is worth checking whether he is trying to make money in the last days before liquidation.

Why check counterparties?

Bankruptcy (insolvency) is the inability of a debtor to satisfy in full the claims of creditors for monetary obligations and to fulfill the obligation to pay government payments.

In the process of declaring an organization or individual insolvent, debtors are subject to restrictions on the disposal of funds. To pay off debts, a register is formed, broken down by priority. Repayment of debt to creditors is carried out according to the queue. The law establishes deadlines for inclusion in the register of creditors. If it was not possible to get into it or there was not enough money for all the creditors in the register, then if the debtor is declared insolvent, all remaining debts are written off.

When concluding an agreement that involves receiving money or material assets from a counterparty, we recommend checking the legal entity for bankruptcy to ensure its solvency.

If the counterparty is citizens or an individual entrepreneur, it is advisable to check for bankruptcy of individuals, since they, along with organizations, are recognized as insolvent.

If the agreement has already been concluded and the counterparty does not make payment or otherwise does not fulfill the monetary obligation, then before going to court with a demand for debt collection, conduct a bankruptcy check of the organization using the TIN or check the citizen. If insolvency proceedings are initiated, please note that in order to collect a debt, you must submit an application for inclusion in the register of creditors' claims.

ConsultantPlus experts analyzed the features of bankruptcy in 2021. Use these instructions for free.

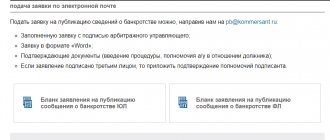

Publication of information about insolvency in the media and on the Arbitration website

In addition to the Unified Federal Register, the law obliges the publication of data on recognition of insolvency in an official source. Today, bankrupts are required to publish a publication about their insolvency in the Kommersant newspaper. A publication is placed in a special column to notify creditors of the procedure. This method of checking an individual is not very convenient, because you have to manually monitor the publication of information about the bankruptcy of individuals on a weekly basis.

It is much more convenient to check whether a bankruptcy case has been opened against a potential counterparty on the official arbitration website kad.arbitr.ru, where information about the bankruptcy of individuals is published.

According to federal law, insolvency practitioners are required to post all stages of the legal process, starting with the filing of an application, in the public domain.

To obtain information about the bankruptcy of individuals, you need to know the last name, first name, patronymic of the alleged bankrupt or his tax payer identification number. They need to be entered into a special window, set the “Bankruptcy” filter and click on the “Find” button. The register of information on bankruptcy of individuals will provide the available data in a couple of minutes. To get more accurate information, because the country is huge and there are plenty of namesakes, it is better to know the region where the person is officially registered, or the data of the Arbitration Court hearing the case.

The convenience of such a system is obvious - the database contains not only information about bankrupt individuals, but also about potentially insolvent counterparties against whom proceedings have been initiated. This allows you to minimize the risk of concluding a deal with an unreliable partner.