A certificate in form 182n is included in the package of mandatory documents that the employer is obliged to issue to the resigning employee. This unified form was approved in 2013 - it replaced the previously valid template 4n, in the sections of which it was impossible to indicate the reasons for the employee’s disability (the updated version of the certificate will contain more detailed information on this part).

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

ATTENTION! The Ministry of Labor, by order of January 9, 2021 No. 1n, made changes to certificate 182n. Points 3 and 4 of the reference and footnote “3” have been corrected. A distinction has been made between making insurance contributions in the period until December 31, 2021 and from January 1, 2021. The changes were made in connection with the transition of social services. payments under the control of the Federal Tax Service.

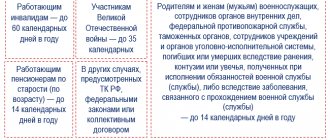

Certificate issuance period

The employer can issue a certificate to the employee either on the last day of his work at the enterprise (without a preliminary application from the subordinate), or, if there is an application, no later than three days from the moment the employee’s written request is registered in the company’s internal documents.

At the same time, exactly when the person left the organization does not matter - the employer is obliged to issue a certificate, even if more than one year has passed since the dismissal.

How can I apply for a certificate of income (payments made) to the Social Insurance Fund?

Today, an application can be submitted in two ways:

- by contacting the regional office of the FSS of the Russian Federation (in person, through an authorized person or by sending an application by mail);

— online through the personal account of the insured citizen.

For applications sent by other means without attaching a properly completed application with a personal signature (via email, feedback form on the website of a regional branch or the Federal Social Insurance Fund of the Russian Federation, etc.), the issuance of these certificates is IMPOSSIBLE!

Why do you need certificate 182n

The certificate provides information about the income that the employee received over the last two years of work (or less if he worked for the company for a shorter period). This data is needed for the further accrual of various social benefits and benefits guaranteed by the state to a person, such as:

- compensation for persons on sick leave;

- pregnant and postpartum women;

- those citizens who care for children until they reach the age of one and a half years.

What to do if they forgot to give you a certificate when you left?

If, for some unknown reason, they forgot to give you a certificate for issuing sick leave upon dismissal, you must contact the Human Resources Department of the organization from which you just resigned as soon as possible. You will have to write an application requesting a sick leave certificate. It usually takes about three days to prepare. Everything will depend on the efficiency of the personnel officer.

If you yourself forgot to pick up a certificate for calculating sick leave from your previous place of work, they may call you and offer to correct your mistake - pick up the finished document yourself, or they will send it at your request by mail to your home address.

In any case, for whatever reason you did not receive this document on time, you will need to pick it up, because without it you will have problems processing sick leave. You can lose quite a lot of money without such a certificate.

Who issues certificate 182n

This document is usually prepared by a specialist from the accounting department of the employing enterprise, i.e. the employee who has access to the resigning employee’s salary information. The form is generated on the basis of accounting data and reporting of the policyholder.

After drawing up the certificate, the director of the organization and the chief accountant must sign it.

Their signatures will indicate that all data entered into the document is current and reliable.

How compensation payments are made based on a certificate

To calculate the above-mentioned types of compensation, the employee’s average earnings for one day are taken, which makes it possible to correctly calculate temporary disability benefits (if there is, of course, a good reason for it, since any absence from the workplace must be confirmed by the necessary documents).

The formula for calculating the average daily salary since 2013 is as follows:

SDZ = OZ: CODE – DIP

where: SDZ – average daily salary, OZ – total salary (for two years); CODE – number of days worked according to the calendar (for two years); DIP – days of maternity leave, child care leave and sick leave.

Small explanations to the formula:

- OZ. This includes all funds that were issued to the employee, provided that contributions to the Pension Fund and the Social Insurance Fund were paid from them. Calculation period: two years before dismissal or maternity leave.

- CODE. This parameter takes into account all days actually worked over a two-year period, but it is also possible to fill in additional lines for other periods of time if they include, for example, maternity leave.

- DIP. According to the law, during the time that an employee spends on sick leave, on maternity leave or caring for young children, he retains his average monthly salary. However, these days are not included in the calculation period, since no deductions were made from these payments to extra-budgetary funds.

The dismissed employee fell ill

Let's say a specialist quit in July 2021. All documents required upon dismissal were issued on time. But the former employee fell ill within 30 days from the date of termination of the employment contract. During this time, he did not manage to get a new job.

The former employee submitted the issued sick leave to the accounting department for payment. Form 182n is not required to be filled out, since sick time after dismissal is not included in the period of work.

Let us remind you that such certificates of incapacity for work are paid in the amount of 60% of the average daily earnings. Moreover, the duration of illness does not matter; all days are subject to payment. It should also be taken into account that payment is made only when the specialist himself is ill. If the sick leave is issued for a child or a close relative, no payments are made.

How to draw up a document

Despite the presence of a standard unified form, the design of form 182n is left to the compiler. Information can be entered into it by hand (with a ballpoint pen of any dark color, but not in pencil) or filled out on a computer, on letterhead (conveniently, the document contains all the necessary details of the employing company) or on an ordinary A4 piece of paper.

It is not necessary to stamp the certificate using a seal, since from 2021 legal entities, as previously and individual entrepreneurs, are exempt from the requirement of the law to certify their documentation using stamps (unless this norm is specified in the internal local acts of the company).

The only condition that must be strictly observed: the presence of “live” autographs of the head of the enterprise (or a person authorized to act on his behalf), as well as the chief accountant (the use of facsimile signatures, i.e. printed in any way, is excluded).

The certificate is usually made in one copy , but if necessary, the employer can issue certified copies of it in the required quantity.

Document structure

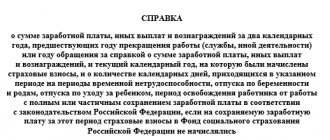

Form 182n consists of several sections.

- The first includes information about the organization that issued the certificate,

- in the second - information about the employee for whom it is intended,

- the third section of the certificate reflects data on wages for the last two years, from which insurance contributions were made to the Pension Fund and the Social Insurance Fund,

- in the fourth - about those periods for which payments to extra-budgetary funds were not made (for example, while on sick leave).

Filling procedure

We fill out form 182n step by step.

Step 1. The issued document must be assigned a serial number and the date of creation.

Step 2. Fill in the organization data in section 1.

Step 3. Fill in the employee’s information in section 2.

Step 4. In section 2 we indicate the terms of work in the organization.

Step 5. In section 3 we provide information on earnings for 2019-2021. Please note that only income that was subject to insurance premiums is indicated.

Step 6. We indicate the name of the period in certificate 182n - periods of incapacity for work are reflected in section 4.

Step 7. And finally, the document is given to the responsible persons for signature; if available, the organization’s seal is affixed.

Sample of a certificate in form 182n

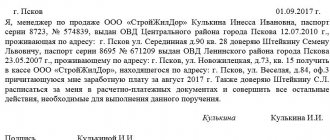

Filling in information about the policyholder

At the very beginning of the document, the date of issue of the certificate is indicated, as well as its number according to the employer’s internal document flow. Next, write the full name of the enterprise (with a deciphered organizational and legal form), as well as the name of the local territorial social insurance fund in which it is served. Then in the form you should indicate the organization’s subordination code (it can be found in the notification sent by the FSS or on the website of this structure), its tax identification number and checkpoint, address and current telephone number for contact.

Filling out information about the insured person

After all the necessary information about the company has been indicated, information about the employee must be entered into the form: his full name, data from the passport (series, number, where and when it was issued), registration address at the place of residence (here in the “subject” column you need indicate the territory, region or republic of the Russian Federation) and the number of the pension insurance certificate (SNILS).

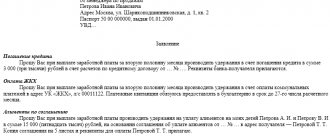

Filling out salary data

In the third part of the form, in order (starting from the year when the employee joined the organization), the periods and amounts (in numbers and in words) of the paid wages are entered. As mentioned above, only the amount of income of an enterprise employee for which accruals were made to the Social Insurance Fund and the Pension Fund of the Russian Federation is taken into account here.

It should be noted that there is a certain limit for each year.

For example, for 2016 , the amount entered here should not exceed 796 thousand rubles. – contributions to the Pension Fund, 718 thousand rubles. – contributions to the Social Insurance Fund. For 2021 : 876 thousand rubles. – contributions to the Pension Fund, 755 thousand rubles. – contributions to the Social Insurance Fund.

If an employee has not worked for a full calendar year, the certificate must include information only for those months that he was employed by the enterprise.

Filling out data on days of temporary disability

The fourth section should also indicate in order the time periods when the employee was disabled (indicating specific dates (in numbers and words) of the beginning and end of each period and their duration). Here you must enter the name of the period (i.e., the officially confirmed reason why he was absent from the workplace). Finally, the document is signed by the director and chief accountant of the company.

Filling rules

Let's see what certificate 182n is and how to fill out the document for 2 years for sick leave. When drawing up reference document 182n, you must provide the following information:

- about the employer (section 1): name, TIN, data of the territorial body of the Social Insurance Fund to which the organization belongs, its registration number, contact details of the company;

- employee (section 2): full name, passport data, information about the period of his work in the organization;

- employee income (section 3);

- periods of incapacity for work during work, periods of absence, if the employee during this time accrued income that was not subject to insurance contributions.

Section 3 provides data on the amount of accruals to the employee for the year of dismissal and for the two previous calendar years. Only the amounts of income from which the company calculated insurance premiums are indicated.

The question often arises: why form 182n contains an amount of earnings that is not equal to the amounts specified in 2-NDFL. This is due to the fact that the government of the Russian Federation annually sets a maximum amount of earnings from which insurance premiums are calculated. If an employee’s income from the beginning of the year exceeds the limit, then insurance contributions to the Social Insurance Fund are not calculated from the excess amount, and they are not taken into account when calculating benefits.

Limit base for calculating insurance premiums:

| Year | Limit base for calculating insurance contributions to the Social Insurance Fund, rub. |

| 2016 | 718 000 |

| 2017 | 755 000 |

| 2018 | 815 000 |

| 2019 | 865 000 |

| 2020 | 912 000 |

| 2021 | 966 000 |

Thus, if an employee’s earnings exceed this amount, then the maximum base is indicated in form 182n. 2-NDFL indicates the full amount of income subject to personal income tax, including payments that are not subject to insurance contributions. This explains the discrepancy.

ConsultantPlus experts sorted out what documents and within what time frame should be given to an employee upon dismissal. Use these instructions for free.