Where to go if wages are not paid

The first action of an employee who is officially employed, if wages are not paid on time, is to send a letter of complaint to the employer.

It must be registered with notification of receipt by the addressee. The director of the enterprise must give you an official response to the complaint. If the company did not respond or the organization refused to pay wages in a response letter, the next step is to contact Rostrud. You need to fill out an application by visiting the labor inspection office or sending an email to the official mail of the government agency. The application must indicate in detail all the facts of violation of the employee’s rights. After this, Rostrud will inspect the enterprise and oblige you to pay wages.

If the employer does not pay wages, you should file a complaint with the prosecutor's office. You need to come to the nearest branch and fill out an application in any form with the employee on duty. It is recommended to contact law enforcement agencies if wages have not been paid for about two months, and complaints to management and the labor inspectorate have not yielded results.

Also, if your salary is delayed, you can go to court. This should be done if complaints to the above government bodies did not help. All previous appeals will serve as evidence that the employer is not fulfilling his duties and violating the rights of the employee. The claim must be filed in the district court at the location of the company's head office.

The actions of an employee who is unofficially employed do not differ from the actions of an employee with official employment. He also needs to first send a written complaint to the employer, and if this does not produce results, file a complaint with Rostrud, the prosecutor's office, or go to court. The only difference is that when applying to government agencies, the employee must prove the fact of employment. Evidence may include:

- correspondence with the employer, which is notarized;

- any documents of the enterprise in which the employee’s name appears;

- statements that indicate the amount of wages, as well as the signature of the director and the seal of the company;

- envelopes containing the employee’s name and salary;

- witness's testimonies.

If wages are not paid on time, and the delay is more than 15 days, the employee may suspend his work. In this case, written notice must be given to the director of the company. Work can also be resumed only upon written notification from the employer of readiness to pay the debt.

Specifics of the claim after dismissal

Wage arrears can be owed either to a working employee or to one who has already been fired. If you file a claim for recovery of wages after dismissal, you should remember one important feature - the statute of limitations.

The specifics of this point are specially emphasized in paragraph 56 of the resolution of the Plenum of the Armed Forces of the Russian Federation “On the application ...” of March 17, 2004 No. 2. Thus, if the employee continues his employment relationship with the company, then the statute of limitations is not applicable at all to disputes regarding the collection of wages, since the employer’s violation is considered lasting until the debt is repaid. This conclusion of the Plenum of the RF Armed Forces, although not entirely compatible with the rules of Part 2 of Art. 392 of the Labor Code of the Russian Federation, but it is quite logical due to the need to ensure the protection of employee rights.

But if an employee is fired, then the statute of limitations, based on established judicial practice, will begin to be calculated from the moment of his dismissal.

For reference: in contrast to the general three-year limitation period for the collection of wages, a shortened period is provided, which is 1 year in accordance with Part 2 of Art. 392 Labor Code of the Russian Federation.

How long can wages be delayed?

In accordance with the Labor Code of the Russian Federation, the employer does not have the right to delay wages. By law, he is obliged to pay wages to employees twice a month with an interval of fifteen days. The payment date is agreed upon at the time of concluding the employment contract. Thus, a delay in payment of wages by 1 day is already considered a violation.

In cases where wages are delayed for up to 15 days, the company is obliged to pay financial compensation for each day of delay. In addition, the company calculates compensation independently; to receive it, you do not need to contact government agencies. And non-payment of wages for more than 15 days, according to the Labor Code of the Russian Federation, is an administrative and even criminal violation.

Compensation

For late payment of wages, the employer pays monetary compensation for each day of delay. In accordance with Article 236 of the Labor Code of the Russian Federation, the amount of the penalty is 1/150 of the key rate of the Central Bank of the Russian Federation, which is calculated on the amount of debt. At some enterprises, the amount of the penalty may be higher; this is indicated in the employment contract.

Compensation for late payment of wages is accrued on both holidays and weekends. It does not matter whether the delay was due to the employer’s fault or not. The presence or absence of funds in the company’s account is also not taken into account.

If the salary was paid in part, compensation is calculated for the remaining amount. The amount of the penalty can be calculated as follows: amount of debt x Central Bank rate x 1/150 x number of days of delay. The debt period is calculated starting from the day following the date of payment of the salary and ending with the day the debt is repaid.

Please note that in accordance with Letter of the Federal Tax Service dated June 4, 2013 N ED-4-3/10209, personal income tax is not withheld from the compensation amount. In addition, based on Letter of the Ministry of Labor No. 17-3/OOG-692 dated April 28, 2021, all insurance premiums are calculated on the amount of compensation.

If wages were not paid on time and compensation was not accrued, you must file a complaint with one of the government bodies listed above.

Worker group lawsuit

In the Code of Civil Procedure of the Russian Federation, in particular in Art. 40, does not contain such a term as “class action”. We are talking only about procedural complicity. At the same time, Part 3 of Art. 40 of the Code of Civil Procedure of the Russian Federation specifically emphasizes that each of the plaintiffs in such a situation acts in relation to the defendant-employer independently.

Accordingly, employees have the right to file a joint claim against the employer. In practice, this means combining several independent claims for payment of wages within the framework of one proceeding. In this case, each of the plaintiffs will need to either represent their interests independently or entrust this to one of the employees (or his representative). This will require a power of attorney. There are no special requirements for filing a joint claim. That is, it will be formalized according to the rules of Art. 131 and 132 of the Code of Civil Procedure of the Russian Federation with the difference that there will be several plaintiffs. Consequently, it will be more convenient to divide the claim into blocks for each employee (to describe the situation, calculate the amount of debt, etc. separately).

Where to complain if you were not paid upon dismissal

If you decide to quit, in accordance with Article 84 of the Labor Code of the Russian Federation, the employer is obliged to make payments on the day of dismissal. At the same time, he must pay wages for the entire period of work. If upon dismissal the employer does not pay the salary, it is necessary to follow the same algorithm as when collecting wage arrears. The first thing you need to do is send a written complaint to the director of the enterprise. If the funds are not reimbursed within ten days, you must complain about the employer to Rostrud or the prosecutor's office. After this, if you are not paid upon dismissal, you need to complain to the court.

It is worth noting that there are controversial situations. For example, in the event of a shortage or in the event of return of workwear in improper condition, the employer has the right to deduct the amount of damage from the salary. The situation also becomes more complicated when the employee works unofficially. In this case, the complaint about non-payment of wages must be supported by documents confirming work at this enterprise.

How to file a petition for suspension of work due to non-payment of wages

If wages are delayed by more than 15 days, employees have the right to suspend the performance of work duties. The employer must be notified of this in writing. Employees have the right to continue the suspension of work until the debt is paid in full.

How to write a claim for wages and suspension of work

Suspension of work is not allowed:

- when a state of emergency is introduced;

- in the bodies of the Armed Forces of the Russian Federation;

- in organizations ensuring the security and defense of the state and population;

- in organizations that ensure the life of the population (energy, water, gas and heat supply, communications, emergency medical care);

- civil servants;

- in particularly hazardous industries.

Lawsuit

If, during the pre-trial proceedings, the employer has not paid the wages or paid the debt partially, it is necessary to file a claim in court to collect the arrears of wages.

In order to force the employer to pay wages, it is necessary to collect evidence confirming the fact of the debt. You must provide the court with:

- employment contract;

- documents on pre-trial proceedings (response to a written complaint addressed to management, results of a complaint to the labor inspectorate or prosecutor's office);

- a statement indicating the amount of debt and the period during which wages were not paid.

If the salary of an employee who does not have official employment is deceived, instead of an employment contract, documents confirming the fact of working in the organization are provided.

In addition to the salary debt and compensation for each day of delay, you can recover funds from the employer for moral damage. The amount of moral compensation is established by the court.

Please note that state fees are not charged for legal proceedings in labor disputes.

In accordance with Article of the Labor Code No. 392, it is necessary to file a claim in court within a year from the first day the debt arose. If you did not have time to submit an application, the court may extend the period for filing a claim for the following reasons:

- inpatient treatment or serious illness (only in cases where the employee was prohibited from getting up);

- long business trip (only when the employee was in a remote area where there is no postal service);

- caring for a seriously ill relative;

- natural disasters.

If the case was decided in favor of the employee, the court order is transferred to the bailiffs. They give 5 days to voluntarily pay off the debt. If the debt is not repaid, the bailiff will forcibly collect the amount specified in the order.

Applications and state fees

To the claim in accordance with the requirements of Art. 132 of the Code of Civil Procedure of the Russian Federation, you must attach a copy of it and copies of the annexes (for the defendant), a calculation of the claims (both the salary itself and interest, if the claim contains a demand for their recovery), as well as copies of other documents that confirm the plaintiff’s arguments. A specific list of documents for the convenience of readers is indicated in the sample statement of claim for delayed wages. Please note that it may differ depending on the actual situation.

Important! As for the state duty, due to the requirements of Art. 393 of the Labor Code of the Russian Federation, the employee is exempt from incurring legal costs; accordingly, they do not need to pay them.

Through the world court

If the amount of debt does not exceed 500,000 rubles, a court order may be issued.

It is issued on the basis of a written request for debt repayment. The features of the procedure for issuing a court order include the following points:

- The order is an executive document.

- The decision is made without the participation of the parties and without a court hearing.

- Published only if there are no additional requirements.

To issue an order, you must apply to the Magistrates' Court. The judge considers the appeal within 5 days. Afterwards, a decision is made to satisfy the requirements or refuse.

From the moment of issuance, the order is transmitted to the employer within 3 days. If the debtor has objections, he must appeal the decision within 10 days of receipt.

If there are no objections, a copy of the order is sent to the applicant or bailiffs. The document is considered received from the moment when a signature confirming delivery is placed on the notice.

Documentation

When going to court, you need to prepare documents.

| No. | Title of the document |

| 1 | Employment contract |

| 2 | Extract from the time sheet |

| 3 | An extract from the internal documents of the organization regulating the procedure for calculating bonuses and incentive additional payments |

| 4 | Calculation sheets |

| 5 | A copy of the notice of suspension of work 2 weeks after the delay in payments (if available) |

| 6 | A copy of the requirements to the employer for debt repayment |

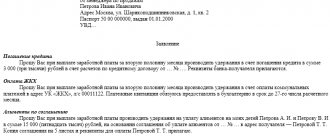

Sample application for issuance of a court order

In order for the court order to be prepared, a corresponding application is drawn up. It is drawn up according to this sample.

The document must reflect the following information:

- name of the judicial authority;

- details of the claimant (last name, first name, patronymic, residential address);

- debtor's data (name of legal entity or full name of entrepreneur, address);

- employment data (date, position);

- description of the situation (lack of payment of wages during the specified period);

- grounds for appeal (Article 236 of the Labor Code of the Russian Federation);

- demands to pay the amount of debt, compensation (with the given calculation);

- list of attached documents;

- date of compilation;

- applicant's signature.

When do you need to pay wages?

Organizations must pay employees twice a month.

The first time - an advance and the second time - the so-called “pay”. Payroll for the past month must be paid no later than the 15th day of the next month (Article 136 of the Labor Code of the Russian Federation). Earlier it is possible, but later it is impossible. Therefore, the exact day of salary payment must be fixed in employee employment contracts and the company’s internal regulations. A delay in wages of at least one day, regardless of its reason, is regarded as a violation of labor legislation (Articles 236, 237 of the Labor Code of the Russian Federation).

Responsibility for working without employment contracts

The responsibility of an organization for working without employment contracts with employees is very impressive. This is liability for violation of labor laws.

If you work without an employment contract with an employee or if you have drawn it up incorrectly, you may be fined. Fines are established in part 4 of article 5.27 of the Code of Administrative Offenses:

- for heads of organizations - up to 20,000 rubles;

- for entrepreneurs - up to 10,000 rubles;

- for legal entities - up to 100,000 rubles.

Repeated offenses when working without employment contracts will cost more.

- The manager may be disqualified for up to 3 years,

- Individual entrepreneurs can be charged up to 40,000 rubles,

- The organization is subject to a fine of up to 200,000 rubles.

If several people work without contracts, then each person will have to pay a fine.

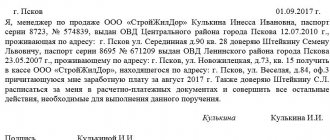

Example of a statement of claim

To the Krasnoarmeysky District Court

of the Chuvash Republic

Plaintiff: Beznosov Vyacheslav Viktorovich, address: 429620, p. Krasnoarmeyskoye,

st. 20 years of October, 59,

tel. 4846516854651

Defendant: IP Yudin Alexander Ivanovich Address: 429620, p. Krasnoarmeyskoye, st. 70 years of Victory, 91,

OGRNIP 46165146516351,

tel. 5684655221

Cost of claim: 56,026 rubles.

Claim for recovery of wages

I, Vyacheslav Viktorovich Beznosov, worked as a commercial director under an employment contract dated November 17, 2018. In accordance with the terms of the contract, the salary was 50,000 rubles. The employer paid wages on the 15th and 30th monthly, for the time actually worked in equal payments. In accordance with the application for the transfer of wages to the card, I received it into my bank account No. 456513564.

On November 15, 2021, I resigned voluntarily. And in accordance with clause 3, part 1, art. 77 and art. 80 of the Labor Code of the Russian Federation. Upon expiration of the notice period for dismissal, the employee has the right to stop working. On the last day of work, the employer is obliged to issue the employee a work book and make final payments to him.

Despite legal requirements, on November 15, 2021, the final payment was not made to me. The amount of wages to be paid, taking into account Art. 236 of the Labor Code of the Russian Federation on establishing the employer’s liability is, as of February 11, 2022:

88 calendar days (from November 16, 2021 to February 11, 2022) x 0.14 (refinancing rate)/150 x 25,000 + 25,000 = 27,053.33 rubles.

The defendant's failure to fulfill his duties resulted in psycho-emotional stress for me. I had certain hopes for receiving payment for my work and connected my personal plans with this. I estimate moral damage at 5,000 rubles.

Based on the above, guided by Art. 21, 22, 80, 84-1, 135,136, 139, 165, 237, 395 of the Labor Code of the Russian Federation,

Ask:

- To recover from individual entrepreneur Alexander Ivanovich Yudin unpaid wages in the amount of 25,000 rubles, compensation for violation of the deadline for payment of wages in the amount of 2,053 rubles, compensation for moral damage in the amount of 5,000 rubles.

Applications:

- Calculation of the amount to be collected;

- Employment history;

- Employment contract;

- A copy of the employment order;

- A copy of the dismissal order;

- Certificate of cash flow for the period from November 1, 2021 to February 11, 2022.

- Notice of sending documents and claims to the defendant

Beznosov V.V. February 11, 2022

conclusions

A citizen faced with the problem of non-payment of wages can apply to the court for help. To do this, he needs to prepare a suitably filed statement of claim and collect documents that are evidence of a violation of his rights.

You can go to court collectively. You can take advantage of this opportunity if the company where the employees are employed has a collective agreement.

The legislation defines the time limits for going to court and the period for the judge to make a decision. An employee can defend his rights within a year from the date of delay in payment of wages. The court makes its decision within 5 days.

Accounting and taxation of compensation

Guaranteed compensation for delays in official payments to an employee, like all other types of compensation, are not subject to personal income tax. For the employer, the calculation of compensation involves additional tax and mandatory payments:

- the accrued compensation does not reduce the tax base for income tax;

- From the compensation amounts, contributions must be paid to extra-budgetary funds - Social Insurance Fund, Pension Fund, Compulsory Medical Insurance Fund.

For employers using the “simplified” tax system according to the “income minus expenses” scheme, the annual income tax cannot be adjusted downwards for compensation expenses.

Employee rights

Employees whose wages are delayed for more than 15 days can (there are certain restrictions under Part 2 of Article 142 of the Labor Code for specific categories of workers or during an emergency):

- suspend your work until the debt is repaid, having previously notified the company administration in writing;

- do not go to work place before salary enrollment.

For employees by virtue of Part 4 of Art. 142 of the Labor Code of the Russian Federation, during downtime, the average earnings are maintained regardless of whether a person is present in the office or not. Average earnings are calculated according to the rules of the Labor Code of the Russian Federation using a special formula. If an employee receives a notification from his boss about his readiness to repay the salary debt, he is obliged to return to work after receiving the corresponding notification or to the next job. day.

Terms of consideration

It was previously noted that an employee can go to court to file a claim for delayed payment of wages within a year, starting from the first day the violation was discovered. What is the deadline for making a decision by the judicial authority?

After receiving the statement of claim and accompanying documentation attached to it, the court considers the information received within 5 days. After this period, a court decision is made.

An order setting out the essence of the court decision is sent to the employer within three days. The defendant is given 10 days to appeal the decision, if it seems necessary to him.

Results

The procedural issues of filing claims to recover wages are spelled out in the legislation in sufficient detail and clearly.

In practice, employees often have difficulties proving the amount of debt, since the employer can pay some payments at its own discretion (for example, the amount of the bonus can be greater than the salary and paid depending on the results of work, the assessment of which, often subjectively, is given by the employer himself, etc. .d.). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.