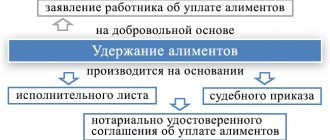

The Labor Code provides several grounds on which an employing organization can make deductions from the wages of its employees.

One of such grounds is the executive documents received by the company.

In addition to alimony, according to writs of execution, for example, deductions can be made on the following grounds:

- compensation for damage caused to individuals,

- compensation for moral damage,

- the amount of principal and interest on the loan,

- compensation for material damage caused to legal entities.

Deductions from wages according to executive documents are mandatory and do not depend in any way on the will of the employer and employee.

According to Article 98 of the Federal Law of October 2, 2007. No. 229-FZ “On Enforcement Proceedings”, persons paying the debtor:

- wages,

- other periodic payments,

from the date of receipt of the writ of execution, they are obliged to withhold funds from the wages and other income of the debtor in accordance with the requirements contained in the writ of execution.

The company is obliged to pay (transfer) the withheld funds to the claimant within three days from the date of payment of the above-mentioned income to the employee.

In this case, the transfer and transfer of funds are made at the expense of the debtor .

The Labor Code limits the amount of deductions from wages to the provisions of Article 138:

- The total amount of all deductions for each payment of wages cannot exceed 20%, and in cases provided for by federal laws - 50% of wages due to the employee.

In accordance with paragraph 2 of Article 99 of Law No. 229-FZ, when executing an executive document (several executive documents), the following may be withheld from a debtor-citizen:

- No more than 50% of wages and other income.

Withholdings are made until the requirements contained in the executive document are fulfilled in full.

The above restrictions do not apply to salary deductions:

- when collecting alimony for minor children,

- when compensating for damage caused to the health of another person,

- when compensating for damage to persons who suffered damage due to the death of the breadwinner,

- when compensating for damage caused by a crime.

The amount of deductions from wages in these cases cannot exceed 70%.

In the article we will talk about the features of the current legislation regarding deductions from an employee’s salary according to executive documents.

Maximum withholding amount

In general, under a writ of execution (several documents), no more than 50% of wages and other income can be withheld from the debtor.

This restriction does not apply when collecting alimony for minor children, compensation for harm caused to health, compensation for harm in connection with the death of a breadwinner, and compensation for damage caused by a crime. In these cases, the amount of deduction from wages and other income of the debtor-citizen cannot exceed 70%. These standards are prescribed in paragraphs 2 and 3 of Article of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”. Thus, in any case, more than 70% cannot be withheld from an employee’s salary. Moreover, deduction in the specified amount is possible solely to satisfy the above requirements (alimony for minor children, harm to health, etc.). If the collection is made to satisfy other requirements, then no more than half of the earnings are collected.

Calculate your salary with alimony deduction in the Calculate web service

It might seem like a simple rule, but in practice it causes problems. Especially when the organization has received several writs of execution, each of which requires deductions to be made in a certain amount. Let's look at specific examples.

Accountant's responsibility for someone else's executive document

If an accountant makes mistakes when processing a writ of execution, he risks receiving a fine from the bailiffs. There was information on the FSSP website that the accountant was issued a fine of 30 thousand rubles

. for not complying with the bailiffs' request to withhold alimony.

To eliminate the risk of non-processing of the writ of execution, it is advisable to timely enter it into the 1C:ZUP program, which will independently calculate the amount of withholding according to the specified conditions. In this way, the accountant will protect himself and the company from possible administrative liability and comply with all the requirements of the legislation of the Russian Federation.

Still have questions? Order a free consultation with our specialists!

Loan deductions: no more than half

We have an employee who, based on a writ of execution, has 1/3 of his salary withheld to pay child support. And now another writ of execution has been received for 50% deductions from income to repay the loan taken from the bank. How much can you keep from an employee in this case?

As already mentioned, when collecting alimony for minor children, up to 70% of earnings can be withheld. But when collecting in favor of the bank - no more than half of the earnings. How to combine these two rules in the case under consideration? Let us turn to the provisions of paragraph 1 of Article 111 of Law No. 229-FZ. It says: if the amount collected from the debtor is not enough to satisfy in full all the requirements for all enforcement documents, a priority is established.

In particular, claims for alimony are paid off first; compensation for harm caused to health; compensation for damage in connection with the death of the breadwinner; compensation for damage caused by the crime, as well as claims for compensation for moral damage. Whereas the banks' demands for debt collection under contracts are satisfied only in the fourth place. Further, in paragraph 2 of Article 111 of Law No. 229-FZ, it is said that each amount collected from the debtor is first used to pay off the first priority claim, and the claims of each subsequent priority are satisfied after the requirements of the previous priority are satisfied in full.

It turns out that in the situation under consideration, the employer first needs to fully “pay off” the alimony claims, since they fall under the first priority. To do this, it is enough to collect only a third of your earnings. This means that this requirement will be fulfilled in full, even if 50% of earnings are withheld. Consequently, there are no grounds for recovery beyond 50% of earnings (up to 70%) in this case.

The remaining part of the withheld half of the earnings after the transfer of alimony must be transferred according to the second writ of execution in favor of the bank. And in this way we act until the corresponding requirement of the bank is fully satisfied (clause 2 of Article 99 of Law No. 229-FZ). Provided, of course, that the collection of alimony does not stop during this period.

Let's give an example. Let's assume that an employee's salary is 10,000 rubles. per month. He has two minor children, for whose maintenance alimony is collected (1/3 of his salary). The employee submitted an application and documents to the accounting department for a standard tax deduction (the amount of his income since the beginning of the year did not exceed 350,000 rubles). Additionally, there is a writ of execution for the recovery of 50% of income to repay the loan debt. Let's calculate the amount of deduction.

According to paragraph 1 of Article 99 of Law No. 229-FZ, the amount of withholding is calculated from the amount remaining after taxation. This means that in this case the amount of deduction will be determined based on 9,064 rubles. (10,000 - (10,000 - 1,400×2) × 13%). Accordingly, the total amount of deduction under writs of execution will be 4,532 rubles. (9,064 ∕ 2). Of these, 3,021.33 rubles will be transferred to fulfill the requirement to pay alimony. (9,064 × 1/3), and the remaining part (RUB 1,510.67) will be transferred to the bank to repay the loan debt.

Calculate wages with deduction of alimony and standard deductions for personal income tax

When are wages garnished?

The bailiff sends the employer a writ of execution to collect debts from the employee if at least one of the following conditions is met (Article 98 229-FZ):

- periodic payments are collected;

- the debt does not exceed 10,000 rubles;

- insufficiency of the debtor's property to repay the debt being collected.

The FSSP can obtain information about the debtor’s place of work from the debtor himself, as well as by sending requests to the Federal Tax Service and the Pension Fund. Each employer provides these regulatory authorities with information about the place of work and accrued income of each employee.

Alimony for children and spouses

The employee received three retention orders. The first is for the maintenance of a spouse in the amount of 0.6 of the subsistence minimum for the working-age population in our region monthly (currently this is 11,907 × 0.6 = 7,144.20 rubles). The second is to support my son in the amount of 1/4 of my monthly income. And third - to support my daughter in the amount of 1/6 of my monthly income. What will be the maximum amount of deductions in this situation? How to distribute the recovered money among three dependents?

As already mentioned, when collecting alimony for minor children, the amount of withholding can reach 70% of wages. As follows from Article 90 of the Family Code of the Russian Federation, amounts paid for the maintenance of a former spouse are also recognized as alimony. But since they are not child support, no more than half of the earnings can be withheld to satisfy these requirements.

At the same time, while establishing the order of repayment of claims under several writs of execution, the legislator did not separate child support from other alimony. This means that penalties for all three writs of execution will relate to one priority - the first (Clause 1, Article 111 of Law No. 229-FZ). Therefore, in this case, it is necessary to apply the rule of paragraph 3 of Article 111 of Law No. 229-FZ. It states: if the amount of money collected from the debtor is insufficient to satisfy the demands of one line in full, then they are repaid in proportion to the amount due to each collector specified in the writ of execution.

This means that the algorithm of actions in this case will be as follows. First, the amount of alimony for the maintenance of the spouse and both children must be withheld within 50% of the employee’s earnings. The resulting amount is distributed among all claimants in proportion to the amount due to each of them. After this, you need to make additional withholding of child support, but so that the collection does not exceed 70% of earnings. The additional amount withheld is distributed only among the children in proportion to the amount due to each of them.

Let's look at an example. Let's assume that an employee's salary is RUB 10,000 and he is entitled to a standard deduction for both children. Then the amount of wages from which deductions are possible will be 9,064 rubles. (10,000 - (10,000 - 1,400 × 2) × 13%). Now, based on this amount, we will determine the payments due to the children: the son should receive 2,266 rubles. (9,064 × 1/4), and the daughter - 1,510.67 rubles. (9,064 × 1/6).

Now we keep half of the earnings (4,532 rubles) and distribute this amount among all three claimants. The spouse's share will be (4,532 ∕ (7,144.2 + 2,266 + 1,510.67)) × 7,144.2 = 2,964.74 rubles. The son's share will be (4,532 / (7,144.2 + 2,266 + 1,510.67)) × 2,266 = 940.36 rubles. The daughter's share will be (4,532 ∕ (7,144.2 + 2,266 + 1,510.67)) × 1,510.67 = 626.90 rubles.

As we can see, the children received less than their due. So, let's move on to additional deductions. To do this, we first determine the amount that can be withheld for child support (within 70% of earnings). It is equal to 1,812.8 rubles. (9,064 × 70% - 4,532). We keep it and distribute it between the two children in proportion to their shares. The son’s share is (1,812.8 ∕ (2,266 + 1,510.67)) × 2,266 = 1,087.68 rubles, and the daughter’s share is (1,812.8 ∕ (2,266 + 1,510.67)) × 1,510.67 = 725.12 rub.

In total, the spouse will receive 2,964.74 rubles, the son - 2,028.04 rubles. and daughter - 1,352.02 rubles.

Calculate your salary according to current rules, taking into account all current local and regional coefficients and allowances

Why does the bailiff block a salary card?

The recovery applies to all bank accounts of an individual, including those opened for salary cards. The answer to the question: how much bailiffs can withdraw from wages is very simple in this case. The write-off will be made in the full amount of the debt. If there is not enough money in the account, the salary card will be blocked. It will not be possible to make expenditure transactions from it until the amount specified in the writ of execution is repaid in full.

What to do in this case? How to remove the block? How long will it take for the bailiff to give you your salary? People who find themselves in a similar situation need to understand that they can avoid such troubles by fully repaying debts under court decisions.

Retention periods

No less difficulties arise when determining the period during which deductions need to be made. Moreover, questions arise regarding the establishment of both the start and end dates of collection. The situation is even more complicated with debt for past periods.

Are retroactive deductions possible?

In mid-May (05/17/2021), the accounting department received a court order dated 01/30/2021. It states that, starting from January 20, it is necessary to collect monthly child support from the employee in the amount of 1/4 of earnings. How long does it take to calculate child support?

The answer to this question is contained in paragraph 3 of Article of Law No. 229-FZ. It says that persons paying wages or other periodic payments to the debtor, from the date of receipt of the writ of execution, are obliged to withhold funds from the debtor’s income in accordance with the requirements contained in this document. Let us recall here that a court order is also an executive document (subparagraph 2, paragraph 1, article 1 of Law No. 229-FZ).

Thus, deductions must begin from the moment the accounting department received the court order (in this case, with the payment of the “advance” for May, since the document was received on May 17).

Calculate the advance and salary taking into account all current indicators Calculate

It remains to determine what amount needs to be collected upon the first payment: 1/4 of the current income, or the amount calculated taking into account the debt. By virtue of paragraph 3 of Article 102 of Law No. 229-FZ, the amount of debt for alimony paid for minor children in shares of earnings is determined based on the earnings and other income of the debtor for the period during which alimony was not collected. If collection is carried out by decision of the bailiff, then the debt is determined by the bailiff and is indicated in the resolution (clause 2 of Article 102 of Law No. 229-FZ).

In this case, the organization carries out collection directly on the basis of the writ of execution. This means that she needs to fulfill the requirement of paragraph 3 of Article 102 of Law No. 229-FZ on her own. That is, she must determine the amount of debt for the period from January 20, 2021 to the date of receipt of the order, during which the alimony established by this document was not withheld.

This debt is calculated based on the employee’s earnings for the specified period. And it must be withheld from current payments simultaneously with alimony for the next month (subject to the limit of 70% of the paid amount established by paragraph 3 of Article 99 of Law No. 229-FZ), until full repayment. That is, at the first payment after receiving a court order, up to 70% of the employee’s earnings may be withheld, if this is necessary to pay off arrears of alimony that have accumulated since January.

Let's look at another example.

On September 27, 2021, the accounting department received a decree from the bailiff to foreclose on the debtor’s salary. The resolution is dated 08/23/2021, and the text states that deductions must be made monthly in the amount of 1/6 of income from 07/12/2021. What should an accountant do in this situation?

This situation is a variation of the previous one. The main difference is that collection is carried out on the basis of a bailiff's decision. This means that the organization is obliged to withhold 1/6 of the debtor’s wages and other income paid starting from the date of receipt of this resolution, that is, from 09.27.2021. And the amount and procedure for collecting debt for the period from 07.12.2021 to 09.26. 2021 inclusive is required to determine the bailiff. This follows from the norm of paragraph 2 of Article 102 of Law No. 229-FZ.

As a result, the organization must receive another order from the bailiff. This document will specify the amount and procedure for withholding the debt. This resolution must be implemented starting from the day it is received.

Draw up regulations on remuneration and internal labor regulations using ready-made templates

The procedure for executing a court decision to write off debt

A court decision to collect a debt from an individual that is not executed voluntarily is transferred to bailiffs for forced collection. Execution of a court decision is carried out in accordance with the requirements of Federal Law dated October 2, 2007 N 229-FZ.

First of all, debt repayment will be carried out using funds in the accounts and deposits of individuals. If there is insufficient money in the accounts, repayment of the debt is carried out at the expense of other property of the debtor, which belongs to him by right of ownership.