Payment of wages in envelopes or their delay has long been firmly established in our lives. However, the dangers of this phenomenon are obvious: you may receive payment for your work partially or not at all. What to do and where to file a complaint against an employer to restore justice? Below we will talk about the fastest and most effective way to restore your rights.

Where to go if wages are not paid

The first action of an employee who is officially employed, if wages are not paid on time, is to send a letter of complaint to the employer.

It must be registered with notification of receipt by the addressee. The director of the enterprise must give you an official response to the complaint. If the company did not respond or the organization refused to pay wages in a response letter, the next step is to contact Rostrud. You need to fill out an application by visiting the labor inspection office or sending an email to the official mail of the government agency. The application must indicate in detail all the facts of violation of the employee’s rights. After this, Rostrud will inspect the enterprise and oblige you to pay wages.

If the employer does not pay wages, you should file a complaint with the prosecutor's office. You need to come to the nearest branch and fill out an application in any form with the employee on duty. It is recommended to contact law enforcement agencies if wages have not been paid for about two months, and complaints to management and the labor inspectorate have not yielded results.

Also, if your salary is delayed, you can go to court. This should be done if complaints to the above government bodies did not help. All previous appeals will serve as evidence that the employer is not fulfilling his duties and violating the rights of the employee. The claim must be filed in the district court at the location of the company's head office.

The actions of an employee who is unofficially employed do not differ from the actions of an employee with official employment. He also needs to first send a written complaint to the employer, and if this does not produce results, file a complaint with Rostrud, the prosecutor's office, or go to court. The only difference is that when applying to government agencies, the employee must prove the fact of employment. Evidence may include:

- correspondence with the employer, which is notarized;

- any documents of the enterprise in which the employee’s name appears;

- statements that indicate the amount of wages, as well as the signature of the director and the seal of the company;

- envelopes containing the employee’s name and salary;

- witness's testimonies.

If wages are not paid on time, and the delay is more than 15 days, the employee may suspend his work. In this case, written notice must be given to the director of the company. Work can also be resumed only upon written notification from the employer of readiness to pay the debt.

Contacting the prosecutor's office

The Prosecutor's Office, as well as the Labor Inspectorate, monitors compliance with the employee's labor rights by the employer.

You can file a complaint against an employer with the prosecutor's office either individually (on behalf of one employee) or collectively (on behalf of a group of employees).

Sample of an individual complaint against an employer to the prosecutor's office.doc Sample of a collective complaint against an employer to the prosecutor's office.doc

After filing a complaint with materials confirming labor violations, law enforcement officials study them within thirty days and then make a decision.

As a result, the employer can expect the following penalties:

- Bringing to administrative responsibility;

- Involvement in disciplinary action;

If a labor dispute has to be resolved in court, an employee of the prosecutor's office may (at his own discretion) become involved in representing the interests of the employee.

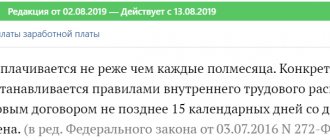

How long can wages be delayed?

In accordance with the Labor Code of the Russian Federation, the employer does not have the right to delay wages. By law, he is obliged to pay wages to employees twice a month with an interval of fifteen days. The payment date is agreed upon at the time of concluding the employment contract. Thus, a delay in payment of wages by 1 day is already considered a violation.

In cases where wages are delayed for up to 15 days, the company is obliged to pay financial compensation for each day of delay. In addition, the company calculates compensation independently; to receive it, you do not need to contact government agencies. And non-payment of wages for more than 15 days, according to the Labor Code of the Russian Federation, is an administrative and even criminal violation.

Compensation

For late payment of wages, the employer pays monetary compensation for each day of delay. In accordance with Article 236 of the Labor Code of the Russian Federation, the amount of the penalty is 1/150 of the key rate of the Central Bank of the Russian Federation, which is calculated on the amount of debt. At some enterprises, the amount of the penalty may be higher; this is indicated in the employment contract.

Compensation for late payment of wages is accrued on both holidays and weekends. It does not matter whether the delay was due to the employer’s fault or not. The presence or absence of funds in the company’s account is also not taken into account.

If the salary was paid in part, compensation is calculated for the remaining amount. The amount of the penalty can be calculated as follows: amount of debt x Central Bank rate x 1/150 x number of days of delay. The debt period is calculated starting from the day following the date of payment of the salary and ending with the day the debt is repaid.

Please note that in accordance with Letter of the Federal Tax Service dated June 4, 2013 N ED-4-3/10209, personal income tax is not withheld from the compensation amount. In addition, based on Letter of the Ministry of Labor No. 17-3/OOG-692 dated April 28, 2021, all insurance premiums are calculated on the amount of compensation.

If wages were not paid on time and compensation was not accrued, you must file a complaint with one of the government bodies listed above.

Fraudsters disguised as employers

Many people are interested in the question of what actions should be taken if an employer has deceived them. Situations of this kind affect two legislative spheres: civil and criminal.

It is for this reason that before answering the question, it is necessary to establish whether the employer is really the culprit of the problem, and what the deception is.

Attention! Thanks to the systematization of the practice of courts and law enforcement agencies, employer fraud was divided into separate groups:

- direct fraud – if individual attackers “play the role” of employers. Such persons can be recognized by certain signs: they can collect funds for the journey to the promised place of employment, under the pretext of completing documentation, etc. The reality becomes an unpleasant event for gullible people who simply want to find a job with a decent income - no one will take no action. Such collections of money by scammers are carried out with a single goal - to collect a sufficient amount and escape with it. And you can forget about employment;

- After hiring a citizen, they begin to deduct certain amounts from him every month in order to pay off the “employment costs” of such an employee. Such costs are justified by the above reasons and more. Often management seriously exaggerates such costs, if they do not simply invent them, demanding money from their own employees;

- Employers often resort to fraud in the process of dismissing employees. Thus, a number of organizations are trying to reduce financial losses by terminating their employment relationships. They resort to various tricks: they do not pay the full amount of the salary due to the employee, they refuse to compensate him for the vacation remaining at the time of dismissal. There were also cases when some employee’s offense “suddenly” surfaced, for which he was given a fine, and all this, oddly enough, on the eve of dismissal. A similar circumstance was used to reduce the amount that was paid to the employee at the time of his payment from work.

Each of the above cases is a direct violation of the law, so injured employees must take measures to protect their rights and not remain silent about what is happening.

Where to complain if you were not paid upon dismissal

If you decide to quit, in accordance with Article 84 of the Labor Code of the Russian Federation, the employer is obliged to make payments on the day of dismissal. At the same time, he must pay wages for the entire period of work. If upon dismissal the employer does not pay the salary, it is necessary to follow the same algorithm as when collecting wage arrears. The first thing you need to do is send a written complaint to the director of the enterprise. If the funds are not reimbursed within ten days, you must complain about the employer to Rostrud or the prosecutor's office. After this, if you are not paid upon dismissal, you need to complain to the court.

It is worth noting that there are controversial situations. For example, in the event of a shortage or in the event of return of workwear in improper condition, the employer has the right to deduct the amount of damage from the salary. The situation also becomes more complicated when the employee works unofficially. In this case, the complaint about non-payment of wages must be supported by documents confirming work at this enterprise.

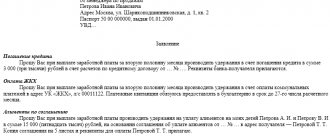

Applying for a loan for an employee

Small firms practice another fraudulent scheme - they ask their employees to apply for a loan from a bank. The explanations are usual - the need to expand trade turnover.

Such loans are not issued to a company, but you can get out of the situation and still win. They promise that after selling the goods, the loan will be easily repaid, plus there will be a substantial profit in your pocket.

Most employers simply take advantage of the gullibility of their subordinates. As a result, the person is given a loan that no one is going to pay for. Building an evidence base in this case is almost impossible.

The transfer of funds to the employer is usually not recorded anywhere and occurs without witnesses. A receipt in such circumstances will also not help, since it only confirms the existence of a civil law relationship between the parties, but not a scam.

Dismissal of a working pensioner at the initiative of the employer.

What scammers can do if they know their SNILS number and passport details, read here.

How to confirm your work experience without a work book, read the link:

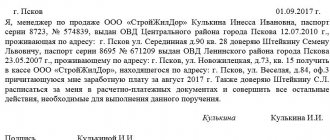

Lawsuit

If, during the pre-trial proceedings, the employer has not paid the wages or paid the debt partially, it is necessary to file a claim in court to collect the arrears of wages.

In order to force the employer to pay wages, it is necessary to collect evidence confirming the fact of the debt. You must provide the court with:

- employment contract;

- documents on pre-trial proceedings (response to a written complaint addressed to management, results of a complaint to the labor inspectorate or prosecutor's office);

- a statement indicating the amount of debt and the period during which wages were not paid.

If the salary of an employee who does not have official employment is deceived, instead of an employment contract, documents confirming the fact of working in the organization are provided.

In addition to the salary debt and compensation for each day of delay, you can recover funds from the employer for moral damage. The amount of moral compensation is established by the court.

Please note that state fees are not charged for legal proceedings in labor disputes.

In accordance with Article of the Labor Code No. 392, it is necessary to file a claim in court within a year from the first day the debt arose. If you did not have time to submit an application, the court may extend the period for filing a claim for the following reasons:

- inpatient treatment or serious illness (only in cases where the employee was prohibited from getting up);

- long business trip (only when the employee was in a remote area where there is no postal service);

- caring for a seriously ill relative;

- natural disasters.

If the case was decided in favor of the employee, the court order is transferred to the bailiffs. They give 5 days to voluntarily pay off the debt. If the debt is not repaid, the bailiff will forcibly collect the amount specified in the order.

Obtaining a court order is one of the ways to collect wages

If an employee individually fails to resolve issues of wage arrears, you can use another relatively quick way to collect funds - apply to a judge for a court order (paragraph 7 of Article 122 of the Code of Civil Procedure of the Russian Federation).

A court order is a document issued by a judge without holding a court hearing and summoning the employee (claimant) and employer (debtor) to court for trial. The issuance of a court order by a judge to collect wages also allows the employee to solve his problems faster (the order is issued within 5 days after receiving the application) than during the usual judicial procedure for recovering earnings from the employer.

To obtain a court order, the employee must submit an application and supporting documents to the judge. See below for the required details of such an application:

The following documents must be attached to the application:

The judge issues a court order after carefully examining the application and attached documents.

This method of collecting wages has one nuance - it can be used only on the condition that (clause 1 of Article 121 of the Code of Civil Procedure of the Russian Federation):

- the amount of the collected salary does not exceed 500,000 rubles;

- the salary was accrued but not paid, and the employee does not dispute its amount.

If the employee does not agree with the amount of the accrued salary and the salary debt has exceeded the half-million dollar limit, in order to collect it, he will have to go to court with a statement of claim, following the standard judicial procedure.

How should an employee behave with an employer?

The line of behavior should be calm, restrained, and friendly. You must constantly monitor your actions, starting from the moment you join the staff.

- You should not agree to work without drawing up a contract, or to accept payment according to gray schemes. In this case, you immediately find yourself in the risk zone.

- If you are still involved in the schemes, then check with the accounting department whether the company transfers contributions and taxes in the proper amount. If not, then pay the personal income tax yourself, this will protect you from tax claims when violations are revealed.

- When entering into conflict with an employer, rely only on yourself. Remember that none of those employees who expressed sympathy and encouragement for you will stand next to you against management.

- Supervisory authorities are obliged to respond to your complaint, but they need solid evidence. When getting involved in a war with your superiors, take care of collecting documents, videos and photos confirming that you are right.

- If you are a non-conflict and impressionable person, then it is cheaper for you to silently look for another job. But if you are active, passionate and convinced that you are right, then fight! Just make sure that the pursuit of justice does not push you beyond the laws of the Russian Federation.

What does a complaint give, and is it worth complaining?

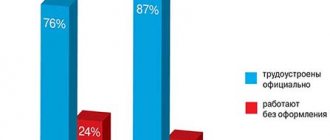

Statistics show that every 5th employee in Russia faces arbitrariness on the part of the employer. The most popular violations are dismissals, layoffs, and delayed wages. It is widely practiced to work without a contract, or the contract specifies minimum rates, and additional payments are made unofficially, in envelopes.

Most complaints were recorded in large cities. Firstly, there are more jobs there, so people have less fear of losing their source of income. Residents of megacities are more informed about their rights, and it is easier for them to decide to take active action.

In small towns and in the provinces there is less work, where people are afraid of losing their job and suffer harassment. And there is little hope for justice here, “everything is captured.”

If there is a trade union functioning at the enterprise, then the best thing to do is to contact them. Trade unions have a wide range of methods of influencing management, the only problem is that there are too few trade union organizations today.

Most complaints still concern wages. But it is difficult to win money litigation against a legally competent employer. Official documents contain only “correct” data, there are no witnesses. And judges do not particularly trust those who were fired earlier, since an insulted person can slander the offender.

It is also difficult to prove the illegality of dismissal, especially when the employee was forced to write a statement of his own free will. It is a little easier to spot violations during staff reductions.

It must be said frankly that employers do not unfairly fire and oppress everyone. Those who fall under the administrative skating rink are primarily violators of routine, those who like to gossip on the sidelines, and not very loyal employees. Sometimes it is a person’s own fault for incurring the wrath of management.