When to Provide Explanations

When conducting an inspection, the inspector has the right to request written explanations. Situations in which taxpayers are required to explain the result of control are spelled out in paragraph 3 of Art. 88 Tax Code of the Russian Federation:

- Errors in submitted reports. For example, inaccuracies or inconsistencies are identified in the declaration. In this case, tax authorities require you to provide justification for these discrepancies or send a corrective report.

- In the adjusting statements, the amounts payable to the budget are significantly lower than in the initial calculations. In such a situation, the inspector will suspect a deliberate understatement of the tax base and payments and will demand an explanation for the changes.

- The submitted income tax return reflects losses. In any case, you will have to justify unprofitable activities to the Federal Tax Service, so prepare a letter with explanations in advance.

The inspection request must be responded to within 5 working days from the date of official delivery of the request - such norms are enshrined in clause 3 of Art. 88, paragraph 6 of Art. 6.1 Tax Code of the Russian Federation. In special cases, the Federal Tax Service will have to notify the receipt of a tax request (letter of the Federal Tax Service of the Russian Federation dated January 27, 2015 No. ED-4-15/1071).

IMPORTANT!

Some requests from the Federal Tax Service do not have a stamp. You will still have to respond to such demands - such instructions are given in the letter of the Federal Tax Service of the Russian Federation dated July 15, 2015 No. ED-3-2 / [email protected]

Writing stages

The process of drawing up explanatory notes is divided into several stages:

- Formation of a plan. Based on it, the optimal text is invented. All items must be placed in strict sequence. Initially, the title page is filled out, after which an annotation is made. After that, the table of contents and introduction are included, and only then comes the main text, divided into separate chapters. All sheets must be numbered, and at the end a conclusion is made and a list of references is left. Applications are attached if necessary.

- Creating a draft. Before creating the actual text, it is advisable to make a draft. It is based on the goals and objectives set when writing the thesis project. The books used by the student must be evaluated and analyzed. The central element of the note is the task of research activity that must be achieved by the graduate. All conclusions contained in the document are supported by diagrams, tables and correct calculations.

- Writing the main text. The lead states the reason for choosing a specific goal and also lists the assigned tasks. The conclusion provides information about achieving the goals of creating the project. Typically, bachelors write a note of 30 pages, and for masters the volume increases to 80 pages. This includes not only the text, but also appendices, title pages, drawings and additional materials.

The perception of the entire work by the certification commission depends on the correctness of the preparation of this document.

How to compose

The general procedure for writing a letter to the tax office for clarification is as follows:

- We compose a response on the organization’s letterhead. If there is no such form, in the header of the document we indicate the full name of the institution, INN, KPP, OGRN and address.

- We indicate the number and date of the requirement for which the explanation is being drawn up. It is permissible to write a response to several tax requests at once.

- If there are errors or inconsistencies in the report, double-check the report to eliminate typos or typos.

- In the descriptive part of the response letter, we reveal in detail and consistently the circumstances of the situation that needs to be explained.

- When answering a request, rely on the facts and document the circumstances. Attach copies of documents to the answer, if any. For example, a copy of the additional agreement to the contract with the condition for increasing prices.

If the inspector requires an explanatory note regarding inconsistencies in the value added tax return, the response will have to be sent electronically. Exceptions to the rules are reserved for organizations that report VAT on paper. If the institution reported electronically, but provided a response to the request on paper, then the tax office will consider such explanations not provided. Such norms are prescribed in the letter of the Federal Tax Service dated January 27, 2017 No. ED-4-15/1443.

ConsultantPlus experts examined whether it is necessary to submit an explanatory note with accounting reports. Use these instructions for free.

to read.

Results

If tax officials have questions regarding the reporting submitted to the Federal Tax Service (inconsistencies in figures, clarification with a tax reduction, declaration with a loss), they will ask the taxpayer for clarification. You should not ignore such a request (it is sent in the form of a demand): comprehensive explanations will help resolve questions and avoid possible checks caused by inconsistencies in reporting. Explanations can be given both on paper and electronically. But if we are talking about issues related to the VAT return, then taxpayers submitting such a declaration electronically must also provide explanations on it electronically.

Sources:

- Tax Code of the Russian Federation

- Code of Administrative Offenses of the Russian Federation

- Letter of the Federal Tax Service of Russia dated July 17, 2013 N AS-4-2/12837

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What happens if you don’t respond to the Federal Tax Service’s requirement?

No matter how much the inspectorate threatens punishment, tax officials cannot fine or issue an administrative penalty for the absence of an explanatory letter:

- Article 126 of the Tax Code of the Russian Federation is not a basis for punishment, since the provision of explanations does not apply to the provision of documents (93 of the Tax Code of the Russian Federation);

- Article 129.1 of the Tax Code of the Russian Federation is not applicable, since a request for written explanations is not a “counter check” (93.1 of the Tax Code of the Russian Federation);

- Article 19.4 of the Code of Administrative Offenses is not an argument; punishment is applicable only in case of failure to appear at the territorial inspection.

Similar explanations are given in paragraph 2.3 of the letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12837.

Is there a fine possible if the requirement is ignored?

Tax liability for failure to comply with the inspection's requirement to provide explanations to the Tax Code of the Russian Federation has not been established. Art. 126 of the Tax Code of the Russian Federation does not apply to this situation, since we are not talking about the requisition of documents (Article 93 of the Tax Code of the Russian Federation), but Art. 129.1 is not applicable, since this is not a counter check (Article 93.1 of the Tax Code of the Russian Federation).

Administrative liability under Art. 19.4 of the Code of Administrative Offenses of the Russian Federation in this case cannot be attracted either. This article applies for failure to appear at the tax authority, and not for refusal to give explanations, which the Federal Tax Service of the Russian Federation itself draws attention to (see clause 2.3 of the letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12837).

Thus, tax authorities have no right to fine people for failure to submit explanations. But still, despite the absence of legal grounds for the fine, it is more appropriate to provide explanations, since this is in the interests of the taxpayer himself. After all, refusing them can lead to another unpleasant consequence, which ConsultantPlus experts talked about:

To learn more about this, get a trial access to K+ and go to the Tax Audit Guide.

For information on the procedure for requesting clarification during an on-site audit, read the article “How tax authorities request clarification from a taxpayer .

Errors and discrepancies regarding VAT

Value added tax is the fiscal liability where accountants make the most mistakes. As a result, discrepancies and inaccuracies in reporting are inevitable.

The most common mistakes are when the amount of tax accrued is less than the amount of the tax deduction claimed for reimbursement. In fact, the reason for this discrepancy is the inattention of the person responsible for issuing invoices or a technical error when uploading data.

In the explanatory note, please include the following information: “We inform you that there are no errors in the purchase book, the data was entered correctly, timely and in full. This discrepancy occurred due to a technical error when generating invoice No.____ dated “___”______ 20___. Tax reporting has been adjusted (indicate the date the adjustments were sent).”

Sample explanatory note

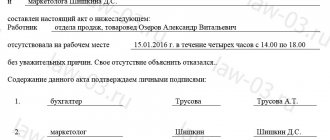

Let's consider an example of an explanatory note for a conditional company, which has been operating since 2005 and is engaged in the production and sale of dairy products. Its chief accountant compiled this document as follows:

Explanations to the balance sheet of PPT.ru LLC for 2021

1. General information

Limited Liability Company (LLC) "PPT.ru" was registered by the Federal Tax Service No. 1 for St. Petersburg on March 29, 2005. State registration certificate No. 000000000, INN 1111111111111111, checkpoint 22222222222, legal address: St. Petersburg, Wonderful Avenue, 1.

The organization's balance sheet is formed in accordance with the rules and requirements of accounting and reporting in force in the Russian Federation.

- Authorized capital of the organization: 5,000,000 (five million) rubles, fully paid.

- Number of founders: two individuals O. M. Kurochkin and P. P. Petrov and one legal entity LLC “Moloko”.

- Main activity: milk processing OKVED 15.51.

- The number of employees as of 31.123.2020 was 165 people.

- There are no branches, representative offices or separate divisions.

2. Basic accounting policies

The accounting policy of PPT.ru LLC was approved by order of director P.P. Petrov. dated December 25, 2019 No. 289. The straight-line depreciation method is used. Valuation of inventories and finished products is carried out at actual cost. The financial result from the sale of products, works, services, goods is determined by shipment.

3. Information about affiliates

Porfiry Petrovich Petrov is the founder, 50% of the ownership share in the management company, holds the position of general director.

Kurochkin Oleg Mikhailovich - founder, 30% share of ownership in the management company.

LLC "Moloko" is the founder, 20% of the ownership share in the management company, Russian organization (founders V.P. Petrov and Yu.K. Sidorov).

During the reporting period, the following financial transactions were carried out with related parties:

- On March 12, 2020, the general meeting of the founders of PPT.ru LLC reviewed and approved the financial statements of the organization for 2019. The meeting decided to pay a profit in the amount of 3,252,000 rubles to the founders based on their share in the authorized capital based on the results of 2021. The payment (including personal income tax withholding for two individuals) was made on 04/01/2020;

- On May 25, 2020, PPT.ru LLC entered into an agreement with the founder of Moloko LLC, Yu.K. Sidorov, an agreement for the purchase of non-residential premises worth 5,102,000 rubles. The cost of the transaction is determined by an independent assessment of the value of the property. Payments under the agreement were made in full on 06/06/2020, and the real estate acceptance certificate was signed.

4. Key performance indicators of the organization

In the reporting year, revenue amounted to:

- for the main type of activity “production and sale of dairy products” - 385,420,020 rubles;

- for other types of activities - 650,580 rubles;

- other income: 170,800 rubles (sale of fixed assets).

Costs of production and sales of products:

- acquisition of fixed assets: 1,410,500 rubles;

- depreciation of fixed assets: 45,230 rubles;

- purchase of raw materials: 110,452,880 rubles;

- wage fund: 137,580,040 rubles;

- travel expenses: 238,300 rubles;

- rental of premises: 8,478,190 rubles;

- other expenses: 532,458 rubles.

5. Explanation of balance sheet items as of December 31, 2020 (using the example of accounts payable)

Availability and movement of accounts receivable

Index Period For the beginning of the year Changes over the period At the end of the year Accounted for under contracts Provision for doubtful debts Received Dropped out Remainder In thousands of rubles with decimal places Under contracts (transactions) Fines, penalties, penalties Redeemed Written off in Finnish result Written off to reserve for doubtful debts Current Overdue Total short-term accounts receivable, including: 2020 25 489,3 (200,0) 15 632,7 300,4 (25 023,2) (102,1) (48,9) 15 726,1 522,1 buyers 20 409,0 (200,0) 10 015,5 300,4 (17 315,3) (87,7) (48,9) 12 750,9 522,1 suppliers 5080,3 — 5617,1 — (7707,9) (14,4) — 2975,2 — Total long-term accounts receivable, including: 2020 50 000,0 — — — — — — 50 000,0 — for interest-free loans 40 000,0 — — — — — — 40 000,0 — TOTAL accounts receivable 30 489,3 (200,0) 15 632,7 300,4 (25 023,2) (102,1) (48,9) 65 726,1 522,1 6. Estimated liabilities and provisions

As of 12/31/2020, an estimated liability was formed to pay for regular vacations of employees in the amount of 7,458,000 rubles, the number of unpaid vacation days is 67, the deadline is 2022.

The reserve for doubtful debts was formed in the amount of RUB 600,000. due to the presence of overdue and unsecured debt of Girya LLC in the amount of 522,000 rubles.

The organization did not create a reserve for reducing the value of inventories in 2021, since inventories do not show signs of depreciation.

7. Salary

Payables for wages as of December 31, 2020 amounted to RUB 3,876,400. (payment for December 2021, due date: 01/12/2021). Staff turnover in the reporting period was 14.88%. The number of employees as of December 31, 2019 is 165 people. The average monthly salary is 25,675 rubles.

Director of PPT.ru LLC /signature/ Petrov P.P. 03/12/2021.

Reporting discrepancies

Quite often there are situations when the same economic indicator has different values in the provided fiscal reporting forms. Such discrepancies are caused by the fact that for each tax, fee, contribution, individual rules for determining the taxable base are established. And if tax authorities require clarification on this issue, provide clarification in free form. In the text, indicate specific reasons why the discrepancies arose.

Also, the reason for this inconsistency is the different norms and rules of tax accounting in relation to a number of specific situations. Write down the circumstances in a letter.

It is welcome to provide explanations with references to the norms of the current fiscal legislation. Even if the company is wrong (incorrectly interpreted the norms of the Tax Code of the Russian Federation), the Federal Tax Service will provide detailed explanations, which will help avoid larger mistakes and fines in future activities.

Reducing the tax burden

This issue is of particular interest to tax authorities. Thus, representatives of the Federal Tax Service constantly monitor the volume of revenues to the state budget. If they decrease, the reaction is immediate: demands with explanations, an invitation from the manager to a personal meeting with a representative of the Federal Tax Service, or an on-site desk audit (a last resort).

In such a situation, you cannot hesitate; you must immediately provide explanations to the Federal Tax Service. In your response letter, describe all the circumstances and facts that influenced the reduction in tax payments. Confirm the facts with documents or provide economic justification. Otherwise, the Federal Tax Service will initiate an on-site inspection, which will take several months.

What to write in an explanatory note:

- Reduction of salary taxes. Reasons: staff reduction, enterprise restructuring, reduction in wages.

- A decrease in profits usually occurs due to the termination of contracts with customers. A copy of the additional agreement on termination of the contract should be attached to the written explanations.

- Increased costs as a result of decreased profits. Justification: expansion of activities (increase in production volumes, opening of a new branch, division, outlet), change of suppliers or increase in prices for inventories and raw materials (attach copies of contracts).

There are many reasons for reducing the tax burden. It is necessary to understand each specific case in detail.

What information is indicated?

There are no legal requirements for the contents of this document. Each accountant independently determines the composition of the explanatory note to the balance sheet for 2021 and the completeness of the data in it, and in what form it is more convenient to provide them:

- plain text;

- diagrams;

- tables;

- schemes;

- graphs.

There is a general outline of this document. The most complete explanatory note usually contains:

- general data of the organization (address, average annual number of employees, types of economic activities, management personnel, etc.);

- general information about the applied accounting policies;

- analysis of the current financial performance of the organization;

- text and tabular explanations.

In order for inspectors to have fewer questions, the document must include at least brief information about accounting methods. This especially applies to the following areas:

- valuation of goods, inventories and finished products;

- assessment of work in progress;

- depreciation of fixed assets;

- recognition of sales revenue.