For a variety of reasons, people are required to pay child support - in relation to elderly parents, minor children, disabled spouses and in some other cases. But what will happen to alimony and arrears if the payer dies? This article examines the inheritance of alimony debts, alimony obligations, and also provides assistance from a lawyer in Moscow on this issue.

- Is alimony inherited?

- Is alimony debt inherited? Acceptance of inheritance

- Proof of Debt

- The debtor's heir is the recipient of alimony

What happens to the alimony debt after the death of the debtor?

Alimony obligations terminate after the death of the payer on the basis of Art. 120 IC RF. Often, during their lifetime, people do not pay alimony, and debts accumulate. Then they have to be paid to the heirs.

Legislation protects the rights of minors in the first place, therefore alimony debt is collected by their representatives through the court. This is possible if payments were made according to one of three documents:

- Writ of execution (IL). Issued after the court decision has entered into legal force.

- Court order. Drawed up by the judge within 5 days when the claimant submits an application for an order.

- Settlement agreement. It is concluded by the payer and the recipient with a notary.

When paying money for a child without a writ of execution (ID) by verbal agreement, it will not be possible to collect the debt from the heirs - it simply does not exist. From a legal point of view, it can only be accumulated if there is an ID.

What points are important to consider:

- According to Art. 1112 of the Civil Code of the Russian Federation, alimony debts of testators are included in the inheritance mass. If, on the contrary, alimony was paid to the testator, the legal successors do not have the right to receive them later.

- Based on Art. 1175 of the Civil Code of the Russian Federation, alimony debt is transferred to the heirs within the limits of the price of the inherited property. If there are several of them, and there is only one property (for example, an apartment), the debt is distributed in proportion to their shares.

In inheritance by transmission, when the successor dies after the opening of the inheritance case before accepting the property, the latter is transferred to his heirs by law. They will not be responsible for the debts of a citizen who did not have time to accept the inheritance, but they will have to pay the debt of the original testator.

A minor child has the right to an obligatory share in the inheritance, even if the will is executed in the name of another person (Article 1149 of the Civil Code of the Russian Federation). He is allocated at least half of the share that he could receive by entering into an inheritance by law.

If there is an inheritance

As mentioned earlier, if there is an inheritance, the legal successors are liable for the debt obligations of the testator on the basis of Art. 1175 of the Civil Code of the Russian Federation.

Example from practice. The man had to pay alimony for the maintenance of his daughter from his first marriage - 12,000 rubles. monthly. He incurred a debt in the amount of 200,000 rubles. In January 2021, he dies, his second wife and child take over the inheritance, because... the girl is entitled to a mandatory share - 1/4 in the ownership. An apartment worth RUB 2,500,000 is inherited.

The ex-spouse (recipient) files a lawsuit to collect alimony debt. As a result of the consideration of the case, a court decision is made to satisfy the claims. The defendant is ordered to pay 200,000 rubles and is given an installment plan.

If there is no inheritance

In the absence of an inheritance, the relatives of the deceased are not liable for the debt obligations of the alimony obligee.

It will not be possible to collect the debt from them.

If the heir is the recipient of alimony

If the recipient of alimony himself enters into an inheritance, the debt will still have to be repaid within the value of the share.

Even if the testator inherited property to the child, the debt remains if there are other heirs.

Can successors refuse inheritance?

The law does not oblige relatives to inherit. Each person decides independently whether he needs the property and debts of the testator.

There are two types of renunciation of inheritance. It is enough for assignees not to take any action for six months or to submit a written application to a notary.

Targeted refusal according to Art. 1158 of the Civil Code of the Russian Federation is carried out only by submitting an application. The heir must submit a waiver application within six months.

If the priority heirs refuse the property or do not accept it, then it passes to the relatives of the next priority. The ultimate legal successor is the state. The creditor may present his claims to the heir of the corresponding queue.

How is child support debt calculated?

The calculation of alimony debt is carried out by a bailiff in accordance with Art. 113 RF IC:

- The period of non-payment is determined.

- The amount of earnings in case of recovery by share method for the above period is established, and the amount of payments is calculated.

- The amounts are added up taking into account the number of months.

Let's look at a practical example. The alimony payer did not pay in August, September and October 2021. In November, the debtor died, and the claimant turned to the bailiff for a ruling on calculating the alimony debt in a shared amount for one child.

It was not possible to establish the income of the alimony obligee for the specified period, so the debt was calculated based on the average salary in the Russian Federation - 30,000 rubles.

30,000 x 25% = 7,500 rub.

7500 x 3 = 22,500 rub. – total amount of debt.

The collector can find out the exact amount of the debt by submitting an application for a decree on debt settlement to the bailiff.

How to dispute alimony debt

Find out the alimony debt by last name (step-by-step instructions)

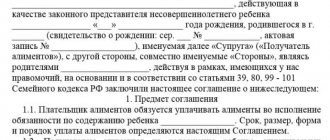

Voluntary payment

If the parties (the alimony payer and the alimony recipient) come to a compromise regarding the frequency of payments, the amount and other points, then they have the right to contact a notary to write and certify the agreement. Adding a clause to the contract regarding the provision of part of the funds from the inheritance for the maintenance of a dependent will not be illegal. The document must indicate the following nuances:

- Information about the recipient of alimony and its payer.

- Dependent information.

Payment details:

- How much will be charged to the alimony claimant’s account?

- When does the payment period end?

- What is the frequency?

- Indexation of the amount.

- Penalties for failure to fulfill obligations.

When drawing up an agreement, the interests of the person for whose maintenance the funds are paid are given priority. You can add any items allowed by law. A document can only be canceled or changed by a notary with the permission of both parties. The agreement is invalid only if there are errors and inaccurate information, in accordance with Article 102 of the Family Code.

How to collect debt after the death of the debtor

In the event of the death of the payer, the recipient must notify the bailiff about this, otherwise the debt for enforcement proceedings will continue to accumulate. A death certificate is provided, on the basis of which the bailiff terminates enforcement proceedings (Article 43 of the Federal Law of October 2, 2007 No. 229-FZ).

What the recipient needs to do step by step:

- Order a certificate from the bailiff with the calculation of the debt. If alimony was paid by agreement, you will have to make the calculations yourself and justify them in court.

- File a claim with the court and attach evidence indicating the existence of a debt. During the review, an examination may be appointed to determine the value of the inherited property.

- Receive a court decision and a new IL, where the heir will be considered the payer.

- Present the IL to the bailiff for forced deduction of payments.

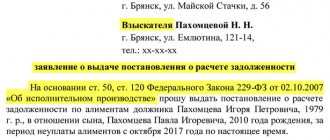

Contents and sample of the statement of claim

The requirements for claims in civil cases are contained in Art. 131 Code of Civil Procedure of the Russian Federation.

The application must contain the following information:

- name of the judicial authority;

- Full name of the deceased debtor;

- registration address, full name plaintiff;

- place of residence of the defendant, full name (heir);

- number of the decision and IL on the basis of which alimony was collected;

- date of death, death certificate number of the payer;

- inventory of inherited property;

- demand for collection of alimony debt;

- date and signature.

The application is drawn up in two copies. One is sent to the court, the second is given to the plaintiff with a registration mark.

Sample claim

Where to contact

The statement of claim must be filed in the district court at the defendant’s place of residence. If there are several of them, go to the address of one of them.

Documentation

Along with the claim, the following is submitted to the court:

- plaintiff's passport;

- an extract from the court decision and IL on the collection of alimony or an alimony agreement;

- certificate of debt settlement from the bailiff;

- statement of the creditor's bank account indicating the lack of receipt of funds.

State duty

The claim for collection of arrears of alimony from heirs is of a property nature, and the fee is calculated in accordance with Art. 333.19 of the Tax Code of the Russian Federation, depending on the amount of debt.

Documents for court

Any circumstance must be confirmed in court. The basis for the petition is a certificate from the executor with the debt recalculated at the time of the defendant’s death. But this is not the only paper that will be required in the process. With this list we determine that such documents should be provided to the court:

- Court order, alimony agreement on the assignment of payments.

- Extracts from the bailiff:

- on the opening of production;

- about the amount of debt;

- on measures taken to repay the debt.

- Other documents that can be used to confirm that the deceased defendant has property (receipts, bank statements, extracts from Rosreestr, etc.).

Attention!

In order to be able to collect alimony debt from the property of a deceased defendant, it is required that the alimony agreement signed by the spouses be notarized. Without the appropriate certificate, the paper will not have legal force, and, therefore, the grounds for forced collection are canceled.

The basis for going to court is Art. 1102 Civil Code. This is a rule that provides for the concept of illegal enrichment due to ignoring debt obligations.

Arbitrage practice

For a long time, the courts held different opinions regarding the collection of alimony debt from heirs.

Some, guided by Art. 120 of the RF IC, refused to satisfy the claims, explaining the termination of any alimony obligations (including for debts) by the death of the debtors. The final point on the issue was put by the Supreme Court of the Russian Federation with its Determination No. 45-KG16-1 dated 03/01/2016. According to the document, the heirs wanted to challenge the initial decision, a ruling was made that satisfied them, but the Supreme Court of the Russian Federation sided with the claimant and explained that alimony debts are inherited. The appeal ruling was overturned, the decision of the first court was left unchanged.

Here are some practical examples:

- The deceased still owes alimony. The plaintiff wanted to recover 777,567.50 rubles from the heiress, but the court satisfied only 388,783.87 rubles. (Decision No. 2-2733/2019 2-70/2020 dated February 26, 2021 in case No. 2-2733/2019).

- The woman collected from the heirs the alimony debt, compensation for the costs of assessing the property and payment of state duty, and also demanded that the ownership of the car be terminated. By decision No. 2-519/2020 2-519/2020~M-100/2020 M-100/2020 dated February 20, 2021 in case No. 2-519/2020, the requirements were satisfied.

- The plaintiff demanded that property worth 637,285.95 rubles, received by the defendant as an inheritance, be transferred to her. By decision No. 2-250/2020 2-250/2020(2-2979/2019;)~M-2981/2019 2-2979/2019 M-2981/2019 dated January 9, 2021 in case No. 2-250/2020 the requirements were partially satisfied, RUR 318,643 was recovered.

Getting rid of alimony obligations using inherited property

The alimony holder has the right to dispose of inherited property or funds at his own discretion. If desired, he can offer a large sum of money for the maintenance of a dependent in order to close the issue of alimony payments. The funds will be used to pay for future years, freeing the person from alimony obligations. The consent of the parties must be legalized at a notary office.

The alimony payer also has the right to provide the dependent with real estate (house, apartment) to stop payments for his maintenance. After receiving approval, an agreement is concluded between the parties, which must be certified by a notary.

Lawyer's answers to private questions

Is it possible to draw up an agreement with the heirs on the allocation of a share in the apartment in exchange for waiving the alimony debt?

Yes, the agreement must be notarized.

Does the father have to pay off the debt after the child's death?

Alimony obligations terminate due to the death of a minor, but the debt accumulates during his lifetime and will have to be paid.

If the child's father dies, who will pay the child support debt for him?

Based on Art. 120 of the RF IC, payment of alimony is terminated. But if the payer has incurred a debt, it will be paid by the direct heirs by law or by will. If there are no such people or they write a refusal of the inherited property, the debtor’s property will pass to the state, or rather to the municipality (such property is considered escheated). In this case, you need to prepare a claim for collection of alimony debt, naming the municipal administration as the defendant.

Are heirs required to pay alimony after the death of the debtor?

No. The inheritance does not include obligations that are inextricably linked with the personality of the testator (Article 1112 of the Civil Code of the Russian Federation).

What happens to the alimony debt after the death of the recipient?

The recipient acts in the interests of the child, and after his death the debt will not go anywhere. It can be collected by the guardian or the child himself after 18 years of age. If the recipient acts on his own behalf, after death no one will be able to demand alimony debt from the payer.

Why aren't they holding on?

There are a number of reasons that exclude the possibility of paying alimony from an inheritance, and they can be listed. The main factor is the irregularity of such income; this factor in itself excludes alimony payments .

In addition, inheritance is not earnings, and alimony can only be paid from income. It is also worth noting that alimony can only be collected for the maintenance of the child, and enrichment of the child does not directly pursue this goal. And the payment of child support itself should not infringe on the rights of the parent who pays the child support.

When will child support payments stop?

We know that parents are obliged to support their children financially until they enter adulthood. But the law also provides for early termination of relations. Let's consider the list of situations provided for in Art. 120 SK, in which the payment of alimony is terminated:

- Recipient's age of majority.

- Adoption of the applicant. In such cases, along with parental rights, the new parent assumes the responsibility of maintaining the minor offspring.

- Death of the recipient.

- Death of the defendant.

- Restoring lost performance. This rule can be applied in situations where a parent pays child support to a disabled adult child. When a person recovers and regains the ability to earn his own living, the parent is relieved of the obligation to pay child support.

- Cessation of need. We are talking about those situations where alimony was assigned to a needy spouse. Cessation of need in this case is grounds for termination of payments.

As we can see, paragraph three of the above list clearly defines that the death of the defendant is the basis for termination of alimony payments.

Important Additions

However, the arrears accumulated during the life of the debtor will be recovered from the heirs of this person

Let's look at the question of who pays the debt if the alimony debtor dies. Here it is appropriate to be guided by the general principles of collecting arrears from the successors of the testator.

In cases of accumulation of overdue payments, the heirs are liable to the recipient of payments within the framework of the share of the property received. Note, Art. 1175 of the Civil Code implies joint liability here.

This interpretation is supported by state jurisprudence. In particular, it is advisable to be guided by the decision of the Supreme Court of the Russian Federation.

Here we considered a case of debt for a specific plaintiff, but such situations are typical of modern realities. The debtor accumulated arrears of alimony until his death. The property of the deceased was distributed in equal parts by three heirs. Accordingly, the plaintiff sought a legal solution to the situation.

Today, judicial practice allows the Supreme Court to satisfy a claim demanding the collection of alimony debt

Article 1110 of the Civil Code talks about the transfer of the property of a deceased citizen to his legal successors. Moreover, in Art. 1112 specifies that, along with the assets of such a citizen, the heirs also acquire the financial obligations of this person.

And the features and principles of repaying the creditor’s claims are enshrined in Article 1175. Accordingly, forcing the heirs to transfer regular payments to the plaintiff is an illegal requirement due to the personal nature of the payments.

However, debt accumulated by the testator during his lifetime is considered an obligation that is inherited by his legal successors. Keep in mind that it does not matter how the arrears were formed.

The court takes into account only the fact of the presence of debt. Thus, the amount in question does not relate to the personality of the deceased person and is subject to return in accordance with the procedure established by law.

General provisions

In Art. 120 of the RF IC lists all cases when the payment of maintenance funds ceases completely:

- Child's coming of age.

- Transfer of parental rights to another person in connection with adoption.

- Disappearance of the need for funds, restoration of efficiency.

- Death of one of the parties to the alimony relationship.

But if the debtor dies, then one of his heirs pays his debt. This is stated in Art. 1112 of the Civil Code of the Russian Federation, according to which the inheritance includes not only property and savings, but also debt obligations.

If there are several beneficiaries after the death of the defaulter, then they will pay the unpaid in a share ratio, in proportion to the property received.

The legislation clearly spells out all the points regulating this situation. Therefore, no significant problems will arise with substantiating your claim. The main thing is to find a competent lawyer or delve into the essence of the issue yourself.

Not only property is inherited, but also the obligation to pay alimony

The termination of alimony payments due to the death of the payer is a fact prescribed by law. Therefore, on the one hand, the heirs have nothing to worry about. However, if during his lifetime the alimony provider has arrears in payments, which often happens, then the situation changes radically.

The current legislation comprehensively protects the rights of minors, and therefore the child claims to pay the financial support debt in full. And if the debtor dies, then his debt obligations are transferred to his heirs. In jurisprudence, death is a decisive factor in changing the legal relationship between the deceased and other persons.

We can talk about:

- termination of obligations (as in the case of paying alimony);

- their occurrence (we are talking about material assistance from the state for burial);

- shifting to heirs and relatives (if the deceased has debts).

But when resolving issues related to alimony, everything turns out to be far from so simple. In practice, lawyers are not always able to accurately answer regarding the payments that are due to the recipient of funds.

Regarding Article 120 of the RF IC, termination of alimony obligations is possible in the following cases:

- when the child reaches adulthood;

- as a result of the death of one of the parties;

- ceasing to be in need or gaining the ability to work;

- adoption or adoption, when the responsibility for maintaining a minor is transferred to the new parents.

Therefore, from the moment the will comes into force, the debt will be distributed among the heirs in relation to their shares and priority.

Actions of the parties to the process

Now let's talk about the strategy for the steps of the heirs and the potential plaintiff. After the death of a person who regularly makes alimony payments, it is advisable for relatives to visit the FSSP inspector to notify him of the event. Of course, no specific deadlines have been established here, but it is appropriate for future debtors to notify the bailiff early.

To reduce the likelihood of arrears accumulating, heirs need to quickly present to the bailiff the death certificate of the alimony payer

Such actions become a guarantee of suspension of accrual of payments and the prescribed penalty. The heirs face paying arrears of alimony after the death of the debtor, which has accumulated in the form of overdue payments. To confirm the words, the visitor only needs a death certificate of a particular citizen. In addition, a useful tip here is to ask the executive service employee to recalculate the amount.

In case of litigation, evidence of timely payments is provided by the defendants. Accordingly, advance preparation for the likely process is required here. As for the actions of the plaintiff, the legislation presupposes a different algorithm of steps, which we will discuss below.

Procedure for preparing for trial

The plaintiff is required to obtain a certificate from the bailiff about the calculation of the amount of debt and the timing of the delay in payments to initiate a lawsuit

After finding out new circumstances, the recipient of alimony is sent to the territorial office of the FSSP to collect information about accrued and received funds.

In this case, the employee of the executive service issues a corresponding certificate containing the necessary information. However, the law does not prohibit the plaintiff from independently calculating the accumulated arrears.

The next step is to file a claim for debt collection from the heirs to the notary, who opens the inheritance. Consider this stage - a prerequisite for filing a claim.

The legislation allows consideration of cases only in situations of notifying the successors of the defaulter about the claims of creditors. In addition, contact with a notary becomes a chance to clarify the circle of persons entering into inheritance rights.

To collect the sought debt, the plaintiff submits a claim to the notary, and then draws up a statement of claim

Having decided on the inheritance base and the circle of successors, the recipient of alimony prepares papers to file a claim to recover the arrears. Keep in mind that lawyers advise drawing up a separate application for each defendant.

True, the state duty here is paid once. Remember, when filing a claim, lawyers recommend referring to the provisions of the current law.

In this case, citizens will need knowledge of Articles 1102, 1110 and 1112 of the Civil Code. In addition, a necessary addition here is the citation of paragraph 1 1175 of Art. Civil Code of the Russian Federation.

To reduce the likelihood of losing the case, the text mentions a review of the practice of the Supreme Court on 02/05/2014. Note that a well-drafted application and the necessary persistence of the plaintiff increase the chances in court.

Theory and practice

As you can see, theoretically, the recipient of alimony has the right to file a claim for collection of accumulated debt against the successors of the former payer. However, real life makes certain adjustments.

Accordingly, there are no guarantees of winning in such disputes. Courts in such circumstances make conflicting decisions, which are determined by the specific case and the evidence base of the defendant.

Lawyers talk about the inconsistency of judicial practice and the high risk of the plaintiff losing the case

You can increase your chances of winning your case by contacting a competent lawyer who has positive experience in resolving such issues. In addition, it is inappropriate to count on winning the case in the court of first instance. Practice shows that the likelihood of winning increases after an appeal is considered. The plaintiff has the right to present the evidence to the judge, which will play a decisive role.

It is important to remember the defendant’s obligation to present to the court undeniable arguments that he is right. Of course, heirs who are not interested in paying such an amount will prepare for the process

In addition, the likely refusal of the successors to inherit becomes an important point here. In this case, the property becomes “escheated” and goes to the state.