General provisions

If a child support debtor dies, who pays the debt?

This question arises among recipients of funds quite often, and therefore it should be considered in more detail. The termination of alimony payments due to the death of the payer is a fact prescribed by law. Therefore, on the one hand, the heirs have nothing to worry about. However, if during his lifetime the alimony provider has arrears in payments, which often happens, then the situation changes radically.

The current legislation comprehensively protects the rights of minors, and therefore the child claims to pay the financial support debt in full. And if the debtor dies, then his debt obligations are transferred to his heirs. In jurisprudence, death is a decisive factor in changing the legal relationship between the deceased and other persons.

We can talk about:

- termination of obligations (as in the case of paying alimony);

- their occurrence (we are talking about material assistance from the state for burial);

- shifting to heirs and relatives (if the deceased has debts).

But when resolving issues related to alimony, everything turns out to be far from so simple. In practice, lawyers are not always able to accurately answer regarding the payments that are due to the recipient of funds.

Regarding Article 120 of the RF IC, termination of alimony obligations is possible in the following cases:

- when the child reaches adulthood;

- as a result of the death of one of the parties;

- ceasing to be in need or gaining the ability to work;

- adoption or adoption, when the responsibility for maintaining a minor is transferred to the new parents.

Thus, the heirs cannot be obligated to look after the child of the deceased payer, and it will not be possible to receive alimony by inheritance. Regarding debts, please refer to Article 1112 of the Civil Code. It states that inheritance means both the property and the obligations of the deceased, including debts.

Therefore, from the moment the will comes into force, the debt will be distributed among the heirs in relation to their shares and priority.

Our lawyers know the answer to your question

Free legal advice by phone: in Moscow and the Moscow region, in St. Petersburg, as well as throughout Russia

According to Article 128, the total estate of the inheritance, in addition to things and property, includes the following objects:

- funds in cash or non-cash form;

- intellectual property;

- intangible benefits;

- securities with or without a documentary basis;

- responsibilities regarding property to be borne by the heirs, which will not exceed its value.

From the above it follows that the debts of the deceased are inherited. Therefore, if there is an inheritance in which, in addition to property, there are debts, then the heir may receive claims from banks or other creditors.

ATTENTION!!! Repayment of the deceased's debts occurs within the value of his inheritance. In order to evaluate the inheritance you receive, it is worth contacting a specialist appraiser.

What to do if the debtor dies

If the alimony payer has died, the recipient of the funds should notify the bailiff in charge of the case. This is necessary in order to prevent a further increase in the amount of debt. If the alimony holder dies, then to confirm this fact, his ex-wife should have a copy of the death certificate in her hands.

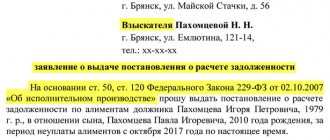

The next stage is writing an application addressed to the bailiff with a request to calculate the amount of debt that arose at the time of the death of the payer.

Based on this certificate, you can go to court to collect the debt from the defendant’s heirs. Regarding Article 1175 of the Criminal Code, they are jointly and severally liable, which is directly proportional to the share they received as a result of inheritance.

The basis for a claim may be Article 1102 of the Civil Code of the Russian Federation, which deals with illegal enrichment by ignoring alimony obligations.

The following documents are usually used as evidence:

- A court order or court decision regarding alimony payments. A notarized alimony agreement is also equivalent to a writ of execution.

- Bailiff's papers, which contain information about the opening of enforcement proceedings, the amount, procedure and regularity of depositing funds, as well as the amount of the total debt that arose during the life of the payer.

- Other documents, including bank statements, certificates, receipts, receipts and checks, as well as payment orders.

How to collect alimony debt after the death of the payer

You can collect alimony debt after the death of a negligent payer on a voluntary basis or through the court. In the first case, you need to reach an agreement and draw up a document with a notary.

When going to court to collect alimony after the death of the payer, you need to prepare a number of documents, the nature of which is defined in Art. 132 Code of Civil Procedure of the Russian Federation:

- statement of claim;

- plaintiff's civil passport;

- death certificate of the debtor;

- certificate of inheritance;

- a document confirming the alimony obligations of the deceased to the applicant;

- documents from the bailiff: a resolution to initiate enforcement proceedings based on a court decision, a certificate of the amount of debt;

- a receipt serving as confirmation of payment of the state fee.

Also attach certificates from government or commercial institutions, checks, receipts, receipts.

How to go to court

The heirs of the alimony holder must pay off the debt. You should not wait until the recipient files a lawsuit to force the collection of funds.

In addition, due to the cessation of money flow, the accumulation of fictitious debt is possible. It can subsequently be challenged in court by providing a death certificate of the payer, but this will require a lot of time.

Therefore, it is advisable to deal with material issues immediately after entering into inheritance rights. If the heirs do not make any attempts to repay the debt, then the recipient of the funds must do the following:

- Notify the bailiff who controls payments in a particular case about the death of the payer. This will prevent the accumulation of fictitious debt.

- You should also write an application for the calculation of debts generated during the life of the alimony holder. Further payments will be made regarding this document.

- Submit an application for recovery of money to the court. The claim must indicate all the heirs of the deceased, among whom the responsibility for paying the debt will be proportionally distributed in accordance with Article 175 of the Civil Code of the Russian Federation.

In most cases, legal proceedings are initiated by the recipient of the funds. It should be remembered that the petition must be filed before the expiration of the statute of limitations, that is, no later than three years after the death of the payer.

You can also refer to Article 1102, pointing out the fact of illegal enrichment due to an outstanding alimony debt. Most often, such claims are satisfied.

What documents should be provided to the court?

By law, the full amount of debt incurred during the lifetime of the alimony recipient must be paid to the recipient.

However, in order to receive funds, it is necessary to initiate legal proceedings, providing the court with the appropriate grounds, supported by documents.

When filing a claim for debt payment in the event of the death of the payer, you must collect the following package of documents:

- The decision of the magistrate regarding the satisfaction of the claim for alimony payments. It is the basis for determining the amount of debt. If the funds were transferred not by a court decision, but on the basis of an appropriate agreement, then it must be provided.

- Legal papers that can be obtained from bailiffs. These documents confirm the existence of alimony payments.

- Statements from the recipient's bank accounts.

- Child support payment schedule.

Cases of judicial practice

Litigation regarding the recovery of funds upon the death of the payor is quite controversial and complex.

In practice, cases often arise when the defendant files an appeal due to insufficient grounds to satisfy the claim in full.

In addition to collecting the debt, plaintiffs often try to require the heirs to make monthly contributions. The latter are trying with all their efforts to prove the fact that the debt that has arisen is a property liability of the deceased and is exclusively personal in nature.

But in this case, such disputes can only delay the judicial process, without in any way affecting the final decision of the judge. The verdict will be based on the following provisions of the law:

- The heirs must pay the alimony debt that arose during the life of the testator. The material obligations themselves are canceled due to the death of the payer.

- Payments are distributed to all heirs in accordance with their turn and shares.

- Collection of alimony debt occurs through legal action.

Obligations of heirs

Despite the fact that the court is called upon to protect the interests of the child, it is impossible to predict the outcome of each such case. The law in this case is not so clear, and when rendering a verdict, the judge may reject the claim on the basis of Article 120 of the RF IC. It talks about the termination of any alimony legal relationship upon the death of a parent or child.

In accordance with this article, third parties cannot bear any obligations towards a minor.

But in most cases, the heirs are still obliged to repay the debt incurred for alimony. Any property of the defaulter can be used to pay off the debt:

- cash;

- intangible values;

- real estate (including proceeds from the sale of an apartment);

- personal belongings;

- shares and other securities;

- intellectual property, for example, rights to literary works, etc.

Why doesn't my child support debt go away?

The norms of the current legislation, namely Art. 1112 of the Civil Code of the Russian Federation, it is provided that debt in any form does not terminate if the debtor dies, but is subject to transfer, along with the rest of the inheritance, to persons claiming the inheritance of the deceased. In this regard, all citizens who have the status of creditors in relation to the deceased have the right to demand repayment of debt obligations, including alimony, from the heirs of the alimony payer.

Read the law

If the only heir of the payer is the recipient of the funds

In practice, situations often arise when, as a result of the death of the alimony recipient, all of his property passes to the recipient of the funds. What to do with debt in this case? In accordance with the law, all debt obligations will be canceled, even if the total amount of the inheritance could not cover the amount of the debt.

In fact, such a situation is quite transparent and can be clarified without any problems by any lawyer. Due to the death of the debtor and the complete transfer of his property into the possession of the recipient, there will simply be no addressee in whose name a claim can be filed demanding further collection of funds.

All child support obligations of a parent to a child automatically terminate as a result of the death of one of the parties. But alimony arrears after the death of the debtor must be repaid from his inheritance.

If disagreements arise in this area, the recipient must go to court to force the collection of funds from the heirs of the deceased.

How much can you collect for child support debts if the child’s father has died?

If all the conditions for collecting alimony after the death of the payer are met, claims can be made against the heirs. The following succession options are possible:

- if, by will or by law, only one heir receives all the property, he will have to be solely responsible for alimony debts;

- if the property was received by several heirs by law, they will have equal obligations to repay debts, unless otherwise determined by them in the agreement (for example, ½, 1/3, etc.);

- when inheriting by will, the size of shares in the property may be unequal, therefore, debt obligations will arise in proportion to the received part of the inheritance;

- if after the death of the payer there is not a single heir left, or all of them refused to accept the property, there will be no one to make a claim for alimony.

In view of these nuances, the heirs may refuse to accept the property precisely because of the large debts of the deceased.