According to paragraph 2 of Art. 6 Federal Law dated 08.08.2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs”, legal entities, individuals and individual entrepreneurs have the right to receive copies of documents contained in the Unified State Register of Legal Entities (hereinafter referred to as the Unified State Register of Legal Entities).

A sample request for a copy of the charter of a limited liability company may be required in various situations, for example: if the constituent document is lost when amending the charter, when opening a bank account, when concluding agreements with counterparties, etc.

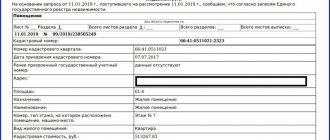

Application for receiving a copy of the charter through government services

, legal entities, individuals and individual entrepreneurs have the right to receive copies of documents contained in the Unified State Register of Legal Entities (hereinafter referred to as the Unified State Register of Legal Entities).

A sample request for a copy of the charter of a limited liability company may be required in various situations, for example: if the constituent document is lost when amending the charter, when opening a bank account, when concluding agreements with counterparties, etc. Consequently, the question arises about the need to pay tax for issuing a copy of the LLC charter. How to obtain duplicates of constituent documents: request procedure General procedure for obtaining duplicates of constituent documents In general, the procedure for restoring documents to the Federal Tax Service is as follows:

Other documents of the legal entity

Many authors who post their articles on the Internet also boldly classify as constituent documents extracts from the Unified State Register of Legal Entities, certificates of state registration and assignment of TIN, protocols, orders for the appointment of a director and other local acts. Sometimes even courts in their decisions refer to these papers as constituent documents. (Resolution of the Thirteenth Court of Appeal in case No. A56-51187/2014 dated April 23, 2015). In fact, this is a grave mistake.

These documents, even with a stretch, cannot be considered constituent. They either simply confirm an already existing legal fact, or use it as a basis for the emergence of new legal relations.

For example, previously, legal entities received from the Federal Tax Service certificates of state registration and registration at their location on printed forms (now these are Record Sheets and certificates on regular A4 sheets). These documents simply confirmed and officially recorded the already accomplished fact of the appearance of the company and its state registration.

But the order (or protocol) on the appointment of a director is adopted after the approval of the Charter by the founders and the formal creation of the organization. Consequently, internal documents, in this case, formalize the emergence of local (corporate) legal relations. So it’s impossible to call them constituent.

Moreover, all kinds of extracts from the Unified State Register of Legal Entities do not fall into this category. They, in their essence, do not create legal facts at all, but contain only information from the register.

Another thing is Sheets of entry on amendments to the Charter or Unified State Register of Legal Entities. They really (as before and evidence) endow a legal fact with legal force. After all, only after state registration of changes to the charter or register do they (that is, the changes) become mandatory for third parties. But does this make the Record Sheets constituent documents? Not at all. After all, as we remember, the constituent document is created only by the participants of the legal entity, and the Federal Tax Service is not one. Consequently, the Sheets of Record are also not considered constituent documents.

How to get a copy of the charter from the tax office

Will it be enough...

- How can I get information about a counterparty to check it? ✒ There are several ways to obtain information about the counterparty: - use electronic services on the Federal Tax Service website (https://www.nalog.ru/) - request documents from...

- : Our organization received a notification from the Federal Tax Service, where, according to clause 2, article 54 of the Civil Code of the Russian Federation and clause 2 of article 8 of Federal Law 129-FZ “On State Registration of Legal Entities”, the essence of the letter is….

- An organization changes its actual and legal address (moving), how to deregister from one tax office and register with another tax office, what documents are needed for this?….

- in the form of a paper document by mail, directly by the applicant himself to the tax authority, an authorized organization or through a multifunctional center;

- in electronic form using Internet technologies, including a single portal of state and municipal services (functions) (if technically possible).

You can send a message to the executive authorities of the city of Moscow as part of a pre-trial appeal.

Control over the implementation of administrative regulations for the provision of public services in the city of Moscow is carried out by the Main Control Department of the city of Moscow.

ADMINISTRATIVE REGULATIONS

PROVISION OF PUBLIC SERVICES OF THE CITY OF MOSCOW

“ISSUANCE OF COPIES OF TITLE, TITLE ESTABLISHING DOCUMENTS”

Pre-trial (out-of-court) procedure for appealing decisions and actions (inaction) of the Department and its officials.

1. The applicant has the right to file a pre-trial (out-of-court) complaint against the decision and (or) action (inaction) of the Department and its officials in the provision of public services.

2. The filing and consideration of complaints is carried out in the manner established by Chapter 2.1 of the Federal Law of July 27, 2010 No. 210-FZ “On the organization of the provision of state and municipal services”, the Regulations on the specifics of filing and consideration of complaints about violations of the procedure for the provision of public services in the city of Moscow , approved by Decree of the Moscow Government of November 15, 2011 No. 546-PP “On the provision of state and municipal services in the city of Moscow”, these Regulations.

3. Applicants may file complaints in the following cases:

3.1. Violation of the deadline for registering a request (application) and other documents necessary for the provision of public services.

3.2. Requirements from the applicant:

3.2.1. Documents, the submission of which by the applicant for the provision of public services is not provided for by the regulatory legal acts of the Russian Federation and the city of Moscow, including documents obtained using interdepartmental information interaction.

3.2.2. Applications for the provision of services not included in the list of services approved by the Moscow Government that are necessary and mandatory for the provision of public services.

3.2.3. Payment of fees for the provision of public services not provided for by regulatory legal acts of the Russian Federation and the city of Moscow.

3.2.4. Documents or information, the absence and (or) unreliability of which was not indicated during the initial refusal to accept documents necessary for the provision of a public service, or in the provision of a public service, except for the cases provided for in paragraph 4 of part 1 of Article 7 of the Federal Law of July 27, 2010 No. 210-FZ “On the organization of the provision of state and municipal services.”

3.3. Violations of the deadline for the provision of public services.

3.4. Refusal to the applicant:

3.4.1. In accepting documents, the submission of which is provided for by the regulatory legal acts of the Russian Federation and the city of Moscow for the provision of public services, on grounds not provided for by the regulatory legal acts of the Russian Federation and the city of Moscow.

3.4.2. In the provision of public services on grounds not provided for by the regulatory legal acts of the Russian Federation and the city of Moscow.

3.4.3. In the correction of typographical errors and errors in documents issued as a result of the provision of public services, or in case of violation of the established deadline for such corrections.

3.5. Other violations of the procedure for providing public services established by regulatory legal acts of the Russian Federation and the city of Moscow.

4. Complaints about decisions (actions, inaction) of officials, civil servants of the Department are considered by the head of the Department or an authorized deputy head of the Department.

Complaints about decisions and (or) actions (inaction) of the head of the Department, including decisions made by him or his authorized deputy on complaints received in a pre-trial (extrajudicial) manner, are considered by a higher executive body of the city of Moscow in accordance with clauses 5.6, 6 Appendix 6 to the resolution of the Moscow Government of November 15, 2011 No. 546-PP “On the provision of state and municipal services in the city of Moscow.”

5. Complaints can be submitted to the bodies authorized to consider them in writing on paper or electronically in one of the following ways:

5.1. Upon personal application by the applicant (applicant’s representative).

5.2. By post.

5.3. Using the Portal if technically possible.

5.4. Using the official website of the Department on the Internet.

6. The complaint must contain:

6.1. The name of the body authorized to consider the complaint or the position and (or) surname, first name and patronymic (if any) of the relevant official to whom the complaint is sent.

6.2. The name of the executive authority of the city of Moscow or the position and (or) surname, first name, patronymic (if any) of the official, state or municipal employee, employee, whose decisions and actions (inaction) are being appealed.

6.3. Last name, first name, patronymic (if any), information about the place of residence of the applicant - an individual, including one registered as an individual entrepreneur, or name, information about the location of the applicant - a legal entity, as well as contact telephone number(s), address (addresses) email (if available) and postal address to which the response should be sent to the applicant.

6.4. The date of submission and registration number of the request (application) for the provision of a public service (except for cases of appealing the refusal to accept the request and its registration).

6.5. Information about decisions and actions (inactions) that are the subject of appeal.

6.6. Arguments on the basis of which the applicant does not agree with the decisions and actions (inactions) being appealed. The applicant may submit documents (if any) confirming the applicant’s arguments, or copies thereof.

6.7. Applicant's requirements.

6.8. List of documents attached to the complaint (if any).

6.9. Date of filing the complaint.

7. The complaint must be signed by the applicant (his representative). If a complaint is filed in person, the applicant (applicant's representative) must provide an identification document.

The authority of the representative to sign the complaint must be confirmed by a power of attorney issued in accordance with the law.

The powers of a person acting on behalf of an organization without a power of attorney on the basis of the law, other regulatory legal acts and constituent documents are confirmed by documents certifying his official position, as well as the constituent documents of the organization.

The status and powers of legal representatives of an individual are confirmed by documents provided for by the legislation of the Russian Federation.

8. A received complaint must be registered no later than the working day following the day of receipt.

9. The maximum period for consideration of a complaint is 15 working days from the date of its registration. The period for consideration of the complaint is 5 working days from the date of its registration in cases of appeal by the applicant:

9.1. Refusal to accept documents.

9.2. Refusal to correct typos and errors made in documents issued as a result of the provision of public services.

9.3. Violations of the deadline for correcting typos and errors.

10. Based on the results of consideration of the complaint, a decision is made to satisfy it (in whole or in part) or to refuse satisfaction.

11. The decision must contain:

11.1. The name of the executive authority that considered the complaint, position, surname, first name, patronymic (if any) of the official who made the decision on the complaint.

11.2. Details of the decision (number, date, place of adoption).

11.3. Last name, first name, patronymic (if any), information about the place of residence of the applicant - an individual or name, information about the location of the applicant - a legal entity.

11.4. Last name, first name, patronymic (if any), information about the place of residence of the applicant’s representative who filed the complaint on behalf of the applicant.

11.5. Method of filing and date of registration of the complaint, its registration number.

11.6. Subject of the complaint (information about the decisions, actions, or inactions being appealed).

11.7. The circumstances established during the consideration of the complaint and the evidence confirming them.

11.8. Legal grounds for making a decision on a complaint with reference to the applicable regulatory legal acts of the Russian Federation and the city of Moscow.

11.9. The decision taken on the complaint (conclusion on the satisfaction of the complaint or refusal to satisfy it).

11.10. Measures to eliminate identified violations and deadlines for their implementation (if the complaint is satisfied).

11.11. Information about the actions carried out by the executive authority of the city of Moscow, a local government body, an organization subordinate to the executive authority and a local government body that provides public services, a multifunctional center for the provision of public services in order to immediately eliminate identified violations in the provision of public services, as well as an apology for the delivered inconvenience and information about further actions that the applicant needs to take in order to receive public services (if the complaint is satisfied).

11.12. Reasoned explanations about the reasons for the decision made (in case of refusal to satisfy the complaint).

11.13. Procedure for appealing a decision.

11.14. Signature of the authorized official.

12. The decision is made in writing using official forms.

13. The measures to eliminate identified violations specified in the decision include:

13.1. Cancellation of previously made decisions (in whole or in part).

13.2. Ensuring the acceptance and registration of the request, execution and issuance of a receipt to the applicant (in case of evasion or unreasonable refusal to accept documents and their registration).

13.3. Ensuring registration and delivery to the applicant of the result of the provision of a public service (in case of evasion or unreasonable refusal to provide a public service).

13.4. Correction of typos and errors made in documents issued as a result of the provision of public services.

13.5. Refund to the applicant of funds, the collection of which is not provided for by the regulatory legal acts of the Russian Federation and the city of Moscow.

14. The body authorized to consider the complaint refuses to satisfy it in the following cases:

14.1. Recognition of the appealed decisions and actions (inactions) as legal and not violating the rights and freedoms of the applicant.

14.2. Filing a complaint by a person whose powers have not been confirmed in the manner established by regulatory legal acts of the Russian Federation and the city of Moscow.

14.3. The applicant does not have the right to receive public services.

14.4. Availability:

14.4.1. A court decision on the applicant’s complaint with identical subject matter and grounds that has entered into legal force.

14.4.2. Decisions on a complaint made earlier in a pre-trial (out-of-court) manner in relation to the same applicant and on the same subject of the complaint (except for cases of appealing previously made decisions to a higher authority).

14.5. The complaint does not allow us to establish those decisions and actions (inactions) of the executive authorities of the city of Moscow and the organizations subordinate to them that are being appealed (the subject of the appeal is not determined).

15. The complaint must be left unanswered on its merits in the following cases:

15.1. The presence in the complaint of obscene or offensive language, threats to the life, health and property of officials, as well as members of their families.

15.2. If the text of the complaint (part of it), last name, postal address and email address are not readable.

15.3. If the complaint does not indicate the name of the applicant (the applicant's representative) or the postal address and email address to which the response should be sent.

15.4. When the body authorized to consider the complaint receives a request from the applicant (the applicant’s representative) to withdraw the complaint before a decision is made on the complaint.

16. Decisions to satisfy the complaint or to refuse to satisfy it are sent to the applicant (the applicant’s representative) no later than the working day following the day of their adoption, to the postal address specified in the complaint. At the request of the applicant, the decision is also sent to the email address specified in the complaint (in the form of an electronic document signed with the electronic signature of an authorized official). In the same manner, the applicant (the applicant’s representative) is sent a decision on the complaint, in which only an email address is indicated for the response, and the postal address is missing or cannot be read.

17. If the complaint is left unanswered on the merits, the applicant (his representative) is sent, no later than 5 days from the date of registration of the complaint, a written motivated notification indicating the grounds (except for cases where the complaint does not indicate a postal address and email address for a response or they are unreadable). The notice is sent in the manner established for sending a decision on a complaint.

18. A complaint filed in violation of the rules on competence established by paragraph 5.4 of these Regulations is sent no later than the working day following the day of its registration to the body authorized to consider the complaint, with simultaneous written notification to the applicant (his representative) about the forwarding of the complaint (unless the complaint does not include a postal address or email address for response or is not legible). The notice is sent in the manner established for sending a decision on a complaint.

19. Filing a complaint in a pre-trial (out-of-court) manner does not exclude the right of the applicant (applicant’s representative) to simultaneously or subsequently file a complaint in court.

20. Informing applicants about the judicial and pre-trial (extrajudicial) procedure for appealing decisions and actions (inaction) committed in the provision of public services should be carried out by:

20.1. Posting relevant information on the Portal.

20.2. Consulting applicants, including by telephone, email, and in person.

21. If, during the consideration of a complaint, signs of administrative offenses or criminal offenses are established, the relevant materials must be sent to the bodies authorized to initiate proceedings in cases of administrative offenses and criminal cases within two working days following the day the decision on the complaint is made (but no later than the working day following the day of expiration of the period established by law for consideration of the complaint).

How to get a copy of the charter from the tax office

The procedure for issuing a copy of the charter. First of all, you need to decide on the required period for receiving documents and their quantity, pay the state fee, make a request for a copy of the charter according to the standard sample, and then submit these documents to the registration authority (FTS). Important An official appeal is drawn up in the form of an application for the issuance of a duplicate document in any form and contains the following information:

This is interesting: What is required to replace a driver's license in 2021

The firmware of the Charter has the right to be signed by a person approved by the general meeting of founders to represent interests in the Federal Tax Service as an applicant. Obtaining a copy of the Charter Produced only at the Federal Tax Service When submitting documents through the MFC, a certified copy of the Charter can only be obtained at the multifunctional center of the Charter (form 2021) Rate the quality of the article .

Charter as the only constituent document

The very first edition of the Civil Code of the Russian Federation considered the constituent documents of a legal entity to be its Charter and constituent agreement. However, such a norm immediately met with sharp criticism from many legal scholars. They argued that the memorandum of association is a consensual civil transaction between entities. That is, at its core, it is an agreement on joint activities, or even an independent type of agreement. It is based on the free will of the parties, is concluded between them, and does not in any way affect the legal capacity of the legal entity.

Therefore, this document cannot be considered constituent. But the Charter (unlike an agreement) is not concluded, but approved. And only it contains all the necessary rules that give legal capacity to a legal entity: location address, name, functioning of governing bodies, distribution of profits, rights and obligations of participants, and so on.

In the end, the legislator bowed to the side of the critics and recognized the Charter as the only constituent document.

Thus, a local regulatory document in the form of a Charter, establishing the legal capacity of a legal entity and containing the mandatory information specified in the law, is considered constituent The charter is signed exclusively by the founders and is subject to mandatory state registration.

How to order a copy of the charter through the multifunctional center

To do this, you need to contact the multifunctional center, whose specialists will advise and help with the preparation of documents necessary for registering the company. A multifunctional center is a government agency whose main goal is to facilitate the interaction of the population with local government authorities. The MFC operates on the principle of a “single window” and allows you to receive many government services in one place, without contacting many different organizations and institutions.

How to order a copy of the charter from the tax office Attention Form for submitting the Charter Features Personally, in order of priority The Charter is represented as part of the constituent documents by the person appointed to create and submit the forms or the founders Use of a representative of interests If the founders are unable to participate in the submission of documents, a representative of interests can participate.

Deadlines for receiving documents

As a rule, in any service for online preparation of tax plan documents, the terms range from one to five business days. However, the period may be extended due to changes in legal address, as well as other deterrent factors. It also depends on the location of the tax service itself compared to the distance from the organization. The deadlines for processing documents do not include non-working days of the organization that prepares the documents, as well as non-working days of the tax organization itself. If the request is urgent, it can be received the next business day, but this will have a different cost.

To find out the approximate date of receipt of the requested documents, you need to rely on the date indicated on the receipt that is sent to the applicant after payment.

How to Get a Copy of the Charter from the Tax Office 2021 Through MFC

How to obtain duplicates of constituent documents: request procedure In the application itself, you need to write a desire for a copy of the charter due to the loss of the document itself. This is mandatory, since the copy is made from the original, which was kept in the archives of the tax service itself.

- name of the legal entity;

- main state registration number;

- TIN and KPP - these data can be clarified on the Federal Tax Service website by entering the name in the form at egrul.nalog.ru;

- legal address of the company;

- information about the applicant: full name, passport details, address and contact telephone number of the director;

- the reason for applying for duplicates (loss, damage to documents);

- preferred method of receiving a response.

Features of obtaining copies of various documents from the Federal Tax Service

The procedure for issuing duplicates itself is not regulated at the legislative level, and therefore organizations often encounter difficulties in the process of restoring documentation. You cannot apply to restore the entire “registration package” of a company at once. For each document there is a separate request with its own nuances.

Let's consider how to obtain duplicates of constituent documents from the tax office, taking into account the contents of the requested copy.

- From the moment of registration of the LLC, one copy of its Charter is kept by the Federal Tax Service. To obtain a duplicate of the constituent document, you need to fill out an application with the wording for issuing a copy of the Charter of the legal entity in the current edition. For this service there is a state duty of 200 rubles (KBK 18211301020016000130).

- To restore the state registration certificate, the application must indicate the OGRN and the date of registration of the company. Some inspectors require that a confirming extract from the Unified State Register of Legal Entities be attached to the request. You will have to receive it separately: it is free for the organization if you can wait 5 days. For an urgent statement, which is not issued the next day, you will need to pay 400 rubles (KBK 18211301020016000130). The fee for the duplicate OGRN itself is 800 rubles - it is advisable to attach the receipt to the application, but tax authorities can check the payment themselves. The KBK details when filling out the payment form are 18210807010011000110.

- Re-obtaining a tax registration certificate (TIN) costs 200 rubles. The receipt indicates the budget classification code – 18210807310011000110.

- When requesting from the Federal Tax Service a copy of the decision of the sole participant or the minutes of the general meeting, organizations are sometimes refused to issue documents. Tax authorities refer to Art. 6 of the Law on Registration of Legal Entities, which states that documents with passport data of company participants are not provided to third parties. The manager is the legal representative of the company, and his right to receive duplicate documents is fixed by the Charter of the LLC. On this basis, the refusal to issue the requested copies to the director and his authorized representative is unlawful. Recorded cases of such refusals due to the inability to transfer documents without a court decision or a request from law enforcement agencies were successfully challenged. The minutes of the meeting of participants may contain a clause on the appointment of the company as CEO, so if the document is lost, it must be restored. As for decisions on changes in statutory documents, the registrar may not have copies of them, since they are not always included in the list of mandatory ones.

Please note that from June 30, 2015, new regulations are being introduced for the provision by tax authorities of information and documents contained in the Unified State Register of Legal Entities (approved by Order of the Ministry of Finance No. 5n dated January 15, 2015).

All our recommendations for obtaining duplicates of constituent documents are given taking into account changes in the regulatory framework.

How to order a copy of the charter from the tax office

If an interested person requires another copy of the constituent document, he must contact the tax authority and declare the need for an additional copy. How to order a copy of the Charter from the tax office? To do this, the applicant will need to follow the following procedure.

- for registration of real estate transactions;

- when performing any notarial acts;

- for submission to judicial authorities;

- during licensing;

- in order to restore a damaged or lost document;

- to open a bank account;

- to third parties - to obtain information about the counterparty for the purpose of concluding cooperation or to confirm his good faith.

About receiving the charter

From the act of the Federal Law on the registration of state documents approving a legal entity, it follows that the relevant body is obliged, at the request of certain interested parties, to present a copy of the charter - a document that also contains an application for registration, various protocols and certificates of the agreement. Absolutely any person has the right to receive copies of such a document.

This information is open and accessible. Also, the need to receive a copy of the charter is very widespread, so there should not be any difficulties in obtaining it and there is also no need to be afraid of the electronic version.

In some cases, the tax office may refuse to issue a copy of the charter if it contains information about the passport data and addresses of an individual.

How to get a copy of the charter from the tax office 2021

To obtain paper confirmation of the existence of a charter, you can make a corresponding request to the MFC by attaching it to the registration documents (paragraph 3, paragraph 3, article 11 of Federal Law No. 312). Based on the results of its consideration, a representative of the government agency will issue an official document with a seal indicating the existence of an electronic copy of the charter.

On April 29, 2021, new amendments to the law “On State Registration of Legal Entities” came into force. " dated 08.08.2021 No. 129-FZ (hereinafter referred to as the Law “On State Registration”), and from the indicated date, legal entities and individual entrepreneurs, although they can still send documents to the registration authority both on paper and in electronic form, however Upon completion of registration procedures, the tax office is obliged to send the business entity documentation in electronic form, certified by an enhanced qualified digital signature (Clause 3, Article 11 of the Law “On State Registration”). The regorgan now provides paper documentation only upon additional request (see below).

Duty for a copy of the articles of association 2021

The Payment of state duty service also allows you to use the non-cash electronic payment service. From March 11, 2014 Order of the Ministry of Finance of Russia dated December 26, 2013 N 139n came into force, from which it follows that failure to provide a document on payment of state duty is not grounds for refusal of registration; the tax authority can request it in the information system on state and municipal payments independently. Thus, you can avoid going to the bank by paying the state fee, for example, through a Qiwi wallet.

Please note that in case of registration of changes to the Charter, it is possible to receive a copy of the new edition of the Charter only 10 working days after the state registration of these changes. We value our clients and constantly strive to improve the quality of services.

How to receive a charter electronically from the tax office

- Create a scanned copy of the charter submitted for registration.

- Download a program to create a transport container containing documents submitted to the tax office. This can be done by following the link.

- Form a transport container, for which you should:

- fill out an application to register the charter or amend an existing document;

- attach a copy of the registered articles of association;

- sign the created package with an electronic digital signature.

- Follow the link, check the functionality of the service and begin uploading the prepared documents to the Federal Tax Service server.

On April 29, 2021, amendments to the law “On State Registration...” of August 8, 2021 No. 129-FZ came into force, according to which branches of the Federal Tax Service of the Russian Federation were exempted from the obligation to issue paper documents to newly registered and liquidated organizations, as well as companies who submitted an application to change information in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs. Instead of the usual completed paper forms, entrepreneurs are issued electronic documents with similar legal force (Clause 3, Article 11 of Federal Law No. 129).

State duty for issuing a charter at the tax office

This means that creating copies from already reproduced documents without the individual consent of the Federal Tax Service is an illegal action. Info Federal Tax Service may restrict access to minutes of meetings or some statements Procedure for filing an application and required documents So, when registering an enterprise with the tax service, the applicant is given only one copy of the Charter.

- On the appointed day, you come to our office to receive the completed document.

- We pay an official fee for you for providing a copy in the amount of 430 rubles, fill out, submit and receive documents from the tax office.

- You fill out the application form on our website, including the name of the organization, its OGRN and TIN. Next, you need to indicate which version of the charter you need. This may be a constituent document when created, amended, or its new edition.

- Within 30 minutes, a specialist from Infora JSC will contact you and clarify the details of the order.

This is interesting: Assignment of Veteran of Labor for Work Experience 35 to 40 in 2021

How should a law firm act?

Unfortunately, the number of companies that provide intermediary services with government agencies and provide services online - very many are, if not fraudulent, then very far from the promises of the companies themselves. Therefore, in order to choose a competent and efficient company, you need to take into account some nuances. Often, low-quality companies work very unreliably, incompetently and employ a staff of lazy and illiterate specialists. As a rule, a quality company has a large list of positive reviews not only from legal entities, but also from government agencies. A good company does not chase short deadlines and has a smaller flow of clients, due to which it works more efficiently. Also, quality companies are not guided by template application forms provided ready-made on the website, but contact the customer “manually” to establish a more individual approach. In such services, a specific specialist is responsible for each individual required type of service. It is very important to pay attention to the procedure for payment for services: it must be done only after receiving the work already done by the company, and not with an advance payment. It is important not just to receive documents in hand or print them out, but to receive truly necessary and specific papers that will be regulated.

The law firm is also required to ensure that all required documentation copies are correctly completed. She should know how to correctly submit documents to the tax authority and when asking an online consultant, he should be able to tell you step by step about this procedure. Also, upon any receipt or refusal to receive a copy of the constituent document, the company must properly verify and approve the information received. If a refusal was received from the tax authorities and the company is not at fault, then it is obliged to provide a letter from the tax office with a refusal, which clearly states the reason for the refusal.

The price for the services performed must be agreed upon in advance and be fixed, that is, it does not become a different amount upon receipt of the documents. The company is obliged to bear all unforeseen expenses, and not to increase the final amount of the service by arguing for any sudden expenses on documents - the company is obliged to take into account all expenses in advance on its own. Attentive attitude towards the client and competent, clear forms to fill out must be provided regardless of the services performed, whether in person or online. In online mode, all email addresses of the applicant and the company itself must also be taken into account.

Also, if there is a need to obtain an urgent and immediate document (within 1-2 days), the company may often require photocopies of already valid versions of the charter. But the order period also often depends not on the actions of the chosen law firm, but on the tax office, which is based on the territorial location in which the customer or his company is located.

Get a copy of the charter from the tax office

- in the form of a paper document by mail, directly by the applicant himself to the tax authority, an authorized organization or through a multifunctional center;

- in electronic form using Internet technologies, including a single portal of state and municipal services (functions) (if technically possible).

If our client provides an extract from the Unified State Register of Legal Entities from the Sbis, Kontur electronic system and certifies it with his seal. Will it be enough...

Where can I get duplicates?

Duplicate copies that have all the attributes of the originals, such as “live” seals and signatures, series and number, are stored at the tax office at the place of registration of the legal entity. The Federal Tax Service, according to the provisions of the Tax Code of the Russian Federation and Law 129-FZ on the registration of legal entities, is obliged to keep records and store all documents provided by organizations to the registration authority. There you can also obtain information about the company contained in the state register of legal entities.

The constituent document of the organization, according to Art. 52 of the Civil Code of the Russian Federation, is only the Charter. An exception is a legal entity in the form of a business partnership: it is created on the basis of a constituent agreement. In everyday life, all papers related to the state registration of a company are called constituent papers:

- LLC charter;

- sheets of amendments to the charter;

- protocol/decision on the creation of a company;

- certificate of registration (OGRN);

- taxpayer registration certificate (TIN).

To obtain each of these documents, a separate request is submitted to the Federal Tax Service.

State duty for duplicates of the LLC charter at the tax office

The state fee for issuing a duplicate of the charter can be paid through the tax office, where a special receipt is generated, or in another convenient way. Often important papers are stored in one place, so all documents of a limited liability company are lost or damaged at once.

An organization can receive a duplicate of the charter once a month free of charge, 5 days after sending the corresponding request. Any individual can receive a copy of the organization’s charter the next day (for this you need to pay a state fee of 400 rubles) or 5 days after submitting a request and paying a state fee of 200 rubles.

The procedure for applying for duplicates of the LLC charter, certificates of assignment of TIN and OGRN

- Transfer of the fee paid for carrying out a legally significant action to issue a duplicate (payment is made according to the details of the territorial unit of the Tax and Duty Inspectorate to which the applicant applies);

- Filling out an application for the issuance of a certified copy by filling out a written form or an electronic form on the official website of the Federal Tax and Duty Service, which is addressed to the Federal Tax Service division at the place of registration of the organization’s legal address;

- Applying to the territorial body of the Federal Tax Service with an application for the issuance of a certified copy, attaching a document confirming the transfer of the required state duty;

- Receiving a certified copy of the required document from the territorial division of the Federal Tax Service.

A limited liability company can issue a power of attorney to any individual to apply for a duplicate, which requires notarization. The tax authority issues a duplicate TIN certificate to the applicant personally or to his representative by proxy. The period for producing a duplicate should not exceed five working days from the date of submission of the application.

To obtain a certified copy of the specified document, you must contact the territorial division of the Federal Tax Service at the place of registration of the Company. The procedure and composition of documents that must be provided to obtain a certified copy are the same for all tax inspectorates in the country.

The charter, approved by the participants of the company upon its creation, is the constituent document of the limited liability company. During the process of state registration of a Limited Liability Company, one of the original copies of the charter remains with the tax authority, so a legal entity has the opportunity to obtain a duplicate of this document.

The official website of the Federal Tax Service contains resources that allow you not only to find out background information on the procedure for applying for duplicates of these documents. but also to file an application for their restoration by submitting an electronic application. To do this, the Limited Liability Company must register on the website and gain access to your personal account.

- Draw up an Application in accordance with the administrative regulations approved by Order of the Ministry of Finance of Russia dated January 15, 2015 No. 5n;

- Collect a package of documents confirming your legal status. faces;

- Pay the state fee;

- Submit documents to the Federal Tax Service or MFC office.

The Tax Service has the right to refuse to provide a duplicate if errors were made when submitting the Application or the package of constituent documents turned out to be incomplete - some inspectorates request a lease agreement or other legal confirmation. addresses. By placing an order for a duplicate of the Charter through a representative company, the possibility of refusal is eliminated.