The second and final procedure on the path to recognizing financial insolvency is the sale of property in the event of bankruptcy of individuals. It allows you to pay off debts or part of them through the sale of the bankrupt’s property.

If the value of the property is not enough to repay the debt, then as a result of the procedure the debts will be written off. Let's consider how long the implementation procedure lasts and how it goes, who is responsible for its implementation and what nuances the bankrupt needs to take into account in the process.

In what cases is it possible to use the implementation procedure?

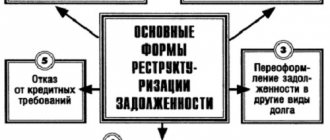

How does restructuring proceed in the event of bankruptcy of an individual?

Bankruptcy involves two stages

: introduction of a rehabilitation procedure and direct sale of property. Rehabilitation in this case is debt restructuring: a plan is drawn up to repay the bankrupt’s debts, which he must fulfill within 3 years. The schedule must receive approval from the creditors, the debtor, and the court.

According to the law, the sale of a citizen’s property can occur only after debt restructuring. In practice, in 80% of cases, the sale of the property of a debtor declared bankrupt is introduced immediately. This may occur due to the low income of the debtor, lack of stable wages, too much debt and other circumstances.

Sale of property

debtor is entered if:

- the parties did not submit a debt repayment plan for consideration by the court (the schedule can be proposed by any interested participants in the bankruptcy case);

- the debtor does not have enough income to fully cover the debt for 3 years (for example, if the debt is 2 million rubles, and the monthly income is 20,000 rubles, for which you still need to support your family);

- the court rejected the proposed schedule (for example, if it significantly violates the interests of the debtor: it forces him to give 80% of his income to pay off the debt, etc.);

- debt restructuring was nevertheless introduced, but the debtor violated the terms of the plan for settlement with creditors;

- the parties entered into a settlement agreement, which was later violated by the debtor or one of the creditors;

- in the application for recognition of bankruptcy, the debtor requested to proceed directly to the procedure for the sale of property (such a right is guaranteed by the Federal Law “On Bankruptcy”).

Final stage of bankruptcy

From this period, the newly-made bankrupt no longer faces the restrictions that were imposed on him in connection with the bankruptcy procedure of an individual. He no longer has the obligation to fulfill creditor demands (at the same time, he is not exempt from fulfilling alimony requirements, compensation for damages and current payments), and he has a chance to start life with a clean slate, without loans and debts.

FINEXPERT 24 is a reliable law firm that employs competent and experienced lawyers. Don't be afraid of BANKRUPTCY! Indeed, in some cases, this is the best way to find peace of mind and gain FREEDOM from debt slavery. Our lawyers have extensive experience and today they have 100% practice in declaring clients BANKRUPTCY. After analyzing your documents, our company’s specialists will undertake all obligations to manage your case and bring it to completion

How long does it take to sell a property?

According to legal standards, the implementation period is on average 4-6 months. It is possible to extend the period for the sale of property if:

- disputes have arisen between the participants in the process requiring litigation;

- it is impossible to sell the property the first time, and a second and third stage of bidding is necessary;

- Additional time is needed for revaluation or examination of the property put up for sale and other circumstances.

Judicial practice: controversial car for a disabled person

In case No. A41-14878/16, disputes between the debtor and the creditor over property delayed the legal process. The first petitioned to exclude from the bankruptcy estate the car and income to support himself and his disabled wife. He needed a car to take his wife to the hospital and to get to work himself. The Constitutional Court and the Appeal agreed with the arguments and excluded what was required, but the Constitutional Court sided with the bank. The judge ruled that the law provides for the exclusion from the bankruptcy estate only of property or funds in the amount of up to 10 thousand rubles. The case was sent for a new review, and implementation was delayed indefinitely.

Bankruptcy procedure for an individual: duration of stages

- Preparing for the case. Includes:

- application preparation: 1-2 days;

collection and preparation of documents: up to 2 weeks;

- selection of a financial manager and discussion of business management: 2-5 days;

- selection of the Arbitration Court for the case - 1 day.

- The court reviews the submitted documents and schedules the first hearing in the case. In practice, this stage takes 3-5 weeks. Here everything depends on the workload of the Arbitration Court and sometimes even on the schedule of a particular judge. The longest waiting periods are in the Arbitration Courts of Moscow and St. Petersburg; there are many cases of litigation here, and judges schedule cases in a month or even two.

- The first court hearing and the introduction of one of the procedures. In relation to the debtor the following may be entered:

- debt restructuring. It consists of drawing up a plan for repaying debts, discussing it and accepting it. Next, the debtor makes payments within a specified time and closes the debt: albeit independently, but under the control of the financial manager.

If a restructuring is introduced in relation to the debtor, then first the creditors or the debtor develop, and then the court approves, a payment schedule for the debt. This will take at least 3 months: the financial manager analyzes the debtor’s finances, reports to the court that the finances are not enough and asks to enter into a sale in order to write off everything.

The maximum duration of the restructuring procedure is 3 years. During this period, a person must pay off debt obligations according to the schedule approved by the court. If the schedule is fulfilled, the case is closed, bankruptcy is not recognized, the person retains the property, but pays off the debts.

sale of property. Consists of forming a bankruptcy estate and assessing property. Next, tenders are held, settlements with creditors are carried out, and debt obligations are closed. If there is no property, the sale takes place without bidding - the manager takes an inventory of the property and reports to the court that there is nothing to sell. Based on the results of the sale, the court writes off the debts to zero.

If a citizen wants to sell a car before bankruptcy or, for example, close a mortgage, the preparatory stage will require more time. Sometimes citizens get divorced before the procedure in order to divide property through the court and keep 2 apartments and assign alimony. Then, after consultation with a lawyer, 2-3 months will pass before filing an application with the Arbitration Court. But this will save the property from sale and write off debts without loss.

In this procedure, from the moment of filing the application until the completion of bankruptcy and debt write-off, at least 6 months pass. On average, physical a person is declared bankrupt within 7-8 months. Complex bankruptcy processes, where an individual has many creditors, has disputed property, and has tax claims, last up to 2 years. But this most often concerns individual entrepreneurs or former directors of companies.

Accordingly, it will take an average of 8-9 months to declare insolvency and complete the legal process, taking into account the preparatory stage.

What property is subject to sale?

The law equally guarantees respect for the rights and freedoms of each party to the case. A bankrupt has the right to keep certain things to himself.

Property that cannot be sold includes:

- the only housing is an apartment or house with a plot;

- personal belongings - hygiene items, clothing, etc.;

- agricultural objects - buildings, sheds, tools, etc.;

- seeds for sowing, domestic animals;

- household items - household appliances, furniture, etc.;

- tools or equipment for work worth up to 10,000 rubles.

So, what can an individual take away in case of bankruptcy? Everything that was not listed in Art. 446 of the Code of Civil Procedure of the Russian Federation, namely: land plots, residential and non-residential real estate, luxury goods, etc.

If the debtor has no other property other than the one mentioned above, and the debt is less than 500 thousand rubles, starting from the fall of 2021, debts can be written off in an out-of-court (simplified) manner. The application is submitted to the MFC; the debtor does not bear the costs of the procedure.

How to file for bankruptcy of an individual through the MFC

Only those debtors in respect of whom the bailiff has issued a resolution to terminate enforcement proceedings due to lack of property will be able to take advantage of extrajudicial bankruptcy (clause 4, part 1, article 46 No. 229-FZ).

However, if the debts were not settled, or the bailiff service completed the proceedings for another reason (for example, if it was impossible to determine the location of the debtor), then the MFC employee will be forced to return the application for bankruptcy.

You can re-apply to the multifunctional center for insolvency after a month.

Features of the sale of bankrupt property

Control over the debtor's assets during the formation of the bankruptcy estate and the subsequent sale of property in the bankruptcy case is transferred to the manager. The latter’s actions can be appealed to the court by both the individual and his creditors.

Important . The procedure for selling property in the event of bankruptcy of an individual with the status of an individual entrepreneur is somewhat different from the usual one. Assets that were used directly for running a business are sold according to the rules established for legal entities, and the remaining property is sold according to the standard procedure.

Spouses' property: will the debtor's family suffer in bankruptcy?

The legal status of property acquired jointly during marriage is specifically regulated by the legislator. The Family Code of the Russian Federation speaks about this (Article 34 of the RF IC).

Example:

Case No. A54-1301/2016 presents a situation where the interests of the bankrupt’s spouse are required to be taken into account as part of the sale of the debtor’s property in bankruptcy proceedings. The debtor's wife started dividing the property after her husband applied to arbitration and bankruptcy was declared against him.

The woman was refused both in the court of general jurisdiction and in the arbitration court, but the Supreme Court of the Russian Federation, in its decision No. b-KP 8-1, took her side and indicated that the second spouse retained the right to a share of the property.

In practice, in a marriage, a regime of joint ownership arises, which means that according to the general rules, if the spouses do not divorce and do not divide property, everything they own is sold, after which half of the proceeds from the auction are returned to the second spouse.

How to preserve property

Bankruptcy does not mean that a citizen will be left on the street with nothing. Judicial practice confirms that with the help of bankruptcy, a citizen gets rid of debts and lives peacefully in his apartment.

The reason is the peculiarities of the sale of property, knowledge of which ensures the protection of the interests of the bankrupt.

Bankrupt's apartment

In 2021, citizens who have one apartment or house and do not have money to pay off debts will file for insolvency. And they are doing the right thing, because the only housing (except for a mortgage) is not confiscated as part of declaring citizens insolvent. The cost of housing does not matter - its price can reach 100 thousand and 100 million.

A bankrupt will not be evicted from an apartment or cottage, even if the area is larger than regional standards. Banks offered to buy a minimum living space on the outskirts in exchange for a luxury apartment, but recently the Supreme Court prohibited the exchange of a bankrupt’s luxury apartment for another. Banks do not have the right to decide where their debtor will live.

Bankruptcy is a legal mechanism for getting rid of debts when there is nothing to pay them off. At the same time, this procedure provides for the sale of a citizen’s property to at least partially repay arrears and debts.

Some defaulters, in order to protect their belongings from the sale of the debtor’s property in the event of bankruptcy of an individual, make dangerous mistakes at auction.

For example.

The debtor gives valuables to friends or transfers them to relatives. The law states that transactions carried out three years before bankruptcy can be declared invalid if they violate the right of creditors to receive debt. Donated items are returned to the former owner, included in the bankruptcy estate and sold.

Transactions with relatives, as well as the sale of assets at a low price, raise suspicions. Lenders will require verification of the transaction, which will greatly delay the process. If a defaulter has several loans, but pays only one, the court will regard this as a violation of the interests of the remaining creditors - everyone must pay in proportion to the amount of the debt. Challenging transactions will result in the debtor not having his debts written off at all.

What to do?

Lawyers advise not to sell all your property - this will only provoke its loss, and besides, you will set up the buyer. If you want to keep your dacha or car, talk to a lawyer in advance - your authorized representative will participate in the auction to officially buy the property.

Mortgage and pledge

Bankruptcy of individuals with a mortgage: how to save an apartment? Related article

Items pledged or mortgaged are included in the bankruptcy estate. Their value and procedure for sale are determined by the secured creditor. This happens with mortgages and car loans.

There is a chance to keep the mortgaged apartment even in case of bankruptcy, if the bank that issued the mortgage is not included in the register of creditors. To make this possible, monthly payments should be made on time and avoid late payments. Other creditors do not have the right to apply for foreclosure of the mortgaged property if it is the only one.

What will happen to jointly acquired property?

The financial manager will sell the common property of the husband and wife; it is registered not in the name of the debtor, but in the name of his spouse. The manager has the right to request information about the property of the other half from Rosreestr, the Federal Tax Service, the State Traffic Safety Inspectorate and other government agencies.

The common property is sent to auction, and the husband or wife of the bankrupt has a choice:

- buy half of the property at auction on a priority basis - at the price that won the auction. If the property is sold cheaply, the spouse will become the sole owner of the property;

- receive half the proceeds from the sale of common property. If the property has become expensive, the spouse will keep his money.

Will a spouse's property be affected by bankruptcy? Related article

What happens in practice.

The financial manager begins to search for the spouse’s property only under pressure from creditors or the court, and this rarely happens. If the bankruptcy procedure begins at the initiative of the debtor, he personally selects SRO financial managers. “His” financial manager is not interested in robbing the client. Typically, the financial manager does not request information about the property of the spouses.

What is the risk?

If the bankruptcy of an individual was initiated by a bank, the situation is different. The jointly acquired property will be found and sold at auction. Concealing property or concluding a marriage contract will lead to negative consequences - transactions will be challenged, and the property will be sent to auction.

It is better to cooperate with the financial manager and evaluate in advance with a lawyer the fate of everything acquired during the marriage.

Stages of property sales

This process is carried out in several stages:

- Drawing up a register of creditors.

Typically, claimants are given 2 months during which they must state their claims. Creditors can find out about the bankruptcy of a particular citizen in the EFRSB (publications are made by a financial manager appointed by the court).Interesting incidents arise when selling collateral. If the deadline is missed, the creditor is not included in the register. This happened in case No. A05-3506/2016, where the secured creditor was not included in the register in a timely manner. In this regard, the bankrupt demanded to exclude the mortgaged housing from the bankruptcy estate on the basis that it is his only one.

The lower courts considered that the absence of a secured creditor does not provide such an opportunity, and the apartment should be sold in favor of the remaining claimants. However, the Supreme Court of the Russian Federation, in its ruling dated June 13, 2019 No. 307-ES19-358, did not agree with them and returned the case for a new review.

- Formation of the bankruptcy estate.

This includes the following processes:- inventory;

seizure;

- property valuation.

In most cases, the assessment is carried out by the financial manager himself, but in controversial situations, professional experts are involved. Their work is paid for by the party that invited the appraisers to participate.

At the same stage, the debtor may apply for exclusion from the bankruptcy estate of property that:

- protected by legislative immunity;

- costs no more than 10,000 rubles.

The financial manager is obliged to check whether the debtor has tried to hide any property, and whether he really found himself in difficult circumstances. If, however, signs of premeditation and fictitiousness are present, then the debts will not be written off, and the debtor himself will fall under liability under Art. 196 - 197 of the Criminal Code of the Russian Federation.

This process can be divided into 2 stages:

- sale of movable property worth up to 100,000 rubles;

It can be sold through advertisements on thematic platforms. - sale of expensive real estate and other property.

This is carried out through the involvement of an organizer for conducting electronic trading at auctions. It can be carried out in several stages, after which the remaining property:will be offered to creditors as payment of debt;

or will be transferred to the bankrupt back into ownership.

At this stage, the financial manager must:

- carry out settlements with creditors;

Source

Article 20.6. Remuneration of an arbitration manager in a bankruptcy case

- The arbitration manager has the right to remuneration in a bankruptcy case, as well as to full compensation for expenses actually incurred by him in the performance of his duties in a bankruptcy case.

- Remuneration in a bankruptcy case is paid to the arbitration manager at the expense of the debtor, unless otherwise provided by this Federal Law.

- The remuneration paid to the arbitration manager in a bankruptcy case consists of a fixed amount and an amount of interest. The fixed amount of such remuneration is for: financial manager - twenty-five thousand rubles at a time for carrying out the procedure used in a bankruptcy case.

- The amount of interest on the remuneration of the financial manager in the event of introducing a procedure for the sale of a citizen’s property is seven percent of the amount of proceeds from the sale of the citizen’s property and funds received as a result of the collection of receivables, as well as as a result of the application of the consequences of invalid transactions. This interest is paid to the financial manager upon completion of settlements with creditors.

Federal Law of October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”

Read completely

At the final hearing, the court reviews the report and closes the case, writing off the remaining debts and releasing the citizen from obligations to creditors.

Bidding in bankruptcy of a citizen

Bankruptcy auctions are held in 3 stages:

- Auction with increasing value. The basis is the market price of the property in increments of 5–10% of the amount. The participant who offers the maximum price wins.

- If there are no applications or if only one applicant participates in the auction, the auction is considered invalid. Then the property is relisted at a discount of 10–30%.

- At the final stage, auctions are held with a decrease in value, applied to illiquid property. The cost is reduced, for example, by 10% every week, until the first purchase request.

- If no buyers are found, the property is offered to creditors in kind.

- If the creditors refuse, then the object is transferred back to the bankrupt with the drawing up of a transfer and acceptance certificate.

Sale of property as collateral

The sale of pledged property is carried out under the control of the pledge bank.

If the bank is involved in bankruptcy, the mortgaged apartment is sold, even if it is the only one. 80% of the proceeds will be transferred to the mortgagee, 7% will be the remuneration of the arbitration manager, and the rest will be used to satisfy the claims of other creditors and pay off expenses.

The same scheme will apply to the sale of a pawned car if you took out a loan to purchase it, and even if you pawned your car at a pawnshop or microfinance organization to receive cash.

If you took out a loan for a kettle or a bicycle, then most likely they will not be confiscated from you and sold at auction. Unless, of course, it's a brand new bike of a very expensive brand.

Things are more complicated with electronic equipment. These are home theaters, expensive gaming laptops. The financial manager will decide whether to withdraw and sell them.

When deciding on bankruptcy, you must understand that you will have to part with part of your property

According to the court, a car, jewelry, a summer house, a second apartment, a plasma TV on an entire wall, fur coats and expensive laptops can be sold to pay off debts. As a rule, a person who decides to go bankrupt no longer has such values - or never had them. Therefore, a potential bankrupt no longer has to be afraid of the word “realization”. The court will not deprive you of your last money.

Consequences of introducing an implementation procedure

If the debtor does not have any property, he does not risk anything. The procedure will be carried out without sales or bidding, and debts will be written off upon completion of all formalities. If you still have property, it is important to remember how the process works:

- pledged property must be sold

, even if it is protected by legislative immunity.This also applies to mortgages - if the only housing is in fact secured by the bank, then it is subject to sale;

- transactions entered into within three years before bankruptcy may be challenged

at the discretion of the financial manager.You should not rewrite your property or draw up gift agreements immediately before the procedure for establishing your insolvency. Such a transaction will quickly arouse suspicion, and the manager will file a lawsuit to declare it invalid.

also include

:

- the need to transfer control over your income to a financial manager for the duration of the entire implementation procedure, who will dispose of them legally;

- the court may decide to impose a ban on the debtor’s travel abroad of the Russian Federation. However, this ban is automatically lifted after the completion of the sale of the citizen’s property.

Do you need to declare bankruptcy? Contact professional specialists! We have successfully assisted in bankruptcy recognition and debt relief in over 3,000 cases. Our team consists of experienced lawyers, crisis managers and economists.

We practice a team approach and individual search for solutions to each case, thanks to which we are able to achieve success even in the most difficult circumstances. We will make sure that your case is resolved in your favor and in the shortest possible time!

Samples of documents for the sale of property

Application form for the introduction of the sale of property (17.1 KB)

Sample of filling out an inventory of the debtor's property (574.9 KB)

Limitations that the debtor needs to be prepared for

The procedure for selling property involves introducing a number of restrictions in relation to an individual who admits financial insolvency. The first thing you need to do is transfer your existing bank cards to the manager. The debtor has one day to do this after the start of the implementation procedure.

Other nuances that are important to consider:

- The debtor will not be able to manage the funds that are in his accounts and open new accounts

- A ban is introduced on transactions involving property: you cannot give, sell, pledge or perform other transactions

- You cannot receive new loans from banks, loans from microfinance organizations, or repay them yourself, that is, without bidding and following the order

FAQ

I live in a house. There is also a share in a city apartment. Will this share be sold if I file for bankruptcy?

Yes, the second home is subject to sale. An inventory of the property will be taken, your part of the apartment will be appraised and included in the bankruptcy estate. Next, the share is put up for sale through electronic trading. If they still don’t buy it (shares in real estate are not very popular among buyers), then the financial manager will first offer it to creditors. If they refuse, it will be transferred back to you according to the acceptance certificate.

Two years ago I gave my granddaughter a dacha - a plot of land with outbuildings. I'm about to file for bankruptcy. Will the gift agreement be challenged?

Rest assured, the transaction will definitely be identified and its circumstances will be analyzed. It matters what your financial situation was at the time of donation. If there were already debts then, then the deal will almost certainly be challenged, and the dacha will be returned to the bankruptcy estate. If at that time there were no delays, then the transaction is unlikely to be considered suspicious.

My only home is a house outside the city. Can they sell it in bankruptcy in order to buy simpler real estate in return?

Not yet. Law enforcement practice regarding the sale of single housing is still being discussed. Therefore, if you are going to declare bankruptcy, it is better to do it now.

During the divorce, the husband got the car, the wife got the house. Will there be problems with his car if his wife goes through bankruptcy?

It all depends on when the debts arose and who spent the money that was loaned. If, for example, you bought a car with this money, and in general the spouses spent the loans together, then there is a risk that creditors will make claims against the car.

We will write off your debts through bankruptcy with a guarantee

A lawyer will call you back in 1 minute and provide advice. It's free.

How is the bankruptcy estate formed?

Bankruptcy estate - what is it? These are objects and property rights of the debtor that will be sold in bankruptcy. After making an inventory of the property, the financial manager himself or by court decision excludes from it property that cannot be taken away in bankruptcy. We have listed the objects that are not taken away above. Everything that remains is included in the CM.

What transactions of the debtor can be challenged in the event of bankruptcy of an individual? persons? Article on the topic

The CM may additionally include:

- money from the sale of accounts receivable. For example, if a former employer owes a bankrupt salary, this claim will be sold;

- collateral transferred to the creditor;

- objects on disputed transactions.

These objects will also go to auction for settlements with creditors.

The car can be kept if you prove to the court that he needs it for work or belongs to the category of transport for the disabled. Our lawyers will tell you more about how cars are sold during bankruptcy and what are the chances of keeping the car during your consultation.