Unfortunately, when businesses go bankrupt, it is not only big businessmen who suffer, who lose a source of huge income, but also ordinary workers and other employees who lose their jobs. Sometimes wages are not paid for months, but employees continue to come to work, hoping for the best. That is why they are so interested in how wages are paid when an enterprise goes bankrupt. And wages must be paid, even if the employee did not last until the end of the bankruptcy process and quit. Moreover, when a legal entity goes bankrupt, there are almost always arrears of wages to employees.

What happens to employees

So, the company went bankrupt, and there were not only shareholders, but also employees. They will also be hit hard. Not only may they not receive a salary for quite a long time, but they will also lose their jobs as a result, since the enterprise declared bankrupt is liquidated. Moreover, it does not matter whether the employee is a socially protected person. For example, even women on maternity leave can be fired, although a compensation mechanism will be included. In addition, in the event of bankruptcy of an organization, employees may demand:

1. Severance pay in the amount of one average monthly salary in production.

2. Receiving an average monthly salary for two months (for the period of employment). This amount will include severance pay. If an employee registers with the employment center, the number of salaries may increase to three

3. To be sent notice of his upcoming dismissal. This is necessary so that the employee has time to prepare for upcoming financial losses. Typically, notices are required to be given at least two months prior to termination.

But compensation is not everything, because employees worked and have the right to receive wages in the event of bankruptcy of the enterprise. It doesn’t matter when exactly they quit – before or after the start of the procedure, or they didn’t quit at all. True, there is a sequence that, according to the law, must be observed.

At the same time, employees, or rather their representatives, have the right:

- take part in meetings of the arbitration court;

- attend meetings of creditors;

- see the reports of the arbitration manager.

Employees have the right to demand wage arrears, defending their interests. To do this, citizens can apply not only to the labor inspectorate, but also to the prosecutor’s office or court.

Types of salary debts in bankruptcy

All salary debts of a bankrupt enterprise are divided into two types:

- Current. These are debts for wages accrued after the date of initiation of bankruptcy proceedings by the arbitration court. It is considered initiated from the moment the court issues a ruling to accept the application for declaring the debtor bankrupt.

- Registered. These are salary debts incurred before the above date.

The duration and procedure for paying wages in bankruptcy depends on the type of debt.

Let us note that when we talk about salary debts, we mean not only the salary itself, but also other amounts due to the employee as remuneration: bonuses, allowances, vacation pay, as well as severance pay. Although such debts in bankruptcy have payment priority over most other debts of the enterprise, the employee may not receive his money at all, but the likelihood of receiving a salary for the current debt is higher than for the registered one.

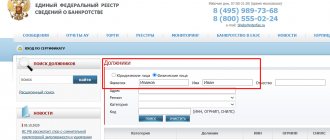

Determining the type of debt is simple: you need to use the online service “Card Index of Arbitration Cases”, where you can find a bankruptcy case by the name of the organization and look at the date of the relevant determination.

Types of debt

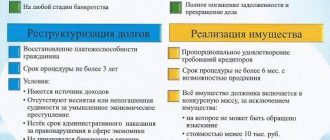

There are two main types of debts of a bankrupt company:

- Current. This is the name given to the amount of money that bankrupt companies must pay after bankruptcy is declared. However, the money in question was not paid to the employees. These amounts are not included in the register of claims, but they are in first place in terms of speed of compensation.

- Registry. This category includes debts on wages, benefits, vacation pay, workers' compensation before the company was declared bankrupt. Such debts are included in the register and are listed among the second-priority debts.

First of all, the debtor must pay legal costs, which cannot be avoided if you go through all the circles of hell of the bureaucratic bankruptcy procedure. Only after this will debts be paid to employees, many of whom may have worked for the company for years and built a career in it. You will also have to compensate for damage to health and morale, but only if the company has such obligations to its employees.

Companies are not always interested in transferring debts to employees; therefore, in order to protect their interests, employees can choose a representative who protects their interests. It is best for this to be a professional who has positive experience in such matters.

According to the law, debts of a current nature are initially paid, and only after that the payment of registered debts begins.

Collection of current debts

Since current debts are paid first in the bankruptcy process, let us consider the features of this procedure in more detail. It should be taken into account that the current debt on wages is taken into account separately and is not included in a special register, which includes all claims of creditors. This is a huge advantage for employees whose salary arrears are included in this list. But there is a nuance: current debts also refer to many other expenses that the debtor incurred during the trial. That is why we will consider what debts can be called current:

- legal costs that arose during the consideration of bankruptcy cases;

- payment for work arb. manager;

- payment for the services of those persons who were attracted by the AU to assist in the bankruptcy procedure (notaries, appraisers, etc.).

As a result, the costs turn out to be more than large, because even if employees stand outside the register queue, this does not guarantee that they will get at least something. This happens because debts are covered by income from the sale of the debtor’s property, which is not always enough.

Wage arrears in this situation cannot be returned through the court. The workers' demands have already been accepted, but the problem is the financial well-being of the debtor, which turned out to be so bad that it is impossible to compensate for the debts. But there is also good news. According to statistics, if wage debts are included in the current debt, most likely they will be returned to the person.

But if an employee’s rights are violated, a complaint to an arbitration court is the most objective measure. If the fact is confirmed, then the court will determine the amount of payment.

Collection of registered debts

If wage debts accumulated before the bankruptcy case began, they will be included in the register. It includes all debts, perhaps excluding current ones, which have their own category, which we discussed above. The register contains not only salary debts before bankruptcy, but also the company’s debts to creditors and third parties.

The register is compiled and maintained by a manager appointed by the arbitration court, but there may be cases when this process is handled by a special registrar organization. It is in order to get into this register that you need to contact the manager in time, otherwise you may not be included in the queue or moved too far in the queue. This is fraught with the fact that there will be no money left to compensate the debt.

In order to ensure that the requirement has been included in the register, you can contact the AU. He can issue an extract from the register, and then there will be no unpleasant surprises. But there are several conditions for how you need to send a document:

- the letter must be registered with a list of attachments;

- sent to the address indicated on the FRSB website.

In addition, in addition to information about whether the employee is included in the register, it will be interesting to evaluate other advantages of the document. It contains all the relevant information on the case, so the workers' representative can view the AC reports to stay informed about what is happening and instruct clients.

By the way, if the registry indicates the wrong amount of debt (for example, less than required), this can be challenged. However, in this case you need to seek help from the district court. His decision serves as sufficient evidence and basis for inclusion of changes in the register.

What to do if the employer demands the return of wages during bankruptcy?

Once again about bankruptcy (previous article: Vicarious liability. How to avoid?).

How to avoid losing paid wages after initiating bankruptcy proceedings?

The Federal Law “On Amendments to Certain Legislative Acts of the Russian Federation and the Invalidation of Certain Legislative Acts (Provisions of Legislative Acts) of the Russian Federation” dated December 22, 2014 No. 432-FZ introduced measures into the Bankruptcy Law according to which the bankruptcy manager can challenge the debtor’s payments to the employee under an employment contract.

Cases of arbitration managers challenging employment contracts that were concluded with employees a year, two or even three years before the date of the introduction of bankruptcy proceedings for the debtor-employer have often appeared in judicial practice.

Let’s consider the employee’s position on such requirements using an example of a case from our practice:

In 2021, the bankruptcy trustee of the debtor organization applied to the Arbitration Court of the Moscow Region with an application to invalidate the transaction in the form of concluding an employment contract in 2015, applying the consequences of the invalidity of the transaction in the form of collecting money from the employee in favor of the debtor in the amount of 3 million rubles. .

The application was filed on the basis of 61.1, 61.2, 61.6, 61.8 of the Bankruptcy Law.

In support of the stated claim, the applicant indicated that the disputed employment contract is an invalid transaction, since it was concluded with unequal counter-performance in order to cause harm to the property rights of the debtor's creditors. In his opinion, the payment of excessively high wages harmed the property rights of the debtor and his creditors.

On unequal counter performance

In accordance with paragraph 1 of Art. 61.2 of the Bankruptcy Law, a transaction completed by a debtor within one year before the acceptance of an application for bankruptcy or after the acceptance of the said application may be declared invalid by an arbitration court in the event of unequal counter-fulfillment of obligations by the other party to the transaction, including if the price of this transaction and (or) other conditions differ significantly for the worse for the debtor from the price and (or) other conditions under which similar transactions are made in comparable circumstances (suspicious transaction). In particular, any transfer of property or other fulfillment of obligations will be recognized as unequal counter-fulfillment of obligations if the market value of the property transferred by the debtor or other fulfillment of obligations performed by him significantly exceeds the value of the received counter-fulfillment of obligations, determined taking into account the conditions and circumstances of such counter-fulfillment of obligations.

The content of this norm is explained in paragraph . 8 P of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 23, 2010 No. 63 “ On some issues related to the application of Chapter III.1 of the Federal Law “ On Insolvency (Bankruptcy) ” (hereinafter referred to as Plenum Resolution No. 63):

“Clause 1 of Art. 61.2 of the Bankruptcy Law provides for the possibility of declaring a transaction invalid in the event of unequal counter-fulfillment of obligations by the other party to the transaction. In accordance with paragraph. 1 clause 1 art. 61.2 of the Bankruptcy Law, unequal counter-fulfillment of obligations by the other party to the transaction occurs, in particular, if the price of this transaction and (or) other conditions at the time of its conclusion differ significantly for the worse for the debtor from the price and (or) other conditions, under which similar transactions are made under comparable circumstances. When comparing the terms of a transaction with similar transactions, one should take into account both the conditions of similar transactions made by the debtor, and the conditions under which similar transactions were made by other participants in the turnover.”

From the terms of the disputed transaction it directly follows that it is a compensatory nature with equivalent counter-compensation. To analyze similar transactions carried out under comparable conditions, we believe that special knowledge and the appointment of a forensic economic examination and/or the involvement of a specialist are required.

Taking into account the above, we believe that there is no sign of unequal consideration and there are no grounds for declaring the transaction invalid under clause 1 of Article 61.2 of the Bankruptcy Law.

Causing harm to the property rights of creditors

In accordance with paragraph. 1 item 2 art. 61.2 of the Bankruptcy Law, a transaction made by a debtor for the purpose of causing harm to the property rights of creditors may be declared invalid by an arbitration court if such a transaction was completed within three years before the adoption of an application for declaring the debtor bankrupt or after the acceptance of the said application and as a result of its completion there was damage was caused to the property rights of creditors and if the other party to the transaction knew about the specified purpose of the debtor at the time of the transaction (suspicious transaction). It is assumed that the other party knew about this if it is recognized as an interested party or if it knew or should have known about the infringement of the interests of the debtor’s creditors or about signs of insolvency or insufficiency of the debtor’s property.

The content of this norm is explained in paragraph 5 of Plenum Resolution No. 63:

“Clause 2 of Art. 61.2 of the Bankruptcy Law provides for the possibility of invalidating a transaction made by a debtor for the purpose of causing harm to the property rights of creditors (suspicious transaction). By virtue of this rule, in order to declare a transaction invalid on this basis, it is necessary that the person challenging the transaction prove the presence of the totality of all the following circumstances:

- the transaction was concluded with the intent to harm the property rights of creditors;

- as a result of the transaction, damage was caused to the property rights of creditors;

- the other party to the transaction knew or should have known about the specified purpose of the debtor at the time of the transaction (taking into account clause 7 of this Resolution).

If at least one of these circumstances is not proven, the court refuses to recognize the transaction as invalid on this basis.”

In this case, the above circumstances are absent, either individually or in combination:

Establishing the purpose of harm

In accordance with paragraph. 2 p. 2 art. 61.2 of the Bankruptcy Law, the purpose of causing harm to the property rights of creditors is assumed if at the time of the transaction the debtor was responsible or as a result of the transaction began to meet the criteria of insolvency or insufficiency of property and the transaction was made free of charge or in relation to an interested party, or aimed at paying (allocating) a share (share) in the property of the debtor to the founder (participant) of the debtor in connection with the withdrawal from the founders (participants) of the debtor, or committed in the presence of one of the following conditions:

- the value of the property transferred as a result of a transaction or several interrelated transactions or obligations and (or) obligations assumed is twenty or more percent of the book value of the debtor’s assets, and for a credit institution - ten or more percent of the book value of the debtor’s assets, determined according to the debtor’s financial statements as of the last reporting date before the completion of the specified transaction or transactions;

- the debtor changed his place of residence or location without notifying creditors immediately before or after the transaction, or hid his property, or destroyed or distorted title documents, accounting and (or) other reporting documents or accounting documents, the maintenance of which is provided for by the legislation of the Russian Federation, or as a result of improper performance by the debtor of the duties of storing and maintaining accounting records, the specified documents were destroyed or distorted;

- after the transaction for the transfer of property, the debtor continued to use and (or) own this property or give instructions to its owner to determine the fate of this property.

Conditions for determining the purpose of causing harm to the property rights of creditors

The content of this norm is explained in paragraph 6 of Plenum Resolution No. 63:

“According to para. 2 - 5 p. 2 tbsp. 61.2 of the Bankruptcy Law, the purpose of causing harm to the property rights of creditors is assumed if the following two conditions are simultaneously present:

- at the time of the transaction, the debtor met the criteria of insolvency or insufficient property;

- there is at least one of the other circumstances provided for in paragraph. 2 - 5 p. 2 tbsp. 61.2 of the Bankruptcy Law.

Established paragraphs. 2 - 5 p. 2 tbsp. 61.2 of the Bankruptcy Law, presumptions are rebuttable - they apply unless otherwise proven by the other party to the transaction.”

From the totality of these provisions, it follows that without establishing a sign of insolvency or insufficiency of the debtor’s property at the time of conclusion of the transaction, it is impossible to establish the purpose of causing harm to the property rights of creditors.

Determining the presence of signs of insolvency or insufficiency of property

According to para. 5 clause 6 of Plenum Resolution No. 63, when determining the presence of signs of insolvency or insufficiency of property, one should proceed from the content of these concepts given in paragraph. 33 and 34 art. 2 of the Bankruptcy Law:

insufficiency of property - an excess of the amount of monetary obligations and obligations to pay obligatory payments of the debtor over the value of the property (assets) of the debtor.

insolvency is the termination of the debtor’s fulfillment of part of his monetary obligations or obligations to pay obligatory payments, caused by insufficient funds.

Further, in para. 5 clause 6 of Plenum Resolution No. 63 clarified that for the purposes of applying those contained in paragraph. 2 - 5 p. 2 tbsp. 61.2 of the Law on Bankruptcy presumptions, the mere presence at the time of the transaction of signs of bankruptcy specified in Art . 3 and 6 of the Law, is not sufficient evidence of the presence of signs of insolvency or insufficiency of property.

Consequently, the mere establishment of signs of bankruptcy of the debtor by the ruling of the Arbitration Court of the Moscow Region on the introduction of a monitoring procedure against the debtor, as well as the decision of the Arbitration Court of the Moscow Region to declare the debtor bankrupt, do not indicate the presence of signs of insolvency and insufficiency of property.

In addition, according to open data, the debtor’s assets as of December 31, 2015 amounted to 90 million rubles. (data from the website www.e-ecolog.ru/buh). Thus, the debtor's assets exceeded the amount of debt.

At the time of the transaction, the debtor was carrying out current activities and continued to pay off creditors.

Accordingly, the debtor had no signs of insolvency and/or insufficiency of property.

Establishing damage to the property rights of creditors

In accordance with paragraph. 6, paragraph 5 of Plenum Resolution No. 63, the burden of proving harm lies with the applicant.

Paragraph 7, paragraph 5 of Plenum Resolution No. 63 establishes that when determining damage to the property rights of creditors, it should be borne in mind that by virtue of paragraph. 32 art. 2 of the Bankruptcy Law, it is understood as a decrease in the value or size of the debtor’s property and (or) an increase in the size of property claims against the debtor, as well as other consequences of transactions or legally significant actions carried out by the debtor, which led or may lead to a complete or partial loss of the ability of creditors to obtain satisfaction of their claims for the debtor's obligations at the expense of his property.

That is, signs of harm are:

- a decrease in the value or size of the debtor’s property and an increase in the size of property claims against the debtor;

- an increase in the size of property claims against the debtor;

- other consequences of transactions or legally significant actions performed by the debtor, which have led or may lead to a complete or partial loss of the ability of creditors to obtain satisfaction of their claims for the debtor’s obligations at the expense of his property.

Based on the available data, we believe that the transaction did not harm the property rights of creditors, because:

- there was no simultaneous decrease in the value or size of the debtor’s property and an increase in the size of property claims against the debtor, because the transaction is compensated and provides for equivalent compensation;

- there was no increase in the amount of property claims against the debtor due to the provision of counter-equivalent compensation;

- no other consequences of the transaction have occurred that have led or may lead to a complete or partial loss of the ability of creditors to obtain satisfaction of their claims for the debtor’s obligations at the expense of his property.

In addition, the size of the assets is greater than the size of the registered debt, therefore there is no violation of the rights of creditors.

Thus, there is no totality of circumstances established by paragraph 2 of Art. 61.2 of the Bankruptcy Law, taking into account the explanation in paragraph 5 of Plenum Resolution No. 63.

The other party to the transaction knew or should have known about the specified purpose of the debtor at the time of the transaction

According to the explanations of the Plenum of the Supreme Arbitration Court of the Russian Federation, given in paragraph 7 of Resolution No. 63, by virtue of paragraph. 1 item 2 art. 61.2 of the Bankruptcy Law, it is assumed that the other party to the transaction knew about the transaction with the aim of causing harm to the property rights of creditors if:

- she is recognized as an interested person (Article 19 of this Law),

- or if she knew or should have known about the infringement of the interests of the debtor’s creditors or about signs of insolvency or insufficiency of the debtor’s property.

These presumptions are rebuttable - they apply unless otherwise proven by the other party to the transaction.

When deciding whether the other party to the transaction should have known about these circumstances, the extent to which she could, acting reasonably and exercising the diligence required by the terms of the transaction, establish the existence of these circumstances is taken into account.

Establishing a sign of interest

In accordance with paragraph 1 of Art. 19 of the Bankruptcy Law, interested parties in relation to the debtor are recognized as: a person who, in accordance with Federal Law of July 26, 2006 No. 135-FZ “On the Protection of Competition,” is included in the same group of persons as the debtor; a person who is an affiliate of the debtor.

In accordance with paragraph 1 of Art. 9 of the Federal Law “On Protection of Competition” a group of persons is recognized as a set of individuals and (or) legal entities that meet one or more of the following criteria:

- a business entity (partnership, business partnership) and an individual or legal entity, if such an individual or such legal entity has, by virtue of its participation in this business entity (partnership, business partnership) or in accordance with the powers received, including on the basis of a written agreement, from other persons, more than fifty percent of the total number of votes attributable to voting shares (shares) in the authorized (share) capital of this business entity (partnership, business partnership);

- a legal entity and an individual or legal entity performing the functions of the sole executive body of this legal entity;

- business company (partnership, business partnership) and an individual or legal entity, if such an individual or such legal entity, on the basis of the constituent documents of this business company (partnership, business partnership) or an agreement concluded with this business company (partnership, business partnership), has the right to give this business entity (partnership, business partnership) mandatory instructions;

- legal entities in which more than fifty percent of the quantitative composition of the collegial executive body and (or) board of directors (supervisory board, fund board) are the same individuals;

- a business company (economic partnership) and an individual or legal entity, if, at the proposal of such an individual or such legal entity, the sole executive body of this business company (economic partnership) has been appointed or elected;

- a business company and an individual or legal entity, if, at the proposal of such an individual or such legal entity, more than fifty percent of the quantitative composition of the collegial executive body or the board of directors (supervisory board) of this business company was elected;

- an individual, his spouse, parents (including adoptive parents), children (including adopted children), full and half brothers and sisters;

- persons, each of whom, according to any of the criteria specified in clauses 1 - 7 of this part, is included in a group with the same person, as well as other persons who are included with any of such persons in a group according to any of those specified in clauses 1 - 7 of this part;

- a business company (partnership, business partnership), individuals and (or) legal entities that, according to any of the characteristics specified in clauses 1 - 8 of this part, are included in a group of persons, if such persons, by virtue of their joint participation in this business company (partnership, economic partnership) or in accordance with the powers received from other persons, have more than fifty percent of the total number of votes attributable to voting shares (shares) in the authorized (share) capital of this business company (partnership, economic partnership).

In accordance with paragraphs 2, 3 of Art. 19 of the Bankruptcy Law, the following are also recognized as interested parties in relation to the debtor - a legal entity:

- the head of the debtor, as well as persons included in the board of directors (supervisory board), collegial executive body or other management body of the debtor, chief accountant (accountant) of the debtor, including these persons relieved of their duties during the year before the initiation of proceedings bankruptcy case or before the date of appointment of the temporary administration of the financial organization (whichever date came earlier), or a person who has or had during the specified period the opportunity to determine the actions of the debtor;

- persons who are with the individuals specified in paragraph. 2 of this paragraph, in the relations specified in paragraph 3 of this article;

- persons recognized as interested in the debtor’s transactions in accordance with civil legislation on the relevant types of legal entities.

Interested persons in relation to a debtor-citizen are his spouse, relatives in direct ascending and descending lines, sisters, brothers and their relatives in descending lines, parents, children, sisters and brothers of the spouse.

The employee does not meet the specified criteria and is not an interested party in relation to the debtor.

The employee knew or should have known about the infringement of the interests of the debtor’s creditors or about signs of insolvency or insufficiency of the debtor’s property

According to paragraph 12 of Plenum Resolution No. 63, when deciding whether the creditor should have known about these circumstances, what is taken into account is the extent to which he could, acting reasonably and exercising the diligence required of him by the terms of the transaction, to establish the existence of these circumstances. The facts that testify in favor of such knowledge of the creditor may, taking into account all the circumstances of the case, include the following: repeated appeals by the debtor to the creditor with a request to defer the debt due to the impossibility of paying it within the originally established period; known to the creditor (credit organization) for a long time, the presence of a file cabinet in the debtor's bank account (including hidden); the creditor's awareness that the debtor has filed for bankruptcy.

Meanwhile, at the time of the transaction, there was no information about the insolvency of the debtor in official periodicals (Several publications are established by law, the information posted in which is considered generally known - the newspaper "Kommersant", which publishes information about the bankruptcy of legal entities, "Bulletin of State Registration" on issues liquidation, reorganization and bankruptcy of legal entities) (Definitions of the Supreme Court of the Russian Federation dated October 7, 2016 No. 305-ES16-13165(1), No. 305-ES16-13165(2)).

The debtor's assets exceeded the amount of his accounts payable, an application to declare the debtor insolvent (bankrupt) was not filed with the court, the debtor carried out business activities and made settlements with counterparties.

Taking into account the legal position set out in the Resolution of the Constitutional Court of the Russian Federation dated July 18, 2003 No. 14 -P, according to which the formal excess of the amount of accounts payable over the amount of assets reflected in the debtor’s balance sheet is not evidence of the company’s inability to fulfill its obligations; such an excess cannot be considered as the only criterion characterizing the financial condition of the debtor, and the acquisition of negative values is not the basis for immediately filing a bankruptcy petition with the arbitration court; the applicant has not proven that the employee knew about the signs of insolvency or insufficiency of the debtor’s property.

Taking into account the above, there are no signs of a suspicious transaction specified in paragraph. 1 item 2 art. 61.2 of the Bankruptcy Law, namely: 1) the transaction was carried out by the debtor for the purpose of causing harm to the property rights of creditors, 2) as a result of its completion, harm was caused to the property rights of creditors, 3) the other party to the transaction knew about the specified purpose of the debtor at the time of the transaction.

Conditions for recognizing a transaction as suspicious

In accordance with paragraph 9 of the said Resolution, when determining the ratio of paragraphs 1 and 2 of Art. 61.2 of the Bankruptcy Law, courts must proceed from the following. If a suspicious transaction was completed within one year before the acceptance of the application for bankruptcy or after the acceptance of this application, then the circumstances specified in paragraph 1 of Art. 61.2 of the Bankruptcy Law, in connection with which the presence of other circumstances specified in paragraph 2 of this article (in particular, bad faith of the counterparty) is not required.

In case of challenging a suspicious transaction, the court checks the presence of two grounds established by both clauses 1 and 2 of Art. 61.2 of the Bankruptcy Law.

As stated above, the proceedings in the present case were initiated at the end of 2015, the disputed employment contract was concluded at the beginning of 2015, that is, within the period of suspicion.

Under the terms of the said agreement, the employee was hired as Deputy General Director with a monthly salary of 200 thousand rubles.

Declaring the invalidity of this transaction, the bankruptcy trustee referred to the excessively high salary of the employee compared to the level of wages in similar positions in other companies, and also indicated that the payment of wages in an inflated amount caused harm to the property rights of the debtor and his creditors.

According to Art. 1 of the Labor Code of the Russian Federation, the goals of labor legislation are to establish state guarantees of labor rights and freedoms of citizens, create favorable working conditions, protect the rights and interests of workers and employers.

The conclusion of an employment contract and other agreements regulating the legal relationship between an employee and an employer are actions of the named entities aimed at giving them rights and obligations within the framework of these legal relationships (Article 16 of the Labor Code of the Russian Federation).

By virtue of the provisions of Art. 129 of the Labor Code of the Russian Federation, wages are remuneration for work, depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation and incentive payments; salary - a fixed amount of remuneration for an employee for the performance of labor (official) duties of a certain complexity for a calendar month of compensation, incentives and social payments.

Articles 132 and 135 of the Labor Code of the Russian Federation stipulate that establishing the amount of wages for an employee is the exclusive authority of the employer.

The main responsibility of the employer is to provide employees with equal pay for work of equal value, payment of wages in full and on time (Article 22 of the Labor Code of the Russian Federation).

The salary of each employee, in accordance with the provisions of Articles 132, 135 of the Labor Code of the Russian Federation, depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended, and is not limited to the maximum amount and is established by the employment contract in accordance with the remuneration system in force at the employer.

In violation of Art. 65 of the Arbitration Procedural Code of the Russian Federation, the bankruptcy trustee of evidence confirming the non-compliance of the employee’s qualifications and professional qualities with the established amount of wages, as well as documents indicating non-fulfillment or incomplete fulfillment, or improper fulfillment (involvement in disciplinary and other liability) by the employee of the duties provided for employment contract, not provided.

As evidence confirming the unequal consideration, the bankruptcy trustee referred to information on the salary of the deputy general director provided by two organizations carrying out similar types of activities.

Meanwhile, the information provided does not indicate the average salary for a similar position, taking into account the scope of job responsibilities in the region.

The bankruptcy trustee did not provide any other evidence of overestimation of the official salary established for the employee.

Taking into account the above, there are no grounds to believe that the disputed employment contract has been concluded with unequal counter-performance.

This conclusion corresponds to the legal position set out in the ruling of the Supreme Court of the Russian Federation dated February 21, 2021 N 302-ES14-7670(5), in the ruling of the Moscow District Arbitration Court dated March 28, 2021 in case N A40-189262/15.

In addition, according to the calculation certificate presented by the applicant during the trial at our request, the employee was paid funds in the amount of 2 million rubles for the period 2015 – 2021. towards wages, including 500 thousand rubles. within the framework of execution of judicial acts.

Based on the terms of the employment contract, the employee’s salary should have been 200 thousand rubles, while according to the bankruptcy trustee’s certificate, monthly payments averaged 100 thousand rubles.

By virtue of clause 3 of Art. 37 of the Constitution of the Russian Federation, everyone has the right to work in conditions that meet safety and hygiene requirements, to remuneration for work without any discrimination and not lower than the minimum wage established by federal law, as well as the right to protection from unemployment.

Meanwhile, the employee’s wages were not paid in full, as a result of which he went to court. There was also no evidence of the employee transferring 3 million rubles, as stated by the bankruptcy manager. There are no grounds to believe that as a result of the conclusion of the disputed transaction, damage to the property rights of the creditors was caused.

Prejudicial significance of judicial acts

The legality of the calculation of wages in accordance with the terms of the disputed employment contract was confirmed by a decision of a court of general jurisdiction that entered into legal force, which, by virtue of Art. 16 of the Arbitration Procedural Code of the Russian Federation is mandatory for state authorities, local governments, other bodies, organizations, officials and citizens.

By virtue of clause 3 of Art. 69 of the Arbitration Procedural Code of the Russian Federation, a decision of a court of general jurisdiction in a previously considered civil case that has entered into legal force is binding on the arbitration court considering the case on issues regarding the circumstances established by the decision of the court of general jurisdiction and related to the persons participating in the case.

In the resolution of the Constitutional Court of the Russian Federation dated December 21, 2011. No. 30-P states:

“Recognition of the prejudicial significance of a court decision, being aimed at ensuring the stability and generally binding nature of a court decision, eliminating a possible conflict of judicial acts, presupposes that the facts established by the court when considering one case are, pending their refutation, accepted by another court in another case in the same or another form of legal proceedings, if they are relevant to the resolution of the case. Thus, prejudice serves as a means of maintaining the consistency of judicial acts and ensures the operation of the principle of legal certainty.

Thus, both recognition and denial of the prejudicial significance of final court decisions cannot be absolute and have certain limits established by procedural law. As the Constitutional Court of the Russian Federation indicated, the inherently exceptional possibility of overcoming the finality of judicial acts that have entered into legal force presupposes the establishment of such special procedures and conditions for their review that would meet, first of all, the requirements of legal certainty ensured by the recognition of the legal force of judicial decisions, their irrefutability, which in relation to decisions made in ordinary judicial proceedings may be shaken if any new or newly discovered circumstance or fundamental violations discovered undeniably indicate a judicial error, without the elimination of which it is impossible for the competent court to compensate for the damage caused (decrees of May 11, 2005 No. 5 -P, dated February 5, 2007 N 2-P and dated March 17, 2009 N 5-P, Determination dated January 15, 2008 N 193-O-P).”

The Constitutional Court of the Russian Federation indicates that the rule on the prejudicial significance of judicial acts can be overcome only in the event of the emergence of new or newly discovered circumstances or the discovery of fundamental violations that indisputably indicate a miscarriage of justice .

The applicant did not provide evidence of the existence of such circumstances that would allow one to ignore the requirement for the prejudicial significance of judicial acts in cases No. 2-1169/2017, No. 33-23366/2017.

In the case under consideration, the court refused to satisfy the stated requirements.

It should be noted that in order for the court to fully, comprehensively and objectively consider the claims brought against you, it is necessary to take into account all the nuances of the relationship between the employee and the employer during the suspicious period. Legal agency CONSULEX provides arbitration and judicial representation services.

Contact us - we will help you defend your rights and legitimate interests!

Queue between employees

Since one point in the queue has its own internal order, sometimes receiving a salary during bankruptcy is a rather complicated process with many misunderstandings. Everyone wants to get paid, but the further people stand in line, the less likely they are to receive compensation. And because employees put in the time and effort, they expect fair compensation rather than the possibility of it.

Even creditors who are in the same queue may not receive money at the same time. To avoid confusion, a special calendar is used. The rules here are simple: the sooner the debt appears, the sooner it will be repaid. But management is paid last. This is due to the size of their salary. If the amounts are greater than the stated limits, they go to the end of the queue (executed in the third queue). That is, they may not be compensated at all.

The amount of debt is formed taking into account:

- interest on arrears;

- vacation pay;

- compensation upon dismissal, etc.

The order of payments is as follows:

- First of all, severance pay and salary debts are returned (if the amount does not exceed 30 thousand rubles per employee).

- Next, the remaining debts to employees are compensated.

- Payment for the work of intellectual property owners.

Within queue groups, amounts are divided in equal shares.

How to avoid problems and maintain your business reputation

Pay your salary on time. Do not try to save money on employees; the salary fund is not the kind of money that can be invested in more “profitable activities” without dangerous consequences. If the delays are forced, make sure that the amount of debt does not exceed 300,000 rubles, and the delay in payments is no more than 3 months. If all the conditions for initiating bankruptcy are present, agree with a friendly creditor to declare bankruptcy and select a suitable arbitration manager. This will allow you to maintain control over your assets. Remember that any conflict with employees will attract public attention not only within the company, but also outside it. Media coverage of the issue may contribute to the loss of the company's positive reputation. Therefore, devote time to anti-crisis measures, work with trade unions, conduct surveys on the psychological situation in the team. Hold a general meeting, explain the reasons for the delay in wages, and state the exact deadlines for repaying the debt. If a company has serious financial problems that require a long period of rehabilitation, it is worth considering the option of reducing staff as painlessly as possible for both parties with payment of the required compensation.

Documents for receiving salary

If wages need to be demanded from a company, usually the most effective measure to obtain compensation is to go to court. This is a necessary step if payment of arrears is carried out with violations or the money is not paid at all. But in order to get a positive result on your application, you will need to collect a package of documents confirming the existence of the problem and capable of correcting it. So, the documents in such cases are:

- claim in duplicate;

- a copy of the employment contract;

- a copy of the order for employment;

- a certificate showing the calculation of the salary according to the tariff grid, that is, its average statistical size is highlighted;

- a copy of the payslip for the months when wages were not paid;

- calculation of total debt;

- decision of the labor dispute commission (copy);

- when submitting documents by a representative - a power of attorney.

The list may be expanded depending on the complexity of the case and how long it has been going on. But if you were unable to receive wages for your work, you need to fight for its return. Even if the company goes bankrupt, this is still possible. The law is on your side. And to increase your chances, it is advisable to hire a good lawyer. He will be able not only to help in returning the “bare” debt, but also, if there is a chance, to receive various dividends that will help hold out until the employees find a new source of income.

What salary payment rules should a bankrupt organization take into account?

Salaries must be paid at least every half month.

The employer sets the specific date for its payment independently in the internal labor regulations, a collective agreement or an employment agreement. But at the same time, it must be paid no later than 15 calendar days from the end of the period for which it was accrued. Read what a delay in salary payment can lead to in the “Practical Encyclopedia of an Accountant” berator.

Thus, although the issue of the procedure for issuing wages has been transferred to the organization, there is a requirement for the maximum permissible period of time after the end of the worked period, during which part of the wages for this period must be paid. And this requirement must also be observed by companies during bankruptcy.

Previously on the topic:

Bankrupt company: is it possible to pay premiums?

Salary amount

Let's talk further about how to receive a salary in a bankrupt enterprise, if during bankruptcy the company changed the salary several times. This fact significantly affects the total amount of the salary paid, and employees may not agree with the presented calculations. However, companies, or rather management and judicial authorities that are involved in the bankruptcy process, act using legal methods.

For example, the court may reduce the amount of the required debt, no matter what kind of debt we are talking about - registered or current. The reason for this change is the fact that the salary increased over the last six months before bankruptcy began. Moreover, this step on the part of the company may be considered an attempt to bring it to a crisis, and then the proceedings will drag on even longer. This does not mean that the money will not be returned at all, it’s just that the difference will be paid only in the third phase, if there is enough money for it.

Let's take a closer look at how debts entered into the register are paid to employees, because there is a certain priority in it. But the unfortunate thing is that there is often not enough money to pay for the remaining debt. At best, only a few injured workers will be refunded; at worst, no one will be compensated.

Repayment of current salary debt

Current salary debt is not included in the register of creditors and is accounted for separately. For the employee, this is a definite plus, since all current debts must be repaid earlier than the registered ones. However, current debts include not only wages, therefore the law determines the order of repayment of such debts.

The following will be paid first:

- bankruptcy court costs;

- activities of the arbitration manager;

- the activities of other persons who were involved by the arbitration manager to conduct the case.

Only after this will the current salary arrears be repaid. Given that the costs of filing a bankruptcy case are significant, the employee may not receive any money. This is especially true for situations where the bankrupt organization has little property, since it is through its sale that all debts are repaid.

In the situation described, it does not make sense for the employee to go to court to collect wages in bankruptcy, since his claims are already taken into account as part of current payments. The only thing that can be done is to send an official request to the arbitration manager about whether the debt to you is taken into account as part of current payments. By the way, practice shows that in most cases the current salary arrears are still paid.

If an employee learns that the manager has violated his rights (for example, by refusing to take into account the current salary debt or reducing its size), he can complain to the arbitration court hearing the case. The amount to be paid will be determined by the court.

Deadlines

If the bankrupts do not intend to pay the money at all, or do not pay the entire debt, it is necessary to seek justice. Persons to whom the company owes debt must be included in the register. But this needs to be done while the registry is open, and ideally as early as possible. The register will be closed two months after bankruptcy is officially declared. That is, the information was published and bankruptcy proceedings began.

Although there are cases when more time passes from the beginning of the procedure to bankruptcy proceedings, this should not stop employees from urgently filing documents. Even after this, it is important to make sure that you are included in the register, otherwise you cannot count on compensation later. There is often not enough money even to pay off the first and second stage debts, especially when the company is small and has large debts.

Employees need to be prepared to wait a long time for compensation debt, and the amount of compensation may not change for the better. Debts are compensated after bankruptcy proceedings. This is the last stage of bankruptcy, which is accompanied by several others, which last from several months to a couple of years. Only bankruptcy proceedings can drag on for six months, or even a year. This depends on many factors, such as the size of the company, the composition of its assets, etc.

How are workers' claims settled?

The insolvency procedure itself proceeds as usual for each type of organization, but employees are in a “privileged position.” Requirements for wages and benefits are satisfied immediately after current payments (clause 4 of Article 134, No. 127-FZ):

- first - in the amount of no more than 30,000 rubles for each month for each employee;

- further – the remaining amounts.

At the same time, salary claims that arose after the filing and acceptance of the bankruptcy petition relate to current payments and are satisfied first (Article 134, No. 127-FZ).

Nuances for certain types of organizations

For certain types of organizations, there are special conditions for initiating bankruptcy by decision of employees .

Thus, a credit organization can be declared bankrupt only after its license has been revoked, which means that employees are required to first submit an application for such revocation to the Central Bank (Article 189.61, No. 127-FZ). Employees can file for bankruptcy of an agricultural organization if the debt amount is over half a million rubles and there is a three-month delay in payments (Article 177, No. 127-FZ). Bankruptcy of a financial organization is permissible if the amount of salary debt is 100,000 rubles and the delay in payments is 14 days or more, or if the court decision to collect the debt is not executed within two weeks from the date of entry into force (Article 183.16, No. 127-FZ).

Can the bankruptcy trustee influence the amount of payments?

Yes maybe. We mentioned this right of the bankruptcy trustee when we wrote about the amount of payments. But this procedure is not the decision of the manager alone. This specialist evaluates the company’s total assets, and if he sees that they are not large enough, he submits a special petition to the court under his control. This court grants or denies pending petitions after examining the company's case. In addition, the manager can review the payment of salary in the case of a specific employee. But he cannot satisfy the demands of persons out of turn. This is illegal and is punishable by fines, removal of the manager and other sanctions.

Salary amount of an individual

If an organization that is at the stage of bankruptcy has repeatedly changed wages, then this makes the process of obtaining funds a little more complicated. Thus, it significantly affects the final salary. However, employees may not be satisfied with the resulting calculation.

Thus, the arbitration court may reduce the amount of the requested debt. The main reason is the increase in the employee's salary over the past 6 months.

Also, this step will be regarded by the authorized body as an attempt by the organization to deliberately bring itself to the stage of bankruptcy. And the trial may drag on for some more time.

Collection of current payments in a bankruptcy case – what does the law say?

The basis that regulates the process of declaring a debtor bankrupt is Law No. 127-F3 as amended on December 29, 2015.

Let's consider the specific points that are set out in this document.

We present them in table form. Laws regulating current payments

| № | Article | Nuance |

| 1 | P. No. 1, article No. 5 | Definition of current payments, how current payments arise |

| 2 | P. No. 2 and No. 3, article No. 5 | The statement that the claims of creditors arising from an insolvency court verdict are considered in the second priority when the requests of creditors from the first priority are fulfilled. |

| 3 | Article No. 95 | Types of payments that are subject to a moratorium and which may subsequently become current payments. |

| 4 | P. No. 1, article No. 134 | The court, upon receiving complaints about the failure of the bankruptcy trustee to fulfill its functions, independently clarifies the size and queue of execution of creditors’ requests. |

| 5 | P. No. 2.1., article No. 134 | The extra money that remains after consideration of the claims of the first and second stages can be paid within the third stage. |

| 6 | P. No. 4, article 20.4 | If the manager caused damage to the debtor or other persons, the court obliges him to pay both current payments and other payments to offset compensation for the damage caused. |

Online loan Monetkin Monetkin, Lits. No. 005894

from 0.27% per day

First loan 0%

up to 100 thousand

14 - 168 days

Take out a loan