The Internet has long been flooded with news that citizens who cannot cope with their debt burden will be able to go through bankruptcy proceedings for free and without the participation of the court. And so, on July 31, 2021, Federal Law No. 289-FZ “On Amendments to the Federal Law “On Insolvency (Bankruptcy) and Certain Legislative Acts of the Russian Federation Regarding Extrajudicial Bankruptcy of a Citizen” was signed and published. This law will come into force on September 1, 2021.

When introducing the bill, it was stated that the adoption of the federal law would help reduce the burden on the courts and increase the accessibility and efficiency of bankruptcy for citizens. In this article we will analyze the procedure for free (simplified) bankruptcy and see if this is really so and whether this novelty was created for people.

- What is simplified bankruptcy?

- Who can undergo simplified (out-of-court) bankruptcy?

- Required documents

- The procedure for registering simplified bankruptcy through the MFC

- Consequences of accepting an application for declaring bankruptcy under a simplified procedure

- Consequences of simplified bankruptcy

What is simplified bankruptcy?

Justifying the need to introduce a new mechanism for bankruptcy of individuals, the initiator of the innovations pointed to a number of reasons:

- stable dynamics of growth in the number of court decisions declaring citizens bankrupt;

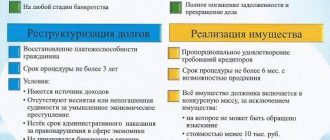

- the ineffectiveness of the rehabilitation procedure—debt restructuring—revealed in practice;

- an increase in the number of bankruptcies in which creditors do not receive any payments at the end due to the lack of income and property of the debtors;

Taken together, all these reasons explain the most important thing: the bankruptcy procedure is a labor-intensive, ineffective and expensive process.

Bankruptcy without court is a chance to get rid of accumulated debt free of charge in a simpler manner.

Free consultation on simplified bankruptcy

Who can undergo simplified (out-of-court) bankruptcy?

The simplified procedure is simplified because in order to initiate it it is necessary to meet a minimum number of conditions.

In order to go bankrupt for free you must:

- have arrears on monetary obligations or obligatory payments to the budget from 50,000 to 500,000 rubles;

- the debt must go through the stages of judicial collection and enforcement proceedings;

- the writ of execution must be returned to the claimant due to the debtor’s lack of property that can be levied against, and all measures taken by the bailiff to find the property have not brought results;

- after the return of the writ of execution, the writ of execution was not presented again for execution.

Everything is quite simple and a citizen can independently assess the chances of filing an insolvency application out of court.

Debtor's property and income

There are important points regarding property. If, during a six-month audit, valuable property subject to recovery is found, or legal income is discovered, bankruptcy will be impossible. Simply put, it turns out that the bailiff “missed” this and closed the case illegally. Therefore, it can be opened again at the request of the owner of the debt.

Similarly: if during these 6 months it is discovered that a citizen has acquired valuable property or began to receive legal income, bankruptcy will not be approved. In addition, during this period, a citizen is prohibited from taking out loans and becoming a guarantor.

Required documents

The law establishes only two mandatory documents that are necessary for a simplified bankruptcy procedure: an application and a list of creditors.

At the time of writing this article, the form of an application for insolvency (bankruptcy) in the “simplified” form has not yet been determined. At the same time, based on our extensive experience in supporting court cases, we believe that it would be reasonable to indicate in it the grounds for the occurrence and amount of the debt, the reasons for its occurrence, and justify your insolvency. If drafting documents causes you difficulties, it is better to contact a bankruptcy lawyer.

As for the list of creditors, the requirements for its content are specified in paragraph 4 of clause 3 of Article 213.4 of Federal Law No. 127-FZ: name of the organization or full name. creditor-individual, amount of debt, location (legal address) or place of residence of the creditor; arrears on obligatory payments arising as a result of the citizen’s entrepreneurial activity are entered in a separate line. The Ministry of Economic Development of Russia has developed a special form for the list of creditors, which is quite understandable for people, into which they only need to enter the necessary information (see Order of the Ministry of Economic Development of Russia dated 05.08.2015 N 530 “On approval of forms of documents submitted by a citizen when applying to court with an application for recognition him bankrupt").

Please note that judicial bankruptcy requires the provision of a whole package of documents in addition to the insolvency application: personal documents, documents confirming the debtor’s property status, documents confirming the basis and amount of the debt, and others. Free bankruptcy frees the debtor from the need to spend time collecting evidence due to the fact that the issue of his solvency at the time of filing the application was investigated by bailiffs.

The procedure for registering simplified bankruptcy through the MFC

The place of the court in the “simplified system” was taken by multifunctional centers providing public services to citizens (MFC).

An application for recognition as insolvent (bankrupt) in a simplified manner is submitted by the debtor to the MFC at the place of residence or stay. Within one working day, the MFC checks the availability of information about enforcement proceedings against the debtor, using publicly available information from the website of the Federal Bailiff Service on the Internet: https://fssp.gov.ru/iss/IP. This resource allows a person to independently monitor the actions of bailiffs - which is what we advise you to do before going to the MFC.

To accept the debtor’s documents, it is necessary that when checking enforcement proceedings:

- there was information about the return of the writ of execution to the claimant on the grounds provided for in paragraph 4 of part 1 of Art. 46 Federal Law No. 229-FZ “On Enforcement Proceedings”;

- there was no information about the conduct of other enforcement proceedings that began after the return of the writ of execution and that were not completed or terminated at the time of verification of the information.

If the results of the check do not correspond to any of the points, within 3 days the MFC returns to the debtor an application indicating the reason for the return - the debtor can apply again no earlier than in one month. If the applicant believes that there are no legal grounds for return, the refusal can be appealed to the arbitration court at the debtor’s place of residence.

Free consultation on simplified bankruptcy

Over 9 months of 2021, more than 5 thousand out-of-court bankruptcies were launched

From September 1, 2021 to September 30, 2021, multifunctional centers (MFCs) published messages about 5 thousand 120 initiated extrajudicial bankruptcy procedures for citizens. The number of returned applications amounted to 7 thousand 920 over the same 9 months. Accordingly, the share of started procedures is 39.3%. In March-September 2021, the MFC published messages about the completion of 2 thousand 801 simplified bankruptcy of citizens.

The amount of citizens' debt declared for write-off for 9 months of 2021 is 1 trillion 781.7 million rubles in the processes started through the MFC. Of these, 985.5 million rubles were written off at the beginning of October. The period allotted for the remaining procedures has not yet come to an end.

The leaders in the total number of initiated extrajudicial procedures for the year - from September 2021 to September 2021 - were:

- Omsk region (327 cases),

- Chelyabinsk region (256 pieces),

- Perm region (179 events),

- Krasnodar region (163 hits),

- Altai Territory (159 applications),

- Lipetsk region (155 submitted documents),

- Samara region (144 cases),

- Republic of Bashkortostan (140 pieces).

Consequences of accepting an application for declaring bankruptcy under a simplified procedure

If during the check on the FSSP database no obstacles were identified for accepting an application for insolvency in a simplified manner, the MFC begins work and publishes a message declaring a citizen bankrupt on the EFRS (Unified Federal Resource for Information on Bankruptcy).

Publishing a message on the EFRSB gives rise to a number of consequences:

- a moratorium is introduced on satisfying the claims of creditors for obligations, with the exception of those who were not indicated in the bankruptcy application; as well as requirements inextricably linked to the identity of the creditor (for more information about which debts cannot be written off, read our article);

- the deadline for fulfilling the stated obligations is considered to have occurred;

- the accrual of interest, penalties and fines stops - the debt no longer grows;

- creditors lose the opportunity to present writs of execution for execution anywhere (to a bank, Pension Fund, etc.) except the FSSP;

- all existing enforcement proceedings, with the exception of those opened in relation to obligations for which debts cannot be written off, are suspended;

- the applicant is limited in the rights to carry out transactions to obtain loans, credits, issue guarantees and other security transactions;

- in the event that the debtor acquires any property or a significant change in the financial situation (for example, employment in a higher-paying job), i.e. the presence of circumstances that make it possible to fully or substantially repay the claims of creditors - he must notify the MFC about this within 5 days, and it, in turn, must terminate the extrajudicial bankruptcy procedure within 3 days.

Stage 3. Interim liquidation balance sheet

This stage is a kind of “fork in the road” at which the similarity of this procedure with voluntary liquidation ceases. It is when drawing up an interim liquidation balance sheet (ILB) that an understanding must come as to whether the liquidated company has the funds to pay all creditors. If there are not enough of them, or there are none at all, it’s time to go into bankruptcy.

Before drawing up the PLP, the liquidator must conduct a reconciliation with the tax office, send requests to the State Traffic Safety Inspectorate, Rospatent, Rosreestr, and other registering organizations in order to search and clarify the property that the company may have. In essence, he collects a “bankruptcy estate” from which the claims of creditors will be satisfied.

So, the PLB is compiled, a message about this is submitted to the registration authority.

Important: according to the law, the PLB itself is not required to submit to the tax office. But sometimes there may be a refusal to register, even though it is illegal. Everyone chooses for themselves what to do - correctly, or to be accurately registered.

So, after receiving the Sheet of Record of Registration of this stage, it is time to move on to simplified bankruptcy.

Consequences of simplified bankruptcy

The simplified bankruptcy procedure lasts 6 months. If during this time the applicant has not identified property through the sale of which the debt can be repaid, a job has not appeared with sufficient income to meet the requirements, or an inheritance has unexpectedly fallen in; and the creditors have not started the bankruptcy procedure of the debtor in court - the procedure will be completed, the debtor will be released from further fulfillment of obligations, and the debt will be recognized as bad.

For an individual, after completing the procedure, in addition to writing off the debt, there are a number of consequences similar to completion by the court - they are listed in Article 213.30 of the Federal Law “On Insolvency (Bankruptcy)” (you can learn more about these consequences in our article on the consequences of bankruptcy of individuals ).

IMPORTANT: it is possible to write off debts within the framework of the simplified loan only for those obligations and for those creditors that are indicated in the application.

However, the “simplified” procedure also has several differences from the standard procedure:

- if less than a year has passed from the moment of termination of activities as an individual entrepreneur to the moment of filing an application for declaring bankruptcy out of court, upon termination, the consequences of bankruptcy not of an individual, but of an individual entrepreneur under Art. 216 of the Insolvency Law, in particular, the debtor will not be able to register as an individual entrepreneur for 5 years;

- You can go bankrupt again through the MFC only after 10 years.

Stage 2. Publications

Immediately after receiving the Sheet of Record of the beginning of liquidation, it is necessary to make a publication in the journal “Bulletin of State Registration”. And in the EFRSFYUL register. For the second, there is a deadline - three working days from the moment of registration of the message about the beginning of liquidation in the Unified State Register of Legal Entities. Basis - pp. “c” clause 7 article 7.1

Federal Law of August 8, 2001 No. 129-FZ (as amended on December 27, 2018) “On state registration of legal entities and individual entrepreneurs.”

As for the deadline, this is not an entirely accurate interpretation of the law, when information must be entered “within three working days from the date of the occurrence of the relevant fact.” Actually, questions arise when the fact arose - when was the decision on liquidation made, or when was it registered with the tax authority? But, since entry into the Unified State Register of Legal Entities lasts 7 working days, it is problematic to enter within three days after the decision is made. Thus, an interpretation was adopted that begins the period from the moment of state registration of the notice of the beginning of liquidation.

Relevant publications are needed so that the company’s creditors, if there are any, can submit their claims within a specified period of time (usually two months, less is not possible).

As a rule, the publication indicates the address of the company indicated in the Unified State Register of Legal Entities.

Important: if, after publication, the tax office suddenly recognized the company’s address as unreliable, and it was decided to change this address (or had to clarify it down to the office and premises), you will have to submit the publication to Vestnik again.

Only information about the beginning of the liquidation procedure needs to be entered into the EFRSFYUL. All other information will be entered there by the registration authority. But if you do not enter, registration may be refused at the next stage. Regional registration tax inspectorates are especially guilty of this. But even in the capitals there are sometimes cases of such refusals, especially recently.

There is a possibility that tax authorities will definitely check this point.

We know all their tricks. Receive free analysis of your situation with specific recommendations for liquidating the company.