Home /Articles on bankruptcy of individuals

Author of the article: Konstantin Milantiev

Last revised July 18, 2021

Reading time 4 minutes

Drawing up a bankruptcy petition for individuals is a responsible task. The further progress of the case depends on this. We will tell you in detail about drawing up a citizen’s bankruptcy claim for the court and an application to the MFC.

How to apply to the court, what and how to fill out, and what documents will be required for bankruptcy of an individual. persons?

How to fill out an application for bankruptcy of an individual to the court?

docx— 46 KB

doc— 25.5 KB

You should write an application after you have prepared for bankruptcy and collected applications and documents. This will help you immediately correctly indicate the amounts and grounds of debts and refer to evidence.

Where to write a bankruptcy application?

Sample application

The so-called HAT is an introductory part where information about the applicant, the court, and the participants in the case is indicated.

Where to apply?

Personal bankruptcy application persons are submitted to the Arbitration Court at the place of registration or current place of residence, which you can document.

Next, provide information about the debtor: full name, year of birth, passport details, place of registration and where the debtor actually lives, telephone numbers, e-mail or other contacts. If you have a lawyer, then write information about him: full name, passport details, power of attorney details

Provide a list of creditors with the names of organizations or full names of individuals, addresses and contacts of creditors.

The bankruptcy application must contain information about the loans - banks, microfinance organizations, collection agencies to which you owe. Don’t forget the lenders to whom you owe small sums of money - housing and communal services companies, the Federal Tax Service, debt for the Internet, telephone, loan on receipt.

In bankruptcy, any debts, both large and small, are written off.

Margarita Kholostova

financial manager

When is a property inventory required and why?

If at the initial stage an inventory is necessary for a detailed assessment of the situation and making a further decision on the case, then the inventory carried out by the financial manager at the stage of property sale has a more practical significance: the objects indicated in it will be assessed and put up for sale.

After the debtor provides the information, the financial manager checks the received data with extracts received from bodies such as Rosreestr, FSSP, and traffic police.

Information on contracts concluded during the three years preceding the initiation of bankruptcy proceedings is also collected and analyzed. If suspicious circumstances are revealed (for example, the sale of real estate at a reduced price or the gift of a large sum to a relative), the transaction will be challenged and declared invalid. Of course, the manager will have to present significant evidence for this.

As part of bankruptcy, the inventory is carried out remotely - the financial manager does not have the obligation to come to the debtor’s place of residence and search there for things belonging to the ward.

Indication of debts to creditors

List what you owe and to whom. Debts can be of any kind, the main thing is to have a document supporting the information. Indicate also those debts that cannot be written off; the court must know about their existence.

For example, if you pay alimony, indicate this fact and the amount of alimony. If you have caused damage to the health of a citizen and are paying him money for treatment, report this in writing, etc.

To make your task easier, read the sample bankruptcy petition for an individual and look at examples of creditors in it.

Sample filling

[354.83 Kb] (downloads: 324)

Filling out the inventory yourself will not be difficult. The approved form contains few sections; the average person can easily fill it out. To eliminate errors, it is recommended to use a sample property inventory. It specifies in detail which column to enter which information, in what format it should be presented, and also provides an example of how to fill it out.

Total debt

How to write the amount of debt in a bankruptcy application

In a bankruptcy application or claim, an individual talks about his debts and the total amount of debt. After describing each creditor, you should calculate the total amount owed.

The amounts of principal and interest, penalties, and penalties are written out separately - in case of bankruptcy, only the loan balance will matter, without penalties. The court includes interest “for the register,” that is, it will be paid last (in practice, it will simply be written off).

If you don’t know the exact amounts, get certificates from banks, microfinance organizations, bailiffs, order a credit history so that there are no errors in the application.

Justification for bankruptcy

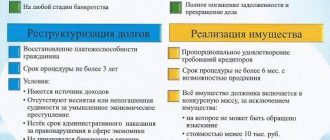

Declaring bankruptcy of individuals must have grounds.

How to find out your credit history? Related article

Briefly but specifically state the circumstances that led you to consider yourself bankrupt.

The court must be satisfied that you

- you have not been able to pay your debts for three months;

- you cannot contribute even 10% of the total debt.

Be sure to let us know if you tried to establish contact with banks and convince them to reconsider the payment schedule.[>

If the banks did not cooperate, and your income fell so much that it became impossible to pay, explain how this happened. Refer to specific circumstances and provide written evidence.

For example, you received an injury that caused you to lose your ability to work. In this case, attach documents from the doctor and tell about this episode in the application.

If you had a stable salary, but were laid off in 2021, explain that you couldn’t find a new job with that salary. Indicate that you joined the labor exchange in an attempt to improve your financial situation.

There may be other reasons, the main thing is to be able to prove them.

Lawsuits and decisions

If you are under legal proceedings for debt collection, or if there are already court decisions, list them. After the introduction of the sale of property and during restructuring, financial claims must be considered by the Arbitration Court, which conducts the bankruptcy case.

Enforcement proceedings are suspended and settlements take place within the framework of the Insolvency Law. But alimony payments and compensation for harm to life and health do not stop - the financial manager will pay money to such claimants from your income.

Margarita Kholostova

financial manager

In this section, also include information about writing off money from your accounts if banks or bailiffs have already partially collected money from you.

Valuation of the debtor's property in bankruptcy

Next, when the property inventory document is ready, an assessment is carried out, which can be carried out:

- financial manager;

- independent experts.

Most often, the assessment is carried out by the financial manager. It is cheaper, faster and more beneficial for all parties in the process. However, if one of the participants in the case considers that the assessment is unfair and expresses objections, an independent expert is brought in. The inviting party pays for the services of experts.

Important!

In some cases, the initiator of the professional examination is the manager himself. In this case, he also pays the costs.

How is property assessed?

We will omit the question of how professional expertise is carried out, since the activities of such specialists are regulated by law. They are also guided by international standards and assessment approaches accepted in their environment.

Sale of property in case of bankruptcy of individuals

If a financial manager evaluates a property, he must be guided by the market value of the property and the degree of its wear and tear.

For example, if an assessment is carried out in relation to a car, then the original price of a car of a similar model is estimated and an analysis of its current condition is carried out: whether repairs have been made, are there any flaws in appearance, what is the condition of the gearbox/engine/body/interior. Based on the data received, the final cost is formed.

During the assessment process, the financial manager also takes into account the following points:

- market valuation of property

(focusing on relevant resources for the sale of similar objects); - expenses

incurred after the acquisition of property by the debtor; if the house has been renovated, a bathhouse and garage have been completed, the area has been landscaped - all these expenses are taken into account when determining the final price; - potential profit

(if the house is located in a tourist place, it takes into account how much you can earn by renting out the property to tourists).

After the final value is formed, the assessment is presented to all other participants in the case: creditors, debtor. If any of them considers that the data is unfair, independent experts may be invited. The final grade will be given through the formation of an expert opinion.

Bank accounts and deposits

Provide a list of open bank accounts and attach copies of agreements.

The bankruptcy application for individuals must contain information about all accounts, so if you have personalized electronic wallets, report them too. If they discover that you are hiding money, the debt will not be written off. The financial manager verifies the debtor's banking and financial information by requesting information about accounts with the tax office. He will see accounts in Russian banks and non-bank financial organizations, and if creditors complain, he will also find accounts abroad.

One of the disadvantages of bankruptcy is that if you have money, the court will oblige you to cover your debts with it. But by hiding accounts, you risk being denied bankruptcy. The discovered money will be taken away, and the deception will negatively affect the court’s attitude towards the debtor, and it will not be possible to get rid of the debts.

Consult a lawyer on how to deal with electronic currency before bankruptcy - anonymously and free of charge! To get a consultation.

What is this procedure

One of the stages of the bankruptcy process is competitive bidding. In order to sell property at auction, it is necessary to draw up an inventory of the debtor's property. Inventory is the responsibility of the bankruptcy trustee. He uses a special inventory form, which includes a list of movable and immovable assets, and funds. The task of the financial manager:

- verify the information entered in the document;

- identify transactions completed over the last three years;

- challenge the facts of sale at a low price.

Property

As with bank accounts, do not try to hide assets.

— 307 KB

Sample of a completed property inventory - 1.67 MB

Concealment of property will be regarded as fictitious bankruptcy, this is the basis for refusal to write off debts. Make a detailed inventory of the property you have in Russia abroad.

Property may be

- movable - for example, a car, a boat, shares, shares in an LLC, valuable equipment;

- real estate - apartment, room, house, garage, parking space, retail space, land, etc.

Ownership is confirmed by state registration certificates, contracts, and extracts from the Unified State Register of Real Estate. Copies must be attached to the bankruptcy petition.

What will not be included in the bankruptcy estate?

According to current legislation, there are restrictions on the inclusion of the debtor’s property in the bankruptcy estate.

Property that is not subject to foreclosure

According to the Civil Procedure Code of the Russian Federation, it is impossible to recover from the debtor:

- individual items and household items (does not apply to luxury items);

- living space or shares thereof, if this is the only real estate for the debtor (does not apply to real estate pledged for mortgage loans);

- a plot of land if the bankrupt’s only home is located on it;

- property that is used by the debtor to earn money (tools, equipment, vehicles);

- livestock, domestic animals, feed and buildings for them used for personal purposes;

- seeds for sowing;

- cash in the amount of the subsistence level and food;

- means of transport for disabled people;

- prizes and awards of the debtor;

- fuel for cooking and home heating.

Property worth less than 10 thousand rubles.

The assessment of such property is carried out:

- arbitration manager;

- an independent appraiser (at the request of the meeting of creditors).

If the debtor or creditors have claims, the valuation of the property can be challenged in court.

SRO of arbitration managers

The financial manager is one of the central figures in bankruptcy; on behalf of the court, he carries out the entire procedure, sells property, and pays off creditors. We talked about how to choose a competent specialist, where to get an SRO AU, and how to negotiate in an article about a financial manager.

According to the Law on Bankruptcy of Individuals, the application must contain the name of the Self-Regulatory Organization of Arbitration Managers. The SRO will propose a candidate, and the court will review and approve a financial manager for your process.

Margarita Kholostova

financial manager

If you specify it yourself, the matter will remain without progress. Indicate only SRO.

Date, signature

Place a date and signature at the end of the application.

note

, before filing with the court, you must send all creditors copies of the application and documents (only those that they do not have), by registered mail with return receipt requested. Postal receipts must be included in the application package (item 7 in our list), otherwise the application will be left without progress until the postal receipts are received.

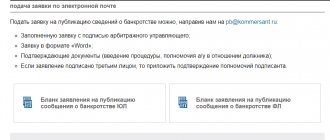

After completing the collection of papers and writing the application, you can file an application for bankruptcy of an individual in court.

Bankruptcy of individuals is not just a formal procedure. If the position is not clearly stated or there is insufficient evidence, the court will refuse or leave the case without consideration.

To avoid such troubles, be careful!

Our services and prices

Free consultation

0 ₽

- You talk about your problem, ask questions;

- The lawyer clarifies the necessary information, analyzes the situation, tells options for the development of events;

- Together you choose a profitable option - bankruptcy, refinancing, just a complaint against debt collectors or a bank;

- The lawyer tells you how to prepare, where to get documents, and what to do in your case.

Read more

Out-of-court bankruptcy in MFC on a turnkey basis

25 000 ₽

- Verification and recording of debts and proceedings in the FSSP, assessment of property and contestability of transactions for 3 years

- Drawing up an application and list of creditors

- Filing a bankruptcy application to the MFC by proxy

- Working with banks and collectors - notification of refusal to cooperate, complaints to the prosecutor's office and the FSSP in case of violations

- Representation of interests by a lawyer in case of objections from creditors

- Six months later, you receive a decision from the MFC to declare you bankrupt and write off your debts.

Read more

Turnkey bankruptcy of an individual

from 8,000 ₽/month.

- Filing a bankruptcy petition

- Collection of necessary documents

- State duty and remuneration of the arbitration manager

- Representation of interests by a lawyer at a court hearing on the introduction of bankruptcy proceedings

- Full support of bankruptcy proceedings by financial managers

More details