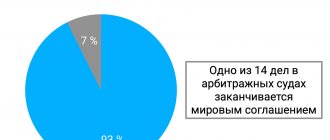

Conciliation procedures are quite common in civil and arbitration proceedings. It is always better to end the dispute so that both parties are satisfied with the outcome and agree to fulfill mutually beneficial conditions. The role of the court, which confirms the agreement reached with its signature, is of great importance. An agreement approved by the judicial seal acquires the force of a court decision, which, as is known, is binding. We previously wrote about the nuances of concluding a settlement agreement in civil proceedings. In this article you can find useful information about the agreement in the arbitration process.

Who concludes

The Bankruptcy Law regulates the settlement agreement in Chapter VIII in Art. 150-167. Article 150 127-FZ states that the debtor, his bankruptcy creditors and authorized bodies conclude this document. The procedure for concluding a settlement agreement in bankruptcy is described in the same article.

| Who decides | How they decide |

| Bankruptcy creditors or authorized bodies | They hold a meeting. At this meeting, agreement is reached. This decision is made by a majority vote of the total number. Most are calculated based on information from the register of claims. Mandatory condition - all creditors have voted for obligations that are secured by a pledge of the debtor’s property The powers of voting representatives must be specifically stipulated in a power of attorney or other document, if this is stipulated in an international treaty of Russia or a federal law |

| Citizen | Accepted by the citizen himself |

| Entity | The head of the debtor or the person who performs his duties. An external or bankruptcy trustee has this right |

Third parties participate by accepting the rights and fulfilling the obligations provided for in the agreement. In Art. 157 127-FZ states that third parties participate if they do not violate the rights and legitimate interests of the participants in the bankruptcy case, whose claims are included in the register of claims or were formed after the day the application for declaring the debtor bankrupt was accepted and the deadline for fulfilling the claims of which came before the date of conclusion of the agreements.

Third parties guarantee or provide guarantees that the debtor will comply with the terms of the compromise document. They can also ensure its proper execution in other ways.

It is possible to reach a compromise at all stages of the bankruptcy proceedings in the arbitration court. For each stage from observation to bankruptcy proceedings in Art. 151–154 127-FZ, special norms are prescribed.

Settlement Statement

The initiator of the conclusion can be any of the parties to the dispute, most often the initiator is the judge considering the dispute. His responsibilities include, before the start of consideration of the case on the merits (Article 172 of the Code of Civil Procedure of the Russian Federation), to find out the desire of the parties to make peace and set a deadline for developing compromise solutions and drawing up the text of the document.

If the parties have drawn up a document, but the draft contains errors, the judge sets a new deadline for correcting them. If the parties do not reach an agreement within the allotted time, the case proceeds to consideration of the merits.

How to compose

In Art. 155 127-FZ states that this is a written document. The same article states who signs the settlement agreement in bankruptcy. This is done by the debtor, and on the part of bankruptcy creditors and authorized bodies, the signature is placed by a representative of the meeting or a person authorized by the meeting of creditors to do this.

If third parties are involved, they or their representatives also endorse the document.

In Art. 156 127-FZ states that the term of the settlement agreement in bankruptcy and the procedure for fulfilling the debtor’s monetary obligations are mandatory conditions.

If the individual bankruptcy creditor or authorized body agrees, the agreement may contain termination provisions. In this case, the following procedures are used:

- receive compensation;

- exchange claims for shares in the authorized capital, shares that are converted into shares, bonds or other securities, novations of obligations;

- forgive a debt;

- other legal methods (for example, termination due to impossibility of execution, Article 416 of the Civil Code)

The main thing is that the chosen method of terminating obligations does not violate the rights of other participants whose claims are in the register of claims.

The settlement agreement may change the timing and procedure for making mandatory payments. The terms of this document, which relate to the repayment of debt for mandatory payments levied under tax law, must not contradict the requirements of the law.

Satisfaction of claims in non-monetary form should not create privileges for the creditors receiving it compared to those whose claims are satisfied in monetary form.

Interest must be calculated on monetary claims and the amount of obligatory payments. The amount of interest is equal to the key rate of the Central Bank (CB) on the day when the arbitration court approved the compromise document. The amount of claims that were not repaid according to the schedule for satisfying the claims of creditors is taken into account.

Let us recall that by decision of April 26, 2019, the Central Bank maintained the key rate at 7.75% per annum.

If the creditor agrees, then you can prescribe a lower interest rate, a shorter period for calculating the interest rate, or be exempt from paying interest.

IMPORTANT!

If in the terms of such a compromise there is no separate provision on the pledge of the debtor’s property, then it is retained.

Contents of the document

The main reason for the rare use of this dispute resolution option is legal illiteracy. Many conflicting parties not only do not know about the possibility of a conclusion, but also cannot draw it up correctly. Many people are afraid to contact professional lawyers, trying to avoid unnecessary expenses, but on their own they draw up a document that cannot be approved by the court due to:

- content inconsistencies;

- motivational legal framework;

- errors in presenting the essence of the dispute;

- non-compliance with the law of the agreements reached, etc.

A common mistake made by plaintiffs ignorant of legal issues is the persuasion of an unscrupulous defendant before concluding a settlement agreement, when the plaintiff renounces his claims in the dispute.

Site Expert

Fasakhovva Elena Alexandrovna

Member of the Russian State Duma Committee on Non-Bank Credit Institutions. Has been involved in bankruptcy proceedings since 2015.

Ask a Question

It should be remembered that abandoning the claim prevents the plaintiff from re-filing a claim against the defendant on the same grounds. Waiver of a claim and a settlement agreement are completely different procedural actions.

The structure of the document should include:

- name of the court to which it is submitted for approval;

- names of the parties (plaintiff and defendant, indicating their details, addresses, contact details);

- reference to the law (Articles 39 and 173 of the Code of Civil Procedure of the Russian Federation);

- statement of the essence of the dispute;

- procedure for the parties to resolve the dispute;

- bank details for fulfilling the obligation in cash;

- attribution of judicial and consulting services (who and in what amount pays legal costs and assistance from lawyers);

- link to article 221 of the Code of Civil Procedure of the Russian Federation, on the consequences of concluding a settlement agreement;

- signatures of the parties.

Hotline for citizen consultations: 8-804-333-70-30

How to Write an Approval Statement

The debtor, external, bankruptcy or financial manager submits to the arbitration court an application for approval of the settlement agreement. This is given from 5 to 10 days from the day when a compromise was reached. This application must be accompanied by:

- draft settlement agreement on bankruptcy;

- minutes of the meeting of creditors who decided to agree to a settlement;

- a list of bankruptcy creditors and authorized bodies that are known but do not make claims. You need to indicate their addresses and the amount of debts;

- register of creditors' claims;

- documents that confirm that there are no debts under the claims of creditors of the 1st and 2nd stages;

- decision of the management bodies of the debtor - legal entity (if there are special rules under 127-FZ);

- letters of objection from bankruptcy creditors and authorized bodies that voted against or did not vote on the issue of concluding a settlement agreement, if such documents exist;

- other documents that must be provided under bankruptcy law. For example, ballots for voting at a meeting of creditors (clause 50 of the Resolution of the Plenum of the Supreme Arbitration Court No. 29 of December 15, 2004).

Conciliation procedures in arbitration

When preparing the case for hearing, in accordance with Part 1 of Art.

133 of the Arbitration Procedure Code of the Russian Federation, one of the tasks of a judge is not only to determine the nature of the dispute submitted for consideration, but also to assist the parties in resolving the issue of reconciliation. In other words, the law directs courts, including arbitration courts, to take measures to achieve a compromise between the parties, if possible. It is obvious that for representatives of the business community it is especially important in most situations to maintain confidentiality and not allow publicity in the consideration of the dispute, which can well be ensured during reconciliation. In this way, the parties can avoid lengthy litigation, thereby eliminating the negative impact on their business reputation.

In accordance with Part 2 of Art. 138 of the Arbitration Procedure Code of the Russian Federation, the parties to the dispute have the right to resort to any conciliation procedure of their choice:

- mediation (mediation) – resolving a conflict peacefully with the help of a specialist mediator. The entire procedure is regulated by a separate law. A list of mediators can be found on the official website of any arbitration court, or on the general website of arbitration courts.

- negotiations are the simplest form of reconciliation without the involvement of a third party. Negotiations to end the dispute on mutually beneficial terms are conducted through proxies, that is, representatives. There are no additional costs; the problem is discussed constructively, since the participants in the discussion are well familiar with the details of the case and the peculiarities of the relationship between the parties. This type of conciliation procedure is often and quite successfully used among entrepreneurs for whom it is important to maintain long-term partnerships (with suppliers, manufacturers, etc.). Negotiations can be either oral or in writing (for example, a claim procedure). The end of the negotiations means making a decision on how to proceed and what steps to take for each of the participants in the discussion.

- A settlement agreement is the most popular way to settle a legal dispute and must be approved by a judge.

As stated

In Part 4 of Art. 150 states that approval of a settlement agreement in a bankruptcy case is within the competence of the arbitration court. With one ruling, he approves the agreement reached and terminates the bankruptcy proceedings. If the participants in a bankruptcy case go to amicable settlement at the stage of bankruptcy proceedings, then the court determines the debtor bankrupt and indicates that the bankruptcy proceedings are not carried out.

The court does not change the content of the settlement agreement, which was adopted at the meeting and submitted to the court for approval. This is enshrined in information letter No. 97 of the Presidium of the Supreme Arbitration Court dated December 20, 2005

In Art. 158 127-FZ specifies the conditions under which the court approves an agreement. It becomes valid only after the debt has been repaid according to the claims of the first and second priority creditors.

Execution of the agreement

If a document is signed, this is not a guarantee that the parties will fulfill the agreements in good faith. When evading obligations, proceed as follows:

- Send a complaint to the Federal Bailiff Service. Here enforcement proceedings are opened, which forces the participant to fulfill the terms of the agreement. He is given 5 days to clear the debt. Penalties for failure to comply with agreements include arrest of accounts, confiscation of property, etc.

- They go to court to cancel the reconciliation procedure due to the irresponsibility of the second participant.

Expert opinion

Egorov Andrey Andreevich

Legal consultant with 10 years of experience. Specializes in family law. More than 3 years of experience in developing legal documentation.

An offer to enter into a settlement agreement is the correct approach to doing business. The legal process “eats up” a lot of time, effort and money, which are wiser to invest in the development of the case.

Litigation requires the expenditure of money, time and nerves on the part of the plaintiff and the defendant. To speed up the matter, the participants have the right to begin a conciliation procedure by formalizing a settlement agreement in the arbitration process.

This is a deal concluded by mutual concessions and compromises. Its initiators can be sure that they will maintain partnerships and at the same time defend their own interests.

Consequences of approval for legal entities

If the arbitration court approves a settlement agreement in the event of bankruptcy of a legal entity, then bankruptcy proceedings are immediately terminated. There are special consequences at each stage of bankruptcy. We collected them in a table.

| Bankruptcy stage | Consequences |

| financial recovery | debt repayment schedule is not being met |

| external control | there is no moratorium on satisfying creditors' claims |

| bankruptcy proceedings | the decision to declare him bankrupt and to open bankruptcy proceedings is not executed. |

The settlement agreement comes into force on the date of approval and is binding. It deprives the powers of a temporary, administrative, external and bankruptcy manager. And the debtor or a third party begins to pay off debts.

IMPORTANT!

It is impossible to unilaterally refuse to fulfill an agreement that has entered into force.

Consequences of approval for individuals

A settlement agreement in the case of bankruptcy of individuals, in addition to the termination of the bankruptcy case, entails the following consequences:

- the citizen’s debt restructuring plan is not in effect;

- the ban on satisfying creditors' claims is lifted;

- the financial manager leaves because his powers have ceased;

- the citizen begins to repay debts to creditors within the terms of the document.

You can go to the world peace only once, and it is mandatory. If a citizen stops complying with the agreement, the court will resume proceedings and automatically declare the individual bankrupt, introducing a procedure for selling his property to pay off debts.

IMPORTANT!

It is impossible to conclude peace a second time.

Statement

Sample settlement agreement in a bankruptcy case

Settlement agreement for bankruptcy of individuals

Legal meaning of the document

A settlement agreement is a document that replaces a court decision on a claim in progress (Part 3 of Article 173 of the Code of Civil Procedure of the Russian Federation) and gives the conflicting parties the right to count on legal protection and forced fulfillment of their obligations, in the event of evasion or delay in performing actions leading to to conflict resolution:

- payment of agreed amounts;

- performing legally significant actions;

- refraining from performing any action for a specified period.

After approval of the document by the judge, it becomes binding and does not require the issuance of a writ of execution, since the parties undertake obligations to voluntarily perform the actions they agreed on.

The consequences of failure to fulfill at least one of the agreed conditions is a reason for its cancellation. The dissatisfied party has the right to appeal to the court that approved the text (Part 1 of Article 428 of the Code of Civil Procedure of the Russian Federation) with a request to issue a writ of execution and transfer it to the bailiffs. Or filing a claim on grounds that existed before the conclusion, if:

- it was about paying off the debt, but the debt remained unpaid after the agreement was approved;

- the defendant did not perform the agreed actions (did not transfer the item in kind, did not complete the work, did not refrain from filing a claim or selling the debt within the agreed period).