What is a TIN and why is it needed?

A taxpayer identification number, or TIN, is a 12-digit number that you (or your employer for you) uses to pay taxes.

You will also need it to check if you have any unpaid taxes and if you decide to register as a sole proprietor.

Importance of TIN

Even a newly born person has his own rights and obligations outlined in the Constitution of the Russian Federation. This is precisely why the need for a TIN is connected if certain situations arise:

- acceptance of inheritance;

- registration of ownership of real estate or vehicle;

- acceptance of property under a gift agreement;

- desire to get a job before adulthood;

- minors starting their own business.

Often the TIN is required to be presented in educational and kindergarten institutions.

Why might you need an INN ID?

A person acquires rights and responsibilities from the moment of birth. Their implementation requires obtaining official documentation, including TIN.

The latter may be needed in the following situations:

- registration of inheritance;

- acquisition of ownership of property;

- conducting transactions within the framework of a gift agreement;

- employment, including until adulthood;

- registration as an individual entrepreneur.

An identifier is often required when enrolling a child in a kindergarten or school.

Regulatory framework: why does a child need a TIN?

The regulations of the Russian Federation do not establish a specific age for issuing a TIN. The procedure is considered voluntary and is carried out at the request of the parents.

However, there are still cases when a municipal institution may request a certificate of registration of a child with the tax authorities. This:

- Entry into inheritance. A certain percentage of the value of the accepted property is paid to the state treasury.

- Registration of property rights. Since the property tax will be paid in the name of the baby.

- When applying for an official job/part-time job. The future employer is obliged to pay 13% personal income tax for its employees.

- When filing a tax deduction. For example, when buying a new apartment, where one of the shares belongs to a teenager.

- To register business activities. A 16-year-old individual entrepreneur is also required to pay tax.

- For admission to an educational institution. For example, kindergarten or college. However, providing a TIN in this case is not necessary.

The situations described above are suitable for minor children under and over 14 years of age.

It is worth noting that a taxpayer identification number is issued to a citizen once and for life. It is assigned at birth, for which the civil registry office transmits all information to the tax service. But whether a child needs to get a TIN on paper or not is decided only at the request of the parents or the minor himself.

At what age can you get a TIN?

Many parents are interested in the age at which they need to obtain a TIN for their child. At the legislative level, there is no exact answer at what age a TIN should be provided to a child, since there are no mandatory requirements. Under 14 years of age, the document may not be required.

When applying for a job, the Taxpayer Identification Number (TIN) becomes mandatory, and in Russia children can start earning money after the age of 14.

Parents can obtain a tax identification number for their newborn child, but this is not mandatory. The solution to such an issue is voluntary, therefore even children's clinics and educational institutions cannot require the presentation of an additional document.

Actions prior to document execution

Before making a TIN for a child through State Services, you will need to go through a number of preparatory stages. The first thing you need to do is register on an online resource to get your own account. At the same time, do not forget to confirm the created record, otherwise it will not be possible to submit an application for tax registration.

Reference! An electronic TIN request for a minor can be sent only through the tax website, but after authorization. But such an action cannot be carried out without having an account with State Services.

To complete the registration procedure on the State Services resource, you will need: a passport, SNILS, phone number and email. It is recommended to take detailed instructions on the Internet.

Also interesting: How to find out your TIN number through State Services using a passport

The required package of documentation to issue a TIN for a child through State Services:

- Russian passport from the parent or official papers for guardianship;

- duplicate pages from the passport with registration and list of children;

- child certificate (in original and copied form);

- confirmation of registration of a minor citizen at the place of primary residence;

- completed standard form (No. 2-2) to obtain a certificate

What is needed to obtain a TIN for a child?

Before you can issue a TIN for your child through government services, you need to prepare everything necessary for this procedure. Of course, you will need an account on the government services website. If there is none, you need to register with government services. Be sure to confirm your account, otherwise you will not be able to apply for tax registration . As noted earlier, an electronic application for issuing a TIN certificate to a child can only be submitted through the tax office website, and you can log in to this resource using your account in government services. You also need to prepare documents in advance to obtain a TIN. Don't worry, the list will be minimal.

To obtain a TIN you will need the following documents:

- A copy of the passport of a citizen of the Russian Federation;

- Copy of birth certificate (for children under 14 years old);

- A document confirming the child’s registration at the place of residence;

- Application in form 2-2-Accounting.

The application will be submitted electronically, so this point can be safely discarded. When filling out the application, you will need your passport data and information from the child’s birth certificate. Also, the originals of these two documents must be with you when visiting the tax office. Perhaps everything is clear with the preparatory part, now let’s look at how to get a TIN for a child through government services, or rather, using the website nalog.ru.

How and where to get a TIN for a child

The procedure is not as complicated as it might seem. If the child is large (for example, a teenager of 14 years old), then he submits the application in person, the parents only put their signature on it. If the child is just a toddler, then his personal presence is not required.

As already mentioned, you will need the following set of documents:

- application to the Federal Tax Service (can be downloaded from the Federal Tax Service website or received directly from the tax office);

- a copy of the passport of the parent submitting this application (if, for example, there are two children (twins were born), then two copies of the passport - one for each child);

- a copy of the child’s birth certificate (formally he is the applicant), which must contain a note on citizenship;

- documents confirming the child’s registration at the place of residence (photocopy of an extract from the house register or registration certificate).

When preparing all these papers, the most important thing is to complete the application. It is necessary to fill it out correctly and as carefully as possible to avoid problems. Please note that in the application, the child himself is indicated as the applicant, and not one of his parents, but it must be signed by the mother or father of the baby.

Personally

This involves going with all the documents and an application to the Federal Tax Service at your place of residence, filling out the application under the guidance and assistance of a Federal Tax Service inspector, submitting all documents and receiving the final TIN there.

Through the tax office online

It is still possible to obtain a TIN using the Internet. For this purpose, you need to go to the official website of the Federal Tax Service and take the following steps:

- Select the “Individuals” section.

Section “Individuals” on the Federal Tax Service website - In the list that appears, click on the “TIN” item.

- Give consent for registration and assignment of a number.

Point of registration and receipt of TIN - Officially register on the website by entering your passport details.

Form for entering personal data to obtain a TIN - Fill out an application for receipt.

The subsequent procedure for receipt will depend on whether the applicant has an electronic signature or not. If such a citizen has not acquired one, then he will have to personally come to the Tax Service office to get the document. This should be done 15 working days after filling out the application.

If an electronic signature is available, then the necessary document can be sent to him by email in the form of a text file, which can then simply be printed. Or, as an option, the document on paper will be sent to the applicant by registered mail.

Also interesting: How to replace a passport via the Internet on the government services portal? The deadline for passport production is 2021.

Federal Tax Service Department

The application form can be obtained from a Tax Office employee and filled out according to the sample from the stand. Then you will need to submit an application, as well as the necessary documents and receive a receipt that the employees accepted them. As a rule, you have to wait 5 business days for the required certificate. If you need it urgently, you can call the department in advance.

Through MFC

In this case, you need to clarify whether your district MFC provides such a service, and if so, then the procedure is similar to registering a TIN with a visit to the district Federal Tax Service.

How to issue a TIN for a child through State Services?

First of all, it is worth noting that only parents can issue a TIN for a child under 14 years of age. Whereas a child who has received a passport can apply for a TIN on his own.

In addition, on the State Services portal you can only make an appointment at the Federal Tax Service office, where you will have to receive the above-mentioned document.

To make an appointment with the Federal Tax Service to obtain a TIN, a child needs to do the following:

- log into your personal account on the State Services portal;

- in the service catalog, select the “Taxes and Finance” section;

- select electronic;

- click “Make an appointment”;

- on the page that opens with your personal data, you need to select the Federal Tax Service branch that you want to visit, as well as the date and time;

- confirm the entry by clicking on the appropriate button;

- then you will need to come to the department of your choice with a package of documents.

Thanks to this recording, you will not have to spend hours in tedious queues, and the document you require will be quickly completed.

How to get a TIN for a newborn child

First of all, it is necessary to note some nuances that will help you not get confused and get the TIN for your child correctly. For example, users are interested in the question of how to obtain a tax identification number for a newborn child

? Here you need to remember the following:

- You can make a TIN for your child immediately after receiving a birth certificate from the registry office;

- However, a TIN will not be issued if the child does not have registration at the place of residence where at least one of the parents is officially registered;

In other words, it is possible to obtain a TIN for a newborn child; you just need to obtain a birth certificate and register the child at the place of residence (temporary registration is allowed).

How to obtain a TIN through State Services for a child under and over 14 years of age

How to make a TIN for a child through State Services

? First of all, it should be noted that only parents who have an electronic signature can obtain a TIN for a child under 14 years of age, as well as obtain a TIN for a child over 14 years of age through the State Services portal. In the absence of an electronic signature, you can order a TIN for a child through State Services by filling out an application for a TIN on the portal, and then personally receive a TIN at the tax office at your place of residence. Also, it should be noted that the child himself can obtain a TIN for a minor child over 14 years old by contacting the tax office at his place of residence.

Receipt deadlines for a minor

Once the individual tax number has been issued, the parent or legal guardian can pick up the certificate. The certificate is issued in the same department of the Federal Tax Service to which the request was sent. If the application was submitted online, then the certificate is received in electronic format or by Russian Post. The latter is due to the lack of an electronic digital signature of the person applying. In all other cases, you must personally visit the district office of the authority.

It is noteworthy that when submitting papers to an institution, employees of the authority are required to provide a receipt for receipt of the submitted documents. As a rule, the period for issuing a certificate is five working days.

Features of registering a TIN for a child

Until the child reaches the age of 14, the issue of obtaining and processing a tax certificate is dealt with by his representative (guardian, parent). You can issue the document immediately after birth.

To obtain a certificate, a newborn will need:

- parent's passport with a list of children and registration (+ copy);

- child's birth certificate (+ copy);

- a document confirming the registration of the baby;

- application in form 2-2-Accounting (if not submitted through the portal).

Children over 14 years old can independently obtain a TIN.

What documents are needed to obtain a TIN for a child?

What documents are needed to obtain a TIN for a child? Documents for issuing TIN for children:

- Parent's passport (or guardianship document);

- A copy of the parent's passport with a registration stamp and a list of children;

- Child's birth certificate (original and copy);

- Registration of the child at the place of residence;

- Completed application for TIN according to form No. 2-2.

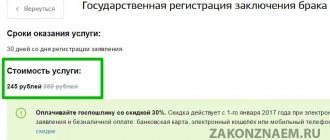

State duty

Payment of the state fee is required only upon receipt of a birth certificate.

To do this you need to do the following:

- Visit the registry office at the place of registration of one of the parents.

- Fill out a request to issue a birth certificate.

- Pay the state fee via bank or smartphone. The amount is 350 rubles excluding commission.

- Submit the package of documents to the employee. The certificate is issued on the day of the request.

You can obtain a birth certificate through the MFC at the place of registration. Also, if the child is 14 years old, he can ask for it himself by presenting his passport.

Also interesting: What to do if you lost your passport. How to replace or restore a general passport

Nuances of obtaining a TIN

- For a newborn baby. Formally, it is possible to obtain a TIN at any age, including immediately after the birth of a baby. The limitation is that first of all you need to register and collect a package of required documents, including a birth certificate. After preparing the documents for the TIN, the child can be registered in the register of taxpayers.

- For a person under 14 years of age. If a citizen has not reached 14 years of age, then by law he is recognized as a minor. Therefore, all decisions for the child are made by the father and/or mother, or an authorized guardian. Personal presence when submitting an application and papers to the Federal Tax Service is not required. The main thing that parents must do is register. It does not matter if the residential addresses are different.

- At the age of 14-18 years. After receiving a general passport, a person has the right to personally visit the tax authority. The passport must contain a mark indicating the place of registration. If you do not have a permanent residence permit, you must submit papers to obtain a temporary document.

Where to contact?

To obtain a TIN for a child, you must contact the Federal Tax Service office at the place of registration of the citizen. Parents prepare documents. There are several ways to submit an appeal.

- Personally. The mother and/or father sends an application to the Federal Tax Service located in the area of residence of the minor citizen. Submission of papers by registered mail with notification and description of the contents is allowed. However, instead of originals, they send photocopies. Copies must be endorsed at a notary office.

Sample of a completed application - Through State Services or on the website of the tax authority. An application for a TIN for a child can be submitted online. To do this, you need to visit the official web page of the tax authority or State Services. To submit a request, you must follow the site tips.

You can submit an application through the Federal Tax Service website

How long will it take to issue a TIN for a child?

According to the law, from the moment an application for assignment of a TIN is received for processing by the Federal Tax Service until the issuance of a certificate, five days pass.

After five days, you can receive the final TIN.

Urgent processing

As we have already indicated above, the registration of a TIN certificate occurs in a fairly quick time - in just five days. As a rule, this period of consideration of the application suits almost all applicants, and none of them tries to urgently speed up this already short process.

However, sometimes unforeseen situations arise in life when a child needs a TIN urgently and without delay. If just such a case happened to you, and you want to receive a tax certificate for your baby as soon as possible, you have the opportunity to request emergency registration of the document from the tax service.

In this case, the TIN will be ready not in five days, as happens in ordinary cases, but in one or two days. Unfortunately, such a service is not available throughout our country, but only in some of its regions.

Is it possible to urgently issue a TIN for a child in your city? Please check with the regional office of the tax service.

Make a TIN for children without visiting the district tax office

When planning to issue a TIN for a child, how to obtain it through State Services without leaving home worries many parents. This is due to the desire to reduce queue time and receive a finished document in a short time.

You can submit a request online on the website of the tax authority or State Services. Additionally, papers are allowed to be submitted via Russian Post in the form of a registered letter with acknowledgment of receipt and an inventory of the contents. However, in this case, you will need to notarize the copies. The production time for the TIN is 5 days, after which you can pick up the finished certificate.

Sample of a completed certificate

Note: when receiving a certificate, you must have your passport with you.

Filling out papers electronically allows you to eliminate being in a queue, since in the Federal Tax Service this happens everywhere. But to complete the procedure online, you will need to obtain an EDS (electronic digital signature). EDS is issued in accredited centers. The signature allows you to submit requests remotely via a special secure communication channel.

Please note: after completing the digital signature, you need to download free software from the website of the regional Federal Tax Service. The document is provided in PDF format to the email address specified in the application.