Of course, almost every resident knows that if he is a debtor and his obligations are confirmed on the basis of a judicial act that has entered into legal force (on collection or in bankruptcy proceedings), his property can be sold to cover the debt of the creditor.

ATTENTION : our lawyer for enforcement proceedings will help you in the procedure for selling the debtor’s property, both on the side of the claimant and on the side of the debtor: professionally, on favorable terms and on time. Call today!

When is the sale of the debtor's property impossible?

To begin with, let us tell you that according to the norms of the current legislation, not all of the debtor’s property can be sold, with the exception of:

- The only residential real estate suitable for habitation (more information about the debtor’s only home is available at the link);

- Property that the debtor needs to carry out professional activities (for example, a car, office equipment);

- Individual items (wardrobe items, etc.);

- Property related to household use, furnishings;

- Food products.

The implementation itself can be either independent (subject to restrictions) or completed by force.

The debtor may independently sell property, the value of which should not exceed thirty thousand rubles, upon appropriate petition.

Compulsory implementation is carried out with the involvement of specialized organizations (Rosimushchestvo or the bailiff service).

What are the disadvantages of enforcement?

First of all, the amount received from such a sale will be lower than the market value, so if the debtor manages to sell his property before it is arrested, this will only be to his benefit. Note! The value of compulsorily sold property cannot be lower than the estimated value (there are exceptions).

Please note that real estate, securities, objects of historical and artistic value, expensive property (according to estimates of over five hundred thousand rubles) are sold only at auction.

USEFUL : read about the sale of property of a bankrupt debtor using the link

How is property sold during bankruptcy?

The sale of the debtor's property takes place in several stages:

First, creditors must apply to the court to request that they be included in the register of creditors' claims. To do this, they provide documents about the debt, which can be: receipts, court orders, loan agreements. If the court satisfies this requirement and creates a register, the paperwork is transferred to the financial manager, who conducts this case.

Compilation of the bankruptcy estate

After this, the bankrupt’s property, which is subject to sale, is included in the bankruptcy estate. An inventory of the property owned by the debtor is compiled. At this stage, the financial manager conducts a check to confirm that the bankrupt has not hidden part of the property that can be sold at auction. To do this, he makes inquiries to Rosreestr, the State Traffic Inspectorate, the Small Vessel Inspectorate, the Tax Service, and even about the availability of patents for inventions and copyrights, analyzes expenses and credits to bank accounts. He also checks all transactions made over three years. If there is evidence that expensive property, cars or real estate were sold significantly below the market price, deeds of gift were concluded in order to transfer the property to their relatives, such transactions can be challenged in court, and the property is included in the bankruptcy estate.

Exclusion of property from the bankruptcy estate

When the bankruptcy estate is formed, part of the property can be excluded from the bankruptcy estate. Everything that cannot be sold for debts is listed in Article 446 of the Civil Procedure Code of the Russian Federation. You should also not forget about the possibility of additionally excluding from the inventory personal property suitable for bidding in an amount of no more than 10,000 rubles; under exceptional circumstances, this amount may be increased. To do this, you need to submit an application to the financial manager and then to the Arbitration Court.

Property valuation

Next, you need to evaluate the described property. This can be done by a financial manager, but if creditors or the debtor do not agree with his assessment, an independent expert can be invited. In this case, his services are paid for by the interested party.

To minimize the risk of losing property during bidding, it is beneficial for the debtor to inflate the price of his property, which will reduce its liquidity at bidding. Unsold property may be returned to the debtor (see Article 148 of Federal Law No. 147). However, this will happen after trading “down,” that is, with large discounts, significantly below the market price, and will then be offered to creditors as compensation. Although loss cannot be completely eliminated this way, the property may revert to the original owner.

It also happens that relatives intend to buy the property at auction, then they need to fight to set the price below the market price.

Organization of auctions

The law provides for bidding only through electronic auction platforms. The entire procedure can be divided into three stages:

1. Primary trading

At this stage, participants offer their prices for the presented lots. The one who offers the highest wins.

2. Repeated bidding

If not all the property is sold under the hammer, it will be offered at a discount of 10% from the initial cost.

3. Public auction

The remaining lots at public auction are offered at a discount of up to 99%

Within half an hour after the end of the auction, a protocol of its passage is formed, which transparently describes the bidding procedure. Within three working days, the final protocol is published, where the winners are named. The financial manager enters into a purchase and sale agreement with them.

At the end of the three stages of the auction, the unsold property is offered to creditors; if they refuse it, it is returned to the bankrupt.

Satisfaction of creditors' demands

The proceeds from the sale of the bankrupt's property are used to pay off the debt. Section 213.27. The Bankruptcy Law regulates the order of payments to creditors.

- First of all, the claims of creditors for current payments are repaid; these are those obligations that arose after the acceptance of the bankruptcy petition - remuneration to the financial manager, legal costs, alimony.

- Next, the requirements for remuneration of employees are satisfied, if we are talking about individual entrepreneurs and companies.

- The next priority includes payments for housing and communal services and other payments after the bankruptcy petition is accepted.

- After this, the requirements from the register of creditors' claims are satisfied.

- First of all, penalties for causing harm to life or health and alimony are paid.

- Next are calculations for employee salaries.

- And finally, settlements are made with the tax office, banks, microfinance organizations and collectors.

80% of the value of the collateral (for example, with a mortgage) is received by the mortgagee. The remaining 20% goes to pay off current payments and debts from the register of creditors' claims.

If the proceeds from the sale of property are not enough to pay off all debts, then they are considered repaid. However, alimony, compensation for harm, and salary debts to employees are not written off in this way. The same thing happens if the debtor is associated with someone with subsidiary liability - that is, there is a right to collect debt from another person.

Completion of the implementation procedure

The outcome is a performance report submitted by the financial manager. The balance of the debt is calculated and written off during the final meeting of the Arbitration Court.

The procedure for selling the debtor's property

As follows from Article 87 of the Law on Enforcement Proceedings and mentioned above, if there is no dispute over the valuation of property, its value is more than 30 thousand rubles. it will be sold by a specialized organization at open bidding (auction), in the following order:

- Within 10 days from the date of signing the act of acceptance and transfer of seized property, it (the specialized organization) must post the relevant information in the media (printed or posted on the Internet)

- If receivables are subject to sale, the rules of Article 76 of the Law apply to such auctions.

- If investment shares are sold, the bailiff makes demands for their repayment to the relevant management company.

- In the period from 10 to 20 days from the date of assessment of the property, it is transferred by the bailiff for sale, about which a corresponding decision is made. The corresponding acceptance certificate is signed (between the bailiff and the specialized organization).

- The value of property (as well as receivables) put up for auction cannot be lower than its estimated value (if you are interested in the procedure for challenging the bailiff’s assessment of property, then follow the link).

- If the property is not sold within 30 days (except for sale at auction), its value may be reduced by fifteen percent (by decision of the bailiff).

- If the property is not sold within 30 days after the price reduction, it can be offered to the creditor in accordance with the priority (as repayment of the debt).

- The transfer of property to the creditor is carried out taking into account its reduced value, that is, 25% below the estimated value. If its value is greater than the amount of the debt, the difference must be returned to the SSP deposit. However, this rule applies to the creditor if he agrees to accept the property.

If the creditor does not agree to accept the property mentioned above, it is subject to return to the debtor, about which a corresponding resolution is made and an act is signed, of which the parties participating in the enforcement proceedings are notified.

When does the sale of property apply?

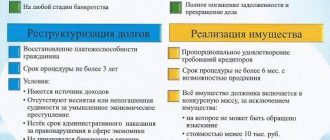

The implementation procedure is a last resort, which is carried out if it is not possible to reach an amicable agreement or debt restructuring, that is, the appointment of a more lenient debt repayment regime. As part of this procedure, a schedule is drawn up for 3 years, during which a person can pay off his debts.

Therefore, the first thing the parties strive to do is to resort to restructuring, because this method is beneficial to all participants in the legal proceedings.

However, the restructuring procedure is not mandatory and sometimes the sale of property begins without this stage.

This happens if:

- participants in the proceedings did not present a restructuring plan;

- the debtor does not have a permanent source of income sufficient to repay the debt;

- the court rejected the restructuring plan;

- the debtor twice delayed payments according to the schedule;

- creditors opposed the restructuring plan;

- the terms of the settlement agreement were violated by the debtor;

Get a free consultation

Time limit for the sale of the debtor's property by bailiffs

After the court decision on debt collection has entered into legal force and a writ of execution has been received by the SSP, the SSP official initiates enforcement proceedings and searches for property.

Within a month from the date of search for property, it must be assessed by the bailiff himself or with the involvement of a specialist (if its preliminary value is more than 30 thousand rubles).

Then, within a period not exceeding 20 days (but not less than 10), the property is transferred for sale. Acceptance of property is carried out within a period not exceeding ten days.

Initially, the property must be sold within a month; after this period, its value is reduced by fifteen percent, and if a buyer is not found within this period, then the property is offered to the creditor as a means of repaying the debt. Moreover, the value of this property should be 25% lower than the estimated value.

If the creditors do not want to accept the property as repayment of the debt, then it is transferred to the owner. Thus, the total period for the sale of property is 3 months (conditionally, of course).

Special procedure for property tax

Real estate is subject to corporate property tax (with rare exceptions when the object is classified as preferential property). Until what point will the sold property form the tax base for the seller? Until it is transferred under the deed to the buyer.

In accounting, it is at this moment that the property must be written off from the balance sheet, since it no longer meets all the characteristics of a fixed asset given in clause 4 of PBU 6/01 “Accounting for fixed assets.” Despite the fact that the seller actually continues to be considered the owner of the building, he is no longer obliged to pay property taxes on it. At the same time, in accounting, to reflect a retired fixed asset until the moment of recognition of income and expenses from its disposal, account 45 “Goods shipped” / a separate sub-account “Transferred real estate objects” can be used (letter of the Ministry of Finance of the Russian Federation dated January 27, 2012 No. 07-02-18 /01, dated 03/22/2011 No. 07-02-10/20).

There is one more feature that arises only for those companies whose real estate was located outside the location of the organization and which, in connection with this, were simultaneously registered with another tax office. Such companies must report property taxes to the Federal Tax Service at the location of the building (this procedure has been in effect since January 1, 2019).

Considering that the tax period for property tax is a calendar year, the declaration must be submitted at the end of the year. However, at that time, the organization will already be deregistered with the tax office at the location of the property, since most likely by that time the new owner will have registered his ownership and will automatically be registered with the Federal Tax Service at the location of the property, and the previous owner will be deregistered. Accordingly, the tax office will most likely not accept a declaration from a payer who is no longer registered with it as a current taxpayer.

How to be in this case? There is a solution. Paragraph 1 of Article 45 of the Tax Code of the Russian Federation allows taxpayers to pay taxes ahead of schedule. How does this relate to submitting a declaration? It’s very simple: the amount of tax payable to the budget is determined based on the declaration data. Accordingly, if tax is allowed to be paid early, then the declaration can also be submitted early. This, of course, is not directly stated in the Tax Code, but there are letters that contain such a conclusion (letter of the Federal Tax Service of Russia dated November 8, 2016 No. BS-4-21/21110). It states that the organization has the right to submit to the tax office a property tax declaration in relation to the sold real estate object during the calendar year before the general deadline for its submission.

Therefore, immediately after the company has transferred the property to the buyer under the deed, it can draw up a declaration and submit it to the tax office with which it is still registered at the location of the property.

What if the moment has already been missed, that is, the ownership has been re-registered and, accordingly, the seller of the property has already been deregistered with the tax office? It's OK. Officials explain that in this case the declaration should be sent to the tax office at the location of the organization (letters from the Federal Tax Service dated May 16, 2019 No. BS-4-21/9108, dated November 8, 2016 No. BS-4-21/21110). Although this procedure is not spelled out in the Tax Code of the Russian Federation, there is no other way to do it here. Please note: the authors of the letters warn that when filling out the declaration, it is necessary to indicate in it OKTMO at the location of the disposed real estate property. Thus, the tax itself, regardless of anything, should be paid at the location of the disposed property.

Petition for the sale of the debtor's property

At the request of a person, namely the debtor himself, his property (not exceeding the value of 30 thousand rubles) can be alienated by him independently (Article 87.1 of the Law on Enforcement Proceedings).

The deadline for submitting such a petition is no more than 10 days from the moment he learned about the assessment of the property. If there are violations, then we, as lawyers for the protection of the debtor’s rights, will help you.

After the bailiff receives the above-mentioned petition, he issues a corresponding resolution, according to which enforcement measures are postponed. In addition, the commented resolution should determine that funds from the sale should be deposited with the SSP within no more than 10 days from the moment when the specified non-normative act was issued. In addition, the debtor is warned of liability for failure to transfer funds, as well as for inaction resulting in failure to sell property.

After the expiration of the 10-day period, the bailiff may invite the owner to keep the unsold property for himself, otherwise it will be transferred for compulsory collection, a resolution, which is sent to the parties to the enforcement proceedings.

Appealing the procedure for selling property

In addition to the above, we consider it necessary to tell you how and where to complain if your rights are violated by the actions of SSP officials.

So, such a complaint can be filed in the order of subordination - to the senior bailiff. You can send a complaint by mail (including electronically) or hand it in yourself. In addition to the mandatory details of the person filing the complaint and the person who violated the right, you must indicate the details of the non-normative act about which you are complaining or the actions/inactions of the SSP employee, and describe the situation itself. The petition part should indicate what you want to achieve if the complaint is satisfied. Of course, sign, date and attach documents confirming your requirements.

The complaint itself must be considered within a period not exceeding thirty days from the date of its receipt.