What is the priority of creditors

During the bankruptcy process, creditors have one last chance to recover money from the debtor. If the defaulter does not have property, or its sale does not allow the debt to be fully repaid, creditors will be left with nothing. The debts will be considered uncollectible, and at the last court hearing they will be written off from the debtor. The right to recover through the courts from bailiffs and collectors is automatically lost.

When conducting a bankruptcy case, the manager forms the bankruptcy estate. It includes cash and property assets that can be foreclosed on. At the expense of the bankruptcy estate, creditors can count on full or partial compensation for the debt.

To participate in the distribution of the bankruptcy estate after the sale, creditors must declare their claims. They submit documents to arbitration, prove the reasons for the occurrence and the amount of the debt. All claims made by creditors are verified by the court.

If the requirement is justified, it is included in the register. Also, all claims are posted in queues, which will be important when distributing funds identified from the debtor or received after sale. The manager is obliged to follow the order of priority in bankruptcy.

What is listed last?

For the bank employee who received the payment, what does payment order 5 mean in field 21 of the order? That if there is a shortage of funds in the client’s account, transfers according to the document are done last.

Such transfers include payments for goods, works and services. Another last order of payment for state duties, current transfers of taxes and fees. When the servicing bank receives several instructions to write off funds that are subject to execution in one turn, the bank executes them sequentially in calendar order. That is, the rule applies: first, the order that was received earlier than others will be paid.

Why do we need a queue?

The priority for bankruptcy of an individual or organization was introduced to determine the priority of different types of claims. The essence of the claim will be visible from the documents submitted by the creditors. A separate priority is provided for claims that arose before filing for bankruptcy and after the initiation of a case in arbitration. In the second case, the queue for current payments is determined.

The order of creditor claims in bankruptcy was introduced for the following purposes:

- to determine the procedure for paying off debts, if such a possibility exists;

- to distinguish between current obligations that arose after the initiation of the case and old debts that caused bankruptcy;

- to avoid disputes between creditors when distributing funds.

The priority of creditors' claims is formed even if the debtor obviously has no property or income. There are situations when, after filing bankruptcy, the debtor has liquid assets that can be sold at auction. In this case, the manager will already have a list of creditors of different priority levels.

The order of priority does not apply to simplified bankruptcy at the MFC. For this procedure, the applicant indicates all obligations that he has to banks, housing and communal services enterprises, individuals and legal entities. Since the MFC does not sell property, the queue of creditors does not matter. It is believed that only those citizens who do not have property file for bankruptcy through the MFC - this was the conclusion made by the bailiffs.

What happens if there is no bankruptcy estate at all?

Sometimes it happens that the bankruptcy estate is not included in the case at all. As a rule, such processes are carried out in relation to pensioners and other socially vulnerable categories of the population.

Material on the topic

Simplified bankruptcy - for those who have no property

From 2015 to 2021, the bankruptcy procedure for individuals...

The absence of liquidation mass means that:

- the person is not working;

- the pension is too small - less than or equal to the minimum wage;

- The bankrupt has no property, except for a single apartment or other things protected by law from seizure.

In such situations, bankruptcy is guaranteed to be recognized, and the person is relieved of unbearable debts. The purpose of the procedure is to free citizens from the debt burden, and the amount of property does not matter.

If you need to declare bankruptcy, but you do not want to lose property, please contact us - we provide the first legal consultation free of charge. We will help you become bankrupt and write off your loans safely!

FAQ

- Is the debtor required to pay a mortgage appraisal if he files for bankruptcy?

No, the assessment of mortgage housing is the responsibility of the bank that issued the housing loan. If the bank or interested parties do not agree, then an expert examination is brought in. It is paid for by those who, in fact, initiated the third-party assessment. - The wife is going bankrupt and the property is being sold. The spouses' jointly acquired property is a two-room apartment. There is also a house from my parents that my husband owns. What are the risks of losing this home?

None if the house was inherited by the husband or as a result of a deed of gift. Such property is not considered community property because it was not acquired during the marriage.

- Situation: the wife pays a car loan (the car is registered in her name), the husband wants to go bankrupt. Will the vehicle be taken away?

If the car loan is issued to a spouse and she pays it, then the car will not be taken away. There is a similar case in judicial practice. Encroaching on a spouse's car as collateral is considered illegal, plus it violates the rights of the bank that issued the loan.

- What is the right thing to do if the ex-husband, the alimony payer, filed for bankruptcy?

We recommend that you immediately submit an application to be included in the register of creditors. The recipient of alimony has the right to participate in the bankruptcy proceedings of the former spouse. The application must be filed in the same court where the debtor is going bankrupt. Please note: to get involved in the process, creditors have 2 months from the start of the bankruptcy procedure. It is important not to miss this deadline.

We will write off debts through bankruptcy with a guarantee

Our lawyer will call you in a few minutes and answer all your questions

Is it possible to influence the order?

You cannot influence the assignment of requirements to a particular category. The documents will immediately show the essence of the obligation incurred by the debtor. For example, if a writ of execution confirms a loan debt, it cannot in any way be classified as payments for compensation for harm or alimony.

The distribution of debts and current payments into certain queues is carried out according to Article 134 of Law No. 127-FZ. Creditors, the debtor, the manager, and the court are required to comply with this normative act. After completing the calculations, the manager will prepare a report. It will indicate how the money is distributed between creditors of different queues.

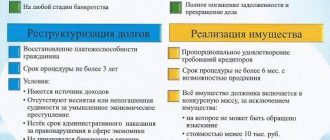

In case of bankruptcy, the priority is determined separately for current payments and obligations that arose before the initiation of the case

Current payments are divided into five queues and are repaid in priority order. Claims that arose before bankruptcy are divided into three stages and are repaid after settlement of current payments.

Collection of current payments in bankruptcy proceedings - contacting the bank

The moratorium (suspension of execution) does not apply to current payments. A writ of execution received by a court decision to collect current payments in bankruptcy proceedings may be presented:

- to the debtor’s bank (Article 8 of the Federal Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ);

- bailiff.

It should be noted that the law assigns supervisory functions to the debtor's bank. Any payment documents (payment orders, checks, collection orders, etc.) must be provided along with documentary evidence that the payment is current. Executive documents are checked in the same way.

In this case, the bank is guided by formal criteria (clause 1 of the resolution of the plenum of the Supreme Arbitration Court of the Russian Federation dated 06.06.2014 No. 36). The claimant’s task is to clearly justify the claim and pay attention to the necessary details of documents confirming the “current” nature of the payment.

In addition, the bank is obliged to comply with the above order of payments. It is determined among the documents presented for payment. If on the date of presentation there are no documents related to an earlier priority, the writ of execution is subject to execution by the bank, as specified in Resolution 9AAS dated 02.02.2015 No. 10AP-16384/14.

What creditor claims are included in the queue?

The order of satisfaction of creditors' claims in the event of a citizen's bankruptcy cannot be determined arbitrarily, at the discretion of the court, manager or creditors. Art. 134 of Law No. 127-FZ divides all overdue debts into three stages. Current payments for obligations arising after the institution of bankruptcy proceedings are distributed over five queues.

First of all

Creditors whose claims arose before the filing of bankruptcy will be able to count on repayment of the debt only after settlement of current payments. This is expressly stated in Art. 134 bankruptcy laws.

First of all, creditors-citizens who have submitted claims for compensation for harm to life and health are included.

According to these requirements, the amount of debt is determined by capitalizing time-based payments. Typically these are payments to compensate for injury to health caused at work.

Please note that compensation payments are not written off in bankruptcy. For example, if the specified demand was presented to an individual, it will remain after the other types of debts are written off. This follows from Article 213.28 of Law No. 127-FZ.

Second stage

The second stage also includes debts to individuals. This includes the following requirements:

- for payment of severance pay upon dismissal or layoff;

- on remuneration of citizens who worked at the debtor enterprise or for individual entrepreneurs;

- for payment of royalties for intellectual property.

Arrears of severance pay and wages may be received by long-dismissed employees or employees working for the debtor at the time of liquidation. When checking the validity of the claims, HR and accounting documents will be requested to verify the amounts and periods in the calculations.

Debt in payments for the results of intellectual property can be determined on the basis of copyright contracts, licensing agreements, and assignments. Future payments are not included in the calculation.

Third stage

The third level priority includes all other creditors whose claims arose before bankruptcy. Debt can be collected in this order:

- on loans, loans to banks, microfinance organizations;

- under assignment agreements in favor of a collection company;

- on obligations to citizens, organizations and entrepreneurs (for example, under loan agreements and receipts, for non-delivery of goods, etc.);

- on taxes, fees and penalties to the budget;

- for utilities;

- for communication services;

- for other types of obligations.

Even debts that cannot be written off after the bankruptcy of an individual will be taken into account in the queues. persons, individual entrepreneurs or organizations. For example, a subsidiary debt collected from a controlling person during bankruptcy can be included in the register of claims. But if this debt cannot be repaid after the sale of the property, it is not written off by court decision.

Creditor claims out of turn

There are a number of claims that are not included in any of the queues, although creditors will be able to recover for them. Here is their list:

- claims for transactions declared invalid during bankruptcy (payments for them will be made after settlement with third-priority creditors);

- according to special rules and out of priority, claims secured by the pledge are satisfied (payment is made at the expense of the subject of the pledge);

- creditors holding bonds without a maturity date will be able to receive payments after settlement of all queues.

The court and the manager will “deal” with all the creditors’ claims. The debtor has the right to object to the inclusion of certain debts in the register, to refer to missed deadlines, incorrect calculations, and other circumstances.

What payments are due to employees in bankruptcy?

Receipt by an employee of a salary in connection with the liquidation of a company is guaranteed by Art. 130 Labor Code of the Russian Federation. If the organization fails, all employees are dismissed with the right to the following payments:

- final payroll (including compensation for unused vacation);

- severance pay in the amount of one average monthly salary;

- average monthly earnings for the period of employment (including severance pay): for 2 months; or 3 months, if the employee registered with the employment center within 2 weeks from the date of dismissal and he was not found a job within 2 months (Article 178 of the Labor Code of the Russian Federation);

- compensation for dismissal within less than 2 months from the date of receipt of notice of the liquidation of the company (Article 180 of the Labor Code of the Russian Federation);

- interest for violation of payment terms (Article 236 of the Labor Code of the Russian Federation).

The order of repayment of claims for current payments

After filing for bankruptcy, the debtor’s current obligations are not relieved, and new debts may arise. If the obligation arises after the initiation of bankruptcy proceedings, it is recognized as a current payment.

For such payments, Article 134 of Law No. 127-FZ provides for a special priority:

- first priority

- expenses for conducting a bankruptcy case (remuneration to the manager, legal expenses, payments to other persons); - second stage

- wages and severance pay accrued for the period after the bankruptcy was filed; - third priority

- payments to persons hired by the manager to exercise certain powers (for example, to evaluate property); - fourth stage

- utilities, payments for energy supply, other similar payments; - fifth priority

- all other obligations that arose after the initiation of bankruptcy proceedings.

There can be many different current payments in one queue. For example, claims may be submitted for each type of utility service. There is also a provision in the law for this case. Between current payments of the same queue, priority is determined by the calendar date of their presentation.