Home / Real estate / Land / Taxes / For legal entities

Back

Published: 04/11/2017

Reading time: 12 min

0

522

In the tax sphere, not only the actual payment of all necessary taxes and fees, but also the timely and correct submission of reporting on them is of great importance. This requirement especially applies to such categories of payers as individual entrepreneurs and legal entities.

Individual land tax payers also have an obligation to submit this document, so it is worth considering the situation in which they will need to submit a zero declaration.

- Concept and purpose

- Who does the filling?

- Procedure for correctly filling out the Cover Page

- First part

- Second part

Who pays land tax

Land tax is paid by land owners and those whose land is in permanent (perpetual) use or lifelong inheritance.

There is no need to pay tax in the following cases:

- the use of land is registered free of charge, for a certain period;

- the plot is rented under a contract;

- the plot is exempt from taxation (in accordance with clause 2 of article 389 of the Tax Code of the Russian Federation).

Benefits are provided for taxpayers:

- Federal. The list of organizations exempt from tax is given in Art. 395 Tax Code of the Russian Federation. Also, indigenous peoples do not pay the tax. And for the citizens listed in Art. 391 of the Tax Code of the Russian Federation, a reduction in the tax base is provided.

- Local. They are established by regulations of local governments and the laws of federal cities - Moscow, St. Petersburg and Sevastopol.

Thus, in the Trans-Baikal Territory, disabled people of groups 1 and 2, disabled people from childhood, veterans and disabled people of the Great Patriotic War, and persons affected by the disaster at the Chernobyl nuclear power plant are completely exempt from paying land tax.

In other regions, both individuals and legal entities may be exempt from tax. In addition, there is a decrease in the tax base.

In Moscow, a 30% discount is provided for sanatorium-resort organizations and healthcare institutions - according to the Moscow city law “On Land Tax” dated November 24, 2004 No. 74 (as amended on January 1, 2019). In Yekaterinburg, local authorities provide Heroes of the Soviet Union with a benefit in the amount of 100 thousand rubles. (decision of the Yekaterinburg City Duma dated November 22, 2005 No. 14/3).

Deadline for payment of land tax

Starting from 2021, it is not required to submit a land tax return (federal law dated April 15, 2019 No. 63-FZ). The tax payment deadline has become the same for everyone: it has been postponed to March 1 of the following reporting year (Federal Law No. 325-FZ dated September 29, 2019). That is, organizations must pay tax for 2021 no later than 03/01/2021.

Individuals and individual entrepreneurs equated to individuals are required to pay tax for 2021 by December 1, 2021 (Clause 1 of Article 397 of the Tax Code of the Russian Federation).

Also, during the tax period - a year - organizations can pay advance payments based on the results of the first, second and third quarters as ¼ of the annual tax amount (clause 6 of Article 396 of the Tax Code of the Russian Federation). Payment of advance payments is provided for by the laws of the municipality (clauses 2 and 3 of Article 397 of the Tax Code of the Russian Federation).

You can get acquainted with the deadlines in detail using the Federal Tax Service service. It is necessary to select the type of tax and the subject of the Russian Federation.

Correct filling procedure

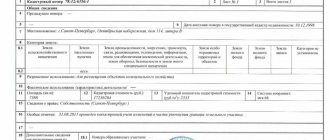

The declaration form is approved by law, therefore this document is filled out in accordance with the established form. It consists of three parts, each containing different information:

Title page

This section contains basic information about the payer, namely:

- full name of the company;

- her checkpoint and tax identification number;

- phone number;

- tax period code;

- code of the Federal Tax Service branch to which reports are submitted;

- reporting period;

- correction code (the declaration can be submitted both for the first time, and for the second or third time);

- OKVED code;

- number of pages of the declaration.

In addition, part of the title page is intended to be filled out by tax authority employees, so it must be left blank.

First part

The least meaningful part of the document, which states:

- OKTMO code;

- KBK;

- the amount of tax to be paid (in the case under consideration, this cell is set to 0).

In general cases, it is recommended to fill out the first part of the declaration after the second, since it is in it that the amount of tax is calculated. But since in our situation its sum is still zero, the first part can be filled in earlier.

Second part

Includes the following data:

- characteristics of the site, namely its area, cost, category of land, type of use;

- KBK and OKTMO code;

- the size of the base for calculating tax (this indicator will be equal to zero, since the object of taxation itself is absent);

- the tax rate applied in a specific constituent entity of the Russian Federation;

- benefit code and its size (if expressed in numerical form);

- tenure of land;

- the total tax amount (zero is also put here).

After filling out each section at the bottom of the page, the person who is responsible for entering the data must put the date the document was executed, as well as his signature, surname and initials. This is usually done by the head of the enterprise, a person temporarily performing his duties, or the chief accountant.

All necessary details for filling out (KBK and other codes) can be found at the tax office, the payer of which is the enterprise or organization. In addition, some of the codes are contained in the Appendices to the Instructions for filling out the land declaration, so they can be viewed there.

Land tax returns can be found here.

Also, when preparing a document, you must adhere to several important rules:

- You can fill it out either manually or on a computer;

- when filling, only blue or black ink should be used;

- When entering text information, you must use block letters;

- data is entered from left to right, starting from the first free cell;

- Only one number or letter can be entered in one cell;

- in the absence of any information, a dash is placed in the empty cell;

- data corrections using correction tools, erasers, blades and similar methods are not allowed;

- If you make a mistake in a document, you can correct it by crossing out one straight line and entering the correct information (but it is better to prepare a new document);

- sheets cannot be fastened or stitched in any mechanical way (thread, stapler);

- Double-sided printing of declaration pages is not permitted.

Since there is no need to carry out any complex calculations when filling out a zero declaration, filling it out will not be difficult and will not take much time. You can submit a document either in paper form (in person, by mail or through a legal representative), or in electronic form, via special telecommunication channels.

You should definitely remember to comply with the established deadlines and provide the document a little earlier, so that if there are any errors or inaccuracies in it, you have time to eliminate them before the deadline.

The use of public land is regulated by the legislation of the Russian Federation. Which banks offer mortgages for the purchase of land? Find out about this by reading our article.

Sometimes, when purchasing a plot of land, it is necessary to draw up an advance payment agreement. You can find out how to do this here.

Land tax rates

Tax rates have not changed in 2021:

- 0.3% for agricultural lands, plots of personal subsidiary plots, summer cottages; lands for the needs of the state, housing stock and infrastructure; areas used for national defense, security and customs;

- 1.5% for other lands.

Subjects have the right to set their own rates, but not higher than those accepted at the federal level.

The table below shows examples of rates in Moscow and Yekaterinburg.

Calculation of land tax

To calculate land tax, the formula is used:

Land tax = Tax base × Tax rate

The tax base is the cadastral value of the land plot as of 01/01/2020. This information is provided by Rosreestr upon request in person or on the official website of the department. For more information about the tax base, see Art. 391 Tax Code of the Russian Federation.

When a land plot has several owners and a purchase or sale of land was made in the reporting year, the formula will look like this:

Land tax = Kst × St × D × Kv,

Where:

Kst - cadastral value;

St - tax rate;

D - share in land ownership;

Kv - coefficient of land ownership in months.

Let's look at an example of calculating land tax:

Ivanov I.A. purchased a plot of land for gardening in the Moscow region on 04/09/2020. The property was registered in the name of I. A. Ivanov, his wife and two children in equal shares. The cadastral value of the plot is RUB 2,354,500.

The tax rate is 0.3%.

Land tax for I. A. Ivanov is equal to:

2,354,500 × 0.3% × 0.25 × 0.75=RUB 1,324.41,

where 0.25 is ¼ share in the property, 0.75 is the ownership coefficient (9 months / 12 months).

When calculating the number of months of ownership, the following feature is taken into account:

- if the plot was purchased before the 15th day of the current month inclusive, then this month is included in the calculation. If the property is registered after the 15th, the month is not taken into account;

- If the land is sold by the owner before the 15th day, then the month of sale is not taken into account for tax purposes. If after the 15th day, it is taken into account (clause 7 of Article 396 of the Tax Code of the Russian Federation).

Accounting

The actual costs at which a plot of land is taken into account may include:

- the cost of the plot paid to the seller;

- real estate, consulting services;

- payments to the intermediary;

- the amount of state duty for land registration;

- other costs associated with the acquisition of land.

On a note! When borrowed funds are used to purchase a plot, the interest on them is gradually included in the cost of the land until the moment when it moves from non-current assets to fixed assets (PBU 15/2008 “Accounting for expenses on loans and credits”).

Transactions with land plots may include: receiving as a gift, under an exchange agreement, receiving as a contribution to the authorized capital, as well as purchase, sale, lease, sale of part of the plot, etc.

How can an organization remove a land plot from cadastral registration ?

Let's look at the most common land transactions that an accountant has to take into account.

Purchase

Land is included in accounting as fixed assets:

- Dt 08/1 Kt 60 - purchase of memory from a counterparty;

- Dt 08/1 Kt 10, 60.76 - acquisition costs (real estate, consulting, material);

- Dt 08/1 Kt 76 (68/invoice “State duty”) - the state duty for registering a land plot is reflected;

- Dt 01 Kt 08/1 - ZU is included in fixed assets.

Land is included in accounting as an object of subsequent resale:

- Dt 41 Kt 60 - purchase of memory from a counterparty;

- Dt 41 Kt 10, 60, 76 - acquisition costs (real estate, consulting, material);

- Dt 41 Kt 76 (68/invoice “State duty”) - reflects the state duty for registering a land plot.

On a note! Despite the fact that there are no clear distinctions between the use of accounts 76 and 68 when accounting for state duties, the tax authorities recommend that the duty for registration of a site be taken into account in account 68, since it is a federal tax (Article 13 of the Tax Code of the Russian Federation).

Sale

Land sold as OS:

- Dt 62 Kt 91 - income from the sale of storage units is recorded;

- Dt 91 Kt 01 - fixed asset deregistered at its cost;

- Dt 91 Kt 10, 70, 60, etc. - the costs of selling the storage unit are taken into account.

Land sold as a commodity:

- Dt 62 Kt 90 - income from the sale of storage units is recorded;

- Dt 90 Kt 41 - the storage unit is written off as a product from the register, at its cost;

- Dt 44 Kt 10, 70, 60, etc.

- Dt 90 Kt 44 - expenses for the sale of storage units as goods are taken into account and written off.

Sale of part of the plot

Let's look at an example of how to correctly account for the sale of part of a plot. Let the memory be listed on account 01 as a fixed asset, a single object. Its cost is approximately 100,000 rubles. After the cadastral work was completed, the land was divided into two parts. One remains in the organization (60,000 rubles), and the other is sold (40,000 rubles). 50,000 rubles were received from the sale.

Let's divide the area in accounting:

- Dt 01 “for sale” Kt 01 “initial” - 40,000 rubles. — a part has been allocated for sale;

- Dt 01 “remaining in the organization” Kt 01 “initial” - 60,000 rubles. – the part remaining in the organization is allocated;

- Debit 91 Credit 01 “for sale” - written off from the register of a loan subject to sale at its cost of 40,000 rubles;

- Debit 62 Credit 91 - 50,000 rub. income from sales.

Next, we take into account the costs of sale, according to the above correspondence: Dt 91 Kt expense account, and reflect the profit (loss) from the transaction Dt 91 (99) Kt 99 (91) .

In this case, it would be correct to divide the plots, and not write off the land plots and register two newly formed objects.

Rent

Initially, expenses for concluding a lease agreement are charged to account 97 “Deferred expenses”, and then in equal shares are written off to accounts for ordinary activities:

- Dt 97 Kt 76 - costs of acquiring the right to lease;

- Dt 19 Kt 76 - VAT accrual on the value of the rental right;

- Dt 68 Kt 19 - VAT is presented for deduction;

- Dt 20, 25, 26, etc. Kt 97 - write-off of a share of expenses during the lease term.

The rent is calculated by posting Dt 20, 25, 26, etc. Kt 76. If the rental conditions allow, VAT can also be deducted from the amount (see postings above).

Sublease, unless prohibited by the contract, is documented by postings: Dt 62 Kt 91 and Dt 91 Kt 68.