Registration of a land plot with cadastral registration is a necessary procedure for obtaining a certificate of state registration of ownership of this property, without which the owner will not be able to carry out subsequent legal transactions, such as sale, gift or lease. It is also necessary for the construction of facilities and communications on this site.

Cadastral registration legally confirms the existence of a given site on the territory of the Russian Federation with certain characteristics that are entered into the Unified State Register.

The body performing the function of cadastral registration acts on the basis of the law “On the State Real Estate Cadastre” and by-laws of the Russian Federation.

How to register a plot of land, a house, land - an action plan

Registration of a real estate property is carried out within ten working days from the date the cadastral registration authority receives the corresponding application for cadastral registration (Clause 1, Article 17 of the Cadastre Law). There is no state fee for state cadastral registration.

- Conclude an agreement with a cadastral engineer or cadastral bureau. Be sure to discuss the estimate in advance. The contract must stipulate:

- estimate,

- deadlines,

- scope of work.

- Collection of necessary documents about the land plot. It is important to agree before concluding a contract who will be responsible for which documents. Usually the owner of the plot provides documents confirming ownership (extract from the Unified State Register of Real Estate, court decisions, acts of the local administration). The remaining materials are collected by a specialist.

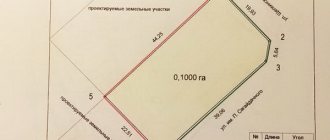

- The engineer makes a geodetic survey of the land plot on the ground, determines the coordinates and prepares drawings.

- The layout of the land plot is agreed upon with the owners of adjacent plots.

- The cadastral specialist prepares a boundary plan that will be used for cadastral registration of the land plot. If a house is built on the land, then for its subsequent registration, a technical plan of the site is also immediately drawn up.

- The owner or his authorized representative submits a package of documents for state registration. Registration of a land plot for cadastral registration is not subject to state duty, unlike registration of rights to an object.

- After the expiration of the established registration period (up to 12 days), the owner receives an extract from the Unified State Register of Real Estate about the main characteristics and registered rights. The extract will contain information about cadastral registration, including a plan of the land plot. In addition, after a month or two, the plot of land itself appears on the public cadastral map of Rosreestr with delineated boundaries. Cadastral passports will not be issued since 2021.

Who carries out the registration procedure and on what basis?

The following categories of persons have the right to register land plots for cadastral registration:

- Owner of the site.

- Tenant, with a lease term of more than 5 years.

- Subject of perpetual use of memory.

- Bearer of the right of lifelong inheritable ownership.

- A person acting on behalf of all of the above persons, acting under a power of attorney certified by a notary.

In addition, there are times when a citizen applies for registration whose case is not suitable for simple registration:

- For example, a plot of land was inherited, and without state registration, it is impossible to become its full owner, so the heir himself registers the property for cadastral registration.

- Or a situation where a citizen wants to buy a storage unit that belongs to the state or municipality.

Attention. The buyer makes a request to the municipality, which approves the registration of the plot, and then the purchase itself is made.

The following documents are the basis for registration:

- Acts establishing the transition, emergence, termination or limitation of the right of an object. Issued by state authorities or local governments that have the appropriate competence to do so.

- Certificates of right to inheritance.

- The contract and other agreements that were concluded during the transaction.

- Judicial acts (only those that have entered into legal force).

- Certificates of right to land plots issued by authorized government bodies.

- A survey plan or survey report drawn up in accordance with the law.

- Map-plan of the land plot, prepared as a result of cadastral work.

- Other documents confirming the existence, origin, transfer, limitation of rights, etc. on the memory.

How to choose a specialist to register a land plot with cadastral registration

Preparing documents for registration of a land plot is a rather expensive procedure; the cost depends on the region and the complexity of the work. The price starts from 10-15 thousand rubles and tends to one hundred thousand. The owner of a land plot does not have the right to independently carry out the necessary work and is forced to turn to specialized organizations or certified specialists.

When choosing an engineer or a specialized bureau, you need to focus primarily on the availability of the necessary qualifications and approvals, and only then discuss the cost of services. A cadastral engineer's mistake can be costly for the site owner.

The specialist must pass a qualification exam, have membership in an SRO and, preferably, professional experience. You can check a cadastral engineer for free on the Rosreestr website in the “Services – Register of Cadastral Engineers” section.

Price

The cadastral value of a land plot is the calculated value established at the time of registration of real estate in the Unified State Register.

As a rule, this cost is directly affected by:

- size of the registered object;

- location of the territory;

- availability of communications;

- category of land and settlement;

- the presence of buildings and structures on the territory of the accounted property.

The cadastral value of a property is formed on the basis of a coefficient calculated as the ratio of the average price of similar plots to the determined amount .

Thus, for objects with high characteristics, the cost according to the cadastre will consist of the sum of the base cost and the coefficient and vice versa.

Where to get documents for registering a plot of land for cadastral registration

Any process of preparing a package of documents for land begins with receiving a current extract from the Unified State Register of Real Estate, which contains information about the main parameters and ownership of the site, which are contained in the Rosreestr databases.

Official extracts from the USRN, certified with an electronic digital signature, are provided by the online service USRN.Reestr. Such statements are accepted by any institution, including Rosreestr, banks and courts. The document can be printed or used electronically.

Often, for land plots acquired several years ago, the owner or heir cannot find the document that provides the basis for obtaining rights to the land. Using an extract from the Unified State Register of Real Estate, you can clarify on what basis this land was received and find it or request a duplicate.

The land survey plan is prepared by a cadastral engineer and must be submitted electronically.

Coordination of boundaries with a forest area by forestry, forest park

If your plot borders on forest fund lands, then signing the Border Location Coordination Act becomes a little more complicated.

According to paragraph 1 of Art. 8 of the LC RF, forest areas within the forest fund lands are in federal ownership. The body that has the right to approve forest boundaries that are in federal ownership is the Federal Agency for State Property Management - Rosimushchestvo.

However, until January 1, 2023, within the framework of the “Forest Amnesty” No. 280-FZ dated July 29, 2017, for the purpose of accounting in connection with clarifying the location of the boundaries of the site intended for gardening, truck farming, summer cottage farming, personal subsidiary plots or individual housing construction , there is no requirement to coordinate the location of part of the border of such a land plot, which is located within the boundaries of the forest district, forest park, if the following conditions are simultaneously met:

- The allotment was provided to the citizen for the specified purposes before August 8, 2008 or was formed from a land plot provided before August 8, 2008 for gardening, vegetable gardening or dacha farming to a horticultural, vegetable gardening or dacha non-profit association of citizens, or another organization under which it was created or the said association was organized. This condition is also considered met in the event of transfer of rights to such a land plot after August 8, 2008.

- The adjacent land plot is a forest plot.

If these two conditions are met, the boundaries will not be coordinated with the Federal Property Management Agency. Also in accordance with Art. 60.2 218-FZ, in the case of crossing borders, the rights to which arose before 2016, and the boundaries of a forest plot, this circumstance is not an obstacle to registration.

In this case, in the act of approval of boundaries, the cadastral engineer indicates: “The border was adopted in accordance with Art. 60.2 of Federal Law No. 218-FZ of July 13, 2015. “On state registration of real estate.”

We have registered the land in the cadastral register - what next?

Now registration in the land cadastre and registration of rights to a plot occur simultaneously.

After receiving an extract from the Unified State Register of Real Estate about the completion of state registration of cadastral changes, you can perform any actions with the land plot - sell, donate, inherit, and so on.

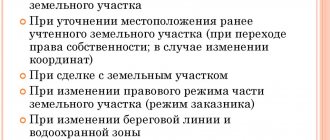

In the future, any changes in the technical characteristics of a plot of land will also need to be registered in the cadastre:

- changes in boundaries or area;

- division or combination of plots;

- erection or demolition of buildings, as well as changes in their area;

- changing the category of land, etc.

To prepare the documents, you will again have to involve a cadastral engineer, who will prepare a new cadastral plan (and, if necessary, a technical plan) taking into account the changed characteristics of the object.

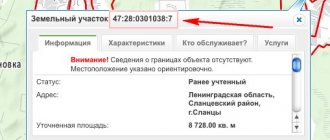

What errors can you encounter when entering information into the Unified State Register of Real Estate?

Accounting errors can be registry or technical:

- Technical ones are quite easy to correct, since they are arithmetic or grammatical typos. For example, information about coordinates in the USRN may contain an incorrect numeric value. To eliminate this problem, you must contact the MFC with an application for change, providing documents containing correct data. The period for Rosreestr to correct a technical error is 3 working days.

- Registry errors, unlike technical ones, are more complex. They are associated with incorrect work to establish boundaries. Such an error can be corrected by a court decision or by issuing a corresponding act by a government body. From the moment you submit documents for correction, the government agency will be required to make changes within 5 working days

How to submit documents

The processes of cadastral registration and registration of property rights are now concentrated in the hands of Rosreestr. Therefore, you can undergo both procedures at once in one organ - this is convenient.

Even more pleasantly, there are several options for interacting with Rosreestr; it is not at all necessary to even personally visit this institution. If all the necessary documents are ready, then you can register the land plot with the cadastral register:

- in person - for this you need to submit a set of paper documents directly to Rosreestr or through the MFC or;

- by mail - send a package of documents to Rosreestr by registered mail with acknowledgment of receipt and a list of the contents;

- via the Internet - send electronic documents through the Gosuslugi portal or directly send them to Rosreestr. This will require an enhanced qualified digital signature.

Text: Natalya Petrakova

On accounting for the leased part of a building or plot of land

There is no need to accompany the application for state registration of rented premises with a technical plan if:

- the Unified State Register of Real Estate contains data on all premises of a given real estate property;

- rented areas are premises (one or more) with common building structures (adjacent rooms), located within one or several floors.

In other cases, registration of a lease for a part of a building or a part of a plot of land is possible only upon submission, respectively, of a technical plan or boundary plan for these parts. Otherwise, Rosreestr will not perform state registration - it will register the lease in the format of an encumbrance on the property. Also, the law No. 120-FZ dated April 30, 2021 stipulates that in the case of renting part of a building or land plot, the entire property is not removed from state registration.

Tax accounting

Land tax

Organizations and entrepreneurs who own and use land plots indefinitely are payers of land tax (Article 388-1 of the Tax Code of the Russian Federation). The tax base is determined by the cadastral value of the site and is a fixed value. Tax rates are determined at the regional level depending on the category of land.

VAT

Land purchase and sale transactions are not subject to VAT (RF Tax Code Art. 146-2, paragraph 6). This applies to both entire plots and shares in them. At the same time, according to Art. 161 of the Tax Code of the Russian Federation, paragraph 3, paragraph. 2, municipal property is subject to VAT when it is sold. The Ministry of Finance (Letter No. 03-07-11/03 dated 13-01-10) explained that municipal and state-owned land plots, despite the above, are excluded from VAT taxation. At the same time, buildings on it are subject to VAT.

Lease of land in state ownership, municipal ownership, as well as land of constituent entities of the Russian Federation is not subject to VAT (Article 149 2 paragraphs of the Tax Code of the Russian Federation). At the same time, sublease of such lands is subject to VAT (Letter of the Ministry of Finance No. 03-07-11/436 dated 10/18/12). Under private property lease agreements, VAT is applied (Letter No. GD-3-3/2391 of the Federal Tax Service dated 06/18/15).

Income tax

You can take into account the costs of purchasing land only at the time of its sale, reducing income by the amount of the purchase of land and the costs of its sale (Articles 268, 271 of the Tax Code of the Russian Federation). According to Art. 264-1 of the Tax Code of the Russian Federation, expenses for the purchase of land in state or municipal ownership, on which buildings, structures, structures are located, or which are acquired for capital construction purposes, can be recognized as income tax expenses.