According to current legislation, any member of this family or a close relative can have temporary disability due to the need to care for a minor family member. But you must follow all the rules, since such options have their own peculiarities. Paperwork is completed in the general manner, that is, you will need to carry out the entire procedure and have the appropriate certificates.

Otherwise, disciplinary sanctions will be applied to persons who are absent from the workplace without valid and confirmed reasons.

The procedure for granting sick leave to care for a sick relative

The social insurance system in the Russian Federation guarantees that an employee will retain his average earnings in the event of his own illness or the incapacity of his family members.

If an employee’s relative falls ill and the employee is forced to care for him, the medical institution issues a certificate of incapacity for work, which can be brought to work and received temporary disability benefits during absence from the workplace. The employer is not obliged to find out who the employee’s sick relative is (Part 5, Article 13 of Law No. 255-FZ of December 29, 2006). To indicate a family relationship on a sick leave for caring for a sick relative, there is a special field where the doctor enters one of the following codes:

38 - mother,

39 - father,

40 - guardian,

41 - trustee,

42 - another relative (clause 65 of the Procedure for issuing certificates of incapacity for work, order of the Ministry of Health dated September 1, 2020 No. 925n).

The legislation establishes a ban on paying sick leave to care for a sick relative in the following cases:

- if a chronic patient is in remission;

- if the employee is on maternity leave or to care for a child under three years old and does not work part-time. If an employee works from home or for several hours a day, then she is paid sick leave according to the general rules;

- if the employee was on study leave or leave at his own expense;

- if health problems with an employee’s family member arose during downtime.

Should I pay for sick leave to care for a sick child if the employee works remotely and can work despite the child’s illness? The answer to this question is in ConsultantPlus. If you don't already have access to the system, get a free trial online.

If a relative falls ill during an employee’s vacation, the vacation is not extended by the number of days of illness, except in cases where the extension is provided for by a local act of the employer. The benefit is paid for the period of sick leave that coincides with the days of vacation, but is not paid. Only days of illness of a relative falling on the days after the vacation are subject to payment (Article 124 of the Labor Code of the Russian Federation, letter of the Ministry of Labor of Russia dated October 26, 2018 No. 14-2 / OOG-8536).

For more information about calculating disability benefits during vacation, read the article “How to extend vacation for sick leave during vacation.”

IMPORTANT! The benefit calculated for a full calendar month, calculated for periods of incapacity for work from 04/01/2020, cannot be lower than the minimum wage. For details, see the material “How to calculate sick leave under the new law.”

The doctor will issue sick leave to care for sick parents or other relatives for the entire period of their illness, but there is a limit on the number of days that must be paid.

Can I open a newsletter for two or more people at the same time?

You can open a document for several people. Two children fit into one, and on subsequent occasions another one is registered. If, during the recovery of one minor, another falls ill, then his data will simply be entered on the current sheet, which will be extended for the required period.

The previous period is not counted towards the total, that is, extension is possible for a standard period.

On a note! If two people provide alternate care, according to the law, then the sheet can be issued for both, taking into account all time frames.

The nuances of paying sick leave for child care

But providing sick leave for childcare has many nuances. First of all, the limit of paid days depends on the age of the child and his illness.

Important! Children are recognized as children of an employee (including non-relatives - stepsons and stepdaughters, as well as wards and adopted children), grandchildren, minor brothers and sisters.

If the child is under 7 years old, then the entire duration of illness is paid, but not more than 60 calendar days per year (90 days for some diseases).

To care for a child over 7 years old but under 15, 45 calendar days per year are given. Social insurance will not pay the employee for the following days. Each sick leave can be no more than 15 calendar days, unless the medical commission recognizes the need to treat the child longer.

For a child over 15 years of age, the following rules apply: 7 calendar days of illness are paid; the annual limit on paid days of incapacity is 30 calendar days.

Attention! Limits for sick days for children are calculated based on age at the time of illness.

For some diseases from the list of orders of the Ministry of Health and Social Development of the Russian Federation dated February 20, 2008 No. 84n, the number of paid days increases. Such diseases include malignant tumors, severe developmental disorders and diseases of the nervous system, asthma, tuberculosis, meningitis, serious limb injuries, burns and some other diseases. In such cases, sick leave for caring for a patient can be paid for all days of illness.

Attention! Care for disabled children until adulthood is paid in full for the entire period of illness, but not more than 120 days a year (Clause 5, Article 6 of Law No. 255-FZ of December 29, 2006).

What other payments are due to disabled people, read the material “Compensation payments under the social security system.”

To account for the number of paid days of incapacity for work of a relative, the company counts only those days when the patient was cared for by an employee of the company. That is, a child could be sick 90 days a year, of which 20 days he was cared for by his mother, a company employee, another 20 days by his father, who works in another organization, and the remaining 50 days by his retired grandmother. You take into account only 20 days of mother's sick leave.

You can also take care of a child during the mother’s leave to care for him - she herself does not have the right to receive payment for a certificate of incapacity for work, but the father caring for the child or any other relative can claim payment for sick leave.

The first 10 days of illness of a child (regardless of his age) during treatment at home are paid taking into account the insurance experience of the caring worker. Starting from the 11th day you need to pay 50% of average earnings. If a child is being treated in a hospital, then payment for all days is based on the insurance period (Part 3, Article 7 of Law No. 255-FZ).

If an employee has two children sick at the same time, one paper BC is issued to care for them. If there are more sick children, a second paper sick leave is issued. When two or more children fall ill, one electronic sick leave is generated at the same time. If the second (third) child falls ill during the illness of the first child, the BC previously issued for the first child is extended until all children recover without counting the days that coincided with the days of release from work to care for the first child (clauses 44, 45 of the Procedure for issuing certificates of incapacity for work, approved by order of the Ministry of Finance dated September 1, 2020 No. 925n).

If you want to check whether you have correctly calculated the allowance for caring for a sick child, use the advice of ConsultantPlus experts. Go to the Ready Solution with a free trial access to the legal system.

How is it paid?

Payment will depend on a number of factors, including insurance length and the amount of earnings for 2 years.

The timing and type of treatment provided, whether inpatient or outpatient, will also be taken into account. Payment beyond the established period for the annual period is not carried out, that is, the benefit, in addition to different rates, also has a limit in each specific case.

Income limits

The upper limit of the benefit is set at 100% of the average salary. The lower one has a minimum of 50%. A number of conditions for determining the boundaries and amounts of payments:

- experience. When working for more than 8 years, full payment is received, and for 5-8 years - 80%. If the experience is less than 5 years, then the rate is 60%;

- age group and category of children. Full payment is made if you are under 7 years of age, disabled or have established diseases, including tumors. A limit of 15 days of payment is fixed for minors 7-15 years old, and 3 days or in exceptional cases 7 for persons 15-18 years old;

- type of treatment. For outpatient, that is, home treatment, the rate will depend on the length of service in the first ten days. Further payment is equal to 50% of the average salary. In case of hospitalization, everything depends on the duration of work.

Typically, average earnings are calculated based on the last two years of work, that is, if there was a one-year break, then the year preceding it is counted.

Calculation procedure

To set the benefit amount, you will need to first calculate the amount, taking into account all the nuances and conditions.

You will need to calculate the average earnings for two years. The total income is divided by the number of days. The result is the average daily earnings, which will be used to determine the amount of the benefit. For an outpatient treatment process with sick leave for more than 10 days, use the formula:

Benefit = total period in days excluding 10 days x average earnings x 50% + 10 x average earnings x percentage, which depends on length of service.

The number of paid days is entered in the first work.

For a hospital, a different formula is used:

Benefit = total period of illness in days x average salary x interest rate for the duration of work.

Terms and conditions of payment

The document, after registration of sick leave and fulfillment of all conditions, can be transferred to management or directly to the Social Insurance Fund, depending on the nature of the papers and the individual characteristics of the situation.

Read also: How to get a certificate for a large family

It is possible to use paper or electronic copies, which have different payment terms. If a paper copy was provided, then payment is made within ten days, and if electronic, then the period is increased to 15 days.

It is worth considering that the payment is provided after the sheet is closed, that is, payment cannot be received in advance. You also need to remember that only the person listed on the form receives it.

Is it possible for a grandmother to take sick leave to care for her grandson?

If a child becomes ill, in some circumstances there is no choice but to provide care with the help of the grandmother. This is allowed by law, and a grandmother should be provided with sick leave to care for her grandson if she works.

Sometimes employers require proof that they live at the same address. However, such a request is unlawful, since it is not legally defined and can be ignored.

Payment of sick leave to the grandmother is made in the usual manner on the basis of the norms contained in paragraph 5 of Art. 6 Federal Law dated December 29, 2006 No. 255-FZ.

How to apply for sick leave to care for a disabled person

When issuing and paying sick leave certificates to employees who need to care for a disabled person, the following rules apply:

- To care for a disabled child under 18 years of age (from 04/10/2018), sick leave can be issued for the full period of treatment, however, no more than 120 days in total per calendar year are subject to payment from the Social Insurance Fund. This period may include different types of treatment (outpatient and inpatient) and various types of diseases. Sick leave is paid according to the following scheme:

- for inpatient treatment, the average monthly salary is paid;

- for outpatients - 100% payment for the first 10 days of illness, 50% payment for all subsequent days.

- Caring for disabled adults is accompanied by sick leave issued for the same periods as sick leave for caring for a parent or caring for sick relatives - 7 calendar days for each disease. You cannot be on sick leave for more than 30 calendar days per year.

In what cases does a b/l open?

There are several conditions:

- Grandparents are officially working. As noted, people who are retired are not paid benefits.

- Parents should not be on vacation. If mom or dad are temporarily not working, then they should have time to care for their sick child. You can read about the connection between sick leave for child care and parental leave here.

- The grandmother (grandfather) must take care of the child while on sick leave. The certificate of incapacity for work will not be paid if the grandmother works while the minor is sick.

- The grandmother must be a relative of the child. You cannot invite an outsider who will take sick leave and take care of someone else’s boy or girl.

- The grandmother must live in the same city where the child lives. However, the point is controversial. Rather, the grandmother (grandfather) and grandson (granddaughter) should live together during the period of the child's illness. Otherwise, it will simply not be possible to provide care.

Otherwise, there are no special requirements or restrictions. If the mother gets sick, then according to the current legislation, the grandmother is given a sick leave (we talked about whether it is possible to simultaneously issue a sick leave for yourself and for caring for a child here).

The legislator’s logic is as follows: a sick mother, most likely, will not be able to provide quality care for the child, and in some cases will not be able to constantly be near her son or daughter. For example, if the parent required surgery.

Results

Many companies are afraid to hire women with children because they believe that the cost of paying average wages during sick leave will fall on the employer - this is not the case. Payment for certificates of incapacity for work is reimbursed by the Social Insurance Fund. The state regularly reviews the rules for paying sick leave and expands the list of diseases for which days of incapacity for work are paid in full. In order not to miss important changes in the rules of social insurance for employees, read our “Salaries and Personnel” section.

Sources:

- Labor Code of the Russian Federation

- Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 N 255-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

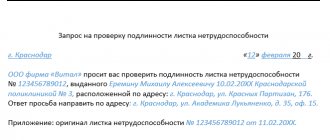

Registration and necessary documents

To correctly issue a certificate of temporary disability for a child, the grandmother must present an identification document, as well as an insurance policy.

Next, the attending physician draws up a special form, in the empty fields of which all the missing data is entered - the child’s age and other necessary information in the form of two-digit codes.

For your information

So, in the column where the reasons for incapacity are indicated, if there is such a fact of receiving a document as the grandmother caring for a sick baby, code 09 must be entered.

The “Care” field displays how old the sick child is (the number of full years is entered in the first cells, or the number of months in the second pair of cells). The code assigned to the family relationship must also be entered here (code 38 indicates the child’s mother, 39 indicates the father, and the number 42 is assigned to other relatives, including the grandmother).

Attention

The legislation does not oblige the person receiving sick leave to prove or in any way confirm his relationship with the sick child.

If several children are sick, the data of both must be entered in this line. If there are more than two children, the grandmother is given a new sick leave.

The line and cells “Benefit amount” and “At the expense of the employer” are not filled in, since the full amount of the benefit will be paid at the expense of the SS Fund.