A gift certificate is a document certifying the right of its owner (holder) to purchase from the person who issued the certificate goods, work or services in an amount equal to the nominal value of this certificate (Letter of the Ministry of Finance of Russia dated April 25, 2011 N 03-03-06/1/ 268; Federal Tax Service of Russia for Moscow dated October 22, 2009 N 17-15/110609).

Upon receipt of the certificate, the employee has the right to choose the goods (work, services) he likes without payment.

Therefore, the transfer of a certificate to an employee represents a gratuitous transfer of property rights to goods, works, and services that have already been paid for, but have not yet been selected.

Typically, a gift certificate has the following features:

- has a limited validity period;

- not bought back;

- is not restored as a result of loss;

- withdrawn at the time of use;

- the negative difference between the cost of the selected goods, works or services and the face value of the certificate is not compensated to the buyer;

- the positive difference between the cost of the selected goods, works or services and the face value of the certificate is subject to additional payment by the buyer.

Let's consider how the costs of purchasing gift certificates, as well as transactions for their transfer to employees of the Organization, are reflected in tax and accounting records.

Why is a product conformity certificate required?

This is a barrier to protect the market from low-quality products. Every country has standards to ensure that the consumer buys things or products that will not cause harm.

For example, an entrepreneur launched the production of children's toys. First, experts conduct research and find out whether the toys are made from safe materials. Check that the parts will not be damaged by children's hands. After this, the production receives a certificate of conformity and enters the market. Without testing and permits, it will not be possible to sell such products. This is illegal.

Businesses often use a certificate of conformity in marketing and advertising. Product manufacturers often emphasize that they care about customers and do everything according to GOST. This means that the consumer receives a quality product.

Advantages and disadvantages of a housing certificate

Let's look at the pros and cons of a housing certificate:

Advantages and disadvantages

Gratuitous. Money is allocated from the regional budget; nothing is required from the certificate holder in return

Relatively simple conditions for obtaining

The certificate can be used at the discretion of the owner: buy an apartment in a new building or a resale building, purchase a house

Long waits in line: for example, it may consist of 200 people, but only five will be issued certificates in a year

Most often, the amount for the State Housing Development Agreement is not enough to fully pay for the property, and you have to add your own money

What products need to be certified

A complete list of goods subject to certification can be found in Government Decree No. 982 of December 1, 2009. For example, in Russia, manufacturers and importers must certify:

- Kids toys;

- Musical instruments;

- Underwear;

- Weapon;

- Cars.

In addition, if a business trades with countries of the customs union, then certificates with the TR CU designation are valid for these territories. List in the Decision of the Customs Union Commission dated 04/07/2011 N 620.

There is one important point. Sometimes a product does not require a certificate, but a declaration of conformity is required. This means that the manufacturer, and not the certification commission, bears responsibility for product quality. Declarations are needed for household chemicals, mineral fertilizers, and lumber. For a complete list, see the same government decree.

If you want to find out whether a product requires a certificate, you will have to study both documents. Because some groups of goods are excluded from certification, but by decision of the customs union they require a declaration. For example, this happened with tea. In general, when starting a business, you should find out all the requirements and find out whether a product certificate is needed.

What is a housing certificate?

A state certificate is a document through which you can partially or fully pay for the purchase of housing. The amount for it is calculated taking into account the standard cost of sq.m., and in each region it is approved by the local administration.

Cash certificates are not issued. They are credited to a bank account, and the transaction is controlled by the bank in any case, even if the housing is purchased with its own funds and not with a mortgage.

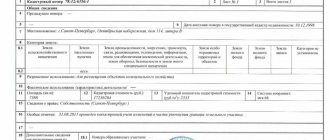

The certificate for the purchase of real estate is personalized and contains the following information:

- Full name, passport details of the owner.

- Date of issue, series and number of the certificate (certificate).

- An amount subsidized by the state.

- Validity.

- Name of the institution that issued the certificate.

Note! The certificate is not inherited; it is issued to a specific person. But real estate acquired with its help can be sold, donated, exchanged, or made any other transaction with it.

Types of certificates of conformity

In Russia and the countries of the customs union there are 2 main certificates of conformity:

- GOST R. This is an abbreviation that means state standard. Certificates appeared in the USSR, but now they add the letter P, which shows that this is a modern Russian standard. Registration of such a certificate will cost on average 12-15 thousand rubles.

- TR TS. This is a certificate that is valid in the countries of the Customs Union. It will have to be obtained if the entrepreneur plans to work outside of Russia in the EAEU countries. The cost of such a document will cost at least 50 thousand rubles.

In addition, in some cases other certificates will be needed:

- Fire safety certificate. There is 123-FZ (Technical regulations for fire safety). The document is valid for some products. For example, for linoleum.

- Certificate of compliance with the ISO management system (ISO). Shows that the manufacturer has implemented a management system according to the rules of the International Organization for Standardization. Sometimes this is required by counterparties or rules for sales outside the customs union.

What is mandatory product certification

The products that need to be certified are listed above. That is, without obtaining a certificate or declaration of conformity, selling these goods is prohibited by law.

The Code of Administrative Offenses of the Russian Federation has article 14.44. “Inaccurate declaration of product conformity.” According to this article, if products are put on the market without certification or using false documents, then they face fines:

- 25-35 thousand rubles for officials;

- 300-500 thousand for legal entities.

And if people, animals, plants, property of citizens and the state have suffered due to uncertified products, then the punishment becomes more severe:

- 35-50 thousand for officials;

- From 700 thousand to 1 million for legal entities.

If because of these products someone suffered serious harm to health, then everything can develop into criminal punishment.

The founder of the Vorontsov Cheeses brand, Alexander Vorontsov, believes that certification for the most part rests on the honest word of the business:

“We receive a declaration of product conformity. It must be said that a business, in principle, can easily pass inspection. For example, we send cheese for examination, but who knows whose cheese it is? I can bring it from Italy and send it for examination. But I don't need it. Because if someone gets poisoned by our products, they can get not only a fine, but also a prison term. As a result, certification, of course, is a necessary thing, but the consumer chooses not by documents, but by real quality. Therefore, it is better to maintain quality not only for regulatory authorities"

VAT

The transfer of ownership of goods, the results of work performed, the provision of services free of charge is recognized as a sale and, accordingly, is subject to VAT (Subclause 1, Clause 1, Article 146 of the Tax Code of the Russian Federation).

Nothing is said about the gratuitous transfer of property rights directly to the Tax Code (Resolution of the FAS ZSO dated November 12, 2010 N A46-4140/2010).

Controlling authorities believe that the transfer of property rights (whether on a paid or gratuitous basis) is recognized as an object of VAT taxation (Paragraph 1, paragraph 1, clause 1, Article 146 of the Tax Code of the Russian Federation; Letter of the Federal Tax Service of Russia for Moscow dated February 24, 2005 N 19 -11/11038).

The tax base in this case will be the price of purchasing the certificate (Resolution of the Federal Antimonopoly Service of the Moscow Region dated February 15, 2006 N KA-A40/97-06).

Thus, when presenting a gift certificate to an employee, VAT must be calculated at a rate of 18% based on the face value of the certificate excluding VAT.

In this case, the invoice is drawn up in one copy in order to be reflected in the sales book.

If the Organization has an invoice for the purchased certificates and the Organization paid for the certificates by non-cash means, then “input” VAT can be deducted. Thus, there will be no losses on VAT: as much as was accepted for deduction, so much was accrued.

What is voluntary certification

Let's return to the law that regulates goods for mandatory certification. There are products that may not be certified. For example, plywood products, matches, high-quality tableware and various polymers.

But some entrepreneurs undergo voluntary certification for marketing purposes. You can tell customers that the company is so confident in quality that it is not afraid to undergo tests that confirm this. Voluntary certification is carried out in accredited centers according to the rules of GOST R.

In addition to marketing, there are also business goals. Some entrepreneurs themselves order certificates of conformity to gain an advantage in tenders. For example, a school purchases dishes in accordance with 44-FZ. There are two identical suppliers, but one is ready to confirm the quality of the products, and the other is not. Most likely, the school will choose the one who offers a better quality product.

Other companies do this in order to become suppliers to large customers. Sometimes brands, using voluntary certification, set up a filter for counterparties. It works like this: polymers are being purchased, but there is a threat of running into low-quality products. The company announces that it purchases only from suppliers who have a certificate of conformity for their products.

Director of online accounting Nebo Artem Turovets believes that they voluntarily undergo certification for the development of the company:

“Sometimes this is not necessary to win clients or counterparties. For example, ISO 9001 standards really help to sort out a company's internal processes in order to become better and more efficient. You just need to understand that such certification will take a year, and you shouldn’t get it for show. Unfortunately, there are companies on the market that will issue a certificate, but this approach makes no sense. I have an ISO 9001 auditor credential and provide training to bring processes as close to the standards as possible. Perhaps later the company will undergo certification"

Application of PBU 18/02

The cost of purchasing gift certificates, as well as VAT accrued upon their transfer to employees, are recognized as expenses in accounting, but are not taken into account when forming the tax base for income tax.

Consequently, a permanent difference arises for this amount, leading to the reflection of a permanent tax liability (PNO) (clauses 4, 7 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19 .2002 N 114n).

The accounting records reflected the permanent tax liability with the following entry:

Debit 99, subaccount “Permanent tax liability”, Credit 68, subaccount “Calculations for income tax” - a permanent tax liability has been accrued.

How to obtain a certificate of conformity and who issues it

The process of issuing certificates of conformity for products is controlled by the Russian Accreditation Agency, and certification centers issue conclusions. They are accredited to work officially and without claims from regulatory authorities. The website of the Federal Accreditation Service contains a register of suitable centers and laboratories.

Go to the page, enter the center data and see the result. The main thing is that there is a green icon near the center. This is a designation that the organization is active and the license is in order.

After this, you need to write an application for a certificate of conformity and select samples of the products to be tested. If production is certified, then representatives of the center will come to the company’s territory. If the product meets the standards, the company receives a registered certificate of conformity. Certain products have additional requirements.

Co-founder of Manfas Brewery Alexander Orlov believes that certification is not difficult, but it takes a long time:

“We have to send each type of beer for examination, describe all the ingredients, alcohol content, what container the drink is in, what will be on the label, we also need to provide all the protocols and examination reports. First, the beer is tested in the laboratory, and then also at the Federal Alcohol Regulatory Authority. As a result, everything takes 3-4 weeks. Beer cannot be sold without a certificate, so you have to wait. And this is quite tedious if you have several types of products. On the other hand, I understand that certification in our area is necessary so that low-quality beer does not enter the market."

Oleg Nevorotov, co-founder of the Upmarket marketplace sales management agency, explains why you need to seriously prepare for certification:

“Suppose we decide to introduce new goods and find a supplier in China that suits us, but when the first order arrives at the border, certificates will be required for customs clearance. You can obtain them by testing the product in accredited testing laboratories. And the laboratory, in turn, needs to make sure that it is examining a sample from the manufacturer who will subsequently produce a batch of this product. Just a couple of years ago, it was enough for the applicant to state that the goods were from factory X, and this was taken on faith. Now the procedure has become more complicated: first you need to make and pay for an application for certification, then the certification body issues an official request indicating the application number, then when sending the factory, it must accurately indicate this number in its accompanying documents, send a sample from the legal entity that is engaged in production, and at the same time indicate the exact details of the applicant. Considering that we deal mainly with foreign senders, mistakes often occur, and we have to start the process again or exchange correction letters for a long time, wasting time and money on this unproductive process. Thus, in practice, receiving and transferring samples to the laboratory, even from experienced companies, can take about 3 weeks. Therefore, certification is the first thing we recommend that future sellers on marketplaces think about.”

To obtain a certificate of conformity you will need a standard package of documents:

- Statement;

- TIN, charter, extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs, OGRN, individual entrepreneur registration documents;

- Company details;

- Technical requirements to be tested.

By the way, if the company has changed its legal address, it will have to undergo certification again.

Personal income tax

The certificate gives the employee the right to receive goods (work, services) in the amount determined by its face value.

This right is transferred free of charge.

That is, the employee has income and a taxable base for personal income tax (Clause 1, Article 210 of the Tax Code of the Russian Federation).

The value of gifts received by an employee during a calendar year is not subject to personal income tax if their amount does not exceed 4,000 rubles. (Clause 28 of Article 217 of the Tax Code of the Russian Federation.).

If the denomination of the certificate is more than 4,000 rubles, then the excess amount is subject to personal income tax at a rate of 13% (for resident employees) or 30% (for non-residents).

Accordingly, the organization in relation to the specified income will be a tax agent (Letters of the Ministry of Finance of Russia dated 09/07/2012 N 03-04-06/6-274, dated 07/02/2012 N 03-04-05/9-809).

The calculated amount of personal income tax will need to be withheld directly from the employee’s cash income upon their actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation).

For example, when paying the next salary. In this case, the withheld tax amount cannot exceed 50% of the payment amount (Article 138 of the Labor Code of the Russian Federation).

If the value of the gift (in this case, a gift certificate) exceeds 3,000 rubles, then it is necessary to draw up a gift agreement in writing (Clause 2 of Article 574 of the Civil Code of the Russian Federation).

However, it is better to have a written agreement in any case.

The agreement is useful in order to confirm the exemption of the value of the gift from personal income tax (when the amount of the certificate does not exceed 4,000 rubles) and to avoid the accrual of insurance premiums.

What does a certificate of conformity look like?

The certificate of conformity for products is issued in paper and electronic forms. In Russia, the form is in force, which is established by Order No. 3725 of the Ministry of Industry and Trade dated October 28, 2020.

The certificate of conformity contains the following information:

Certificate registration number. Number format RU C-XX.YYYY.A.00001/ZZ:

- RU is a designation for the Russian Federation.

- C—the number belongs to the certificate of conformity.

- XX is the code of the country where the product for certification was produced. These are letters of the Latin alphabet, and for countries there is an All-Russian Classifier. For example, the letters DE stand for Germany.

- YYYY — Certification authority code (last 4 characters from the register of accredited persons).

- A - means that the product is in a single copy. For mass production, the letter B is used.

- 00001 — serial number of the certificate in the registry.

- ZZ - the last 2 digits of the year when the certificate was issued.

Applicant. A company that sends products for certification. Manufacturer. Information about the manufacturer and products that need to be certified. If the company is not located in Russia, then indicate the code GLN. Certification body. All information about the center that issues the certificate: from name to legal address. Full information about the product : name, brand, codes, number and lot size. If there is too much information, then an application is added to the certificate. OKPD code 2 (for Russia) or TN VED EAEU (for the Customs Union) . Compliance with the requirements. They prescribe the regulations that are adopted in Russia for the certification of these products. Grounds for issuing the certificate. This field indicates information about research or test reports that confirmed that the product successfully passed the test. Additional Information. For example, that the company undergoes voluntary certification. Validity period of the certificate. Signatures of the head of the accreditation center and the experts who conducted the tests.

How much is a housing certificate issued for?

The amount depends on the estimated cost per square meter in the region, and the number of family members of the applicant eligible for the certificate.

The standard for the total area of housing is set by regional authorities, but usually it looks like this:

- 33 sq.m. for one person.

- 42 sq.m. for a family of two.

- 18 sq.m. for everyone, if there are three or more people in the family.

Example: The owner of the certificate lives in an official marriage and has one child. Estimated cost sq.m. in his region is 45,000 rubles. He requires housing with an area of at least 54 sq.m.

45,000 x 54 = 2,430,000 rubles. – he will be given a certificate for this amount.

Note: if there is not enough money on the certificate to purchase an apartment, payment with your own funds or a mortgage or maternity capital is allowed.

Validity period of the certificate of conformity

In Russia, certificates of conformity are issued for a period of 1 to 5 years. For example, if the product passes according to GOST R, then the maximum period is up to 3 years. This is enshrined in the law “On Technical Regulation”.

If products sold in the countries of the Customs Union undergo certification, then the validity of the documents can be up to 5 years. The main thing to remember is that you will have to undergo verification every year so that the certificate is not suspended or revoked.

If there is a need to check the validity period of the certificate, use the service from Rosakcreditation. Enter the document number and get information about the document:

- Green circle with a tick - the certificate is valid.

- An orange circle with a checkmark means the certificate has been stopped. The reason is indicated in the description.

- Red circle with a tick - the certificate has been cancelled. The reasons and grounds are stated in the description.

- Archived—the certificate or declaration has expired.

Insurance premiums

Payments and other remuneration made within the framework of civil contracts, the subject of which is the transfer of ownership or other property rights, are not subject to insurance premiums (Part 3 of Article 7 of the Law of July 24, 2009 N 212-FZ).

And a gift agreement is just such an agreement (Article 574 of the Civil Code of the Russian Federation).

Thus, in the case of transfer of a certificate to an employee under a gift agreement, the object of taxation with insurance premiums does not arise (Letter of the Ministry of Health and Social Development of Russia dated 03/05/2010 N 473-19).

Is it possible to fake a certificate of conformity?

This is difficult, but entrepreneurs know that there are organizations on the market that offer to buy fake certificates and declarations. It will be possible to work with such documents before the first inspection, and Rosakkreditatsiya annually conducts dozens of inspections to identify counterfeit certificates.

Recently, trading platforms have also joined the fight for the quality of goods. for example, in the spring of 2021, Ozon and the Federal Accreditation Service announced cooperation. The marketplace will add data about certificates and declarations to product cards. This will help identify sellers with low-quality goods.

Oleg Nevorotov believes that consumers also benefit from certification:

“Now that the certification process has become more transparent, consumers of products can be sure that if a product has a certificate of conformity, then it was real samples that were tested, and not the first ones that came across or similar ones, as often happened before. In addition, laboratories are constantly inspected, and those companies that violate legal requirements cease their activities. On the one hand, this leads to an increase in the cost of the certification process, but on the other hand, it makes the attitude towards it more trusting and meaningful, which is much more important for the market, as it gives the consumer confidence that the products comply with existing standards.”

In general, certification protects the market from low-quality goods, and this encourages the production and sale of goods that will not harm the consumer.

Who is eligible for a housing subsidy certificate?

The list of persons who are entitled to a certificate is specified in clause 5 of the Decree of the Government of the Russian Federation No. 153. These include:

- Department of Internal Affairs employees and military personnel subject to dismissal.

- Employees of the State Border Service, Department of Internal Affairs, Federal Penitentiary Service, if their term of service exceeds 10 years, and they are dismissed for health reasons, due to staff reduction, or reaching the service age limit.

- Former military personnel with at least 10 years of service, if they were dismissed due to age, medical reasons or staff reduction.

- Former employees of the Department of Internal Affairs, the Ministry of Emergency Situations of the Russian Federation, the Federal Penitentiary Service, who have worked for at least 10 years and are registered as needing housing under a social tenancy agreement.

- Dismissed from the tax police and recognized as needy.

- Family members of military personnel, employees of the Ministry of Emergency Situations, Department of Internal Affairs (except for NIS participants) who died while serving.

- Employees of the Russian Guard retiring due to age, medical conditions or staff reduction if their service period exceeds 10 years.

- Family members of deceased employees of the Russian Guard.

- Persons moving from closed military camps.

- Liquidators of the Chernobyl Nuclear Power Plant in need of improved living conditions.

- Forced migrants.

- Those moving from the Far North and entitled to social housing payments in connection with the move.

- Recipients of social housing benefits moving from ZATO.

- Those moving from the territory of the Baikonur complex.

Note! All of the above categories of citizens must be recognized as in need of improved housing conditions. If a person already has an apartment that meets all the requirements, a certificate will not be issued.

Legal advice: it’s also not worth deliberately worsening your living conditions in order to obtain a certificate. Clause 7.1 of Government Resolution No. 153 states that intentional deterioration means the exchange of one apartment for another of a smaller area, alienation of living space, or failure to comply with the terms of the housing use agreement, resulting in eviction through the court.

How to obtain consent to purchase an apartment from your spouse?

Who is eligible and how to receive a subsidy for the purchase of housing?