A mortgage in a civil marriage is not prohibited by law. But such a concept does not exist in law. The borrower is either legally married (registered in the registry office) or is considered single/unmarried.

However, many families in Russia would like to purchase an apartment with a mortgage in a civil marriage. Let's see what to do correctly when applying for a loan for a couple who have not officially registered their family.

Marriage without registration - what the law says

Civil marriage is a convenient form of life for many families. Allows you to avoid complex divorce procedures and ignore bureaucratic procedures associated with changing your last name. But in matters of property, a mortgage in a civil marriage sometimes turns into a problem for one of the parties.

With the classic lending scheme, the loan is issued to one person, but the spouse must act as a co-borrower. In this case, the apartment (house) is considered common property. Even if the loan is actually paid by one of the spouses, the second one still has the right to half of the apartment (base -).

A mortgage in a civil marriage has its own characteristics. In the event of a divorce, the entire apartment (house) goes to the person who is listed as the owner on paper. And it doesn’t matter that both of them paid for the loan from the family budget.

Mortgage for unmarried people: pros and cons

It happens that partners have a complicated family history, have children from previous marriages, problems with credit history and proof of salary. In this case, taking out a mortgage in a civil marriage may have certain benefits. You can agree with your spouse who will formally be the owner and who will actually pay the costs of servicing the loan.

But in the event of a quarrel or separation, an oral agreement will not be evidence in court. The housing will go to whoever is listed as its owner.

In general, the disadvantages of unregistered relationships when concluding a mortgage agreement boil down to the following:

- complex division of property through the court in case of separation;

- the need to document your expenses for loan payments;

- infringement of the rights of children (if a woman is not a spouse and does not have formal rights to an apartment, then the children may not even be registered at this address);

- inability to take advantage of preferential programs (for example, for large or young families).

Difficulties may arise when obtaining a mortgage in a civil marriage with maternity capital. Often the loan agreement is drawn up in the name of the husband. After all, the wife is on maternity leave - her income is very small. At the same time, maternity capital is used to repay the debt only if the borrower is the legal spouse .

Attention! Even if a husband and wife live happily ever after in an informal union, the possibility of one of them dying prematurely cannot be ignored. When separating, the couple has a chance to resolve the property dispute amicably. But in the event of the death of the owner, the other half is actually left with nothing. The apartment is now claimed by the relatives of the deceased: his parents, children, brothers and sisters.

Advantages and disadvantages

If a bank offers a mortgage lending program specifically for people living in a common-law marriage, this implies involving the other half as a co-borrower. This method of home lending has several disadvantages:

- If people decide to separate, problems may arise when dividing property and repaying the loan. In a marriage, debt obligations and real estate are always divided in half, regardless of which spouse has invested in it and how much money it has invested.

- State mortgage lending programs are provided only for legal spouses. If you live in a civil marriage, you cannot use them. The exception is “Young Family”, where one of the parents under the age of 35 can apply for participation if he is raising a child alone.

- If the second spouse has existing loans or has a damaged credit history, the bank may refuse to engage him as a co-borrower. If the main borrower does not have enough income, the loan will be refused altogether.

In fact, mortgage lending in a registered marriage and cohabitation differs only in that official spouses clearly become co-borrowers, while civil spouses have the right to choose - to take out a housing loan for only one person or to bear debt obligations together.

How to get a mortgage in a civil marriage - consider all the options

Let's say that registering a relationship with the registry office is undesirable. What choices does an unregistered couple have:

- The loan and square meters are issued entirely for one person. According to the documents, the second person has nothing to do with the purchased housing.

- One person receives a loan and housing, the second is a guarantor. In this case, the second party is obliged to bear the cost of paying off the loan in the event of difficulties. But at the same time, he still does not have any rights to the apartment.

- The mortgage and property are registered in the name of two people - they act as co-borrowers. And the residential premises are received as shared ownership. At the same time, the contract specifies the responsibilities of each party.

Recommended article: How to make money on a mortgage without investment

Of course, the share scheme for non-partnered spouses is the safest. But it works effectively if each member of a small family team has income and is able to service his part of the debt. If there is only one main earner, then it is wiser to use the first or second option.

Important! The mortgage agreement can be drawn up in such a way that it will regulate the order of payments (who pays what part of the debt). It also indicates what share of the apartment will belong to each of the co-borrowers after the loan is repaid. Therefore, when taking out a mortgage outside of marriage, it is better to consult with an experienced lawyer.

Joint mortgage outside of marriage into shared ownership is the fairest option

If both are going to pay for housing, the easiest way to protect yourself is to initially divide the apartment into parts. These may be equal or unequal shares. Not necessarily – 50/50. A ratio of 30/70 or 20/80 can be provided. Thus, property is distributed in proportion to the contribution of each spouse.

The spouses will also pay the loan in proportion. Either equally or in accordance with the allocated shares. Please note that registering an apartment for two people in a civil marriage is convenient when receiving a tax deduction and when using maternity capital funds. Let's say a woman has funds received for children in a previous marriage. She can use it to pay her share.

Important! If a husband and wife separate, each of them remains the owner of his or her part of the home. The owner can sell or bequeath his share to another person, but the former spouse will have the right of first refusal.

How to pay a mortgage in a civil marriage

It is not only how the mortgage loan is structured that is important. It matters who actually pays for it. Let's consider different situations:

- one person takes out a mortgage, and he pays it off;

- one person takes the loan and another pays it;

- the down payment belongs to one of the spouses, and the loan is paid by the other;

- the apartment is rented out in equal shares, but only one person pays;

- The apartment is in shared ownership, and both pay.

As we see, in this case it is beneficial to use a share scheme. Then, upon separation, there will be a minimum of complaints.

Important! When registering an apartment as joint shared ownership, it is advisable to prescribe all the nuances of the division of payment responsibilities in the loan agreement.

But family relationships can be quite confusing. A simple scheme is not always easy to implement. It happens that a solvent borrower has a bad credit history. Or it is advantageous to register an apartment in the name of a non-working woman in order to use maternity capital (). Or one spouse loses their job, and the burden of repayment falls entirely on the shoulders of the other.

In any case, it is necessary to determine in advance what part of the apartment one party can pay for and what part the other can pay. And register ownership in accordance with these shares.

Take note! Remember that, in accordance with the purchase of real estate, a citizen of the Russian Federation has the right to a tax deduction (refund of part of the taxes paid). If a person was in a civil marriage and paid a mortgage, but is not a homeowner, he will not be able to get his taxes back.

What right do spouses have to jointly acquired property?

The main difficulty in the process of considering a claim for division of shares for each of the borrowers lies in accurately recording the amounts of money contributed under the mortgage lending agreement.

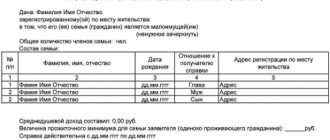

During their life together, not all of its participants think about recording the amounts of money that were contributed as payment for the loan obligation. Experts recommend saving:

- all receipts confirming payment of utility bills;

- documents on the purchase of expensive equipment;

- monthly payment receipts.

Thus, the spouses have proof of financial solvency for the loan obligation. During a divorce, these papers will be attached to the property division file.

If there is no such evidence, then the real estate remains with the potential owner specified in the mortgage agreement. If he is unable to continue making payments, the co-borrower must continue making monthly payments. Upon full payment of the mortgage agreement, the housing becomes his property. Thus, an ordinary guarantor, when fulfilling his credit obligations, can become the owner of an apartment or private house.

If the husband contributed 80% of the monthly payment amount, and the wife the remaining 20%, then when dividing the property, most of the apartment will belong to the husband. Spouses must collect checks to equally divide their shares if the terms of the division were not specified in the loan agreement.

Save bills and receipts

In an official union, relations are regulated. But in an unregistered marriage, dividing property is more difficult. Therefore, if an apartment was purchased with a mortgage outside of marriage, it is necessary to preserve all documentary evidence of payments.

Recommended article: What is more profitable: mortgage or rent - buy or rent

This is especially true if you pay for a loan from a card, through a terminal or from an electronic wallet. Make sure the payer is identifiable. It may be better to make payments over the counter by showing your ID.

Important! Having payment orders in hand, you will be able to prove that you actually repaid the loan and participated in the acquisition of property.

Buying an apartment out of wedlock with a mortgage – which bank to contact

Many organizations are ready to provide a mortgage loan to an unsigned couple. The bank is less and less interested in the personal life of the borrower. An institution's solvency is important. If you have a down payment and a good income, the financial institution will have no reason to refuse lending.

Another question is whether the bank will agree to see the unofficial spouse as a co-borrower. In some institutions, only relatives can act as co-owners. In this case, it will be impossible to supplement the income of the second partner and increase the chances of approval.

Important! Many women are concerned about the question of whether a common-law husband can be a co-borrower on a mortgage. Yes – it’s easier today than 5 or 10 years ago. Not only the husband, but also other relatives can be a co-borrower. For example, if the bride’s parents have paid the entire down payment (30 or 40%), they can act as co-borrowers and claim a share in the apartment.

How can you get a mortgage while not married at Sberbank?

Today, large banking institutions willingly lend to unscheduled borrowers. In the Marital status section, a Civil marriage item even appeared. At the same time, it is possible to register housing as common property, use maternal capital, and also include children among the owners. In this case, the apartment (house) is pledged to the bank until the debt is fully repaid (based on).

Attention! Today, more and more banks are ready to lend according to a scheme where the co-borrower on the mortgage is a common-law husband or wife. Among them are Raiffeisen, Rosselkhozbank, Otkritie, Promsvyazbank and many others. The list is updated every month.

Important to know: How does a mortgage transaction work - frequently asked questions

Mortgage loan agreement: what to look for when signing

Purchase and sale agreement with a mortgage - important points for the seller and buyer

Legislation

All aspects of mortgage lending are regulated by the Federal Law of July 16, 1998 No. 102-FZ “On Mortgages”:

| Art. 9 | The mortgage agreement specifies the subject of the transaction and other circumstances related to it, incl. and the presence of a co-borrower (if any) |

| Art. 7 | If you are purchasing housing that is in common ownership, written consent is required from each owner |

| Art. eleven | The mortgage agreement is subject to state registration in the Unified State Register of Real Estate as an encumbrance. It is removed only after the debt is fully repaid |

| Art. 29 | The borrower has the right to use the purchased property to obtain benefits. An agreement limiting this possibility is considered void. |

| Art. 37 | Sale, donation or exchange of a mortgaged apartment is possible only with the consent of the lender |

| Art. 50 | If the borrower violates the terms of the agreement or the norms of the Civil Code of the Russian Federation, the mortgagee (bank) has the right to demand early repayment of the debt, and if there is a large delay in payments, recovery of all amounts in court |

Thus, the same rules apply to citizens living together as to other people. There can be no talk of dividing the mortgaged property in this case due to the lack of official registration of the relationship.

How to take out a mortgage for two people outside of marriage and use family capital

A mortgage loan sometimes extends over 15–20 years. During this time, changes may occur in the life of the family team. For example, children will appear.

If the loan is fully or partially issued to a woman, it is easy for her to exercise her right to maternal capital. But if the loan was taken out by a man, the only way out is to enter into a legal marriage in order to take advantage of the benefits from the state.

Note! Sometimes clients mistakenly believe that the bank should advise on the use of family capital. In fact, the Pension Fund decides on loan repayment through MK. This is where you need to go.

If you take out a mortgage and then sign

There are situations when you need to buy an apartment quickly. The spouses simply do not have time to visit the registry office. They want to get a loan first and then get married officially.

In this case, it is important to understand that the apartment will be considered purchased before marriage. The rights to it will be the one whose name is written in the certificate of ownership or extract from the Unified State Register of Real Estate. In the event of a divorce, the housing will completely go to him, unless the second spouse proves joint payment of the debt after registering the marriage.

To avoid disagreements, spouses can draw up a document immediately after the wedding. And fix in it the provision according to which the apartment is considered their joint property.

Newlyweds also have the opportunity to change shared ownership to joint ownership after signing. And transfer the co-borrower to the status of a spouse. But all this is done in agreement with the credit institution ().

Recommended article: What to do with a mortgage if the developer goes bankrupt

The concept of cohabitation without registration

Previously, this term meant a legalized relationship between a man and a woman without a wedding in a church. Now in the modern world, people have given a new definition to this concept.

A civil marriage is considered a cohabitation of a man and a woman without official registration of marriage , thus a young family has the opportunity to think and make a decision about future marriage.

Today, there are more and more people who do not legalize their relationships. And every young family needs to have all the conditions for development, including housing. Therefore, given such demand, banks decided to create programs for such people that would allow them to purchase the desired apartment.

Mortgage in a civil marriage and property: how to protect yourself

When applying for a mortgage, money is taken from various sources. This could be personal savings, help from parents, maternity capital, loans from friends. And common-law spouses cannot always pay the debt in equal shares. Some pay more, some pay less.

If a man and woman do not intend to get married, it is better to agree on a payment plan in advance. And indicate the amounts that each party spent (or is going to spend in the future) on the purchase of housing. Moreover, the agreement must be secured by a notary, indicating all amounts on paper.

In this case, lawyers recommend adhering to the following recommendations:

- Register the apartment as shared ownership. Keep all payments, checks, receipts. Monitor the fulfillment of obligations by the other party.

- If one of the spouses (or his parents) gives funds for the down payment, document this fact - draw up a donation agreement.

- Think about who and how will receive a tax deduction after purchasing real estate.

- Read the forum on mortgages in a civil marriage, you will learn many interesting nuances.

We recommend reading: Tax deduction for mortgage interest

How to get a tax deduction for a co-borrower on a mortgage

Important! Although it is customary to save money in Russia, you should not be frugal when it comes to residential real estate. Especially if the situation is legally unstable (the couple are not spouses, but they live together in a mortgaged apartment). It is better to seek advice from a qualified lawyer.

How to prevent risks

In order not to be left broke in the event of a separation and to divide everything fairly, you should pay attention to ways to prevent risks:

- Draw up a loan agreement before concluding a loan agreement. It must indicate who is making the down payment and in what amount.

- If there is only one borrower, but in fact the other half also invests money, it is recommended to keep receipts for all transactions involving transfers from one person to another.

- Register the apartment as common property, indicating the shares for each party.

The best option is to register the marriage at the registry office, because in this case the parties to the transaction not only receive legal protection, but can also use government programs designed for young families.

Pros and cons of a mortgage in a civil marriage - what they write about in reviews

There are quite a lot of responses to this problem on the Internet. They say that the topic is relevant, but, unfortunately, there are no proven recipes. The authors of the reviews strongly recommend resolving issues of property division in advance, consulting with specialists, and studying the laws.

The question is often raised on forums whether a common-law husband or wife can claim real estate if the costs of the mortgage were borne by the other party. Such precedents have occurred in judicial practice. If the plaintiff manages to prove in court that the couple lived together for a long time and ran a joint household, then theoretically the common-law spouse can claim half of the apartment. The final decision depends on the evidence base, the experience of the judge and the lawyers involved.

The situation is also often discussed when a common-law husband takes out a mortgage and then stops paying for it. Of course, the apartment is taken away for debts (), and the other party cannot influence the process, even if it participated in paying the loan. If the housing is registered for two people, then the second party to the transaction will be able to re-register the contract in their name, pay the remaining balance and become the owner of the real estate.

What happens to the loan and property if the couple decides to separate?

One of the unpleasant aspects of civil relationships is the risk of separation. Unfortunately, modern statistics are not at all reassuring and this can happen to any couple. During the period of living together, a couple who decides to take out a home on a mortgage must protect themselves from clarifications and proceedings. Will help reduce the risk of losing your home:

- Conclusion of an agreement between common-law spouses, which clearly states who pays what amount of the mortgage loan. Thus, even if the apartment is registered for one person, there is a chance in court to sue for part of the housing in proportion to the amount of contributions (read about how to protect yourself from unnecessary hassle with the help of an agreement when buying an apartment with a mortgage).

- When repaying the loan monthly, you must indicate your own data and full name, which will be displayed on the receipts.

If the property is registered in the name of one spouse, and he is also the payer of the loan, then he will also be the owner of the apartment after separation. In other cases, having evidence of loan payment, you can prove your rights in court

Reference! Cohabitants or common-law spouses are not heirs, the only exception being their mention in the will.

Let's summarize: is a mortgage given in a civil marriage and under what conditions?

Taking out a mortgage while in an unregistered relationship is possible today. But both persons must take care to protect their interests. The safest option for the transaction is a mortgage in a civil marriage for 2 co-borrowers with a share allocated for each of them. If this option is not suitable, you will have to collect written evidence of your actual participation in the loan repayment. And prepare for litigation if it is impossible to reach an amicable agreement.

Take note! In fact, a marriage between two people is registered in order to resolve property disputes in a civilized manner. Therefore, if young people are going to legalize their relationship, it is better to do this before going to a credit institution.

Rate the author

(

4 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Publication dateAugust 9, 201August 9, 2019

How is a mortgaged apartment divided after separation?

If a couple decides to separate, there are several possible scenarios:

- The apartment goes to the borrower in full. Even if the second person also invested money in repaying the loan, if he does not participate in the transaction, he will have to prove his right to housing through the court.

- The parties peacefully agree on the division of property.

If a co-borrower from a couple was involved, the apartment will be divided in equal parts or in the shares specified in the agreement.

If the marriage is consummated

When a mortgage is issued and a marriage is subsequently registered, the purchased property cannot be considered joint property, because it was purchased before going to the registry office. If desired, the parties can enter into a marriage contract and outline in it all the nuances of the division of real estate in the event of a divorce.