Art. 178 of the Labor Code of the Russian Federation guarantees resigning employees financial resources to support them during the period of employment - severance pay. The goal is to financially support a former employee while he is looking for a new job, if he had to leave the old one not through his own will or fault. The employee receives this payment on the day of dismissal.

Question: How to calculate and take into account severance pay and average earnings during the period of employment for an employee dismissed due to staff reduction? View answer

In the article we will look at the subtleties regarding the calculation of this benefit, the procedure for its payment, its relationship to taxes and contributions, and also analyze who has the right to count on it and in what amount, and who does not have to count on this financial support.

What is the procedure for paying severance pay in case of early dismissal during layoffs ?

Who pays severance pay upon dismissal?

An employer - a legal entity is obliged to guarantee the payment of severance pay to dismissed employees, except for the grounds for dismissal listed in the law.

Question: How to include a provision for severance pay upon dismissal in an employment contract, including by agreement of the parties? View answer

If the employer is a private entrepreneur , then the issue of payment of severance pay remains at his discretion. These points are discussed during hiring and must be reflected in the employment contract. If the main document, which is intended to regulate the concluded labor relations, does not address this issue, the dismissed person may be left without severance pay, and this will be legal.

Question: Is severance pay subject to personal income tax upon dismissal in connection with the liquidation of an organization, reduction in the number or staff of employees in the amount established by Art. 178 of the Labor Code of the Russian Federation (clause 3 of Article 217 of the Tax Code of the Russian Federation)? View answer

Responsibility for evasion of personal income tax

The legislation of the Russian Federation contains information and the risks of unlawful non-withholding or non-transfer of tax to the budget entail penalties:

| Violation of the law | Penalties | Normative act |

| Failure to withhold or transfer taxes to the budget | 20% of the amount to be paid | Article 123 of the Tax Code of the Russian Federation |

| Failure to withhold or transfer taxes to the budget on a large scale | · a fine of 100,000-300,000 rubles or in the amount of wages for a period of 1-2 years with deprivation of the right to hold certain positions for up to 3 years; · arrest for up to 6 months or imprisonment for up to 2 years. | Article 199 of the Criminal Code of the Russian Federation |

Dismissals with benefits

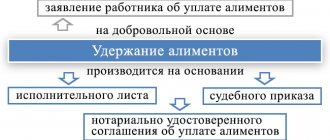

When a dismissal order is issued, it indicates the basis for releasing the employee from his position and the corresponding article of the Labor Code. Each reason has its own procedure for terminating employment agreements, which in many cases includes the accrual of “severance” benefits. It is based on the following grounds:

- liquidation of an enterprise, organization, firm;

- reduction in staff or numbers;

- professional unsuitability for medical reasons (if there is no other suitable vacancy or the employee’s desire to take it);

- complete loss of ability to work (according to a medical report);

- reluctance to continue working in changed working conditions;

- disagreement with transfer to another location following the employer;

- conscription into the army or substitute service;

- leaving maternity position;

- cancellation of an incorrectly drawn up employment contract;

- vacating a position for an employee who previously occupied it, who was wrongfully dismissed and reinstated by a court decision or labor inspectorate.

NOTE! Severance pay is available to almost any employee forced to leave their position, as long as they are in compliance with the law and the provisions of the employment contract.

Insurance premiums

The topic of insurance premiums, which are paid from employees’ salaries, should also be touched upon. When an employer enters into an employment contract with an employee, he must withhold a certain amount from the employee's salary. Such deductions are called insurance premiums. This is made to deposit this amount into funds such as:

- social insurance fund;

- Pension Fund;

- health insurance fund.

From the last salary of the resigning employee, a certain amount is also withheld and sent to these funds in the form of insurance premiums.

As for severance pay, it is not subject to insurance contributions (unless, of course, the established amount is exceeded - 3 months or 6 months (if this is the Far North) salary).

Managers also quit

And, accordingly, they have the right to an honestly deserved severance pay, but only on the condition that there are no illegal actions on their account or they did not make decisions that negatively affected the finances of the enterprise. In what cases are labor benefits accrued to top managers:

- if they are removed from office by the decision of the founders without any guilt (clause 2 of Article 278 of the Labor Code of the Russian Federation);

- the boss, his deputy, the chief accountant, whom the new owner of the business decided to fire.

FOR YOUR INFORMATION! If, by a court decision, a person (whether a manager or an ordinary employee) has been prohibited from engaging in certain types of activities, then, upon leaving this position, he also has the right to a “severance” payment.

Early layoff

If an employee himself takes the initiative and wants to leave the organization even before directly signing the layoff order, then he can easily afford it. In this case, he will be required to provide written confirmation of his consent to early dismissal. In this case, the employer will be required to pay the former employee severance pay for the unworked period of time remaining from two months.

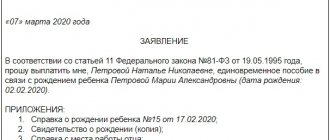

Application for early dismissal

Who will be left without benefits?

There are several reasons why those being laid off are not legally required to pay severance pay. In most cases, they imply the own will or the guilty actions of the dismissed employee. The exception is short-term contracts.

These grounds do not imply corresponding payments:

- care according to one’s own desire (clause 3. part 1 of article 77 of the Labor Code);

- the employee failed to complete the probationary period (Part 1 of Article 71 of the Labor Code);

- agreement of the parties;

- initiative of the employer, if the misconduct of the dismissed person provides for an extreme measure of administrative liability (Article 81 of the Labor Code);

- inconsistency with the position held by the employee;

- when a contract concluded for 2 months or less comes to an end.

What amounts can you expect?

The amount of accrued severance pay is calculated in accordance with the following factors:

- Average monthly earnings.

- The number of days in the compensated period, excluding weekends and holidays.

- Territorial location of the enterprise.

ATTENTION! Since the essence of this payment is support in the first two months of new employment, only working days are taken into account. The more weekends and holidays there are in the compensated month, the less the benefit will be.

Payment can be made for a period of 2 weeks, a month or 90 days after dismissal.

Salary for 14 days is due to the following categories of dismissed:

- upon dismissal due to medical reports;

- conscripted into the armed forces;

- if you refuse to move to a new location if the organization moves there;

- when a former employee is reinstated;

- if you are unwilling to work in changed conditions;

- “conscripts” during which the enterprise is liquidated or its staff is reduced.

Earnings for 1 month are based on:

- upon cancellation of employment contracts executed with certain violations;

- upon complete dismissal due to the cessation of the organization's existence.

3 monthly salaries will be received by:

- managers, their deputies and chief accountants who leave their positions by decision of business owners.

IMPORTANT! The employee will be paid the amount of average earnings for another 2 months after hour X, if during this time he fails to find a new job. In some situations, the Employment Service decides to extend the payment for another 1 month (if the dismissed person applied to this body within 14 days and did not find a job after 2 months).

Some regions of Russia are in special conditions, for example, the Far North and areas equivalent to this region. If the enterprise from which the employee leaves is located in a similar zone, then all payments are calculated differently, for example, the period for maintaining wages during the job search period can be increased to six months (Article 318 of the Labor Code of the Russian Federation).

To calculate labor benefits, it is enough to calculate the average daily salary and multiply it by the number of days subject to compensation.

Vacation compensation and taxation

If an employer has a need to pay a resigning employee compensation for unused vacation, he must withhold personal income tax from this amount.

Despite the presence of a list of compensations not subject to income tax, this type of payment is not included in it (paragraph 7 of paragraph 3 of Article 217 of the Tax Code of the Russian Federation). Personal income tax is withheld at the time the employer actually pays the amount for unused vacation, since he, in this case, acts as a tax agent.

According to subparagraph 1 of paragraph 1 of Art. 223 of the Tax Code of Russia, the moment of receipt of taxable income is considered to be the day the money is issued through the company’s cash desk or transferred to the employee’s bank account.

Expert opinion

Irina Vasilyeva

Civil law expert

If an employee plans to first go on vacation and then resign, tax must be withheld on the calculation date - the last day of work before the vacation. At this moment, the citizen receives an amount from which income tax has already been deducted.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

Examples of calculating labor benefits

- The LLC where S.M. Galuzinsky worked is being liquidated. The employee earned 8,000 rubles. per month. We calculate the average earnings per day: the number of working days for the year was 220, multiply the salary by 12 months and divide by the number of days worked: 8000X12/220 = 436.36 rubles. The basis for dismissal involves the accrual of S.M. Galuzinsky. amounts equal to one average monthly salary. Next month there will be 20 working days (no holidays). Thus, Galuzinsky S.m receives 436.36X = 8727 rubles.

- Salary of Denisova V.A. – 10,000 rub. per month On January 11, 2016, she was fired due to staff reduction. For the previous accounting year, she had 249 working days, she earned 12x10,000 = 120,000 rubles, which means an average of 120,000/249 = 481.9 rubles per day. Next month (from January 12 to February 12, 2021) there will be 23 paid days. January 11 Denisova V.A. received severance pay in the amount of 23X481.9 = 11083 rubles. A week later, she contacted the Employment Center, but she was unable to get a job by February 12, and benefits were awarded to her again. From February 12 to March 12, 21 days without days off, minus March 8, so she is entitled to 20x481.9 = 9638 rubles for this period. If she had not involved the Employment Service or registered after January 24, this payment would have been her last. In the work book of Denisova V.A. There was no record of a new place of work for the next month either. Since she contacted the Employment Service on time, she is entitled to one more, final financial assistance. In the third billing month (from March 12 to May 12, 2016) there are 19 working days (except Saturdays and Sundays, May holidays are also excluded). Denisova V.A. will receive 19X481.9 = 9156 rubles. She is not entitled to any more payments.

IMPORTANT INFORMATION! The Labor Code of the Russian Federation provides a minimum of guaranteed financial support for those who have lost their jobs.

The amount of the benefit may be revised upward if such a possibility is noted in the collective agreement or local regulations of a particular enterprise.

Restrictions on reduction

When wanting to reduce the number of employees, an employer inevitably faces restrictions, since not every employee can be laid off. The Labor Code provides for several categories of citizens, the reduction of which is prohibited by law and may entail serious checks if the laid-off employee reports this to the labor inspectorate. The list of employees not subject to redundancy is given below.

Who can't be laid off?

It is also prohibited to lay off employees who are not currently present on site for two reasons:

- vacation;

- sick leave

The only exceptions are cases of liquidation of an enterprise, when all employees are subject to conditional layoffs. In all other circumstances, management must comply with existing restrictions.

What about tax payments?

This payment, received on the last working day, constitutes the income of an individual, but such income, as Art. 217 of the Tax Code of the Russian Federation, is not subject to income tax if the amount is accrued in the amount established by law. Insurance and pension contributions for the amount of benefits specified in the Labor Code are also not made.

If an enterprise, by its own will, enshrined in the relevant documentation, increases the minimum payable prescribed by law, then the excess is subject to taxation. Insurance premiums and personal income tax will have to be paid on the amount that exceeds the usual payments.

Who is obliged to calculate, withhold and pay personal income tax?

In accordance with Article 226 of the Tax Code of the Russian Federation, the following counterparties are required to calculate from an individual (taxpayer) and pay a certain amount of tax to the budget:

- organizations registered in the Russian Federation;

- entrepreneurs (obliged to pay both for themselves personally and for employees);

- privately practicing notaries;

- lawyers who have organized private law offices or consultations;

- separate divisions of companies whose head offices are registered in foreign countries, but divisions are located on the territory of the Russian Federation

Responsibility for calculating, withholding and paying personal income tax rests not with the employee as a taxpayer, but with the employer.