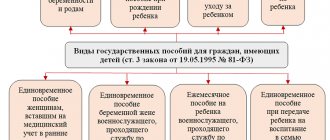

At the birth of a child, an employee under an employment contract is entitled to:

- benefits for registration in the early stages of pregnancy;

- maternity benefits;

- lump sum benefit for the birth of a child;

- child care allowance up to 1.5 years;

- allowance for caring for a child up to 3 years old (if the child was born before January 1, 2021).

All benefits, except the last one, are paid at the expense of the Social Insurance Fund. Starting from 2021, in all regions, the Social Insurance Fund transfers money directly to employees. For information on how to assign benefits, read the article “How to help an employee receive benefits from the Social Insurance Fund at the birth of a child?”

Maternity calculator

The employer no longer calculates the amount of benefits - this is done by the Social Insurance Fund. The calculator will help you find out in advance the amount of maternity benefits and the monthly child care benefit for up to 1.5 years.

How to use the calculator?

- In the first step, select the benefit type. For maternity benefits, you need to indicate data about the period from the employee’s application (based on a certificate of incapacity for work), and for child care benefits up to 1.5 years, also data about the child. Calculation years will be determined automatically. By default, this is 2 calendar years preceding the vacation. Since 2013, periods of sick leave or parental leave are excluded from them. If there were such periods, indicate them.

- In the second step, the employee’s earnings for 2 accounting years are indicated. These are all payments for the calculation period for which insurance contributions to the Social Insurance Fund are calculated. Indicate the regional coefficient, if provided. Check the box for part-time employment, if any. The insurance period is taken into account if it is less than six months. This is necessary to calculate the average daily earnings and compare them with the calculation of minimum wage benefits.

- In the third step, you will see the final calculation of the benefit amount.

Mortgage repayment assistance

If from 2021 to 2022 another child was born or adopted in a family with at least two children, she can receive 450 Decree of the Government of the Russian Federation of September 7, 2019 No. 1,170 thousand rubles to repay the mortgage. If the debt is less than this amount, the balance will be burned. You can use the offer once.

An application for this type of assistance is submitted to the bank. And the credit institution is already resolving the issue with the joint stock company Dom.rf, which is responsible for this.

Benefit for registration in early pregnancy

To whom?

An employee who registered in the first 12 weeks of pregnancy.

How many?

Until July 1, 2021, the employee received a one-time benefit of 708.23 rubles. The amount was increased by the regional coefficient, if the region has one.

The rules have changed since July 1st. Now the benefit has increased and became monthly. The benefit amount is equal to 50% of the cost of living in the region. But only those whose income per family member is less than the subsistence level will receive it.

How is it prescribed?

Before July 1, the employee brought the employer an application and a certificate from the hospital about registration in the early stages of pregnancy.

From July 1, the employee independently applies for benefits from the Pension Fund or submits an application through State Services. The employer does not participate in the assignment of benefits.

Compensation payments in Moscow and St. Petersburg 2021

In Moscow, the time frame for registering a pregnant woman has, in fact, been extended to 20 weeks of pregnancy. Expectant mothers who have permanent registration in the capital and are registered with a Moscow medical organization can apply for benefits with a certificate of registration for a period of up to 20 weeks.

When registering for pregnancy up to 20 weeks, a Muscovite will be paid 634 rubles. The amount of the benefit was approved by Decree of the Moscow Government dated November 27, 2007 No. 1005-PP as amended on May 20, 2020.

The Moscow benefit is not tied to the birth of a child. When a baby is born, parents can apply for other one-time payments and periodic benefits.

But in St. Petersburg the situation is a little different. Residents of the northern capital need to have a certificate of registration of the expectant mother for up to 20 weeks in order to receive a payment after the birth of a child of at least:

- 32,339 rubles - for the first;

- 43,122 rubles - for the second;

- 53,900 rubles - for the third and subsequent children.

In addition, the size of the payment in St. Petersburg is also affected by whether the pregnancy is multiple. If, for example, twins are born, then the children will be counted “in order”: first and second, and payment will be made for each (Social Code of St. Petersburg as amended from 10/07/2020).

Payments are often indexed. Therefore, at the time of publication of this article, we indicate “not less than.” The exact amount of payments for registration up to 20 weeks in St. Petersburg in 2021 may be higher.

Maternity benefit

To whom?

Only the mother of the child.

How many?

The amount of the benefit depends on the employee’s salary for the previous two years. The amount will be calculated by the FSS, but you can find it out in advance using a calculator or yourself according to the instructions:

- Calculate your income for the last two calendar years from which you paid contributions to the Social Insurance Fund. If an employee goes on maternity leave in 2021, income from 2021 and 2021 is taken into account. If you have already had maternity leave in these two years, you can take the previous years so that the benefit amount is larger.

- Compare the amount of income for each year with the maximum base for calculating insurance premiums. For 2021 - 865 thousand rubles, for 2021 - 912 thousand rubles. If the amount of income is higher, for the calculation take the maximum base for contributions in each year.

- Determine your average daily earnings - instructions in the article.

- Compare the average daily earnings with the minimum and maximum. The minimum from January 1, 2021 is 420.56 rubles, and the maximum is 2434.25 rubles. If the average earnings are lower or higher than these amounts, consider the benefit from the minimum or maximum earnings. The regional coefficient is calculated from above.

- Calculate the benefit amount: multiply the average daily earnings by the number of calendar days of vacation.

If the employee’s insurance experience is less than six months, then the benefit is paid in the amount of the minimum wage, taking into account the regional coefficient for a full calendar month.

If an employee, despite the dates of incapacity for work on the sick leave, brought it and wrote a vacation application later - she has such a right - the benefit is paid only for the actual vacation time.

How is it prescribed?

The employee brings you documents:

- a free-form application for maternity leave - this application remains with you;

- application for benefits for the Social Insurance Fund;

- sick leave;

- a certificate of the amount of earnings from your previous place of work, if during the previous two calendar years she worked not only for you.

Attach an inventory to the application, sick leave and certificate and submit the documents to the Social Insurance Fund within 5 days.

When is it paid?

The Social Insurance Fund will check the documents and pay benefits to the employee within 10 days.