Different circumstances of death dictate different conditions and responsibilities for bearing funeral expenses. The issue of compensation for funeral expenses within the framework of the Civil Code can be approached from two sides.

And if you go beyond it, you will find that the legislator also offers a social benefit for burial. In this article we will look at the issue comprehensively.

After studying our material, you will find out what rights you have related to reimbursement of expenses for someone’s burial. In any case where you encounter obstacles to exercising these rights that are not provided for by law, we recommend that you contact an experienced lawyer.

Funeral benefit amount in 2021

Amounts of funeral benefits in 2021 (Clause 1, Article 9 of the Federal Law of January 12, 1996 No. 8-FZ “On burial and funeral business”):

- from 01/01/2021 to 01/31/2021 - 6,124.86 rubles. (Resolution of the Government of the Russian Federation dated January 29, 2020 No. 61).

- from 02/01/2021 - 6,424.98 rub. (Resolution of the Government of the Russian Federation dated January 28, 2021 No. 73).

These amounts are increased by the regional coefficient if it is established in your area (Clause 1, Article 10 of Federal Law No. 8-FZ):

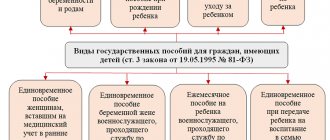

What payments are due in connection with the death of a close relative?

Family members of the deceased, if they independently handled the funeral, can apply for benefits from the state on a general basis. If a family is recognized as low-income, relatives of the deceased have the right to apply to local social security authorities for additional compensation. If the death occurred as a result of a car accident, and the deceased was insured, the relatives will receive compensation under OSAGO.

Payments in connection with the death of a close relative are also accrued by the management of the enterprise. Additional funds are accrued only if such a clause was provided for in the contract, but management is obliged to return earnings and all due monetary compensation if the citizen continued to work until his death. If the death of an employee occurs as a result of an accident, his relatives are provided with insurance or compensation provided for in the contract.

Where to apply for benefits

Funeral benefits in 2021 are paid (Articles 9, 10 of Federal Law No. 8-FZ):

| Who will pay the funeral benefit? | In which case |

| Employer |

|

| Territorial department of social protection at the place of residence |

|

| Territorial department of the FSS |

|

| Regional branch of the Pension Fund of Russia |

|

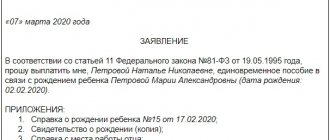

Documents - grounds for accrual

The benefit can be paid not only to relatives and legal representatives, but also to other citizens involved in organizing the funeral ceremony and paying for services for it (Article 10-1 of Federal Law No. 8) on the basis of documents submitted to the accounting department:

- statements of the recipient citizen;

- death certificates (original).

The certificate will not be returned to the recipient.

The recipient can apply with these documents not only to his main place of work, but also to his part-time job. It is illegal to refuse to pay benefits to a part-time worker (Article 10-2, clause 2 of Federal Law No. 8, Article 287, paragraph 2 of the Labor Code of the Russian Federation).

It is impossible to receive benefits twice, because the original death certificate will remain in one of the organizations: at the main place of work or part-time.

If an organization interacts with a funeral company that has provided free services, it will compensate for the costs of the service according to the list, based on (FSS Regulation No. 16 dated 02/22/96, clause 12):

- invoices for services;

- death certificates.

The compensation period is 10 days.

How to organize a funeral ?

Documents for receiving funeral benefits

The set of documents for receiving funeral benefits looks like this (clause 2, article 10 of Federal Law No. 8-FZ):

- identification document of the applicant;

- application for payment of benefits;

- death certificate issued by the civil registry office.

Sometimes additional documents may be required. Their list should be obtained from the source of payments (from the employer, the Pension Fund of the Russian Federation, Social Insurance Fund, social security authorities).

For example, when paying a funeral benefit for a deceased pensioner who was not working on the day of death, you will need to present the deceased’s work book as a document confirming the fact that the pensioner was not working on the day of death. And in the event of the death of an unemployed person (not a pensioner), a certificate from the employment service will be required - a document confirming the fact of absence of work on the day of death.

It is not necessary to provide any documents (cash receipts, contracts, receipts) confirming expenses incurred in connection with the funeral to receive benefits.

Useful information from ConsultantPlus

Check out the sample documents drawn up in connection with the payment of funeral benefits:

– Application for payment of social benefits for funeral;

– Order for payment of social benefits for the funeral of a deceased employee.

The city ritual service Ritual.ru stores all documentation about completed orders

In the case of organizing a worthy funeral, expenses are confirmed by a completed and signed Agreement for the provision of funeral services and Specifications, from the funeral service and a cash receipt. The city specialized funeral service Ritual.ru is legally required to keep an archive of documentation about completed orders. This ensures that in the event of a dispute, the customer will receive all the necessary documents to pay the required compensation.

You might be interested:

- Money for funeral

- Heirs' rights

- Contract for the provision of funeral services

June 28, 2018

Funeral benefit in 2021 in the system of direct payments from the Social Insurance Fund

In 2021, despite the transition of all employers to a system of direct payments from the Social Insurance Fund, funeral benefits are still paid by the employer with subsequent reimbursement of the amounts paid from the Social Insurance Fund. To receive compensation, the employer submits to the fund a death certificate and an application for reimbursement of benefits.

The FSS makes a decision within 10 working days from the date of receipt of the documents and no later than 2 working days transfers the money to the employer’s current account (clause 13, clause 16 of the Regulations on the specifics of the appointment and payment of insurance coverage in 2021, approved by Government Resolution dated 30.12 .2020 No. 2375).

For questions regarding the assignment, payment and reimbursement of funeral benefits, you can contact the hotline of your regional FSS office.

Who pays for expenses incurred?

Compensation is paid through inheritance. This means that the payment falls on those who currently manage or dispose of the inherited property. Who exactly pays compensation depends on whether the inheritance was accepted.

- If the inheritance was not accepted, then compensation for the expenses incurred is paid by the executor of the will (if the executor was appointed by the will or decision of a notary);

- If the heirs have assumed their rights, then the payment of compensation falls on them.

A person who has incurred expenses and wishes to receive compensation must contact a notary. An application for compensation for necessary expenses must be submitted in writing. All costs indicated in the application must be confirmed in the form of invoices and checks.

After considering the application, the notary decides to issue a compensation order, which will be transferred to the heir/s or executor of the will. In case of controversial issues (refusal of the notary to make such a decision, refusal of the heirs to pay the expenses), the person who incurred the expenses should go to court. The compensation received should not exceed the amount of the inheritance.

Taxes when paying funeral benefits

Funeral benefits are not subject to personal income tax and insurance contributions and are not taken into account in tax expenses (clause 1 of Article 217 of the Tax Code of the Russian Federation, subclause 1 of clause 1 of Article 422 of the Tax Code of the Russian Federation, subclause 1 of clause 1 of Article 20 of the Federal Law of July 24 .1998 No. 125-FZ “On compulsory social insurance...”, Letter of the Federal Tax Service dated 09/03/2018 No. BS-4-11 / [email protected] ).

Procedure for reimbursement of expenses

Compensation for necessary expenses is not considered the debts of the testator and is paid before them. Article 1174 establishes the following procedure for paying compensation for expenses incurred for:

- Organizing a decent funeral and treating the disease that led to death;

- Protection and management of inheritance;

- Forensic notarial services.

In some cases, this order is violated, and the testator's creditors are the first to apply for debt compensation. If such a situation arises, then to obtain the required compensation for the necessary expenses, you should go to court.

Let's sum it up

Funeral benefits in 2021 are paid:

- in the amount of 6,124.86 rubles. (if death occurred before 01/31/2021) and 6,424.98 rubles. (taking into account indexation carried out on 02/01/2021);

- by the employer or other authorities, depending on the category to which the citizen belonged at the time of death (pensioner, unemployed, etc.);

- on the basis of a death certificate received from the registry office, the passport of the benefit recipient and his application. Sometimes additional documents are required, which can be obtained from the source of benefit payment.

What funeral expenses can be reimbursed?

First, let's figure out what the legislator understands by burial? There is the Federal Law “On Burial and Funeral Business,” Article 3 of which invites us to understand it as traditional ritual actions for burying the remains of the deceased, which do not contradict the requirements of sanitation and others. Specifically this:

- burial in a grave or crypt;

- cremation and burial of urns with ashes;

- surrendering the remains to water.

Sanitary, environmental and other requirements do not require scattering of ashes over a cliff or sea (how beautifully this is often filmed in movies); a grave or crypt must be prepared for the urn.

Placing remains in water is generally an exceptional case: according to the Charter of the Navy, only sailors whose bodies cannot be delivered and buried on land are buried in this way.

What expenses can the government help with? According to Article 9 of the relevant law, compensation may be for:

- preparation of necessary documents;

- necessary items (coffin, clothes, shoes for the deceased, preparation of the place, etc.);

- transporting the body to where it will be buried (cemetery or crematorium);

- payment directly for funeral services (for example, cremation and receiving an urn with ashes).

The cost of all these services is set by local governments. Separately, it should be said that the legislator provides for the process of reimbursement of expenses not just for a funeral, but for a “dignified funeral” (the wording used in Article 1174 of the Civil Code).

This concept has a broad interpretation and is evaluative. The presence of such wording, depending on the situation, allows you to request reimbursement for the costs of organizing a funeral dinner or funeral orchestra, for example.

Here it will be necessary to look at how expedient such expenses were: for example, what is the point of organizing music if there was no procession behind the coffin?

Tax deduction for funerals

The Code does not provide for a tax deduction for expenses incurred during the burial of a loved one. As for one-time cash benefits, they relate to income, and accordingly personal income tax must be paid from them.

Incapacitated recipients of benefits (pensioners, disabled people, minors) and citizens receiving payments for the first time are not subject to taxation. Such assistance from an enterprise is not taxed if its amount does not exceed 4,000 rubles.

Who bears the funeral costs?

The circle of heirs of the testator is established by law, with supporting documents. After the heirs have accepted the inheritance, they are presented with all expenses, and until the acceptance of the inheritance, the expenses are presented to the executor of the testator's will. Heirs can also pay for the funeral with funds that they accepted as an inheritance (for example, a current account or a cash deposit in the testator's bank). The heirs can withdraw this money for the funeral before the expiration of six months from the date of opening of the inheritance and no more than one hundred thousand rubles.

Useful : read how to register an inheritance in another city using the link

A person who is himself an heir, who paid for the funeral on his own, can recover money from other heirs, if any, and also if this person is not an heir, but spent money on the funeral (for example, neighbors who do not have any family ties with the deceased ). To recover expenses from heirs, you must have documentary evidence of these expenses, these could be:

- Receipts (for example, wreaths, coffins, clothing purchases);

- Receipts (for example, payment for inheritance protection services, transportation of the deceased to the burial place);

- A contract or agreement for the provision of medical services (for example, treatment before the death of a person in a paid medical organization);

If there are heirs, then based on the above, with the help of supporting documents, you can demand compensation from the heirs by presenting them with evidence. The heirs will be required to reimburse the costs.

If no heirs have been identified, then the person who paid for the funeral must contact the notary at the place of residence of the deceased person, providing a certificate of death and information about the citizen’s place of residence. Based on the documents provided, the notary must issue a document to the person for the issuance of funds to reimburse the expenses incurred. Based on this document, a person can receive monetary compensation at a bank branch or at the Pension Fund of the Russian Federation.

Funeral expenses may also be borne by the state on the basis of burial legislation. In addition to social benefits (funeral compensation), you can receive services from the state. The list of services provided to the person who bury the deceased free of charge:

- Preparation of documents;

- Transportation of the deceased body to the cemetery;

- Burial;

- Provision and delivery of a coffin, as well as other items necessary for burial;

All of the above services are provided by specialized funeral homes, which are paid for from the budgets of the Russian Federation. Payment to the funeral home is made no later than six months from the date of burial of the deceased.

ADVICE FROM A LAWYER : watch the video on registering an inheritance and ask your question in the comments of the video to get a free answer from a lawyer