We explain how to get your former lawsuit opponent to pay your legal fees.

If you win in court, you have the right to demand that the losing party return the money you spent on the case.

Technically, this is easy to do: you need to submit an application and attach several documents. The problem is that the courts very often reduce the amount that must be returned. We explain what to do so that you get back not just a few pennies, but as much money as possible.

In this article we write mainly about subsidiary courts, but our instructions also apply to other courts.

When to file for collection?

There are two strategies:

1. At the beginning of the trial.

The text of the statement of claim must include a request for reimbursement of expenses. After you win the case and the final judicial act is issued, the amount specified in the application will be returned to you.

Disadvantages of this strategy: At the beginning of the trial, you cannot know how much you will spend on lawyers. And in the application you need to indicate the amount that you have already paid - and only that (or less) will be returned.

If the trial drags on and the defendant files an appeal, you will have to pay more than you thought, and getting the money back for new expenses will be problematic. You will have to constantly look for new financial documents, certify them and attach them to the case materials.

2. Within three months after the completion of the trial

After all the steps have been completed and the final judicial act has entered into legal force, you have three months to file an application for recovery of costs.

The application must be submitted after the opponent’s time to appeal the court’s decision has expired. For example, filing an appeal is allowed within a month: wait until this month has passed, and then bring an application for reimbursement of expenses to the court.

What types of legal expenses are there?

There are several types of costs that may be incurred during a lawsuit.

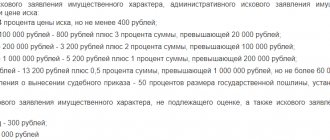

- State duty. For some types of claims, a mandatory payment is required - a state fee. Its size is set by the state. The established amount is paid before filing an application with the court and a document confirming payment must be attached to the statement of claim. Therefore, if the fee is not paid on time and is not included with your application, your case will not be processed.

- Costs associated with the consideration of the case. This type of cost is also divided into several categories:

- amounts for payments to persons involved in the case;

- housing costs for persons who must appear in court in this case;

- costs of searching for the defendant;

- expenses for the execution of a court decision;

- loss of time;

- other expenses – postage, etc.

This list is considered open, and, in fact, the party who incurs these costs can petition the court to recover other reasonable costs that arose in the provision of services by the lawyer in your civil case or as a result of independently handling the case.

USEFUL: watch a video with tips on claiming legal costs, the deadline for this, as well as challenging the amount of collected costs, write your question in the comments of the video to receive a FREE answer

Representative services. In civil proceedings today, this can be not only a lawyer, but also any citizen. The participation of such a person in the process is, of course, not mandatory. Typically, the judge decides on the amount of the penalty based on experience and knowledge of the cost of such services in his region.

What documents are needed?

1. Application for recovery of legal costs

It looks something like this:

2. All documents confirming expenses for the trial

Agreement with lawyers, certificates of completed work, cash documents, hotel receipts, expense reports, boarding passes and air tickets. The more documents collected, the better.

The main thing is that the papers have legal force. For example, the court will not consider a contract without a certificate of completion of work: it is considered that payment is transferred only if this certificate is signed.

List of legal costs

Costs include:

- representative services;

- cost of examination;

- postal items;

- fare;

- costs for issuing a notarized power of attorney.

The list of costs is open. Most often, judges consider applications for the recovery of legal costs for a representative, and therefore the main amount of money is paid by applicants for highly qualified legal assistance.

It is not always possible to receive a full refund. When considering such issues, the judge proceeds from reasonable limits within which funds are subject to compensation.

The Supreme Court of the Russian Federation noted that when resolving the issue of reimbursement of costs, it is legally significant to establish a connection between the amount of costs incurred and their justification, necessity and reasonableness, based on the prices that are usually set for such services.

Reasonable costs in established practice mean the costs that would be charged for similar services under similar circumstances. When determining reasonableness, the volume of the stated requirements, the price of the claim, the complexity of the case, the volume of services provided by the representative, the time required for the preparation of procedural documents, the duration of the consideration of the case and other circumstances are taken into account.

When resolving the issue of the amount of money collected for reimbursement of costs, the court does not have the right to reduce them arbitrarily, unless the other party raises objections and provides evidence of the excessiveness of the amount of costs collected.

Are you going to court? Study court decisions on similar cases. The database of judicial practice in ConsultantPlus will help you find them (get free access to it by clicking on the link below). The database contains decisions of all Russian courts, and the search is as simple as in Yandex.

Is there anything my lawyers can do to help me recover the maximum legal costs?

Yes. In addition to what they already have to do (collect all documents, including receipts for hotels and taxis, and sign a certificate of completion of work), here’s what will help increase the amount of expenses collected.

1. Payment by bank transfer

Even if all the documents and attachments to the documents are available, a bank statement will convince the court more.

2. Detailed list of works

Often lawyers write in the contract only the result of the work, for example, “Preparation of a legal position”, “Participation in a court hearing”.

This is faster, but the court cannot estimate the amount of work. It is better to specify all stages in the contract: “Preparation of a petition”, “Preparation of a written opinion”, “Preparation of objections”. The more stages are reflected, the easier it is for the court to assess the scale of the case.

It makes sense to indicate the cost of each stage separately.

For example, we always describe the stages of work in detail and see that this really helps clients recover large sums. Recently, for example, one of our customers returned almost all the money spent on the trial.

If you have a question about bankruptcy, subsidiarity or protection of personal assets, subscribe to the newsletter on our website. Once a month we review one request, provide detailed advice and send action instructions by e-mail. Only for subscribers.

Expensive process: how to recover legal costs

Judicial formalism and ignorance of the market

The law does not have clear criteria for the collection of legal expenses. Because of this, judges are forced to evaluate their “reasonableness.” According to Gennady Yurin, lawyer at Allen & Overy Allen & Overy Federal rating. group Corporate Law/Mergers and Acquisitions group Maritime Law group Natural Resources/Energy group TMT group (telecommunications, media and technology) group Transport Law group Financial/Banking Law group Bankruptcy (including disputes) group International Arbitration group Arbitration proceedings (major disputes - high market ), the criteria of reasonableness, despite the existing clarifications of judicial practice, remain “rather broad”. They effectively allow the court to determine the reasonable amount of costs for the services of lawyers and representatives, guided by its own internal belief and subjective opinion, for example, about the complexity of the case and the time that a qualified representative should have spent on preparing the legal position of his client.

But another problem arises from this, says Pepelyaev Group partner Pepelyaev Group Federal Rating. group Foreign trade activities/Customs law and currency regulation group Tax consulting and disputes (Tax consulting) group Tax consulting and disputes (Tax disputes) group Labor and migration law (including disputes) group Digital economy group Antimonopoly law (including disputes) group Land law/Commercial real estate/Construction group Intellectual property (including disputes) group Compliance group Natural resources/Energy group Pharmaceuticals and healthcare group Environmental law group Bankruptcy (including disputes) group Corporate law/Mergers and acquisitions group Family and inheritance law TMT group (telecommunications, media and technology ) group Financial/Banking Law group Arbitration proceedings (major disputes - high market) group Dispute resolution in courts of general jurisdiction Yuri Vorobyov, - judges do not have a common understanding of the market for legal services for judicial representation and the cost of such services. This can make it difficult to prove that a particular service should cost exactly what was paid for it.

To correctly resolve issues of distribution of costs, judges do not have enough experience, says CA advisor Muranov, Chernyakov and partners Muranov, Chernyakov and partners Federal Rating. group Arbitration proceedings (medium and small disputes - mid market) group Dispute resolution in courts of general jurisdiction Olga Benedskaya. “The judicial community is very closed; people from consulting and business do not come to it, and litigation between lawyers and their clients regarding the recovery of the cost of legal services is negligible,” explains the expert. Because of this, the court in a dispute over legal costs is in the same difficult situation as when resolving a dispute about the recovery of damages, when their amount cannot be justified.

Lawyer in the practice of dispute resolution and international arbitration ART DE LEX ART DE LEX Federal rating. group Antimonopoly law (including disputes) group Land law/Commercial real estate/Construction group Compliance group Natural resources/Energy group Dispute resolution in courts of general jurisdiction group TMT group (telecommunications, media and technology) group Arbitration proceedings (major disputes - high market) group Bankruptcy (including disputes) group Corporate Law/Mergers and Acquisitions group International Litigation group Criminal Law group Financial/Banking Law group Intellectual Property (including disputes) Valeria Ivacheva points out another systemic problem. “In the vast majority of cases, the courts reduce the amount of recovered costs to certain standard amounts,” says the expert. Usually this is 150,000 rubles, 300,000 rubles, 600,000 rubles, notes Ivacheva, and the problem, according to the lawyer, is not even the problem of proving the amount and attributability of expenses, but a certain ideological position adopted in the judicial system.

The courts formally treat applications for the collection of legal costs, and if the case has not gone through two rounds of consideration and has not lasted more than three years, then one cannot count on a thorough consideration of the application for the collection of legal costs and the recovery of an amount even close to that originally claimed.

Valeria Ivacheva

Another difficulty in recovery, according to Vorobyov, is that in the overwhelming majority of cases, judges give the most general arguments to justify the recovery of a particular amount, without explaining the reasons for excluding part of the costs incurred. “This complicates both the process of challenging individual judicial acts and the establishment of specific criteria that can be used when determining the cost of services in other cases,” explains the lawyer.

The problem of expensive lawyers

What share of legal costs can be recovered from the opponent most often depends on the amount. If it is small, the chances of returning everything or almost everything are high. “We have seen examples, including in our own large projects, where local lawyers are brought in to participate in numerous similar trials in the regions, when relatively small amounts of expenses for the services of representatives were recognized as justified and reasonable and were recovered from the losing party in full or almost in full “says Yurin.

But if the costs are relatively large, for example, a reputable law firm is involved, then the chances of full reimbursement are less. “There is an obvious trend: the higher the amount of legal costs recovered, the higher the percentage of reduction in legal costs will be,” comments Ivacheva. “Courts often refuse to take into account that different law firms or private lawyers may charge different amounts for similar services,” confirms Daniil Zherdev, lawyer at KIAP KIAP Federal Rating. group Arbitration proceedings (medium and small disputes - mid market) group Compliance group Family and inheritance law group Intellectual property group (including disputes) group Dispute resolution in courts of general jurisdiction group Labor and migration law (including disputes) group Criminal law group Antimonopoly law (including disputes) group Foreign trade/Customs law and currency regulation group Land law/Commercial real estate/Construction group Corporate law/Mergers and acquisitions group International arbitration group TMT (telecommunications, media and technology) group Financial/Banking law group Bankruptcy (including disputes) group Tax consulting and disputes (Tax consulting) Company profile.

At the same time, it will not be possible to refer to the positions of lawyers in international and Russian ratings of law firms: back in 2021, the Plenum of the Supreme Court indicated that the reasonableness of the costs of paying for the services of a representative cannot be explained by the fame of the representative.

Recovery of the full amount is also possible in situations where the losing party behaved in bad faith and delayed the process.

Yuri Vorobiev

Detailed evidence needed

But even if it is not possible to recover all the expenses incurred, you should try to recover as much as possible. The most important thing is to prove the connection between the costs incurred and the case being considered in court, Ivacheva notes. According to her, the courts usually recognize the costs of meetings on the project, familiarization with the case materials and correspondence with the principal and other persons as not attributable to judicial representation. Ekaterina Boldinova, partner at Five Stones Consulting Five Stones Consulting Federal rating. Group Tax Consulting and Disputes (Tax Disputes) Group Labor and Migration Law (including disputes) Group Private Wealth Management Company Profile, advises to draw up an acceptance certificate for the services provided in as much detail as possible - this will make it easier to prove what the amount of expenses was.

Daniil Zherdev gives a number of tips that will help substantiate the “reasonableness” of the stated claim for recovery of costs. The following is needed.

✔️ Explain to the judge the complexity of the case - with references to the category of the dispute, volumes of materials, number of participants, court hearings and completed procedural actions - examinations, interrogations of witnesses and others.

✔️ Indicate the amount of time spent by the lawyer and the number of procedural documents prepared.

✔️ Show the court what prices for similar services are in the region where the dispute is being considered.

✔️ Try to find judicial practice in similar cases in which the court collected legal costs commensurate with those declared.

Vorobiev advises demonstrating to the judge the obviousness of the position of the winning party and indicating that the process was a way to delay the execution of the final decision. Then you need to show what benefit the opponent received as a result of such procedural behavior. “If the losing party delayed the case, this can be used against it, demonstrating to the court that the loser himself contributed to the increase in legal costs collected from him,” confirms Yurin.

To increase the chances, it is necessary to indicate in the application only those services that the court considers relevant to judicial representation, and accordingly, the hours of work in such quantities that the court considers reasonable, Ivacheva emphasizes.

One of the tools for justifying the different costs of legal services can be a joint study of the Federal Chamber of Lawyers and the VETA expert group on the cost of legal services in different regions, Zherdev notes. But the expert adds that courts are very reluctant to accept this research as evidence and often ignore it. “Over the past months, I have twice made attempts to refer to the study and attach it to the case materials, but both times it was ignored, and the declared legal costs were reduced by 1.5–2 times,” the lawyer said.

Business trips and examinations are also expenses

The amount of expenses depends not only on the cost of legal services directly. There are also side expenses, for example, pre-trial examination, expert opinions, notarized protocols for inspection of Internet sites.

It is necessary to justify not only that these expenses were actually incurred and the documents were submitted to the case, but also that the evidence was necessary for the correct and complete consideration of the case, advises Tatyana Sviridova, a lawyer in the dispute resolution practice of CMS Russia CMS Russia Federal Rating. TMT group (telecommunications, media and technology) Pharmaceuticals and healthcare group Antitrust law group (including disputes) Land law/Commercial real estate/Construction group Corporate law/Mergers and acquisitions group Tax consulting and disputes (Tax consulting) group Financial/Banking law group Intellectual property (including disputes) . “It is best to quote from judicial acts on the merits of the dispute, where the courts evaluate the evidence and draw a conclusion based on it,” the expert comments. If there is no indication of documents in judicial acts, then it is necessary to prepare a detailed justification for why this evidence was necessary, what arguments of the party and the conclusions of the court they support, and in response to what arguments of the opponent were presented.

Courts often question the need for several representatives to participate in a meeting, Sviridova notes, and, as a result, refuse to reimburse travel expenses for all lawyers. There is also skepticism about the costs of overly expensive hotel rooms or hotels in which representatives lived. Thus, in case No. A65-16916/2016, the district court confirmed: it is impossible to impose on the opponent the costs of paying for luxury rooms. In the same case, the plaintiff tried to recover 220 rubles, which his representatives spent on candy, but received a natural refusal.

But practice on this issue is also heterogeneous. Thus, the 10th AAS in case No. A41-108478/2017 o. In this case, the defendant tried to prove that the hotel where the lawyer lived had cheaper rooms, but the court satisfied the stated requirement.

Arbitration courts generally treat travel expenses fairly, and it will most likely be possible to recover them. In case No. A42-8269/2016, the district court rejected the tax service’s reference to the fact that the lawyer could have used public transport instead of a taxi. The party to the dispute cannot be required to find a cheaper travel option, the court noted, but the actual travel costs incurred should still not be excessive.

Not only money

Ivacheva notes that the courts formally approach the question of how it is possible to pay for the services of a representative. They often refuse to collect expenses on the basis that the parties agreed to pay not in money, but in another way, says the lawyer.

But practice on this issue is gradually changing, and the parties have more freedom. Thus, in February, the Supreme Court recognized the legal payment of a representative’s services as a right to demand the recovery of legal costs (see “The Supreme Court allowed payment of legal costs by assignment”). Based on this approach, a new business model for the provision of legal services can be formed, Ivacheva is sure.

And in case No. A12-39006/2018, the Supreme Court admitted that the legal costs incurred can be recovered in the form of damages. But in this case, it is necessary to prove the illegality of the defendant’s actions. In a similar case, the plaintiff, a federal research and production company, failed to do this (see “Pre-trial costs for lawyers: the Supreme Court clarified when they can be recovered”).

- Maxim Varaksin

Results

Representative expenses in a court of general jurisdiction, on the basis of the provisions of the Code of Civil Procedure of the Russian Federation, can be recovered by the winning party from the losing party. To do this, the subject must prove to the court the fact of making representation expenses, the legality of the representation expenses, and the reasonableness of their amount. In turn, the losing party has a chance to reduce the list of costs collected by the opponent on a wide range of grounds.

You can learn more about the specifics of litigation involving business entities from the articles:

- “You can contact the RF Armed Forces through the “My Arbitrator” system”;

- “The procedure for appealing a tax authority’s decision in court.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is a court of general jurisdiction?

To courts of general jurisdiction in accordance with the provisions of Art. 1 of the Law “On Courts of General Jurisdiction” dated 02/07/2011 No. 1-FKZ include:

1. Federal judicial institutions, represented by:

- Supreme courts of constituent entities of the Russian Federation, cities of federal significance;

- district, city, interdistrict courts;

- military courts;

- various specialized courts determined at the level of federal constitutional laws.

2. Courts of the constituent entities of the Russian Federation, represented by a single legal institution - justices of the peace.

The competence of courts of general jurisdiction is to resolve issues and cases within the framework of civil, administrative and criminal legislation (Article 4 of Law No. 1-FKZ). In particular, a court of general jurisdiction has the authority to make decisions on the collection of representation expenses from certain parties to legal disputes. Let's study the specifics of these expenses in more detail.

Official reception and service

First of all, it is necessary to determine what exactly can be considered official reception and service; the Tax Code does not disclose these concepts. Therefore, only in accordance with the order of the manager, the meeting plan or other documents can it be proven that the meeting was of an official and business nature.

For example, a chance meeting between two executives and their dinner together will not be official. But if this meeting was planned, and certain funds were allocated for its holding by order of the manager, and after the meeting the manager presented a report on the negotiations held and the amounts spent, we can talk about an official meeting.

Nuances of collecting representation expenses in courts of general jurisdiction

The term “representation expenses” has several interpretations:

- Traditionally, this concept corresponds to the costs of an individual or organization to represent their interests in court. For example, this could include paying a lawyer.

- Representation expenses within the meaning of the regulatory provisions of the Code of Civil Procedure of the Russian Federation are rightfully considered part of legal costs. Their lists are defined in Art. 94 Code of Civil Procedure of the Russian Federation. Representative expenses can be recovered by the party that won the case in a court of general jurisdiction from the losing party (clause 1 of Article 98, clause 1 of Article 100 of the Code of Civil Procedure of the Russian Federation).

- In turn, in arbitration procedural legislation the concepts of “representative expenses” and “legal costs” are clearly distinguished. The party obligated to pay court costs, based on the specifics of the consideration of the case on its merits, is determined by arbitration (clause 1 of Article 110 of the Arbitration Procedure Code of the Russian Federation). Representation expenses in arbitration disputes are always recovered from the losing party (clause 2 of article 110 of the Arbitration Procedure Code of the Russian Federation).

Disputes (and, accordingly, issues of recovery of representation expenses) are resolved in courts of general jurisdiction if at least one party is an individual (citizen of the Russian Federation or another state, not registered as an individual entrepreneur). In arbitration, in turn, disputes are considered if the plaintiff and defendant are business entities with the status of individual entrepreneurs or legal entities (clause 2 of article 27 of the Arbitration Procedure Code of the Russian Federation).

It is possible that this situation will change over time. In the spring of 2016, information appeared in the largest Russian media about the discussion of the merger of arbitration and general courts. This innovation, according to experts, may be a continuation of the judicial reform, within the framework of which the Supreme Arbitration Court of the Russian Federation was abolished in 2014, and its functions were transferred to the jurisdiction of the Supreme Court of the Russian Federation.

Let us note that, in principle, representation expenses cannot be recovered from the side of the dispute in the status of an individual who has an employment contract with the other party to the dispute (Article 393 of the Labor Code of the Russian Federation).

Probably the most problematic issue when reimbursing entertainment expenses is their amount. Let's consider based on what criteria it is determined.

Accommodation

As for living expenses for representatives of other organizations , fiscal experts believe that these expenses cannot be taken into account for profit tax purposes. This is due to the fact that, according to Article 264 of the Tax Code of the Russian Federation, a reception means exclusively breakfast, lunch or another similar event. Paying for guests' stay is beyond the scope of this concept. It is difficult to dispute this argument, but sometimes such attempts are successful.

Standard for entertainment expenses when calculating income tax

According to clause 2 of Article 264 of the Tax Code of the Russian Federation, entertainment expenses are accepted for tax accounting purposes as part of other expenses within 4% of labor costs incurred during the reporting (tax) period.

Since income and expenses when calculating taxable profit are taken into account on an accrual basis throughout the year, the accountant needs to recalculate the amount of expenses that fall within the standard on a monthly or quarterly basis.

Order for expenses

If the costs of receiving counterparties arise infrequently, the manager can issue an order in relation to each event. The order, as a rule, reflects the essence of the event (negotiations, business meeting), the duration of the meeting, the participants of the meeting, the maximum amount of expenses, the person responsible for the event and the expenditure of allocated funds.

| As you can see, this document clearly shows the purpose of receiving representatives of the partner company. In companies where entertainment events are carried out frequently, the manager usually does not draw up a separate order for each of them, but approves the provision on entertainment expenses. This document contains the procedure for implementing representational events, the procedure for using funds for representational purposes, documenting and monitoring their expenditure, as well as the circle of persons responsible for representational functions. |

Transport

Paragraph 2 of Article 264 of the Tax Code of the Russian Federation establishes that entertainment expenses include transportation support for the delivery of officials participating in negotiations to the venue of the entertainment event and (or) meeting of the governing body and back.

This clause does not cover the payment of travel costs for negotiators from other cities or countries to the city in which the official event will take place. Based on this norm, entertainment expenses include payment for travel of arriving invited persons to the location of the official event, for example, from the location of the host organization or from the hotel.

If negotiations are unsuccessful

During inspections, the tax authorities require, in order to justify representation expenses, to submit some document indicating a positive result of negotiations: an agreement, a protocol of intent, etc. And if there are no such documents, then the tax authorities believe that the entertainment expenses are unreasonable.

Meanwhile, the Tax Code of the Russian Federation does not put forward such conditions and does not in any way link the recognition of entertainment expenses with the positive result of the meeting.

If a business meeting does not bring the expected results, for example, a long-awaited contract for the organization is not signed, then, in our opinion, it is also possible to recognize expenses for profit tax purposes. After all, the goal of negotiations may simply be to establish good relations with partners. In addition, the Tax Code does not contain a direct requirement for positive results of the meeting.

To avoid disagreements with the tax authorities, it is advisable to draw up a report or protocol indicating that the issues were discussed, but no agreement was reached.

Place and time of negotiations

Tax authorities often try to refuse to recognize entertainment expenses due to the location of the negotiations. The disagreement here is caused by this: on the one hand, the Tax Code of the Russian Federation directly states that the location of entertainment events does not matter. But, at the same time, there is a restriction according to which expenses for organizing entertainment and recreation are not representative (paragraph 2, paragraph 2, article 264 of the Tax Code of the Russian Federation). Therefore, very often, according to inspectors, meetings in bars, cafes or restaurants are personal and unofficial.

However, in disputes of this kind, arbitration courts often side with taxpayers and recognize the legality of accounting for the costs of renting premises for a business meeting. If the organization has submitted documents indicating that it does not have premises suitable for receiving delegations of potential clients, conducting negotiations and concluding transactions.

The time for reception and negotiations of the Tax Code of the Russian Federation is not limited. This means that, subject to other conditions, the concept of an official reception will also correspond to a dinner organized for representatives of other organizations outside working hours.