The direct responsibility of any parent is to provide comfortable living conditions for their child. The alimony payer is obliged to pay benefits at any period of his life. It’s good if he has a permanent source of income, is officially registered with the organization under an employment contract, and the accounting department pays a fixed amount to the alimony recipient every month. However, no one is immune from unforeseen circumstances and from the sudden cessation of the activities of the organization - the employer, in which there is a reduction in staff. What is severance pay, and what responsibilities in relation to the recipient of alimony does the alimony payer bear upon dismissal (downsizing) from work, we will consider in the article. Alimony from severance pay upon layoff

What is severance pay?

Reduction of employees in an organization can be carried out for various reasons:

- staff reduction due to a decrease in enterprise income;

- bankruptcy of the company;

- closure of an organization and termination of the activities of a legal entity.

In each of these cases, the enterprise employee is left without work and livelihood, because it is not always possible to immediately find a new place of work. The state foresaw this point, and in order to protect a person who lost his job from financial problems, he obliged the company to pay monetary compensation to the former employee. This is severance pay, and it is equal on average to three salaries officially established at the conclusion of the employment contract. So, an employee who has been laid off receives the following payments after leaving the company:

- salary for the last month worked;

- compensation for vacation, which he did not have time to use;

- severance pay.

Severance pay

Thanks to the money received, a person is protected from the stress of being deprived of a source of income, and has enough time left to look for a new job.

Payments for which alimony is not charged

Not all types of income fall into the category of other, that is, there are transfers from which the alimony provider is not required to transfer money.

These include:

- payment for “harmfulness” - compensation for employees working in conditions of increased danger;

- payment for property.

The second option involves a situation where an employee receives a new uniform on a regular basis. But if he has kept his uniform well and can wear it for another period, then money is paid instead of things.

Withholding of alimony from severance pay

Russian legislation has an officially recognized list of income from which alimony should be deducted. Severance pay is recognized as one of them (). The Resolution states that alimony must be collected from any benefits given to the employee during the period of employment during layoffs at enterprises. Let's consider the conditions and procedure for collecting alimony from severance pay during layoffs.

Conditions for collecting alimony from severance pay

Deductions from severance pay in favor of the alimony payer will be made only if a number of conditions are met:

- the presence of a court order regarding the established amount of alimony;

- the presence of an alimony agreement between former spouses, certified by a notary (this is a prerequisite).

Types of collection of alimony for adult children

Also, the recipient of alimony has the right to demand payment of interest on severance pay only if we are talking about a minor child. In all other cases, the entire amount of severance pay will be transferred to the employee of the enterprise to whom it was assigned (except for the deduction of taxes). So, alimony from severance pay will not be collected in the following cases:

- presence of a disabled child over 18 years of age;

- presence of disabled parents and other relatives;

- assignment of alimony for the maintenance of the wife.

Attention! This order is established, so there can be no exceptions.

The procedure for collecting alimony from severance pay

Russian legislation strictly establishes the order of payment of alimony. That is, in what sequence payments will be made to the bank from the organization’s budget. Each company has a partner bank that provides it with a current account for storing and maintaining funds. The following deductions are made monthly from this fund:

- taxes;

- alimony;

- wages, etc.

The procedure for paying and collecting alimony

Data for deductions is provided to the bank by the accounting department, and this data clearly establishes the amounts of payments, the details by which they should be deducted, as well as the payment number, which determines its urgency and importance. Alimony payments come number one. This means that if there are not enough funds in the company’s bank account to cover all the needs, the bank will carry them out in descending order of importance (which is reflected by the payment order number).

The first payment that will be made from severance pay is alimony for a minor child. Therefore, if for some reason alimony does not reach the recipient, there is a reason to contact the relevant authorities, because this payment should have been made in the first place.

Further, the order of payment of alimony will occur according to the following scheme:

- Submission by the chief accountant to the partner bank of an order on the payment procedure indicating the recipient’s details.

- Whether the bank makes a money transfer to the account of the alimony recipient (by post or to a bank account - depends on the decision made in court).

- Receipt of funds by the recipient.

Video - Alimony from the unemployed and other nuances of collecting alimony

The amount of severance pay and alimony from it

As mentioned above, severance pay, according to Russian law, is equal to three salaries fixed in the Employment Contract. The amount of alimony payment is fixed by a court order or a notarized alimony agreement.

If the court decided to deduct alimony in the amount of 25% of the former spouse’s salary, then this percentage will be deducted from the severance pay.

Example: the salary of a laid-off employee under the Employment Contract was equal to 10,000 rubles.

This means that the alimony collected monthly was equal to 2,500 rubles. When laid off, an employee receives severance pay in the amount of 30,000 rubles. This means that the following will have to be transferred to the alimony recipient’s account: 2500 x 3 = 7500 rubles. How to calculate the amount of severance pay

Compensation for unused vacation and alimony

Compensation for unused vacation refers to those amounts from which alimony can be withheld and calculated. This is also evidenced by the above-mentioned Decree of the Government of the Russian Federation dated April 18, 2014.

Thus, compensation for unused vacation is paid in the following cases:

- The employee did not go on vacation at all during the calendar year.

- The employee returned from vacation earlier than expected, and there is a need to pay him extra for the remainder of the unused vacation. An application is written and sent to the employer.

The law allows compensation only for the following types of leave:

- main annual;

- additional;

- for child care.

The organization's accountant takes the average salary for one day and the number of days spent on vacation and, using this information, calculates the amount of compensation.

Alimony deductions from monetary compensation for an employee’s unused vacation are possible for the following categories of citizens:

- mother of a minor child;

- disabled parents;

- pregnant ex-wife;

- disabled children.

It is worth noting that the calculation of alimony from compensation for unused vacation is carried out in the same way as the payment of child support from severance pay.

Payments and procedure for withholding alimony upon dismissal by agreement of the parties

The entire procedure for withholding alimony described above concerned the dismissal of an employee from an enterprise; let us consider the procedure for deduction in case of voluntary dismissal by agreement of the parties.

If an employee wants to terminate the employment contract at his own request, he will not be paid severance pay. He will receive the following payments:

- salary for the last month worked;

- vacation pay.

According to Russian legislation, alimony will be deducted from both payments in the amount established by the Court Order or the alimony agreement. Judicial procedure for collecting alimony

How long does it take to pay child support after dismissal?

The table of contents of any writ of execution directly indicates the date by which the due payments must be made. As a rule, this is the beginning/end of the current month, when all formal employees are paid the wages stipulated by the agreement. If withholding is intended, the responsible accountant must calculate the required interest on alimony in advance and transfer these amounts to the direct account of the territorial FSSP within 3 days.

The deadline is usually indicated in the writ of execution itself, which is available to the formal employer. But in practice this period does not exceed approximately 3 days. This rule also applies to deductions upon final dismissal - funds are transferred to a direct account no later than the exact date specified in the existing writ of execution.

After the last payment, this sheet must be returned to the territorial FSSP due to the dismissal of the payer.

Responsibilities of the administration of the former employer after the dismissal of an employee

If the laid-off employee was a payer of alimony, then the employing organization has a number of other responsibilities that it must carry out during layoffs.

So, the employer’s responsibilities after reducing the alimony payer:

- Notification of bailiffs that an employee has been laid off (the letter must be sent to the organization of bailiffs addressed to the person responsible for the execution of the Court Order).

- Notification of the court, which made a decision on the payment of alimony and established its amount.

- Notifying the alimony recipient that the payer is left without a permanent income (at least for the near future, until he finds a new job).

All these measures are necessary in order to provide the recipient of alimony with a guarantee of a decent existence. Because lack of work does not relieve the payer of responsibility. For non-working citizens, Russian legislation also provided for the procedure for paying alimony and established their approximate amount. Warning the bailiffs is necessary so that they take strict control of the situation and do not leave the receiving party without alimony.

If the employing company is somehow involved in shaping the future fate of the laid-off employee (for example, with its help he found a new place of work), then the administration of the former employer must notify all of the above persons about this fact. Legal documents on severance pay upon layoffs

The state takes strict control over the life situations of alimony payers in order to provide the weaker sections of the population with protection and a decent existence. Failure to comply with any of these points entails liability and fines may be imposed on the violator.

The company is also obliged to provide a completed writ of execution to the bailiff service, which must indicate:

- the total amount of alimony paid during the employee’s period of work in the organization;

- the number of days (months) during which alimony was deducted;

- amount of debt and its period.

If the employer, for some reason, did not notify the relevant authorities about the dismissal or reduction of an employee, or did not bring to their attention information about his future fate that he has, then a fine will be imposed by the state. Who exactly was responsible for the improper information will be clarified privately, but often the head of the company bears responsibility. The fine is 10,000 rubles.

Video - Alimony from an unemployed person. How much should he pay?

Law on dismissal of alimony worker

The procedure for the employer's actions in the event of dismissal of the alimony worker is regulated by Art. 111 IC RF and Art. 5 No. 229-FZ.

According to this article, a company that withholds alimony on the basis of a court decision or a certificate certified by a notary is obliged to report the dismissal of an employee to the executive authorities. The deadline for this is three working days. Also, the person receiving alimony - the second parent - is notified of the dismissal of the alimony provider.

If the employer has information about the subsequent place of work of the alimony payer, he must provide this information too.

When moving from one place of work to another, the parent involved in paying child support does not have the right to hide the new place of employment. He must inform the bailiff and the person receiving alimony about the change of employer. Notification of additional earnings, if any, is also required.

Failure to comply with these requirements may result in the responsible persons being subject to administrative liability.

Notice periods

When dismissing an alimony payer, the organization is obliged to notify the bailiffs of the termination of the contract within 3 days after the dismissal. If, without good reason, the employing company fails to send the notice within the prescribed period, it will be held administratively liable.

The employer is also responsible for the safety of documents. Therefore, they should be stored only in specially designated places: internal archives of the enterprise, safes and other methods of storing securities.

Valid reasons for the lack of notification and delivery of a writ of execution are force majeure and force majeure, which include:

- flood;

- earthquake;

- natural fires due to which residents were evacuated, or a fire in the employer’s building;

- participation in an accident of a courier delivering correspondence with notifications and enforcement documents;

- other circumstances with serious consequences.

Legal assistance

Tricks for avoiding child support obligations are reaching a new level. Payers try to hide their income, so they often disguise it as other payments. It is quite difficult for alimony recipients to keep track of everything at once. Even if bailiffs get involved in the case, they limit themselves to an oral conversation with the debtor, after which the case continues to lie on the table. The best thing to do is contact a lawyer.

Don't know how to calculate alimony?

Contact our lawyers for a free consultation. Experts will tell you which incomes are sources for alimony and which are not. If you are the payor, you will need help determining severance pay. Lawyers will help determine the exact size and take care of preparing the necessary documents. Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- FREE for a lawyer!

By submitting data you agree to the Consent to PD Processing, PD Processing Policy and User Agreement.

Anonymously

Information about you will not be disclosed

Fast

Fill out the form and a lawyer will contact you within 5 minutes

Tell your friends

Rate ( 1 ratings, average: 5.00 out of 5)

Author of the article

Irina Garmash

Family law consultant.

Author's rating

Articles written

612

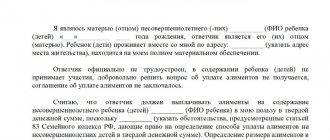

Notification to bailiffs of dismissal

When dismissing an employee of an enterprise who makes alimony payments, the employer is obliged to notify the bailiff and the recipient of alimony about the termination of the employment relationship with the citizen.

The notice is drawn up taking into account the following rules:

- in the “header” it is indicated in whose name the notification is being drawn up, and only after that does all the basic information about the reason for sending appear;

- the name “Notification” is mandatory, after which no punctuation marks are added;

- after the name, the basis for sending the notice is indicated - dismissal of an employee obligated to pay alimony;

- after the grounds, reasons or decisions are written down, based on the reasons for sending the document - termination of fulfillment of obligations to withhold alimony payments;

- attachments are drawn up on additional sheets, which must go after the main text of the letter; the main page contains a list of all attachments indicating the pages and number of sheets;

- information is provided about the employee who drew up the notice.