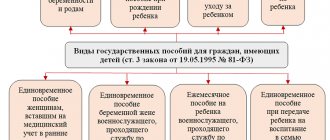

At the birth of a child, an employee under an employment contract is entitled to:

- benefits for registration in the early stages of pregnancy;

- maternity benefits;

- lump sum benefit for the birth of a child;

- child care allowance up to 1.5 years;

- allowance for caring for a child up to 3 years old (if the child was born before January 1, 2021).

All benefits, except the last one, are paid at the expense of the Social Insurance Fund. Starting from 2021, in all regions, the Social Insurance Fund transfers money directly to employees. For information on how to assign benefits, read the article “How to help an employee receive benefits from the Social Insurance Fund at the birth of a child?”

Maternity calculator

The employer no longer calculates the amount of benefits - this is done by the Social Insurance Fund. The calculator will help you find out in advance the amount of maternity benefits and the monthly child care benefit for up to 1.5 years.

How to use the calculator?

- In the first step, select the benefit type. For maternity benefits, you need to indicate data about the period from the employee’s application (based on a certificate of incapacity for work), and for child care benefits up to 1.5 years, also data about the child. Calculation years will be determined automatically. By default, this is 2 calendar years preceding the vacation. Since 2013, periods of sick leave or parental leave are excluded from them. If there were such periods, indicate them.

- In the second step, the employee’s earnings for 2 accounting years are indicated. These are all payments for the calculation period for which insurance contributions to the Social Insurance Fund are calculated. Indicate the regional coefficient, if provided. Check the box for part-time employment, if any. The insurance period is taken into account if it is less than six months. This is necessary to calculate the average daily earnings and compare them with the calculation of minimum wage benefits.

- In the third step, you will see the final calculation of the benefit amount.

Does the calculation of benefits change with direct payments?

The procedure for calculating sick leave has not changed due to the transition to direct payments.

But from January 1, 2021, a new minimum wage is in effect - 12,792 rubles, that is, the minimum benefits have increased.

As in 2021, sick leave for a full month of incapacity should not be lower than the federal minimum wage, regardless of the length of insurance coverage and the employee’s actual earnings.

When calculating benefits for the first 3 days of illness:

- calculate the benefit taking into account the employee’s insurance record in the usual manner;

- calculate the benefit based on the new minimum wage, taking into account the regional coefficient;

- compare the calculation results, select the largest value and multiply by 3 days of incapacity.

The minimum wage amount is taken on the date of opening the certificate of incapacity for work.

The free “My Business” service will help you calculate employee salaries and benefits quickly and without errors.

Benefit for registration in early pregnancy

To whom?

An employee who registered in the first 12 weeks of pregnancy.

How many?

Until July 1, 2021, the employee received a one-time benefit of 708.23 rubles. The amount was increased by the regional coefficient, if the region has one.

The rules have changed since July 1st. Now the benefit has increased and became monthly. The benefit amount is equal to 50% of the cost of living in the region. But only those whose income per family member is less than the subsistence level will receive it.

How is it prescribed?

Before July 1, the employee brought the employer an application and a certificate from the hospital about registration in the early stages of pregnancy.

From July 1, the employee independently applies for benefits from the Pension Fund or submits an application through State Services. The employer does not participate in the assignment of benefits.

How to proceed with direct payments to the Social Insurance Fund

Procedure for payment of benefits from the Social Insurance Fund from January 1, 2021.

- The employer receives from the employee documents for assigning and calculating benefits: a certificate of incapacity for work - a paper form or electronic sick leave number, a child’s birth certificate, certificates from other places of work, etc.

- No later than the fifth calendar day, he transfers to the FSS a package of documents with an inventory or sends information using an electronic register.

- The FSS checks for errors. If something is wrong with the documents, he sends a notice to the employer within five working days - by mail or via electronic communication channels. Corrections must also be made within five days.

- When the FSS receives all the necessary information, it will make a decision on the assignment and payment of benefits within 10 calendar days.

- If the decision is positive, the money will be transferred to the employee’s account within 10 calendar days from the moment social insurance receives all documents.

- If a payment is denied to an employee, the Social Insurance Fund will receive a decision within two working days.

From 01/01/2021, the employee provides information for calculating benefits when hiring. When an insured event occurs, he only needs to bring the missing documents (clause 2 of the Regulations, approved by Government Decree No. 2375 of December 30, 2020).

Maternity benefit

To whom?

Only the mother of the child.

How many?

The amount of the benefit depends on the employee’s salary for the previous two years. The amount will be calculated by the FSS, but you can find it out in advance using a calculator or yourself according to the instructions:

- Calculate your income for the last two calendar years from which you paid contributions to the Social Insurance Fund. If an employee goes on maternity leave in 2021, income from 2021 and 2021 is taken into account. If you have already had maternity leave in these two years, you can take the previous years so that the benefit amount is larger.

- Compare the amount of income for each year with the maximum base for calculating insurance premiums. For 2021 - 865 thousand rubles, for 2021 - 912 thousand rubles. If the amount of income is higher, for the calculation take the maximum base for contributions in each year.

- Determine your average daily earnings - instructions in the article.

- Compare the average daily earnings with the minimum and maximum. The minimum from January 1, 2021 is 420.56 rubles, and the maximum is 2434.25 rubles. If the average earnings are lower or higher than these amounts, consider the benefit from the minimum or maximum earnings. The regional coefficient is calculated from above.

- Calculate the benefit amount: multiply the average daily earnings by the number of calendar days of vacation.

If the employee’s insurance experience is less than six months, then the benefit is paid in the amount of the minimum wage, taking into account the regional coefficient for a full calendar month.

If an employee, despite the dates of incapacity for work on the sick leave, brought it and wrote a vacation application later - she has such a right - the benefit is paid only for the actual vacation time.

How is it prescribed?

The employee brings you documents:

- a free-form application for maternity leave - this application remains with you;

- application for benefits for the Social Insurance Fund;

- sick leave;

- a certificate of the amount of earnings from your previous place of work, if during the previous two calendar years she worked not only for you.

Attach an inventory to the application, sick leave and certificate and submit the documents to the Social Insurance Fund within 5 days.

When is it paid?

The Social Insurance Fund will check the documents and pay benefits to the employee within 10 days.