| Billing period: | standard (12 months) other (months) Error |

| Date on which the calculation is carried out: | |

| Working time schedule: | |

| Number of working days excluded from the billing period: | days Error |

| Number of hours worked: | hours Error |

| Number of days worked: | days Error |

| Month | Salary | Indexation coefficient | Bonuses and other payments |

| February 18 | Error | Error | Error |

| March 18 | Error | Error | Error |

| April 18 | Error | Error | Error |

| May 18 | Error | Error | Error |

| June 18 | Error | Error | Error |

| July 18 | Error | Error | Error |

| August 18 | Error | Error | Error |

| September 18 | Error | Error | Error |

| October 18 | Error | Error | Error |

| November 18 | Error | Error | Error |

| December 18 | Error | Error | Error |

| January 19 | Error | Error | Error |

Labor relations between employer and employee are not complete without calculating average earnings. There are situations at work when knowing the exact amount is necessary to provide paid leave or send an employee on business trips. Various payments, such as severance pay or disability, require the company's accounting department to determine the average salary.

Average earnings are calculated both independently and using a special calculator. It simplifies the complex counting process and helps save effort and time.

How to use the calculator

The average earnings calculator is easy to use. For each month you will need to enter two values.

1. Indicate how many days the employee worked in a particular month.

2. Enter the employee’s salary for the same month in the next field of the calculator. You must indicate the amount in rubles.

You can set values in the calculator either by entering numbers from the keyboard or using the arrow buttons.

Please note that all months must be filled in. If the employee did not work in any of them, set the value to “0”.

When everything is ready, click on the calculator button “Calculate average daily earnings.”

The result will be displayed below.

How does the average earnings calculator work?

Step 1. Select the date for which you want to make a calculation. The calculation of average monthly earnings in the online calculator is carried out by month, but there are formulas that allow you to calculate the amount in a few days.

Step 2. For each month, enter the data in the fields (if in the month the employee did not go to work on holidays and did not have non-working days, simply leave the fields blank).

Step 3. Fill in all 12 months with data and at the end click the “Calculate” button.

When else do you need to calculate your average daily earnings?

Average earnings are calculated according to the rules established by Decree No. 922 of December 24, 2007. The Labor Code lists several cases when the average salary should be calculated:

- employee leave (regular, educational);

- temporary disability, maternity leave, child care;

- business trip;

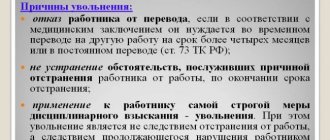

- calculation of compensation upon dismissal;

- downtime due to the fault of the employer;

- other paid absences from the workplace (donor days, suspension of work due to non-payment of wages for more than 15 days, undergoing a mandatory medical examination, etc.).

No salary

If the employee does not have any payments during the calculation period (12 months) or for a time period exceeding this period, the accounting department must take the employee’s monthly salaries for the previous period as a basis. Thus, if from June 1, 2017 to June 1. In 2021, the employee did not receive a salary or did not work at all, then the time period from June 1, 2016 to June 1, 2016 will be taken as the calculation period. 2021.

If the employee did not have payments before the start of the pay period, then the accounting department will take as a basis the salary in the month from which the employee became entitled to maintain the average salary.

In the case where payments did not take place and during the period of occurrence of the case giving the right to maintain the average monthly earnings, the calculation will be carried out based on the salary assigned to the employee.

What exactly should be taken into account when calculating average earnings?

How average earnings are calculated is specified in the Regulations on the Calculation of Average Earnings. Average daily income is calculated based on wages for the previous 12 months. Its calculation includes all days and payments for the time when the employee was at work, and does not include for the time he was absent from work:

- disease;

- vacation;

- business trip;

- other absence, paid or unpaid.

One-time payments that are not related to the employee’s performance of work duties should not be included in the calculation: holiday incentives, financial assistance.

If bonuses were paid during the calculation period, they must be accounted for as follows:

| Type of award | The procedure for inclusion in the calculation |

| For a period less than the estimated period (monthly, quarterly) | Completely one for each bonus indicator (for example, revenue volume, number of sales) |

| For a period longer than the estimated period (for example, for fulfilling a long-term customer order) | In the amount of a monthly portion for each indicator for each month of the billing period |

| At the end of the year | Included in full, regardless of the date of actual accrual and payment |

If there was an increase in salaries throughout the company or in the department in which the employee works, then the payments included in the calculation after the increase must be adjusted by the coefficient:

Accounting for bonuses

When calculating average earnings, bonuses and other types of additional remuneration are taken into account according to a special algorithm.

Thus, one bonus is taken into account for any one indicator for each month that is calculated. That is, if we assume that the employee received two additional remunerations in one month, but according to different indicators, for example, one for exceeding the plan, the other for an improvement proposal, then only one of them will be taken into account.

In the same way, the following are taken into account:

- bonuses and any other remuneration issued based on the results of two or more (up to 12) months;

- bonuses and other types of remuneration issued based on annual results within a calculated period of 12 months. The time of accrual of annual bonuses will not matter, the main thing is that the period for which the bonus was issued was included in the last 12 months;

- one-time payments for long service.

Calculation algorithm

To calculate the average daily payout, in any case, we use the formula:

The average monthly salary in Russia for an employee should not be lower than the minimum wage.

An online calculator will help you correctly and quickly calculate your average earnings.

There are some specific features for different bases for paying average earnings. Below we will consider the most common cases when payment must be made based on average earnings.

Average earnings for a business trip

How to calculate the average monthly income for 12 months while on a business trip? First, determine the base for accrual and determine the billing period.

Include similar categories of payments in the database, but exclude material assistance, benefits, compensation for travel, accommodation, recreation, and food. Take into account the amounts that were accrued over the previous 12 months.

Include only the time actually worked in the pay period. Exclude days of illness, other business trips, vacations, downtime and other unworked time from the calculation.

Having determined these indicators, divide the base by the number of days worked. The resulting average daily earnings must be multiplied by the number of days spent on a business trip.

Please note that the duration of a business trip includes days spent on the road (to the place of business and back), days of downtime or delays. For weekends and holidays on which the employee did not work while on a business trip, average earnings are not accrued.

Vacation pay calculation

Leave is granted and paid in calendar days. With a fully worked month in the billing period, the indicator “Number of days in the billing period” includes 29.3 calendar days. For each incompletely worked period, the number of calendar days included should be determined by the formula:

The length of annual leave is 28 calendar days (Article 115 of the Labor Code of the Russian Federation). It may be provided in parts. The average daily income obtained by dividing the base by the number of calendar days in the billing period is multiplied by the number of vacation days.

Vacation: calculation features

When calculating vacation, the base and period are determined in a similar manner. The structure of payments included in the calculation is the same: we include remuneration for work provided for by the remuneration system, but exclude social payments and certain types of compensation. Average daily earnings when calculating compensation upon dismissal are calculated in the same way.

The time period for calculation is determined according to special rules. For each fully worked month falling within the billing period, we take into account the average number of days - 29.3. This is a similar average of days for calculating vacation pay ((365 days a year - 14 holidays) / 12 months).

If the month is not fully worked out, then use the formula:

Example.

In April, the employee was on a business trip from the 1st to the 10th. He worked the rest of the days completely. The base for calculating vacation is 1,000,000 rubles.

Let's do the calculation:

1. 29.3 / 30 days. in April × (30 days - 10 days business trip) = 19.5 days. for a month not fully worked.

2. Then the number of days for each month out of 12 calendar months are summed up.

3. 19.5 days. (for a month not fully worked) + 29.3 × 11 months. (for the rest of the time) = 341.8 days.

4. Average daily earnings - 1,000,000 / 341.8 = 2925.69 rubles.

To determine the amount of vacation pay, you must multiply the resulting average daily earnings by the number of vacation days, excluding holidays.

Please note how to calculate the average daily earnings upon dismissal to compensate for unused vacation. It is calculated in a similar manner.

Calculation for certificate of incapacity for work

Determining the average daily income for sickness benefit has a number of features. Firstly, it is determined based on payments for the two calendar years that preceded the year in which the employee took sick leave. Secondly, the number of days in the billing period is always taken to be 730 (Federal Law of December 29, 2006 No. 255).

The income on the basis of which the benefit will be calculated includes all payments from which insurance contributions to the Social Insurance Fund were calculated in case of temporary disability.

The base for the payroll period is determined not only by the income that was paid to the employee at the current place of work, but also by income from previous employers. The employee must confirm his salary at his previous place of work with a certificate in a form approved by the Ministry of Labor.

For benefits, a maximum amount of income included in the calculation is established annually. It is equal to the maximum amount from which contributions are paid:

| Year | Limit value, rub. |

| 2017 | 718 000 |

| 2018 | 755 000 |

Therefore, in 2021, the maximum daily benefit cannot exceed (755,000 + 718,000) / 730 = 2,017.81 rubles.

Also, the daily benefit payment cannot be lower than calculated from the minimum wage. The minimum average daily earnings from the minimum wage in 2020 is 11,280 × 24 / 730 = 370.85 rubles.

Calculations in case of salary increase

The calculation of the average salary in the event of a salary increase carried out by the employer or as a result of the adoption of framework legislation will be carried out taking into account exactly when the salary increase took place.

- If the salary was increased during the pay period, then the average monthly salary will be calculated taking into account the increasing coefficient, calculated according to the scheme: the official salary in the month of the increase is divided by the official salary before the increase. The difference will be the coefficient, the calculation of which is included in the calculator system.

- If the salary was increased after the end of the billing period, but before the occurrence of an event giving the right to maintain the average monthly salary, then the average earnings for the billing period will be increased.

- If the salary was increased after the occurrence of an event giving the right to maintain the average salary, then the average salary will be increased from the day the salary was increased until the day the right to maintain the average salary ends.

The very fact of a salary increase will entail an increase not only in official salaries, but also in other types of remuneration directly resulting from the size of the salary.

Calculation of benefits upon liquidation of an organization

Payments to employees upon company liquidation include:

- salary until the day of dismissal;

- compensation for unused vacation;

- severance pay;

- benefits during employment if the employee has not found a job within two months; in exceptional cases, by decision of the employment service, income is retained for another month.

The average daily income for compensation for vacation not taken is determined similarly to the calculation for vacation pay.

Let's look at how to calculate the average daily earnings for severance pay and payments retained during employment. It is determined by dividing the base by the number of days worked in the billing period. Severance pay is determined by multiplying the average daily income received by the number of working days in the first month after dismissal. The amount of payment saved during the job search is calculated in the same way.

Why do you need to calculate the average monthly salary?

Sometimes it is necessary to provide a certificate of average monthly earnings. It may be required by social protection services or at the employment center when registering an individual for payment of benefits due to temporary unemployment. Also, determining the exact amount is necessary when applying for loans in banking institutions and for courts.

These are the most common cases in which you need to know the average salary. The coefficient is usually calculated for three months or six months. Calculating average earnings is most often necessary not for personal needs, but for an urgent situation. Dismissed workers often cannot find a new suitable position, so they come to the employment center. A certificate of average salary is one of the documents required for calculating financial assistance.

The principle of calculating average daily earnings

The Tax Code of Russia establishes a clear procedure and sequence for determining the average salary. The following calculation principles exist:

- During the calculation, you need to take into account annual and monthly bonuses, advances and all incentives from management in the form of cash increases.

- Salary increases for each quarter are taken into account.

- Any accruals that are provided for by the company’s collective agreements are also taken into account.

The calculation period is 3 months before dismissal or voluntary resignation from a position. All payments until the termination of the employment relationship and from the last three months are counted and also used in the average daily earnings formula.

However, there are some exceptions to the income required for accounting. All social assistance payments are not taken into account. These include anniversary bonuses and one-time financial assistance. Compensation for leave for pregnancy and childcare is not included in the calculation of the average salary. In the event that work experienced downtime for corporate reasons, the employee is not responsible for this. The billing period does not include:

- the date when the employee was temporarily disabled due to pregnancy or caring for children under 3 years of age;

- period of compulsory leave (study, paid, free);

- days of temporary care for persons with disabilities;

- the time an employee is absent from the company is not his fault.

These factors should be included in the average salary calculator. It facilitates the calculation of the ratio of wages actually worked for the days actually worked for the established pay period.

Calculation of average earnings for 3 months at the employment center

Before bringing a certificate to the employment exchange to register the applicant as unemployed, it is necessary to use a clear calculation formula. To receive unemployment benefits, you need to know your average daily earnings. The amount of all payments for the billing period should be divided by the days actually worked. The estimated time is taken over a 3-month period.

After determining the average daily salary, you can calculate the total average salary for the month - this is done either independently or using a calculator, using a certain formula:

- Average salary = Total number of working days* Average daily earnings

This algorithm is constant and has not changed for many years. There is no need to constantly look for new calculation formulas, because they are always relevant. To facilitate the process, an average earnings calculator was created. It applies this algorithm and produces accurate results in a short time.

Calculation of average earnings for accrual of vacation pay

Obtaining the average monthly salary for holiday pay is slightly different. In this case, the billing period includes vacation time, which is thirty calendar days. The following formula is used:

Average salary = Number of days worked / Number of calendar days* 29.3

Every employee needs annual leave, so everyone who works officially will be faced with calculating the average salary.

Certificate form

At the request of the employee, the employer is obliged to issue him a certificate for the labor exchange. The employer has the right to draw up a document in any form indicating all the necessary indicators, but the employment service usually requires using the one recommended by the Ministry of Labor (Letter No. 16-5/B-421).

The Ministry of Labor of the Russian Federation, in order No. 62 of August 12, 2003, establishes how to calculate the average earnings for an employment center, what period to use, what payments to include.

ConsultantPlus experts discussed how to obtain a certificate of average earnings for unemployment benefits. Use these instructions for free.

What is included in income when calculating

The list of incomes summed up to determine average earnings includes:

- salary at temporary and piece rates , as well as monthly and basic salaries;

- commissions with a tariff-free payment system;

- incentives and regional allowances;

- awards;

- payment for processing;

- the cost of the part of the salary paid in kind;

- remuneration of representatives of elected authorities;

- salaries of municipal employees;

- media workers' fees.

It is important to note that only one bonus for each indicator per month can be included in income. For example, if an employee was given 2 bonuses for a conscientious attitude to work in a month, then only the first one is taken into account when calculating the average salary.

If part of the salary is paid in the company's products, then the average market value of such products is taken for calculation in order to avoid artificially lowering the price in the accounting department of the employer's company.

Billing period

To calculate, you need to take the three months that precede the employee’s dismissal. The following times must be excluded from the period:

- illness, child care, maternity leave;

- being on a business trip or paid leave;

- absence from work with or without maintaining income.

There are situations when an employee quits on the last day of the month. In this case, to calculate the average monthly salary, it is allowed to use three months, taking into account the month of dismissal. It is advisable to apply this procedure if the employee received a significant bonus and the average monthly salary calculated for this period exceeds the average earnings calculated according to the general rules (Definition of the Supreme Court No. KAS06-151).

Instructions for using the vacation pay calculator in 2021

To quickly calculate your vacation pay, use our free calculator. The principle of its operation is based on three operations:

1. First, specify the rest period in the format “day.month.year”. Then select the type of vacation and specify the billing period.

Please note the auxiliary fields:

- The “There are exclusion periods” field is checked if there were exclusion periods in the billing period (illness, business trips, etc.).

- The field “If there was a salary increase in the billing period...” is marked if there was a salary increase throughout the company. This is done so that the calculator automatically indexes the employee’s earnings for the months preceding the increase.

2. Next, the employee’s income is indicated to calculate the average daily earnings, excluding the amounts of sick leave, etc. (see question mark in the calculator).

3. Receive a full calculation of vacation pay, highlighting the approximate amount of personal income tax and vacation pay to be issued.

Vacation registration

There are two types of leave - main and additional, the calculation and documentation of which are identical.

The employer must create a vacation schedule for each year. No later than 2 weeks before the start of the vacation according to the schedule, the employee must be reminded in writing about the upcoming vacation. An employee may ask to reschedule a planned vacation. In this case, the transfer is carried out in agreement with management.

If an employee goes on vacation, an order is issued for him. The calculation of vacation pay is presented in the form of a calculation certificate containing a full calculation of the average daily earnings, the amount of vacation pay, withheld tax, and the amount due to be paid to the employee.

Submit reports for employees. Extern gives you 14 days for free!

Try for free

Who is entitled to compensation for unused vacation?

When an employee leaves the company, most often he has “non-vacation” days of vacation. The accountant calculates the amount of these conditional vacation pay according to special rules, withholds personal income tax and pays it along with the last salary and severance pay.

No compensation is paid to employees who are simply transferred from one department to another without being fired. It is also not issued to external part-time workers who are transferred to their main place of work. And an employee who was hired less than half a month ago and is now being fired will not receive anything.