Along with the usual employment of a pregnant woman, there are cases when managers arrange a job for their friend or relative before giving birth. The purpose of such employment may be to pay the employee maternity benefits at the expense of the Social Insurance Fund and subsequent reimbursement by the company of the costs incurred to pay the benefits. This scheme was beneficial several years ago, when sick leave was calculated based on average daily earnings. The situation has long since changed.

Now, to calculate sick leave, the previous two calendar years are taken. If a maternity leaver has not worked before, she will receive maternity benefits at the minimum rate - 398.79 rubles per day. The benefit for the standard 140 days of maternity leave will be 55,830.60 rubles.

Often the reason for such employment by a pregnant woman is the desire to help a woman she knows build up her work experience. Since the period of pregnancy and childbirth and child care up to 3 years is included in the length of service for calculating a pension only in case of employment. For non-working mothers, this period may not be included in the length of service if the woman did not work anywhere before pregnancy.

Important on the topic

Amounts of child benefits for 2021. Table

Take maternity leave

Maternity leave

The employer receives documents from the employee:

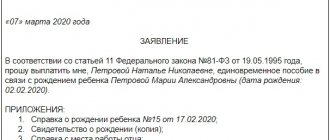

1. Sick leave from the antenatal clinic. Remember that electronic sick leave works just as well as paper sick leave. They work with them in the FSS personal account.

2. Application for maternity leave in any form. It is not necessary to take it before the start of your vacation. It is possible after that, within 6 months.

The vacation lasts 140 days: 70 before childbirth and 70 after. Sometimes employees do not apply for leave and work until the last minute. This is normal: vacation is a right, not an obligation. Only for days of work they do not pay benefits.

Non-standard situations from the order of the Ministry of Health and Social Development .

— In case of multiple pregnancy, leave is taken at the 28th week for 194 days: 84 before birth and 110 after.

— When adopting a child, leave is taken from the date of adoption. It ends when the child turns 70 days old. If the child is more than 70 days old at the time of adoption, maternity leave is not allowed.

— In case of complicated pregnancy, an additional 16 days are taken. In this case, the employee writes an application to extend the vacation.

When you have found out the duration of your vacation, fill out the following documents:

— Sign the order granting leave.

— Fill out your personal card.

— Fill out the time sheet.

Child care leave up to 1.5 years

The employee decides for herself whether to take vacation or return to work. Instead, any working relative can go on parental leave: the child’s father, grandmother, grandfather, aunt or uncle. You can alternate the vacation as you like: for example, the mother stays with the child for a month, then the father spends a month.

For vacations of up to one and a half years, the benefit is 40% of the average salary for the previous two years.

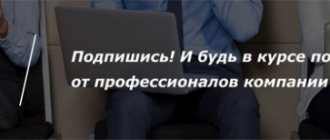

To apply for leave, ask the employee for the following documents:

- Statement.

— Child’s birth certificate.

— A certificate from my husband’s work that he is not on similar leave.

Issue the leave order again, fill out your personal card and time sheet.

It is allowed to combine parental leave and work. There are two options here: part-time or part-time. For example, an employee can work 7 hours a day or 4 days a week. The main thing is that the bet is incomplete. Otherwise, there is a risk that the Social Insurance Fund will refuse to make the payment.