The amount of the claim is the totality of all claims of the plaintiff against the defendant, subject to payment, based on the plaintiff’s statement of claim. In accordance with Article 91 of the Civil Procedure Code, the price is determined:

- For claims for the recovery of funds, based on the amount of money recovered;

- For claims for reclaiming property, based on the value of the claimed property;

- For claims for urgent payments and issues, based on the totality of all payments and issues, but not more than three years;

- For claims for unlimited or lifetime payments and issues, based on the totality of payments and issues for three years;

- For claims for a decrease or increase in payments and distributions, based on the amount by which payments and distributions are reduced or increased, but not more than for a year;

- For claims for termination of payments and disbursements, based on the totality of remaining payments and disbursements, but not more than for a year;

- For claims for early termination of a property lease agreement, based on the totality of payments for the use of property during the remaining term of the agreement, but not more than for three years;

- In claims for ownership of an object of real estate owned by a citizen by right of ownership, based on the value of the object, but not lower than its inventory estimate or in the absence of it - not lower than the estimate of the value of the object under the insurance contract, for an object of real estate owned by an organization - not lower than the balance sheet value of the object;

- For claims consisting of several independent claims, based on each claim separately.

The concept of the price of a statement of claim

There is no precise definition of this term in Russian regulations. At the same time, according to Art. 131 of the Civil Procedure Code, 125 of the Arbitration Procedure Code, a mandatory element of the claim is information about the amount that the injured party requests to recover in its favor.

The value of the claim can be defined as a cost reflection of the violated legitimate interests of the applicant, for the protection and renewal of which legal proceedings were initiated. The calculation of the stated claims is a separate document or part of the main petition, which provides the formulas and procedure for calculating the amount of the required payment.

Calculation of the cost of the claim can be included in the application or issued as a separate application

Change in claim price

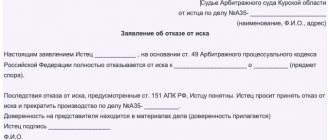

The legislation of the Russian Federation provides for clarification of the value of the claim of only one part of the claim: either the grounds or its subject. If both parts are changed, a new claim must be formed, which must be submitted independently. Consequently, a simultaneous change in the grounds and subject is not carried out.

The grounds must be varied if the plaintiff has misstated the circumstances upon which they rely.

For example, if a claim for the eviction of a temporary tenant is submitted to the court, and the applicant justifies this requirement by the fact that the residents do not have registration. Such a circumstance cannot serve as a basis for eviction of people. For this reason, it is necessary to change the basis of the claim, for example, to the expiration of the period of use of the residential property.

What forms the final cost of the application?

The price value of presentation can be calculated if the subject of the dispute is property claims. Non-property requests, such as forced deregistration at the place of residence or reinstatement at work, are not subject to assessment.

Among the positions that are reflected in cash are:

- principal debt;

- penalties, including penalties, and penalties for violation by a party of obligations under a contract or law;

- losses, which include actual damage and lost profits;

- payment for the use of other people's funds.

Important. Moral damages and court costs are not included in the price of the petition. Mental suffering and emotional discomfort are not considered material damages, although they are reflected by the party in monetary terms.

State fees and attorney fees are considered as additional costs, which, however, can be reimbursed by the defendant if the case wins.

Legal expenses are reimbursed by the defendant if the court found the claim to be correct.

Moral claim

A claim for compensation for moral damage is a monetary expression of harm to physical or moral suffering caused to a citizen by the actions of other persons who violated his personal non-property rights. One of the manifestations of moral damage is experiences that are usually associated with various kinds of illnesses that arose against the background of moral suffering regarding the violation of rights on the basis of Art. 151 Civil Code of the Russian Federation.

In arbitration proceedings, moral damage is rarely recovered due to the fact that the main condition for filing a claim for compensation for moral damage is the presence of the subject of the dispute - an Individual and the presence of an arbitration clause in the contract or an agreement to transfer the case to an arbitration court.

The importance of assessing claims

The plaintiff is obliged to independently evaluate the claims made by him in the process. This is equally relevant for both civil and arbitration proceedings. Designation of this parameter in the submitted documents:

- is regarded as the main issue on which a decision needs to be made. The judge considers the case within the framework specified by the applicant, and going beyond the established boundaries is allowed only in exceptional cases.

- is an imperative instruction, ignoring which will lead to the abandonment of the application without progress (Article 136 of the Code of Civil Procedure, 128 of the Arbitration Procedure Code);

- serves as the basis for determining the state duty in accordance with the norms of the Tax Code of the Russian Federation;

A person who indicated in the application the amount of losses lower than the real one risks not receiving proper compensation even after a positive judicial act. Identification of the fact of underestimation or overestimation of the volume of planned collection may become grounds for refusal to open proceedings.

Note. The cost of the claim is calculated in the state national currency. The corresponding rule is contained in Art. 317 Civil Code of the Russian Federation. Even if the parties have agreed to pay in foreign currency, claims are made and the debt is paid in rubles.

The cost of the claim is calculated only in rubles

What is not included in the price of a claim under the Code of Civil Procedure of the Russian Federation

The claim price does not include:

- The amount of compensation for moral damage, since this requirement is of a non-property nature, although it is compensated in monetary or material form (clause 10 of the resolution of the plenum of the RF Armed Forces “Some issues of application ...” dated December 20, 1994 No. 10). The amount of compensation in this case is determined by the court, taking into account all the circumstances of a particular situation, and not by the plaintiff (clause 2 of article 1101, part 2 of the Civil Code of the Russian Federation). In this case, the plaintiff has the right in his application, in addition to claims of a property nature, to indicate the desired amount of such compensation, but the judicial authority has the authority to change it at its own discretion (see, for example, the appeal ruling of the Moscow City Court dated September 4, 2019 in case No. 33-35321/2019 ).

- Monetary amounts of compensation for claims for the protection of honor, dignity, good name and business reputation, since these claims are non-property.

- State duty (since in accordance with subparagraph 1, clause 1, article 333.19, part 2 of the Tax Code of the Russian Federation), the calculation of the state duty is based on the price of the claim) and other legal expenses.

- Services of a damage assessment expert, because are recognized as legal costs (Decision of the Sixth Court of Cassation of General Jurisdiction dated April 27, 2020 in case No. 88-4958/2020).

Legal costs may be included in the claims as a separate item, and their distribution between the parties to the case is made in accordance with Art. 98 Code of Civil Procedure of the Russian Federation.

Features of counting in civil proceedings

For civil disputes, the rules for calculating the cost of a petition are established in Art. 91 Civil Code. The specific counting algorithm depends on the nature of the conflict. The price component of the application is determined in the following cases:

- about debt collection - as the amount of debt;

- on the reclaiming of movable or immovable assets - according to the monetary value of the thing;

- on the collection of alimony - as the total amount of payments for the year;

- on compensation for failure to provide urgent and open-ended payments or issues - as the amount actually not received, but not more than for 3 years;

- on reduction, increase or termination of payments and disbursements - for the unpaid balance or for changed payments, but not more than for a year;

- on early termination of property lease - as the balance of funds unpaid before the due date, but not more than 3 years;

- on establishing ownership of real estate - according to the inventory or balance sheet valuation, statements from the concluded agreement.

Sample certificate of inventory value of an object

If the appeal lists several independent items, their value is determined based on the value of each petition. When accepting an application, the judge has the right to correct the monetary value of the stated claims indicated by the plaintiff if obvious inaccuracies and omissions are found in the submitted document.

Concept

The value of the claim is the value of the plaintiff's rights violated. When filing a claim with government agencies, the plaintiff must clearly know and indicate what damage must be compensated to the defendant.

The meaning of the price in the claim

Before filing a claim, the following points must be taken into account:

- The price of the claim is the volume of property claims expressed in a certain amount of money. If the claim is satisfied, the defendant will be obliged to pay this money to the injured person.

- The price of the claim must be specified in the application (Article 131 of the Federal Law No. 138 of November 14, 2002).

- The currency used to fulfill the obligation is the Russian ruble. This point is regulated in Article 317 of Federal Law No. 51. If the cost of damage is determined in foreign currency, it must be translated into the currency of the Russian Federation.

What is included in the claim price

The content of the value of the claim is determined by Article 91 of the Code of Civil Procedure of the Russian Federation:

- In cases involving the collection of funds, the price is determined depending on the amounts to be collected.

- When reclaiming property, the value is determined based on the price of the specified items.

- The cost of a claim in cases related to alimony payments includes the amount of all annual payments.

- If we are talking about urgent issues and payments, then the price of the claim includes these transfers for a period of no more than three years.

- In cases of transfer of lifelong or perpetual payments, the value is established according to the totality of payments for three years.

Principles of calculation in arbitration proceedings

The monetary equivalent of the appeal in the arbitration process, as in civil procedural legal relations, is indicated by the plaintiff. The judge has the right to check the information provided or make calculations himself if there are errors in the application.

When determining debt, fines and penalties are also taken into account. If several different claims are submitted, the cost of the claims is calculated as the total amount of all listed items. The final amount of the monetary equivalent of violated rights is established as follows:

- debt collection - according to the volume of debt;

- recognition of a document as such that it is not subject to execution - for the disputed amount;

- reclaiming property, land - in accordance with the valuation of the thing.

Important. If a case is being considered to recognize the right of ownership, use, possession or disposal, the amount of the state duty is determined according to the rules applied for non-property disputes.

Fee rates for non-property disputes

Calculation of the claim amount

When filing a claim, the price will affect the amount of the fee. To correctly calculate this indicator, you can use the following data:

- formalize the calculation of the amount of money, taking into account the principal debt and penalties;

- contact an independent appraiser and conduct an examination;

- take information from contracts, payment documents, claims;

- obtain a certificate of cadastral value of real estate from Rosreestr or order a certificate of inventory valuation through the BTI;

- use other sources of information for calculations.

Note!

When going to court, you can also indicate non-property claims. In this case, cost calculation is not required, and the state fee for filing a claim will be determined in a fixed amount.

A typical example of a non-property requirement is the determination of the procedure for using real estate. In this case, we are not talking about the recovery of a certain amount or the transfer of property, so the claim is not subject to assessment.

In legal disputes involving legal entities, accounting data, certificates of physical and actual wear and tear, and transaction agreements may be used. The defendant has the right to disagree with the assessment indicated in the application. To argue his objections, he can present a counter-calculation, an independent expert’s opinion and other information.

Rules for determining the amount of state duty

The rules for calculating state duty are established in:

- Art. 333.19 Tax Code - for cases considered in civil proceedings;

- Art. 333.21 Tax Code - for disputes that are resolved through arbitration.

However, in any case, the amount of the mandatory state fee depends on the final cost of the petition submitted by the plaintiff. The calculation can be carried out if the claims are of a property nature. Non-property claims are not subject to monetary valuation.

In civil proceedings, the fee to be transferred to the state budget is paid according to the following mechanism.

Table No. 1.

| Cost of claim, rubles | State duty | Restrictions | |

| Fixed component, rubles | Percentage component | ||

| up to 20000 | — | 4% | not less than 400 |

| 20001-100000 | 800 + | 3% (from charges exceeding 20,000) | — |

| 100001-200000 | 3200 + | 2% (over 100,000) | — |

| 200001-1000000 | 5200 + | 1% (over 200000) | — |

| More than 1000000 | 13200 + | 0.5% (over 1,000,000) | no more than 60,000 |

Sample receipt for payment of court fee

If a citizen files a property claim for 40,000 rubles, then the state duty is calculated using the following formula:

GP = percentage component (3% of the stated requirements over 20,000) + fixed component (800 rubles).

Percentage component = (40000 - 20000) * 3% = 600.

Duty = 600 + 800 = 1400.

So, for transferring the appeal to the court for consideration, 1,400 rubles should be transferred to the state budget.

In the arbitration process, calculations are carried out according to a similar principle. Only the specific rates that are reflected in the table differ.

Table No. 2.

| Circulation price, rubles | State duty | Restrictions | |

| Fixed rate, rubles | Interest rate | ||

| up to 100,000 | — | 4% | not less than 2000 |

| 100001-200000 | 4000 + | 3% (from charges exceeding 100,000) | — |

| 200001-1000000 | 7000 + | 2% (over 200000) | — |

| 1000001-2000000 | 23000 + | 1% (over 1,000,000) | — |

| more than 2000000 | 33000+ | 0.5% (over 2000000) | no more than 200,000 |

An example of an online calculator form for calculating legal costs

Fee on claim

The state fee for consideration of the claim is calculated and paid by the applicant before submitting documents to the court. The payment will be calculated in two ways. For non-property claims, citizens need to pay only 300 rubles. For similar disputes involving organizations, the fee will be 6 thousand rubles.

If the subject of the application is of a property nature, the state duty will be calculated as a percentage of the amount of the claim:

- at a price of up to 20 thousand rubles. (inclusive) payment will be 4%, but not less than 400 rubles;

- with a claim price of 20 thousand. up to 100 thousand rubles. you need to pay 800 rubles. + 3% of the amount exceeding 20 thousand rubles;

- if the price is from 100 thousand to 200 thousand rubles, the duty is paid in the amount of 3.2 thousand rubles. + 2% of excess of 100 thousand rubles;

- at a price from 200 thousand to 1 million rubles. you need to transfer 5.2 thousand rubles. + 1% of excess of 200 thousand rubles;

- the highest amount of duties for claims with a price of 1 million rubles. – 13.2 thousand rubles. + 0.5% of the excess amount of 1 million rubles. (but not more than 60 thousand rubles).

Note!

The fee for a claim may be reduced by the court at the request of the plaintiff. To do this, you need to prove a low level of income or other valid reasons.

If the entire cost of the claim is recovered from the defendant, he will also have to reimburse the costs of paying the fee. The only exceptions are cases when the defendant is released by law or court from such an obligation.

Difficulties in calculations

In practice, situations sometimes arise when, when submitting a petition to the court, it is difficult to calculate the entire volume of the stated claims due to objective circumstances. The procedure for resolving existing complications in this case is regulated by paragraphs. 9 clause 1 art. 333.20 Tax Code.

The algorithm of actions if it is impossible to preliminarily determine disputed claims is as follows:

- The judge sets the initial fee.

- The applicant pays this initial fee.

- When the final decision on the case is made, the payment collected from the defendant is fixed and the corresponding court fee is calculated.

- The plaintiff pays the difference within the time limits established by law.

Summary

The value of the claim is understood as the total amount of property claims that the applicant presented to the defendant. For the calculation, an expert’s opinion, contracts, certificates of cadastral and inventory value of real estate, and other data are used. The amount of the fee depends on the value of the claim, and claims of a non-property nature are subject to a fixed fee.

Incorrect calculation of the cost of claims will lead to problems when filing documents and paying fees, and may also lead to a negative court decision. Our lawyers will help you avoid these problems and will calculate the cost of your claim and the amount of the fee.

ATTENTION!

Due to recent changes in legislation, the information in this article may be out of date!

Our lawyer will advise you free of charge - write in the form below.

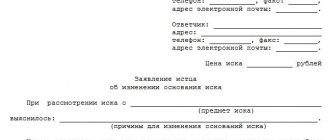

Changes in the value of claims

Current legislation allows the plaintiff, after filing an appeal, to clarify the claims made. Requirements can be adjusted upward or downward. In this case, a corresponding petition is submitted to the court.

An increase in the size of the stated claims entails an additional payment of the state fee, and a decrease means that the applicant will be refunded the overpaid funds.

Application form for the return of overpaid funds

The grounds for adjusting the subject of the dispute are often errors in calculations or partial voluntary fulfillment of obligations by the debtor at the stage of judicial review.

Property rights cases

In cases related to the return of property to the rightful owner, the cost of the claim is calculated depending on the value of such property. The cost of the claim is calculated in a similar way if the lawsuit is related to the recognition of ownership of specific property.

It is possible to demand the return of property:

- from someone else’s illegal possession (Article 301 of the Civil Code of the Russian Federation);

- from a bona fide purchaser (Article 302 of the Civil Code of the Russian Federation).

When claiming his property, the owner may include the following in the value of the claim:

- the amount of all income that the unscrupulous owner received or should have received during the unlawful use of the property;

- the amount of all income that a bona fide owner received or should have received, starting from the moment he received information about the illegality of such possession or was served with a summons in a claim for the return of property.

The price of a claim brought by the owner of the property (this norm applies to both bona fide and dishonest owners) may include the amount of compensation for the necessary costs of the property, calculated from the moment from which the owner is due income for the disputed property (Article 303 of the Civil Code of the Russian Federation).

To calculate the price of the claim, any value of real estate, confirmed by documents, for example cadastral value, is taken. For individuals, it cannot be lower than the inventory value (if it is absent, lower than that specified in the insurance contract), and if the object belongs to an organization, it cannot be lower than the balance sheet (clause 9, part 1, article 91 of the Code of Civil Procedure of the Russian Federation).

Making payments

Russian procedural legislation does not contain direct instructions regarding the form in which the calculation of the amount of a claim submitted to the court should be prepared. The plaintiff has the right to choose one of the following options:

- highlight a separate block for calculations in the text of the statement of claim;

- submit the calculation in a separate document as an attachment.

To determine the amount of debt, the applicant reflects in the documents a detailed breakdown of the expenses incurred and losses that occurred due to the fault of the defendant. It is allowed to present information in the form of tables and diagrams. In addition, you should definitely note:

- the grounds for accrual of debt and the argumentation of the chosen method of calculation (you can use an agreement, the terms of which were violated, refer to the norms of codes and laws);

- the period of delay in fulfilling obligations, if the law or contract establishes a period for the implementation of the agreement reached;

- procedure for determining penalties, penalties and fines.

Calculating penalties for pre-trial conflict resolution

Note. The defendant has the right to protect his interests and defend his chosen position. To do this, he can prepare his own calculations and submit them to the court for consideration.

Calculation of the cost of a claim in cases of recovery of sums of money

The price of a claim for the recovery of funds is equal to the amount recovered. The price of the claim may include the amount of the main monetary obligation, as well as interest for the use of other people's funds (Article 395 of the Civil Code of the Russian Federation) and a penalty.

Example

Vasiliev turned to Sokolov with a statement of claim to collect the debt in the amount of 500,000 rubles. under the loan agreement and interest for using it, which amount to 80,000 rubles. In addition, he submitted a demand for payment of interest for 30 days of delay in fulfilling the obligation under Art. 395 of the Civil Code of the Russian Federation in the amount of 20,000 rubles. In this situation, the price of the claim will be equal to the sum of all these claims, that is, 600,000 rubles.

Clause 65 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 24, 2016 No. 7 directly allows for a penalty to be demanded “up to the day of actual fulfillment of the obligation.” If this requirement is satisfied, then the court indicates in the decision to collect the amount of the penalty calculated until the day the decision is made. If the decision is not voluntarily executed, the amount of the penalty during the collection process is recalculated by the bailiff.

The Code of Civil Procedure of the Russian Federation does not require re-calculating the price of claims, taking into account the time that has passed from the filing of the claim to the issuance of a court decision and, accordingly, the amount of the penalty that has changed during this period.

The interest collected from the debtor for the use of someone else's money is stated in the court decision in a fixed amount only in situations where the monetary obligation is fulfilled by the debtor before the decision is made. Otherwise, the court in its decision, among other mandatory data, also indicates that interest is subject to accrual on the day the creditor actually pays the funds.

Early termination of a real estate lease agreement (property lease)

It is necessary to take into account that the norms sub. 8 clause 1 art. 91 of the Code of Civil Procedure of the Russian Federation also applies to the lease agreement (Article 606 of the Civil Code of the Russian Federation).

The cost of the claim in case of early termination of a property rental agreement is calculated as the amount of payments for the use of property during the remaining term of the agreement.

In this case, we are talking about agreements concluded for a specific period.

Termination of agreements concluded for an indefinite period occurs according to the rules of Art. 610 Civil Code of the Russian Federation.

Both the tenant (tenant) and the lessor (lessor) can apply to the judicial authority for early termination of the contract.

Cases regarding alimony payments

In the case of collection of alimony payments, the total claim consists of monthly transfers that must be received by the recipient over a period of 12 months.

Depending on the method of collecting alimony, two calculation options are possible:

- in a fixed amount – a fixed amount is multiplied by 12;

- as a share of total earnings - the monthly salary is multiplied by a percentage and by 12.

Based on the specific situation, the judge has the right to adjust the price of the claim (paragraphs 12-14 of the Resolution of the Plenum of the RF Armed Forces of October 25, 1996 No. 9).

When filing an application for the collection of alimony, a citizen is exempt from transferring state fees to the federal budget.

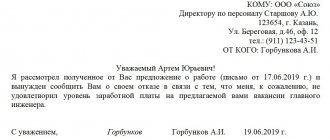

What kind of receipt should be in order to collect a debt through court?

A citizen’s receipt is equivalent to a loan agreement if the amount he borrowed does not exceed 10,000 rubles (Article 808 of the Civil Code of the Russian Federation). If the amount is larger, a written bilateral agreement is required.

However, even if there is no agreement, you do not lose the opportunity to collect the debt through the court if the receipt is drawn up correctly.

A receipt for an individual's debt must contain:

- name of the locality, date of writing;

- FULL NAME. parties, addresses of residence (registration), passport data;

- the circumstances of the issuance and terms of the loan (if the money is given at interest, this must be indicated), the date of the planned repayment;

- confirmation of the fact that the borrower received the money in person.

It is good if the borrower additionally indicated that he is of sound mind and memory, and there is no pressure on him.

Here is an example of a correctly drawn up receipt:

The receipt does not have to be certified by a notary, but if there is a certification, there will definitely not be any problems with proving it in court.

What about legal entities? Is there legal force in the receipt according to which money was transferred on behalf of the organization on the receipt?

Only when the receipt confirms receipt of money under the loan agreement (main agreement receipt).

Transferring money only by receipt on behalf of the organization is a big mistake. Even if it's the director himself. Why?

A receipt is not adequate confirmation of receipt or disbursement of cash by a legal entity. It is necessary to draw up a full-fledged loan agreement (Articles 807-811 and 814 of the Civil Code of the Russian Federation).

Any cash transactions, in accordance with Central Bank Directive No. 3210-U, are carried out according to settlement and payment statements and cash orders.

But: if you still had to give money against a receipt, then you have the right to go to court.

It is important! Failure of a company to comply with the rules of non-cash payments is not an absolute reason for the court not to take such payments into account when considering a dispute.

However, when filing a claim for collection of a debt on a receipt, remember that the court may issue a special ruling so that your organization can check compliance with the legislation on payment procedures. They can fine an official 4,000-5,000, a legal entity 40,000-50,000 rubles (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).