Competent loan processing

As a rule, when receiving borrowed funds, the debtor writes a receipt for their receipt, which indicates the amount and period of repayment. The lender (the person who lent the money) is often confident that this is enough to confirm his rights. Indeed, a receipt is a document that can be presented to the court if it contains all the necessary information to establish the existence of a debt.

Unfortunately, the receipt often forgets to indicate other essential conditions: the interest rate on the loan, the frequency of repayment if the debt is to be paid in installments, passport details and place of residence of the borrower. If he violates the agreement and payment terms, the creditor has the right to go to court.

Moscow notary Kolganov I.V. comments:

“This is a troublesome procedure that takes a lot of effort and time. If you certify the loan agreement with a notary, the debt collection procedure is significantly simplified.”

What legal force does a promissory note have?

Many Russian citizens want to know a comprehensive answer to this question: does a standard promissory note, written by hand, without any sample and not certified by anyone, have legal force?

If it has legal force, then how will it be possible to collect a debt using a receipt (if it is written on an ordinary piece of paper, not according to any established templates and samples)? And is this really possible? In fact, collection of credit debt against a receipt is carried out in accordance with part two of Article 808 of the Civil Code of the Russian Federation. This article basically says that you can use the borrower’s receipt to collect credit debt. Such a receipt certifies the fact that the lender has transferred a certain amount of money. This receipt is a confirmation of the loan agreement. However, it does not have to be notarized or drawn up in front of witnesses. In this case, all this is not necessary. How such a document is roughly drawn up can be seen at the stand of almost any notary office (there are very detailed examples of such documents there).

A receipt is a very serious document, and if the borrower does not repay the debt within the time period indicated in it, then, guided by this document, the lender has the right to file a claim with the courts in order to collect the debt.

What can be the subject of a loan

In most cases, the subject of the loan is cash, but this is not necessary. Raw materials, materials, and other things and items can be provided on loan. In addition, according to Art. 818 of the Civil Code of the Russian Federation, debt on rent (real estate, production tools), as well as that arising as a result of a purchase and sale agreement, can be replaced by a debt (loan) obligation.

An agreement (document) on borrowing relations is drawn up between legal entities and individuals. At the same time, the notarized form of the loan agreement is not mandatory; it is certified voluntarily, by agreement of the parties.

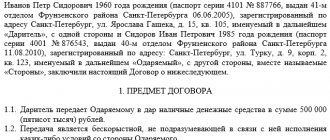

Sample

If the loan amount exceeds 10,000 rubles, then the document must be drawn up in writing (Article 808 of the Civil Code of the Russian Federation).

Since the law does not establish a mandatory handwritten form, the receipt can be issued in printed form.

The law also does not provide for a special form. However, the following conditions must be met:

- the document must contain full name. and passport details of the parties;

- it is necessary to indicate the essence of the drafting (I transfer, and he borrows);

- the amount of debt must be entered in numbers and in words;

- each party must sign and decrypt;

- the signature must exactly match the signature from the passport;

- You must indicate the loan period and date of registration.

If the parties involve witnesses to transfer funds, they must also sign the document and indicate their information. If the debtor refuses to make payments, witnesses can be additionally brought to court to confirm the fact of the transfer of funds.

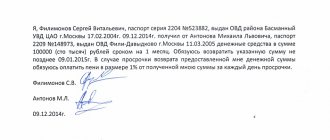

Sample

Benefits of notarizing a loan

To protect yourself from possible troubles, the lender prefers to draw up an official document. Certification of a loan agreement by a notary provides many advantages:

- the text will indicate all the necessary details of the borrower (passport details, residential address)

- the interest rate for the use of borrowed funds and the procedure for its payment to the lender (usually monthly);

- the notary will check the borrower’s documents against the database of the Ministry of Internal Affairs and the bankruptcy register, which eliminates the falsification of documents;

- the parties are explained the provisions of the Civil Code of the Russian Federation on the procedure for granting and repaying loans;

- If the borrowers fail to fulfill their obligations, the lender may contact the notary for affixing a writ of execution.

A notarized loan agreement between individuals or, in the case where one of the parties is an organization, relieves the lender of the need to go to court if the borrower fails to pay the debt. The notary's writ of execution gives the loan agreement the force of an executive document. The creditor can submit it to the bailiff service or to the enterprise where the debtor works, as well as to the credit institution where the borrower has an account. The funds will be written off to repay the debt unconditionally.

Receipt of no claims

The last type is a no claims receipt. Such a document is drawn up by the party receiving certain services, goods, etc. Example: issued by the creditor to the debtor upon timely receipt of the required loan amount under a previously drawn up agreement. Another option is a document on acceptance of the completed structure.

The main difference: the described option is not always associated with a specific agreement. It is often drawn up by a participant in an accident in the absence of claims against the other party. Example: an accident occurred due to external circumstances (natural events, negligence of road services, etc.). Here the driver may decide not to make a claim against the other party. Because she, in his opinion, is the same victim.

What are the benefits of a notarized loan?

Borrowing money from an individual (legal entity) has significant advantages compared to a bank loan. As a rule, the bank requires a certificate of income, the involvement of guarantors, and collateral. In addition, the interest rate changes depending on specific conditions (income level, loan term), the decision can take a long time. If it is negative, an entrepreneur or private individual who urgently needs money will waste time.

At the same time, a loan agreement between individuals is certified by a notary on the day of application, which significantly simplifies the borrower’s task.

Moscow notary Kolganov I.V. comments: “The creditor more easily agrees to such a transaction, knowing that he receives guarantees of debt repayment through the use of the writ of execution mechanism. The debtor, in turn, protects himself from unfounded claims: unexpected increases in interest rates, demands to return the money ahead of schedule.”

Rules of the Civil Code on loans

- If the borrowed amount is over 10,000 rubles, a written agreement must be drawn up between individuals. When one of the parties is an organization, the agreement under any conditions must be written, regardless of the size of the loan.

- The date of conclusion of the agreement is considered the day of transfer of money (things), which is confirmed by a receipt or other document confirming their receipt by the borrower (an act indicating in the agreement that the subject of the agreement has been transferred and received).

- Before notarizing the loan agreement, the notary will make sure that the amount is indicated in ruble equivalent. Foreign exchange transactions in private relationships are not permitted.

- The document must specify the procedure for repaying the debt: in parts, in full and terms, as well as a condition on interest. If the loan is interest-free and its size is over 100 thousand rubles, this must be indicated directly. If there is no indication, interest is charged at the Central Bank rate in the general manner.

- If the loan agreement certified by a notary does not indicate a repayment period at all (on demand), then the creditor can demand the debt only after a written warning to the debtor 30 days before the day the demand is made.

How to write a receipt correctly

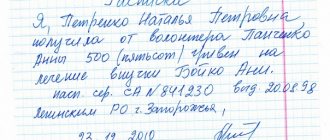

A properly executed receipt is drawn up by hand in one copy and must contain the following data: - title of the document; - last name, first name, patronymic, passport details of the person who gives the receipt and the person to whom it is given; - a specific and complete indication of what the receipt is for (the exact amount of money received, a list of valuables). The quantity must be indicated in numbers and in words next to it in brackets; - in the official receipt you must indicate the number of the order or instruction on the basis of which money or material assets were issued; — the purpose of transferring money or material assets; — the period for the return of transferred funds or property; - signature of the person who gave the receipt (for an official receipt - certification of the signature by the head of the enterprise); - date of; - data and signatures of witnesses.

Features of calculation and payment of interest

The lender and the borrower agree on the presence (absence) of interest for the use of money (things) at their own discretion. In this case, the provisions of the law must be taken into account.

- If the amount does not reach 100 thousand rubles, and the agreement does not indicate interest, the loan is considered interest-free;

- If the loan size exceeds the above limit, the general rule applies: the rate (or lack thereof) is directly specified in the contract, otherwise the calculation is made at the Central Bank rate (5.5% as of July 2020);

- Interest can be paid in any order under the agreement: monthly, along with the payment of part of the debt, or at the end of the contract;

- If the debt is paid in installments, the creditor has the right to demand early repayment of the entire amount if the partial installment is not paid within the agreed period;

- With an interest-free loan, the borrower has the right to repay the entire amount ahead of schedule;

- The amount of interest received by the creditor is a financial benefit. Income tax is calculated and paid from it.

If the parties decide to draw up a loan agreement with a notary, they will be explained all the provisions of the law and warned of the consequences of failure to fulfill the agreement. If a legal dispute arises, a notarized agreement is the main evidence in court, and the fact of the loan does not require additional confirmation (proof).

In the case where the notarial loan agreement does not include provisions on liability for late payment, the default rule applies: penalties are charged on the overdue amount for the period from the established payment date to the date of actual repayment. Interest corresponds to the key rate of the Central Bank for the calculation period.

Penalties (fine) are not collected if the agreement establishes a penalty for delay in debt payment, unless otherwise provided by law or agreement (Articles 395, 811 of the Civil Code of the Russian Federation).

Compilation rules

Regardless of the type chosen, the composition rules remain identical. And the first rule: the document described is always written by hand. This is required, in particular, to determine the handwriting of the writer. The originator's signature alone is not enough here. When using fill-in forms, dashes are placed in the spaces.

The receipt looks like this:

- The document begins with a title. The type of paper being compiled is always indicated here. If it does not fit any of the listed options, then the most suitable name is selected. As a last resort, you can consult a lawyer.

- Enter the name of the locality where the contract is drawn up.

- Information about each of the parties to the agreement is indicated. Full name, registration, year of birth, etc. If one of the participants is a representative of a legal entity, enter the name of the organization and position. Minimum requirements: full name, passport number and registration. If there are no names, a graphological examination will have to be carried out. And it does not always give a satisfactory result.

- A full description of the agreement is given. In particular, two events are indicated. The first is the beginning of an agreement, the acceptance of certain obligations by one of the parties. And the second is the event that completes the agreement, the fulfillment of the undertaken obligations. Example: in the case of a promissory note, the phrases “borrowed” and “I undertake to repay by...” are written, indicating the date.

- The subject of the agreement is described in detail. If a monetary amount appears, the entire figure is written, without rounding, in words. And the deadline for payments, with other conditions, is always given. Upon receipt of documents: listing the entire package with the terms of transfer (to whom, how, when). In the case of a storage agreement, the item being transferred to the second party is described in detail. Actions in case of failure to fulfill the obligations of one of the parties are also listed here.

- The date the document was written is indicated below the text.

- At the end of the agreement, the signatures of each party are placed. Or the originator, if the document is filled out unilaterally. It is advisable to add signatures of witnesses, if available. Uninterested persons who have no direct or indirect relation to the case are selected as witnesses. Here you need their full name, passport number and registration.

The agreement should not leave large gaps. If there are any, dashes are added using the same pen/pencil that was used to fill out the document. This is done so that in the future neither party will be able to make adjustments to the previously drawn up agreement.

How to draw up a loan agreement through a notary

The form of agreement between the lender and the borrower provides for the inclusion of the following main provisions:

- description of the item (amount of money, things, items);

- deadlines for fulfilling obligations (schedule for installment plans);

- procedure for calculating and paying interest (if provided);

- rules for resolving conflict situations;

- liability of the parties for violation of the contract;

- identification data of the parties.

In practice, private loans against a notary receipt are the most common, but there can be many options. Often contracts include a collateral clause, then in addition to the main document, a collateral agreement is drawn up.

If real estate is used as collateral, the loan agreement must be notarized - this is a legal requirement.

The text of the agreement must indicate which party actually has the collateral. The second case, also often encountered in practice, is a notarized loan between the founders and the management of the LLC. As a rule, an interest-free agreement is drawn up, which must be expressly stated in the document.

Receipt for fulfillment of certain obligations

A receipt for the fulfillment of certain obligations. The list of possible obligations is very long. In particular, it includes: carrying out construction work, transferring documentation, providing certain services, delivering goods or a sum of money, etc. It is often written on official letterhead. Drawed up by the party taking on the listed obligations.

The difference between the document: the conditions associated with the fulfillment of obligations under the drawn up agreement are listed in detail. An important point: if the other party violates its obligations, the receipt is considered invalid. Example: receipt for construction work. The customer undertakes to deliver materials on time (specified in the document). If this obligation is not fulfilled, the agreement is canceled.

What to do if the debtor becomes bankrupt or dies

Both a legal entity and an individual, including an individual entrepreneur, can be declared bankrupt.

If the loan agreement was drawn up through a notary, the lender, based on the application, is included in the register of creditors. You need to contact the temporary (administrative) manager within 2 months after the publication of information about the debtor’s bankruptcy on Fedresurs or other publications (“Kommersant”).

If the borrower dies, the debt is legally transferred to his heirs. They are obliged to pay it within the value of the inheritance received.

How much does it cost to draw up a loan agreement with a notary?

For notarial acts, a tariff (state fee) is paid in accordance with the Tax Code, plus legal and technical services or UP&T are paid.

Under loan agreements with a notary, the price of technical work is a fixed amount, the amount of which is established by the chamber, and the amount of the state duty depends on the amount of the transaction. *see current rates in the appropriate section

Certifying a money loan agreement from a notary will cost less than paying possible court costs and legal fees if it is necessary to collect a debt from an unscrupulous borrower. The use of a writ of execution saves time and does not allow the debtor to transfer assets to dummies.

The notary office of Igor Vladimirovich Kolganov is located at st. Mnevniki, 23, open daily until 20:00, and also on Saturdays until 17:00. Please contact the telephone numbers listed on the website to arrange a convenient appointment time to certify a loan agreement between individuals (legal entities), including urgent ones, in urgent situations.

Common mistakes when drawing up receipts

You should be very careful when drawing up a receipt. The presence of errors in the document can complicate the debt collection procedure.

Mistakes that are most often made when drawing up receipts:

- Lack of important details and mandatory clauses of the document. For example, if the receipt does not indicate the borrower’s passport details or does not have his signature, the receipt cannot be considered valid.

- Lack of data on the size of the loan or discrepancy between the amounts indicated in words and figures.

- Issuing a receipt in the name of a person who did not participate in the transaction and did not receive money.

- The presence of errors and corrections in the documents.