Money is a necessary attribute of the life of a modern person. Therefore, when they run out, many Russians turn to friends or relatives for help. Unfortunately, few people think about the safety of such a loan. It should be remembered that the transfer of large sums of money must be accompanied by a receipt. In most cases, this document is used in financial relations between individuals and when applying for a loan in microfinance organizations. Next, let's talk about what a receipt for receiving funds is and how to draw it up correctly.

What is a receipt and why document it?

A receipt is a written certification of the fact of transfer of funds from one person to another. In the event that financial disagreements arise between the lender and the borrower, this document will serve as proof of the transfer of money and will also confirm the terms of the loan.

The receipt is not a mandatory document. However, if the lender doubts the borrower’s integrity, it is recommended to document the transaction.

The receipt for the transfer of money does not have strictly established forms. Depending on the circumstances, the receipt may be:

- Subject - the text of the document indicates the purpose of the loan.

- Pointless - there is no clear goal (only the loan amount, conditions and repayment period are indicated).

- Notary certified.

- Handwritten or typed.

Experts recommend making a receipt in writing (by hand). Firstly, it is easier to identify the author of a document by handwriting. Secondly, if the parties to the transaction have a conflict regarding the return of the amount of money, the receipt will be excellent evidence in court.

In accordance with Art. 808 of the Civil Code of the Russian Federation, a loan agreement between individuals must be concluded in writing if its amount exceeds 1000 rubles. If the lender is a legal entity - regardless of the amount.

Important: in accordance with paragraph 2 of Art. 163 of the Civil Code of the Russian Federation, the receipt does not have to be certified by a notary. Only the loan agreement is subject to mandatory certification. In this case, the receipt comes as an attachment to it.

What is the benefit of a receipt for receiving money?

In the event that some unforeseen situation arises and the other party refuses to return the money to you, the receipt is written proof that the money has been transferred. A receipt will also not be superfluous if you are planning to go to court to restore justice.

However, it is worth keeping in mind that not every receipt will be able to help you in resolving a controversial situation. For its preparation, as for any document that has legal force, there are certain rules and subtleties. We tried to summarize and consider each of these rules.

Regulatory regulation of receipts for receipt of funds

In accordance with paragraph 2 of Art. 808 of the Civil Code of the Russian Federation, a receipt confirms the loan agreement and its terms. This document can be drawn up as a supplement to the above agreement or be an independent element of the transaction.

The law does not provide for a clear form for drawing up a mortgage. No federal regulation regulates the contents of the receipt. Therefore, the parties to the transaction have the right to rely on their own beliefs.

It is not necessary to notarize the receipt. However, clause 1 of Article 163 of the Civil Code of the Russian Federation provides participants in a financial transaction with the opportunity to certify a document, thereby confirming the legality of the transfer and receipt of funds.

Important: a notary has the right to certify a receipt only if it is an attachment to the loan agreement.

Do I need to get it certified by a notary?

The law does not establish the obligation of the parties to draw up a document in notarial form. But in case of failure to fulfill the obligation, a notarized receipt has greater legal force.

On the one hand, contacting a notary significantly increases the cost of document preparation. Since a simple written form does not require special costs.

On the other hand, the debtor will not be able to say that he signed the document while intoxicated, under the influence of threats, or without being aware of his actions. Therefore, it is almost impossible to challenge a notarized receipt in court.

Let's consider how much it costs to contact a notary. There is no single cost for the service. Each region has a regional notary chamber, which independently regulates prices for notary office services.

Are witnesses needed?

Witnesses are not required to be present when the money is transferred and when the receipt is written. Their presence is an initiative of one of the parties. However, if the lender-borrower relationship progresses to litigation, witness testimony will become an important element of support.

If the lender decides to involve witnesses in the financial transaction, then only uninterested adults can act in their role. Personal data of witnesses (full name, passport data, actual residence address) are written down in the text of the document.

The receipt is signed by witnesses (in this case they act as persons who certify the transaction).

The difference between a promissory note and a cash note

Let's immediately define the concepts:

IOU

a document confirming the existence of a debt under a loan agreement.

Cash receipt

a document confirming the fact of transfer and receipt of money.

Thus, a promissory note implies more than just the transfer of funds. Things, securities and other expensive items can be transferred under this document.

In order to certify the existence of a debt to the borrower, it is necessary to draw up a promissory note. A cash receipt should be drawn up if you need to confirm the transfer of funds as repayment of debt under a loan agreement.

Basic terms and definitions

A receipt for borrowed money is a personal document that is needed to protect the rights of both parties.

Debt documents are allowed to be used in situations where the parties to the transaction are:

- Only individuals.

- One individual and one legal entity between whom the transfer takes place.

Each case has its own characteristics associated with filling out promissory notes. But the legislation has not yet established a single, unified form of the document. Therefore, it is permissible to simply fill it out in free form.

Typically receipts are small pieces of paper. They contain the main positions relating to debt at a particular point in time. The more nuances are described, the greater the likelihood of a problem-free transaction.

Rules for drawing up a receipt for receiving funds

The legislation does not provide for a clear form of execution of this document. It is recommended to use a written form. A receipt, the text of which is printed on a computer, does not contradict legal norms. However, if in case of untimely repayment of borrowed funds it is necessary to perform a handwriting examination, this will not be possible.

It is advisable to indicate the following information in the text of the receipt:

- Date and place of signing the document.

- Full name of the borrower, his passport details, registration address (if the place of actual residence does not coincide with the place of registration, it is advisable to indicate both addresses), current telephone number.

- Full name, passport and contact details of the person who is borrowing funds.

- Loan amount (indicated in numbers and words to avoid inaccuracies). If the receipt is issued in a foreign currency, you must indicate the current exchange rate, as well as specify the conditions for the return (at what rate, in what currency).

In addition, the text of the receipt should indicate the period and conditions for the return of money.

The interest rate, penalties for late payment, as well as additional debt repayment options should be specified as additional conditions

At the end of the text of the document, the signatures of the parties and witnesses (if they take part in the transaction) must be placed.

The receipt is drawn up in two identical copies . This is necessary to exclude the fact that one of the parties made changes to the text of the document. Each copy is signed by the parties to the transaction.

If the text of the mortgage note is typed electronically, it must be signed by the lender. Both printed copies are hand-signed by the parties (the use of facsimiles is prohibited).

Lending money is a responsible procedure that must be legally formalized. Therefore, before drawing up the text of the receipt, it is recommended that you familiarize yourself with a sample of this document.

It should be noted that the receipt is drawn up only by agreement of all parties to the transaction.

By hand

The requirements are the same as when following the general rules. It is important that the debt against receipt is drawn up with the data of each party. Only under such circumstances will the document be valid. Notarization is not required.

But it is permissible to carry out the procedure if both parties to the transaction agree with such a requirement. Then the written document is sent to a specialist. If a dispute arises with the citizen who wrote, a special handwriting examination is carried out.

Write all important information regarding the parties and the amount of money itself. Otherwise, it will not be able to become evidence in court proceedings. The form of writing does not matter.

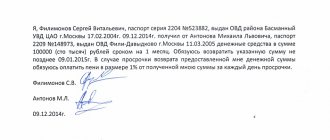

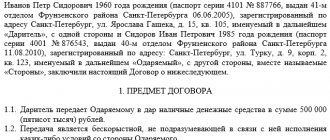

Sample handwritten receipt

What types of receipts exist?

The following types of receipts exist:

- About borrowing money - relevant in the case of loans to unfamiliar people who do not inspire trust.

- About receiving money under the contract. The main difference: in the text of the document it is necessary to indicate that the purpose of the payment is to repay the debt under the agreement.

- About receiving an advance for work. The purpose of the loan is to receive an advance payment for work under the contract.

- About receiving wages. The text of the document must indicate for which specific period wages are paid.

- About the safety of property.

- About receiving documents.

Important: the loan receipt is solely an attachment to the loan agreement, which confirms its terms and also certifies the transfer of a sum of money. The loan agreement may include provisions for the accrual of interest for the use of the lender's funds. This item must be written down in the receipt.

A receipt for receipt of money is direct evidence of the transfer of funds. A cash receipt can be substantive or non-substantive.

The text of the subject receipt clearly states the borrower's goals regarding the further sale of funds. A non-objective mortgage does not have a clear wording. It specifies only the size of the loan, the terms and conditions of its repayment.

Regardless of what type of receipt will be issued, it must contain the main points: passport and contact information of the parties, purpose of the loan, amount, currency, conditions and repayment period of the debt.

Types and features

Taking into account legal norms, such documents do not have clearly defined types, however, to determine when and which one to use, documents are divided into the following types:

- substantive – a description of the purpose for which the funds are provided;

- pointless when there is no clear purpose for obtaining a loan.

In addition, the type of document is influenced by the following circumstances:

- drawing up by a notary with its subsequent certification;

- by hand, for example, to receive a salary.

The paper may provide funds under various circumstances of receipt:

- advance payment for services provided;

- salaries, scholarships, pensions and other payments;

- money for performing services;

- loan from a microfinance organization or other organization.

Also, such a document can be issued by a financially responsible person, for example, when an employee receives equipment or other operating systems against receipt.

Errors when drawing up a document

Making a receipt for receiving funds is quite simple. Many citizens use ready-made document samples. However, not all samples provided on the Internet exactly correspond to the legal requirements for drawing up a loan agreement. Most of the participants in the transaction make mistakes, which in the future may cause the borrower to fail to repay the debt.

Errors that affect the legitimacy of a document include:

- Inaccurate or incomplete data of the parties to the transaction.

- The loan amount is not written in block letters.

- There is no exact deadline for repayment of borrowed funds.

- Presence of blots and errors in personal data.

Unfortunately, the legal side of issuing a receipt is only the tip of the iceberg. Few people pay attention to the ethical and moral side of the process of fulfilling the terms of the contract.

Transferring the loan amount to the bank account of a relative of the lender is the most common mistake of the borrower. The text of the receipt should always indicate the bank details to which transfers will be made to repay the debt (only relevant in case of non-cash payments). If the lender asks the borrower to transfer money to an account that is not related to previous agreements, you should not comply with his requests - in most cases this is fraud.

Lenders unwittingly make a mistake that casts doubt on the fact of further debt collection from the borrower in court. Paragraph 1 of Article 807 of the Civil Code of the Russian Federation states that the loan agreement is considered concluded from the moment the money is transferred. This means that if, during a non-cash transfer of funds, the lender does not indicate the purpose of payment, the loan agreement may be considered not concluded.

You should not take the borrower’s word for it; always check his passport details, because they are his personal identifier.

How to apply for debt repayment by receipt

It is not enough to simply place the money in the hands of the lender or transfer it to the agreed upon bank account. All actions of the parties must be documented.

When the debt is fully repaid, a corresponding receipt is drawn up, the author of which is the so-called creditor.

The document contains the following information:

- Passport and contact details of the parties to the transaction.

- Loan amount (in numbers and words).

- Date and amount of debt repaid.

- Purpose of debt.

The text must include a phrase stating that the debt has been repaid in full within the agreed time frame. The lender also informs in writing that it has no claims against the borrower.

At the request of the parties, the receipt for the return of funds can be certified by independent witnesses.

How not to pay?

The law provides for situations when a citizen may legally not spend according to a receipt.

| No. | Situations |

| 1 | At the time the loan is issued, the recipient is deprived of legal capacity |

| 2 | At the time of execution of the document, the debtor has not reached the age of majority |

| 3 | The person was unable to understand the consequences of his actions (due to the use of potent drugs or mental illness) |

| 4 | The citizen did not sign the receipt (the signature was forged) |

| 5 | The funds have been returned and there is a supporting document |

What to do if the debtor refuses to pay money

There are cases when the borrower, due to circumstances or his own reluctance, refuses to return the funds. In this situation, the lender has the right to go to court.

You must provide the court with a statement of claim, a passport or other document confirming your identity, as well as a receipt for receipt of funds.

There are two types of legal proceedings for the return of funds: easy (the borrower agrees with the debt and admits that he is unable to fulfill his obligations in a timely manner) and complex (the defendant does not recognize the debt, refuses his obligations and denies signing a receipt for receipt of funds) .

- In the first case, the court will be on the side of the plaintiff. In this situation, the lender can independently (without involving a lawyer) cope with all the complexities of the legal process.

- In the second case, it is better to seek the help of a lawyer. If the receipt was made in writing, the court will order a handwriting examination. All additional financial costs will be borne by the plaintiff. However, if the court makes a positive decision, the defendant will have to cover all costs.

You can get legal assistance on issues of drawing up a receipt for receipt of funds on our website.

All about collections under a loan agreement

When lending money, the receipt becomes your main document proving the debtor’s obligations to you. The borrower is obliged to repay the amount received within the time frame and in the manner stipulated by the agreement (Article 810 of the Civil Code of the Russian Federation). If the debt is not repaid or the payment terms are violated, you have the right to recover the amount under the loan agreement through the court. The receipt in this case will serve as the main evidence of the defendant’s guilt. First, let's look at the general algorithm for the process of collecting money from a debtor, and then we'll look at each step in more detail.

- Personal appeal to the debtor. This is the so-called attempt to peacefully collect the debt.

- Drawing up and sending an official complaint to the debtor. Subsequently, a postal notification of delivery of the letter is attached to the general package of claim documents.

- Drawing up a statement of claim.

- Payment of state duty. Its size is not fixed and depends on the amount of the claim.

- Collection of documents for filing a claim. In addition to the text of the claim itself, the plaintiff attaches all documents proving his right to file a claim against the debtor.

- Waiting for a decision on the case.

- Receiving a writ of execution in case of a positive decision and contacting the bailiff service to collect the debt.

Legal practice considers pre-trial measures as the first step in resolving debt disputes. This includes attempts to resolve the conflict peacefully. You can do this yourself (through a conversation directly with the debtor and his relatives) or by contacting a mediator. This is a qualified specialist who studies the essence of the claim and offers effective ways to resolve the conflict out of court.

- Submitting a claim to the debtor.

An integral component of this stage of collection is sending the claim to the debtor in writing. The text must state the debt requirements and notify the borrower of your intention to go to court. The letter is sent to the debtor's postal address. A copy of this appeal, along with a notification of dispatch, will be an additional substantiation of your statement of claim and must be attached to it. If the conflict cannot be resolved peacefully, the debt is collected through the courts.

- Filing a claim.

The rules for filing a claim are set out in Art. 131 Code of Civil Procedure of the Russian Federation and Art. 125 AKP RF. The statement of claim is made in writing. The document includes the following information:

- Details of the plaintiff and defendant, details of the court and the amount of claims.

- A detailed description of the situation that led to the conflict and violation of the plaintiff’s rights (the fact of transfer of money, execution of a receipt, etc. is mentioned).

- Description of evidence supporting claims.

- Calculation of the amount of debt in rubles (can be attached as a separate document).

- Directly a request to recover from the defendant the declared amount (principal, interest, legal costs, etc.).

The statement of claim is accompanied by the original and a copy of the loan agreement, a receipt for payment of the state duty, a calculation of the amount of debt, a notice of delivery of the pre-trial claim to the defendant, copies of the statement of claim, etc. Please note that if your rights as a lender are violated and delays occur, you are not required to send a pre-trial claim to the borrower demanding repayment of the debt. The very fact of filing a claim in this case will be a demand for repayment of the debt. However, the pre-trial collection procedure is mandatory in some cases:

- for disputes involving legal entities (Article 4 of the Arbitration Procedure Code of the Russian Federation);

- in the absence of a debt repayment period established by a receipt (Article 810 of the Civil Code of the Russian Federation);

- subject to the claims procedure for resolving disputes established by the agreement itself.

In the case of a claim dispute resolution procedure, you have the right to go to court 30 days from the date of sending the demand to the debtor. The postal receipt and an inventory of the contents will act as confirmation of your attempt to resolve the conflict peacefully.

- Filing a claim.

You can submit your application to the court in person, send it by Russian post, courier service, or send it through your personal account “My Arbitrator”. By law, you have the right to make claims against the debtor within 3 years. This is the statute of limitations established for this type of case. The missed statute of limitations may be reinstated. To do this, you must provide the court with evidence of missing dates for a good reason. The following are authorized to consider the claim:

- Magistrates' courts (to resolve disputes between individuals, under written loan agreements, with a debt amount of no more than 500 thousand rubles).

- Arbitration courts (for conflicts involving legal entities or individual entrepreneurs).

If the debtor is an individual, claims are presented at the defendant’s place of residence; in case of conflicts with legal entities, at the legal address.

- Consideration of the case in court.

If the amount of the claim is no more than 100 thousand rubles, the case is considered under simplified proceedings (Article 232 of the Code of Civil Procedure of the Russian Federation). If the court finds your evidence convincing, a decision will be made to find the defendant guilty of violating the debt agreement. Based on this decision, a writ of execution is issued. It is on this basis that money is collected from the debtor. To initiate the collection procedure, you can contact the FSSP of the Russian Federation or collect the money yourself, for example, by contacting the accounting department at the debtor’s place of work to initiate the seizure of his wages.

- Debt collection through a court order.

Collection in debt cases can be carried out not only by way of claim proceedings, but also by order. Claims whose amount does not exceed 500 thousand rubles are considered by order. Nuances of the order of consideration of the case:

- the order is issued in a short time according to a simplified scheme;

- the order itself is a document of execution, which means it can be presented to bailiffs to collect money from the defendant;

- the fee for issuing a court order is 50% cheaper;

- If the court order is canceled by the defendant, you have the right to file a claim in court for recovery according to the standard scheme.

The court order will be ready within 5 days from the date of filing an application with the court and comes into force after 10 days.